An Actuarial Internship Guide for Aspiring Actuaries

Gain invaluable insights into launching your actuarial career with a comprehensive guide to actuarial internships, where practical experience merges with academic learning to enhance employability and industry expertise.

“My year-long actuarial placement prepared me for the workplace better than any university module could ever dream of doing”

Those are the thoughts of one of my colleagues who, much like myself, undertook an actuarial placement at the UK’s largest pensions consultancy. A year-long work placement is the most important year of any students’ studies. A survey conducted by reed.co.uk in 2011 found that almost three-quarters of graduates considered their work experience to be an invaluable part of their degree. Nowadays there is an ever-increasing importance of having practical work experience under your belt before entering the working world for good.

I took away more benefit from my placement year than I could ever have imagined. Most of all, a placement year is an opportunity to learn. I entered it with hesitation and trepidation but 14 months on I have finetuned an abundance of interpersonal and professional skills, which leads me to definitively state a placement year is the most invaluable experience any student could avail of.

Understanding Actuarial Placements

Good question. A placement is effectively a free trial; a ‘try before you buy’. It allows employers the benefit of building relationships with universities in order to assess potential future graduates by employing them on a temporary basis.

As for students, it is an incredible opportunity to learn about their future industry, build a professional network and boost their employability with practical on-the-job experience.

Ultimately, you are still a student. A placement year is a compulsory part of many undergraduate degrees and carries academic credit. Typically, the university works closely with employers, awarding you a wide support network, and it plays a key role in helping you to secure a placement in the first place. There are dedicated placement coordinators that help students build relationships with employers, offer interview practice and help to finetune your CV to the nth degree.

Students also have the opportunity to work further afield. I wanted to remain in Belfast so I was limited to the pensions industry. However there is an abundance of opportunities in the Republic of Ireland and across the UK in other sectors such as insurance, reinsurance and banking. The most adventurous of students can even jet across the Atlantic to work in the likes of Toronto and Vancouver.

It is much more of an experience than simply working 9 ‘til 5. Many students will live away from home for the first time, experience an office environment, and hone countless skills that are yet to be unearthed.

Notwithstanding that, the goal of a placement is of course to gain practical experience within the industry and to develop a professional network to give students a head start as a graduate. The benefits of a work placement are perfectly summarised by former chief executive of careers website, Prospects, Mike Hill, who believes “a placement year shows you have a work ethos and makes you far more employable”.

Comparing Actuarial Placements and Summer Internships

A placement year differs greatly from a summer internship. Internships are typically undertaken during the summer to gain experience and enhance your employability. Whereas a work placement typically lasts for the best part of a year – for instance, a placement year is a compulsory part of my actuarial undergraduate degree and is required to last between nine and 15 months. That is not to understate the usefulness of a summer internship.

The short-term nature of an internship can in fact be a positive. It grants a student an insight into the industry and can greatly enhance your CV. It demonstrates:

- A willingness to learn about the career path

- A genuine interest in the industry

- A proactive attitude to obtain work experience (generally unpaid)

- Commitment to sacrifice your summer holiday in order to amplify your career prospects

And perhaps most importantly of all, it gives a student something material to talk about in a job interview.

On the flip side, I would argue an internship just isn’t long enough to really learn about the job role. If an internship is the equivalent of dipping your toes into the shallow end, a placement year is diving straight into the deep end. Some will sink and some will swim.

My placement year changed (for the better) six months in. It is at this stage that I began to put my learning into practice, and really felt at home on-the-job. I started my placement two months early, and it was the best decision I made as it gave me an invaluable head start. I had the opportunity to drain as much knowledge and help out of my new colleagues before the remaining placement students joined the company.

