What are the Different Types of Actuary?

What is an Actuary?

“What does an actuary do?” I’ve given a number of answers to this question throughout my time at university when someone from the non-financial world has asked me about the career I wanted to pursue.

In my first year of university (when I didn’t have a comprehensive understanding of the meaning myself), I responded with, “it’s like accounting, but with more mathematical application.” In my second year, I progressed to “we use statistical models based on historic data to predict the impact of future events.” Now, after a year working in the industry and in my final year of studies, I respond with knowledge-based enthusiasm, “we attempt to quantify and manage risks.”

With this definition, the follow up question is usually, “what types of risk do actuaries manage?”

To answer this, we must consider the different types of actuary, and the different fields actuaries work in.

Traditional Types of Actuary

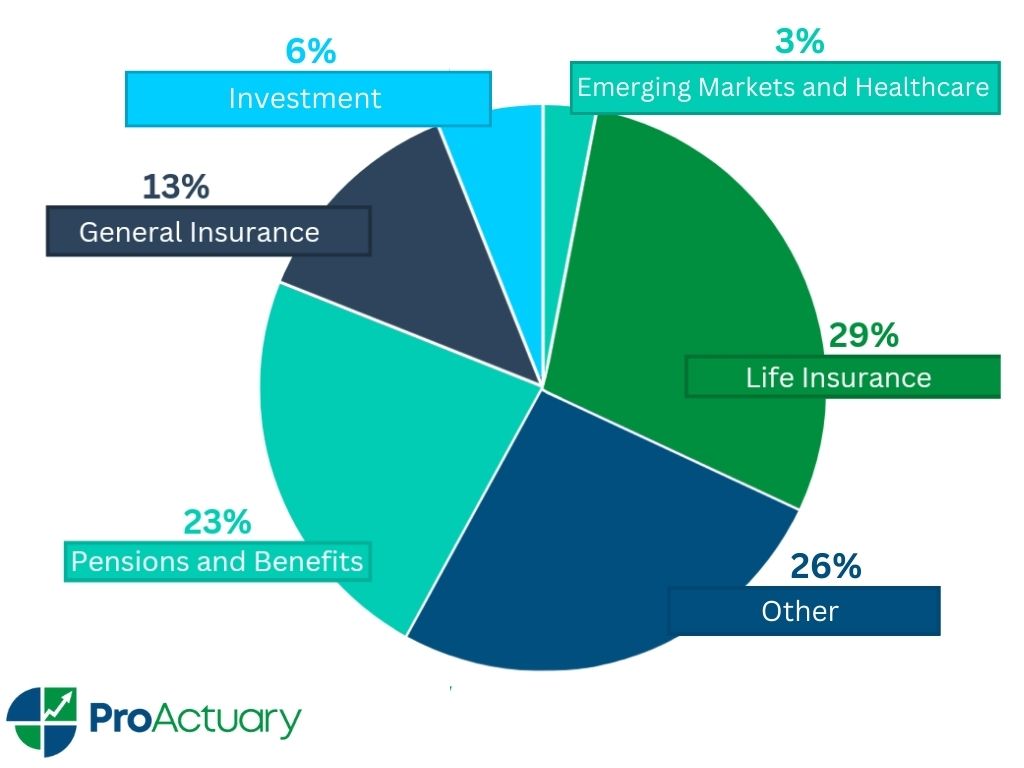

The Pension, Life and General Insurance sectors accounted for 65% of the roles of UK actuaries in 2018. The second-largest category (“other”) includes banking and enterprise risk management actuaries. Investments, emerging markets and healthcare round out the traditional roles or types of actuary.

This article will focus on the roles and responsibilities within the Pension, Life and General Insurance sectors. For each category I spoke to an actuary within the sector.

To close, I considered wider fields (not captured in the pie chart) that actuaries can diversify into in future.

Types of Actuary: 1. Pensions Sector – The Pensions Actuary

Pensions enable individuals to accumulate retirement savings throughout their career. Actuaries help design, test and evaluate a company’s pension plan to ensure it will meet the needs of the trustee, employer and scheme member. They also account for the associated investment risk and regulatory requirements.

This involves advising on the following:

- Scheme funding: An actuarial valuation is carried out every three years to ensure the contribution rate enables the fund to cover its liabilities.

- Investment assets: Advise on suitable investments to fund the scheme.

