Actuarial Risk – What Is It and How Does It Affect

Unpack the essentials of actuarial risk management with a comprehensive guide that explores underwriting, investment, inflation, and longevity risks—key areas where actuaries employ strategies to secure financial stability.

Consider this scenario: There has been a sudden deluge in your neighbourhood and your house sustains significant flood damage. Luckily, you had the foresight to pay for flood insurance, which covers the cost of your repairs.

Have you ever stopped to wonder where the money comes from to cover these repairs? The “extortionate” premiums you have paid over the years is what enables the insurer to cover the huge pay-out required to cover the damages to you and your neighbours’ properties.

Without these premiums, insurers would be unable to cover the claims, putting their business at risk and putting the financial stability of the policyholders in jeopardy.

This analogy shows the importance of accurately quantifying actuarial risk and setting premiums at an appropriate level. In this article, we will delve into actuarial risk and the various areas it covers – justifying the “extortionate” premiums you pay.

What is Actuarial Risk?

Actuarial risk is defined as the likelihood of financial loss or uncertainty arising from unpredictable events or circumstances, based on statistical analysis and modelling of data. In insurance, it can refer to the possibility of assumptions used proving to be inaccurate.

Where Does Actuarial Risk Come From?

Underwriting Risk

This is a primary cause of actuarial risk. It refers to the difficulty faced by an insurer in accurately assessing and pricing insurance policies, which could lead to a mismatch between the premium charged and the expected future pay-out. Miscalculating the risk associated with underwriting can occur due to several factors, such as inadequate data or outdated statistical models.

Later in the article we will look at the developing technologies which are playing a vital role in allowing insurers to make more accurate assessments of a policyholder’s risk profile – these technologies can prevent you paying the “extortionate” premium you feel you don’t deserve!

Investment Risk

This poses a significant threat to insurers and requires actuarial expertise. Insurers rely heavily on investment portfolios to generate returns and meet their long-term obligations. However, fluctuations in market conditions and unexpected market crashes can cause significant loss in asset values, leading to financial instability and heightened actuarial risk.

Additionally, actuaries face the challenge of market risk. It differs from investment risk in that it relates to the broader market rather than a specific investment. It can be described as systematic risk and cannot be eliminated through diversification.

Inflation Risk

Inflation is a key area of concern in actuarial risk management, particularly under the current times of record high inflation figures. Inflation has a huge impact on the insurance industry, driving up the cost of claims in all lines of business. For example, in the motor industry, the increased cost of labour and parts has driven up the cost of vehicle repairs. As a result, liabilities for insurers have skyrocketed.

Inflation is a two-edged sword for insurers, as the increased cost of claims and business operations under normal circumstances could be passed on to the consumers through increased premiums. However, at a time when many policyholders are already struggling with the increased cost of living, there are concerns that insurance will be a key area where people look to save money, potentially leading to a loss of business.

Longevity Risk

Insurance companies and pension funds face an ever-developing challenge presented through continuous improvement in medical technology and healthcare, leading to increased life expectancy. This increase in longevity poses a threat to these entities; this is known as longevity risk. Longevity risk is the possibility of life expectancies and actual survival rates surpassing pricing assumptions and expectations, creating markedly higher cash flow demands than anticipated.

The magnitude of the issue is very large, with an increase of over 10 years to life expectancy in the UK since 1950 (from approximately 67 to now over 80). Defined Benefit pension funds are particularly susceptible to this risk, as they guarantee annual pay-outs throughout retirement. Even a small increase in life expectancy can generate a colossal increase to liabilities for a provider. This has been the key driving force behind the shift away from Defined Benefit pension schemes in recent times.

What are the Strategies Used to Combat Actuarial Risk?

Actuaries play a crucial role in developing risk management frameworks that safeguard both the providers of insurance or pension plans and the individuals who rely on them, ensuring a secure future for all parties involved.

Hedging and Diversification

Hedging is a key tool in actuarial risk management to combat investment and market risk, providing a means to mitigate the financial impact of adverse events. Hedging can be viewed as a safety net to protect your organisation from unforeseen financial losses. It is essential that actuaries consider the potential impact of market volatility and ensure investment portfolios are suitably diversified to reduce the risk of catastrophic losses. Over exposure to one sector can cause financial ruin in the case of an extreme event. The 2008 financial crisis highlighted the crucial role of diversification in risk management.

Insurance giant AIG faced a near-collapse in part due to its lack of diversification. AIG had invested heavily in the subprime mortgage market, which inflicted major losses when the market crashed. The company’s financial instability threatened to destabilize the entire financial system, and the US government had to intervene with a bailout package of $182 billion, preventing AIG’s collapse.

Insurers should use diversification within their asset portfolio to offset inflationary risks. They can do so through increasing exposure to real assets like real estate and infrastructure, which have strong links to inflation and have historically proved to be effective hedges against inflation. This complements other elements of insurers’ investment portfolios to manage risk.