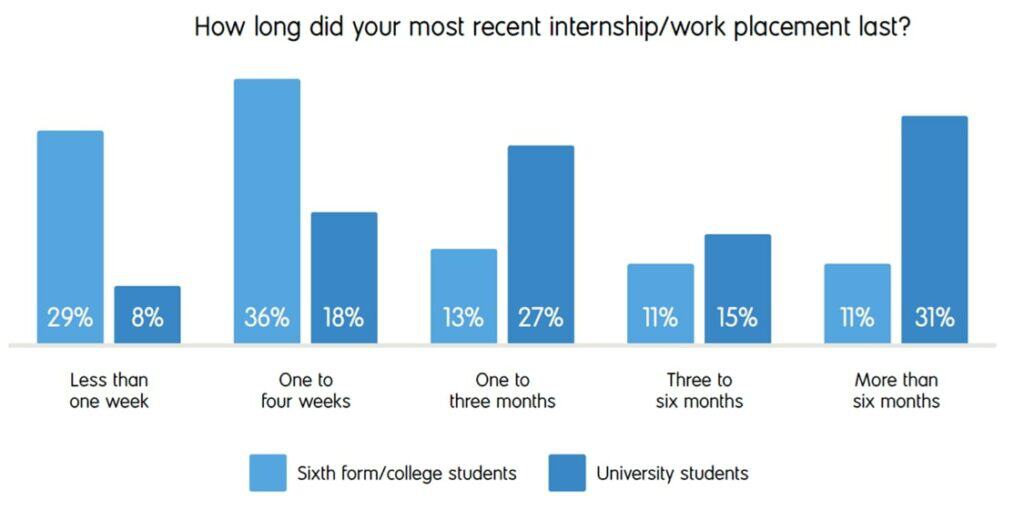

I had two more months of asking countless questions, two more months of making mistakes, and two more months of learning from them. Figure 1 shows that just 31% of work placements undertaken by university students last more than six months. That isn’t enough time to fully engage in your new industry as, from my experience, the second half of a placement year is the most useful as this is when you start to put your learning into practice.

Key Lessons from an Actuarial Internship Experience

I completed a 14-month work placement at the largest pure pensions consultancy in the UK. The company has won numerous awards at the UK Pensions Awards and the UK Employee Experience Awards in recent years, so I was enthused by the prospect of working for such a highly-esteemed company that clearly values its employees.

I entered the world of GMP equalisation, which is tricky to explain briefly but I will try. Essentially it is a legal requirement, arising from the Lloyds Judgement in 2018, to equalise pensions that were accrued in the 1990s to ensure that a member is not treated less favourably on the grounds of sex (as there were different rules for males and females for this specific type of pension). I encountered an awful lot of technical jargon throughout my placement, much of which took me a lot of practice to truly understand.

My primary role as an actuarial associate was to analyse and check bulk member data, carry out bulk ‘equalisation’ calculations and produce advice reports that were presented to the Trustee(s) of the pension scheme.

I was entrusted with overseeing the progress of numerous schemes through this process which involved liaising with senior actuaries and juggling multiple deadlines to ensure client satisfaction.

Towards the end of my placement, having earned the trust of my peers, I was challenged with collating data for 200+ schemes and to produce a report summarising the results for marketing purposes. This exposed me to another aspect of a multi-faceted business in terms of the importance of flexible marketing material to maintain current and attract new clients.

Gaining Essential Skills from Actuarial Internships

One of the key takeaways from my placement was the stark increase in confidence I experienced over the year. I became a much more-rounded person, both from a professional and personal point of view.

Given the backdrop of the COVID pandemic, much of my placement was completed virtually which initially challenged, but ultimately enhanced, my communication skills. It forced me to communicate with colleagues and pick up the phone to them when I encountered an issue, as I couldn’t just turn around to the person at the next desk and discretely ask for their help.