- Risk management: Measure, manage and mitigate the financial risks associated with the pension scheme including asset-based risks (investment strategy, returns and performance) and liability-based risks (such as longevity, inflation, interest rates and sponsor strength or covenant risks).

To provide further insight into the sector, I interviewed a qualified actuary working for Mercer, an actuarial consulting company in Belfast.

Why did you choose this type of actuary work?

“It was not a conscious choice per say, albeit as luck would have it, it was absolutely the right choice for me in terms of the nature of the work. At the time I was entering the job market, Belfast tended to cater more towards the Pensions sector. As a Pensions consultant, the work consists of a combination of technical analysis, problem solving and then taking that analysis and translating it into a solution for our clients. I thoroughly enjoy, talking to members of pension schemes, trustees and corporate clients.”

What future developments do you see occurring within this industry?

“There is a keen focus on setting a long-term funding strategy as part of consultation from the Pensions Regulator on the Funding Code of Practice. We are also seeing a move towards transferring liabilities to third parties to help manage the risk burden (insuring liabilities via buy-in contracts or removing risk entirely as part of a buy-out with an insurance company). Another significant issue relates to the sex equalisation of Guaranteed Minimum Pensions*, whereby actuaries must help affected pension schemes rectify benefits.”

Types of Actuary: 2. General Insurance Sector – The General Insurance Actuary

General Insurance includes non-life insurance such as home, motor and travel insurance products. Consumers purchase these products from insurance companies to protect themselves against the risk of significant financial loss. Actuaries play a key role in helping insurance companies assess and manage the financial risks associated with providing these products.

Actuaries operate within three main categories:

- Pricing: Quantify the risk associated with a customer to determine their premium, the amount should also ensure the company maintains adequate funds, competitive pricing and deters high risk customers.

- Reserving: Use statistical techniques and statistical data to predict the insurer’s future claims and liabilities to determine the provisions needed for reporting purposes.

- Capital modelling: Forecast an insurer’s future liabilities and assets to determine its solvency and capital needs, ensuring compliance with Solvency II* regulations.

* Solvency II: Regulatory requirements that set out how insurance companies are funded and governed. This is an important pillar of the industry’s risk management process.

To share their outlook of the sector, I interviewed a qualified actuary working for Aviva Insurance, an insurance company based in Dublin.

Why did you choose this type of actuary work?

“After graduating from university, I looked for jobs in the General Insurance sector as it was a relatively new industry for actuaries to work in. What also attracted me to the field was its fast-paced environment, when we introduce a new insurance product we can quickly see the results and market reaction within a few days. In contrast, Life Insurance has longer development periods.”

What future developments do you see occurring within this industry?

“In the short term, the regulatory changes surrounding customer fairness and dual pricing* will impact how actuaries operate. In the long term, the development of driverless cars may impact claims frequency. This will have an impact on risk management.” [While claim frequency may decrease due to less human error, claim severity could increase in line with expensive repairs].

*The Central Bank of Ireland is investigating the use of dual pricing within insurance. This includes the insurer charging existing customers a higher premium than new customers. This has led to unfair price discrimination in the case of elderly customers who may not have easy access to the internet to shop around.

Types of Actuary: 3. Life Insurance Sector – The Life Insurance Actuary

Life Insurance provides financial support to the insured person’s family in the event of their death. The most common types of policies are Whole Life and Term Life Insurance. The insurance contract provides cover to the policyholder until death or for a defined period, respectively.

Actuaries manage the risks associated with Life Insurance by:

- Pricing products based on a customer’s mortality risk factors such as age, smoking status and occupation.

- Monitor the funds of the insurance company to uphold the payments of benefits to customers and adhere to the Solvency II regulations.

- Provide advice to the insurance company on investment and strategic risk management.

To provide some insight into the sector, I interviewed a student actuary working for Irish Life Insurance, an insurance company based in Dublin.

Why did you choose this type of actuary work?

“I chose to work within Life Insurance as I was attracted by the exciting advancements occurring in the sector. The use of technology is becoming more prevalent in efforts to improve efficiency of work in the industry. For example, wearable technology can collect customer health data including activity levels, BMI and blood pressure. The analysis of this data enables insurers to give custom quotes.”

An illustration of how an Apple Watch could track blood sugar in future.

What future developments do you see occurring within this industry?