Actuaries must strike a balance between risk and reward to effectively manage risk. While diversification helps to reduce risk, actuaries need to make informed decisions that optimize investment portfolios to allow them to generate returns which will meet their future liabilities.

Financial instruments such as derivatives are useful tools to hedge against market risk and minimise the effect of a downturn in market performance on portfolio value. It is essential that companies make effective use of these instruments to offset the unavoidable threat posed by a market crash. Expertise is required to use these tools, as they involve taking highly leveraged positions which can create further risk if not utilised correctly.

Capital Adequacy Assessment

Capital adequacy assessment is a crucial method of actuarial risk management, providing a comprehensive evaluation of a company’s financial resilience. This assessment uses the company’s assets, liabilities, and risk exposure to analyse whether sufficient resources are available to cover liabilities, even under extreme scenarios.

Capital adequacy represents the first of the three main pillars of the Solvency II framework, which was introduced in 2016 to protect insurance policyholders. Under Solvency II, insurers must maintain a capital level that ensures they can meet their obligations to policyholders and withstand financial shocks.

Through assessing capital adequacy, insurers can identify potential risks and take appropriate actions to manage them. This not only benefits the insurers themselves but also ensures that policyholders are protected, providing stability and security in the insurance industry.

Reinsurance

Insurers paying for insurance? Yes, they must pay the “extortionate” premiums too. Reinsurance is a risk management method used by insurance companies worldwide, which may be lesser known to consumers. Put simply, reinsurance is insurance for insurers, where a portion of the risk is transferred to another company in exchange for a premium.

Reinsurance reduces exposure to large losses, as the reinsurer will typically take on a percentage of the insurance claim over a certain value. This allows the company ceding the risk to meet their financial obligations to policyholders even in the event of a major catastrophe. It reduces the risk exposure of the insurer, meaning they are also required to hold less capital to protect against extreme events. Reinsurance allows insurance companies to take on more risk and underwrite larger policies, helping to grow their business and remain competitive.

Risk-Based Pricing and Risk Pooling

Another strategy to manage risk in insurance is through adopting risk-based pricing, where the price of a product or service depends on the consumers perceived risk. Customers with a higher perceived risk of making a claim, such as younger drivers or individuals with a history of health problems, pay higher premiums than customers with a lower perceived risk. The use of risk-based pricing allows insurers to price products more accurately to the risk posed, ensuring that customer’s premiums are fair based on their level of risk.

Risk pooling is a traditional risk management technique in insurance. Using risk pooling, the risk of loss is spread among a large group of individuals or entities. The use of risk pooling ensures that each individual’s potential loss is reduced, and the overall risk to the insurer is more manageable.

For example, a health insurance risk pool is a group of individuals whose medical expenses are combined to calculate premiums. Pooling these expenses together allows the relatively higher costs of the less healthy to be offset by the lower medical costs of the healthier. In the same way, risk pooling can be used to manage other types of risks, such as weather risk. Ultimately, risk pooling allows companies to reduce their overall exposure to risk, protecting themselves and their stakeholders from the potential fallout of a single catastrophic event.

How Are Developing Technologies Affecting Actuarial Risk?

The field of actuarial risk management has been rapidly changing throughout the last number of years, with technological advances such as artificial intelligence (AI) and machine learning transforming the way risks are assessed, priced, and managed. AI and machine learning algorithms are now capable of processing vast amounts of data and extracting insights from it in real-time, enabling insurers to make more accurate predictions and respond to emerging risks more quickly.

For example, AI has been adopted by insurance companies to assist with Risk-based pricing. Telematics data collected from connected cars is used to inform underwriting decisions and pricing for car insurance policies. This proves to be massively beneficial for young drivers, helping to make insurance affordable to them by mitigating the “extortionate” prices usually charged to the typically high-risk young driver.

In the past, life insurance premiums would be calculated through considering the customers’ demographics, and actuarial models were run to determine the price of insurance. But that’s all changing. Usage of wearable devices will now help insurers in setting realistic premiums for customers. Insurers can now utilize wearable devices to establish accurate insurance premiums for clients, accounting for their health condition at the time of policy issuance. This replaces any guesswork in evaluating factors relating to a customer’s health risk with a new evidence-based pricing system.