The key skills and benefits I acquired from my work placement include:

- Establishing numerous working relationships with key members of the team through asking for help and offering support in ad hoc projects

- Advancing my technical skillset through a daily use of Excel and its endless functions

- Independently reviewing the work of other colleagues and providing constructive feedback

- Training less experienced members of the team which required the ability to communicate technical concepts in a non-technical manner

- Vast exposure to member data and the complexities of pension schemes, enhancing my knowledge of the pensions industry as a whole

- A conviction to offer my own solutions to modelling complexities and discuss these with experienced, qualified actuaries

One thing that became clear in hindsight was the substantial change to my placement experience after the first six months. By this stage I had made the rookie mistakes and was now developing an aptitude for my work. I began putting my learning into practice and started to take the initiative by communicating technical concepts with senior members of the team and invited open debate.

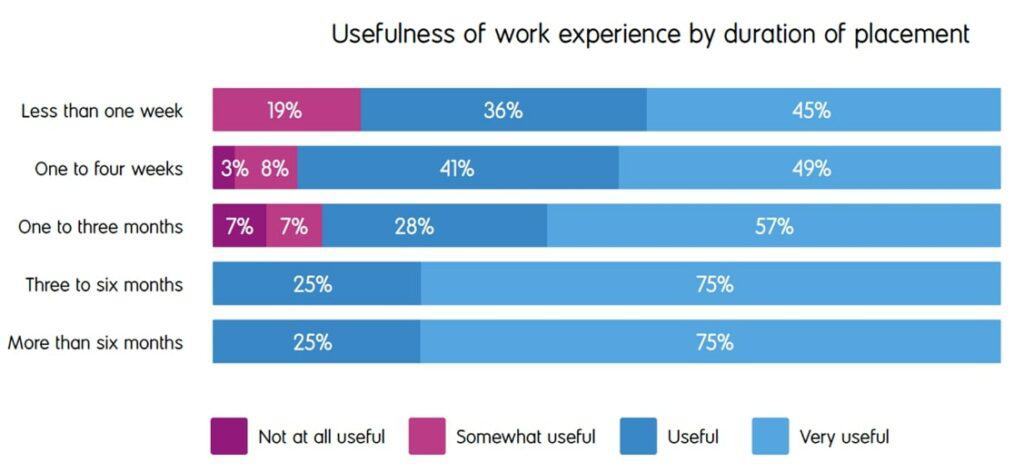

Figure 2 mirrors my experience – the longer your work placement, the more valuable it is. In 2020, 100% of students found their work placement to be at least ‘useful’ having spent more than six months in the workplace. This is when the real learning and development starts.

Overcoming Challenges in Actuarial Internships

It’s about time I address the elephant in the room: the worldwide pandemic which meant that the vast majority of my placement year was completed from the comfort of my own home.

For the first 12 months of my placement, I visited the office just four times, two of which were due to IT issues. Thankfully, I was able to work in the office once a week during the final two months of my placement as the company rolled out a new flexible working model.

The main challenges associated with working from home were keeping myself accountable for fulfilling my duties during the day despite not being in a purpose-built office environment. It was easy to feel disenchanted working from home, especially in the latter months of my placement as I required less support to complete my work and fulfill my responsibilities.

The experience of working in the office was an alien one at first but I quickly grew to really enjoy it. The ability to socialise with members of the team and ask for their help in person was much more engaging than via a message over MS Teams.

Working from home was a challenge at first. Nonetheless it was a necessary challenge given that hybrid working models will likely be the backbone of any future career in the actuarial industry. In fact, 67% of work placements in 2021/22 were expected to be a hybrid of working from home and face-to-face interactions, according to the Prospects Early Careers Survey 2022.

The findings of this survey are in keeping with my experience. Respondents found hybrid placements the most useful and online placements ranked last in respect of the various working models. I felt re-energised being able to work in the office during the last two months of my placement and would actively seek a company that follows a hybrid working model when securing a graduate job. The benefits of face-to-face interactions cannot be underestimated.

Actuarial Internships: A Journey of Learning and Growth

You learn too many lessons whilst on placement to recall one-by-one. However, one key piece of advice I would give to anyone embarking on an industrial placement is to say yes to every opportunity. Why? Because you will either succeed or you will learn.