“We will see a lot more flexible products for policyholders in the future; as we have seen in the past year with Covid-19, the financial markets can rapidly change and therefore flexible plans would be beneficial for many customers. Also, with an ageing population we need to find solutions to provide insurance to the older generation while maintaining profitability*.”

* Such methods may include using “big data” techniques to predict life expectancy of policyholders and transferring the risk to third party investors who are willing to gamble using longevity swaps.

Types of Actuary: 4. Opportunities to Diversify – Actuaries in Wider Fields

It is clear from the traditional types of actuary discussed that actuaries require data and data analysis to quantify risk.

Today there are large amounts of data available at our fingertips (quite literally due to fingerprint technology). Actuaries can avail of this data to build models that support and prepare companies for an uncertain future.

In Taylor Swift’s 2020 hit single, “No Body, No Crime,” she sings about a wife uncovering her husband’s infidelity in the line, “That ain’t my jewellery on our joint account.”

In a similar way, by identifying unusual spending patterns, banks can use predictive modelling to detect a divorce; even before the couple is aware of their pending expiration. The bank can then commence the process of lowering the credit limit of the lower earning partner in anticipation of the divorce and its financial consequences.

The data collection doesn’t stop there. While we live our day-to-day lives, we leave traces of a digital twin, even on a mundane trip to the grocery store we produce mass amounts of data. For example, your car’s telematics box monitors driving safety by recording your speed, breaking and route to the store. While shopping, your smart watch records your physical activity, which can be used to predict your future health. Even the rhyme of your walking has the ability to detect early onset of heart problems.

Whilst waiting in queue at the checkout, you’re typically engrossed in your smartphone, whereby the facial recognition technology can identify your emotion and prompt a product or service that you are more inclined to purchase. Finally, using a coupon based on your previous Clubcard spending, you are persuaded to buy your guilty pleasure snack for 50% off.

Data has also been used to enforce the law. In China the majority of customer data is uploaded to the state. The authorities can use facial recognition data to impose order among its citizens; for example, a person identified jaywalking will receive a text issuing a fine before they have even crossed the street, in some cases their image will be projected on nearby screens to notify surrounding people of the offense.

How Can Different Types of Actuaries Contribute to Risk Management in Future?

Actuaries have the skill and experience to process and analyse the digital traces of data produced by individuals.

As part of the qualification exams, actuaries are required to demonstrate their mathematical statistics capability using R software, a programme commonly used to process big data.

Furthermore, actuaries use statistical techniques for data modelling. There is a growing demand to incorporate these skills in the application of machine learning. In fact, the Institute and Faculty of Actuaries has responded to the demand for using artificial intelligence by including both theory and application of machine learning in 10% of the CS2 actuarial syllabus, introduced in 2019. This demonstrates the increasing awareness that actuaries have the capability to integrate into wider fields by applying predictive modelling techniques.

Actuaries have analytical minds that enable them to process data, draw conclusions and communicate the results in a clear and concise manner, while keeping their audience in mind. This is a transferable skill the profession can promote to data driven companies that use complex, machine learning models. Actuaries can use their intuition and business judgement to not only train algorithms, but to also unravel the implications of the models’ outcomes and translate them into actionable strategies.

The actuarial qualification exams provide credibility to the actuary’s work as they require years of diligence and studying to complete. The qualification demonstrates a thorough understanding of risk management, mathematical, statistical, financial and economic theory, which are fundamental to making financial decisions.

There is potential for misuse of customer data and breaches of privacy concerns, demonstrated by the Cambridge Analytical scandal (2008), when a whistle blower reported the company was using Facebook data to analyse the best way to manipulate American users into a particular method of voting. It seems rational to give actuaries the responsibility of processing data as they have comprehensive regulatory knowledge and are held to a high ethical standard under the Actuaries’ Code. For example, actuaries are expected to practice “integrity” and to “speak up” if they witness unlawful behaviour.

Today, there exist countless complex and interconnected risks, which actuaries have the skill and technical ability to navigate.

Data is the new oil and by expanding into non-traditional, data driven fields, the actuarial profession will embark upon an exciting journey in redefining the different types of actuary.

Orla Lewsley

“Orla Lewsley is a Pricing Analyst at Prestige Underwriting Services Ltd. Prior to that she was an Actuarial Analyst at Mercer. Orla graduated from Queen’s University Belfast in 2021 with a BSc degree in Actuarial Science and Risk Management. You can connect with her on LinkedIn.”