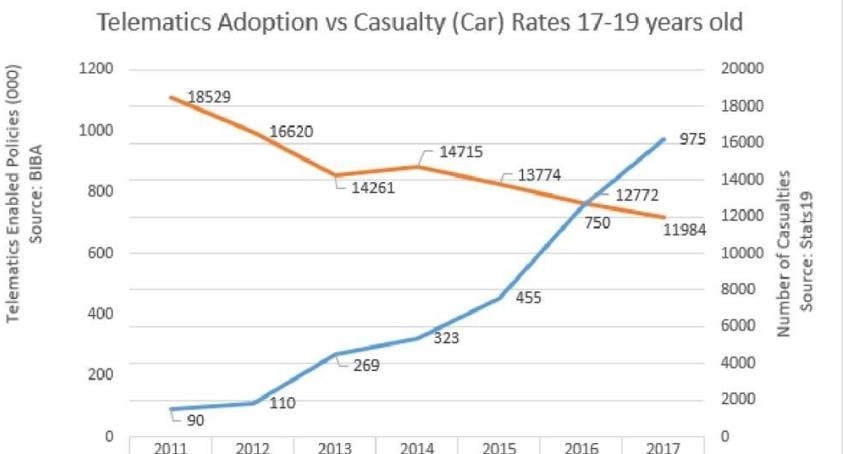

Furthermore, through providing incentives for customers to take steps to reduce their risks, such as adopting safer driving habits, risk-based pricing combined with technology can promote healthier and safer behaviours in society. Research carried out by the Insurance Times has shown that the use of telematics has reduced casualties caused by road collisions by 35%, and as shown in Figure 2, this is continuing to improve with the increasing adoption of telematics over time.

This is strong evidence for the use of these emerging technologies as a method of managing actuarial risk. It benefits both insurer and policyholder; the insurer’s volume of claims is reduced, and the policyholder’s accident and potential injury risk is reduced.

What Are the Issues Surrounding Actuarial Risk Management?

The practice of actuarial risk management relies heavily on data – both historical and current, to make accurate predictions and projections. Availability and quality of data can pose a significant challenge to making these projections. Incomplete or inconsistent data can lead to mistaken or poor risk assessments and poor decision-making. This problem is amplified in emerging risks or newly emerging markets, where there is limited historical data. AI has recently emerged as a game-changer in this area, offering tools and techniques to assist organisations with gathering, maintaining and enhancing data more effectively.

The ability of AI to automate data collection and processing, eliminating the risk of human error and guaranteeing more consistent and accurate data is a massive advantage. Using AI- powered algorithms, organisations can extract insights from vast amounts of data efficiently, allowing them to identify emerging risks and trends rapidly.

Effective communication and reporting of risk are critical components of actuarial risk management. The difficulty lies in conveying complex technical concepts and models in a way that is easily understandable to stakeholders who may not be experts, such as senior management and board members. It is essential that actuaries provide accurate and transparent reports on risk, supplying sufficient details enabling stakeholders to make informed decisions. Failing to communicate and report risk effectively can lead to incorrect decision-making, potentially risking the future of the business.

The increased use of AI in actuarial risk management presents challenges in terms of compliance with regulations like the General Data Protection Regulation (GDPR). AI systems have vastly increased the volume of data companies are handling, making it trickier to ensure compliance with GDPR’s various pillars such as data minimisation, purpose limitation, storage limitation and confidentiality.

Additionally, AI systems must be designed in a way that personal data is processed lawfully and transparently, with the data subject’s rights in mind. Organisations must provide clear and concise information on data processing activities, including the purpose, legal basis, and data retention period.

Making use of AI in risk management can significantly improve risk reporting, but organisations must be aware of the regulatory requirements and ensure they are complying. In doing so, they can maintain the trust of their stakeholders and build a solid reputation for ethical and responsible data management practices, helping to both attract and retain customers.

What Will Be the Role of Actuaries in Risk Management in the Future?

There has been much discussion over the last number of years surrounding the future role of the actuary, and how they could be replaced by the new technologies discussed earlier. However, I disagree; I feel there will always be a requirement for an actuary’s expert judgement.

While the role of an actuary has been changing rapidly over the last number of years, there will always be a need for human judgement to be applied to tasks such as assumption setting. The automation will reduce the time spent number crunching and writing reports. Therefore, in the future actuaries can spend more time on higher value activities, particularly in the area of risk management. More time can be spent assessing threats and putting strategies and frameworks in place to minimise their impact.

Current actuaries need to upskill and become familiar with the new and emerging technologies, as they will continue to become increasingly important to actuarial work. It is essential that the users of the technologies are experts, otherwise it could lead to risks not being assessed accurately if the systems are not functioning as they are supposed to.

The softer skills of an actuary will also continue to become more important as the technology gets more complex. They need to be able to communicate simply how the models are working, to allow non-experts to trust the models and give them confidence that the exposure to risk is being competently assessed.

In conclusion, managing actuarial risk is essential to securing the futures for both the provider and the consumer in any actuarial work. Technological advancements can be a massive help in managing these risks, but it is essential that actuaries continue developing alongside the technology to make effective use of it. The technology can allow risks to be assessed more accurately – and making use of it may help you avoid paying “extortionate” premiums in future!

Actuarial Risk FAQs

Jonathan Drennan

“Jonathan Drennan is an Actuarial Analyst at Allianz Global Life. Prior to that he was an Actuarial Intern at Pension Protection Fund. Jonathan graduated from Queen’s University Belfast in 2023 with a BSc degree in Actuarial Science and Risk Management. You can connect with him on LinkedIn.”