“I have not failed. I’ve just found 10,000 ways that won’t work.”

– Thomas Edison

A placement year is littered with learning curves. Sometimes you place too much trust in your initiative and make a rookie mistake, and whilst it would be easy to dwell on your mistakes, you have to use them as a learning opportunity. It is important to remember that you are still a student; you are there to learn. It’s unrealistic to get 100% in your university modules. Therefore it is equally as unrealistic to expect to never to make a mistake on placement. What you must do however is ask for help and learn from your misjudgements.

Another useful tip I would give to fellow students is to record all the tasks/projects you complete whilst on placement and to make note of any highlights/milestones. This way, you have some concrete evidence of achievements within the workplace. It also allows you to quantify the progress you have made from day one, which can be helpful not only in relaying to a future interviewer, but also in reassuring yourself that you have made significant strides when you reach a stumbling block.

Securing Your Actuarial Internship: Tips and Strategies

There are multiple things you can do to boost your chances of securing an industrial placement at the company of your choice. These are my seven most important tips when seeking to land a placement role.

- Contact past placement students to learn about the company and demonstrate this proactive approach in your interview

- Use flashcards to mimic interview-style questions. Remember: the employer is just as interested in you as a person than as a student, so be prepared to talk about yourself!

- Arrange a mock interview with your placement coordinator to finetune your interview technique and make use of their feedback

- Don’t get too bogged down on the industry, instead focus your efforts on where you would like to work. If you don’t like the industry you work in, e.g. pensions, then at least you can rule it out as a future career path

- Research extensively into the company. The company website should be your first port of call for company background, recent news and highlights

- Know your industry. Read articles about recent developments in the industry and find a way to bring this up in the interview. For example, in my interview, I discussed the role of the Pension Protection Fund after Toys R Us fell into administration

- Always ask a question at the end of the interview. What you say isn’t that important, what is important is that you show an interest in the company you are applying for. For example, you may ask what their working model is, or how they support graduates through professional exams

Navigating Your Actuarial Career Path Through Internships

There is no doubting that completing an industrial work placement as part of your academic studies puts you ahead of the curve. You become instantly more employable. In fact, 88% of employers agree that students with work experience under their belt arrive to the workplace with better skills.

There are numerous benefits to your future career prospects as a direct result of completing an industrial placement year. Practical work experience is one of the first things employers will look for in a graduate. Given only 7% of students completed a placement year as part of their degree in the past 12 months, this practical experience gives you a unique selling point and ensures your CV will stand out.

The experience of the office environment during a placement year can help to alleviate the nerves associated with starting a graduate role and entering the office for the first time. And if you are lucky enough to secure a graduate role with the same company in which you completed your placement year, you will just be picking up where you left off.

The impression I made on my employer during my placement year led to me securing a graduate role without having to negotiate the rigmarole of applying for jobs and preparing for interviews. This eliminates the stress of having to balance your studies alongside securing a graduate job in your final year, which in turn boosts your chances of scoring highly in your course. Of course, as an actuarial student, this is of paramount importance given the exemptions from the actuarial exams that are available through accredited degree programmes.

Final Reflections on Actuarial Internships

A year-long industrial placement prepares you for the workplace in a way that no university module can replicate. There will undoubtedly be challenges throughout a placement year, each of which should be viewed as a learning opportunity as opposed to a failure. There are numerous benefits to completing a year in industry. However, the overarching positive is the boost to your employability and your CV. There are lessons to be learned in your introduction to the workplace, none of which will do your future career prospects any harm.

Actuarial Internship FAQs

Ryan Boyd

“Ryan Boyd is an Actuarial Assistant at XPS Pensions Group. Prior to that he was an Actuarial Associate at XPS Pensions. Ryan graduated from Queen’s University Belfast in 2023 with a BSc degree in Actuarial Science and Risk Management. You can connect with him on LinkedIn.”