Wearables in Insurance: Where Do We Go From Here?

Introduction

Actuaries, working in the pre-digital era, writing out calculations by hand, would have found it difficult to imagine today’s actuary having such immense data, technology and computing power at their disposal.

Ubiquitous smartphones, advanced artificial intelligence, autonomous vehicles, the internet of things, drones and blockchain are just some of the new technologies today’s actuary is exposed to. The future holds even more exciting prospects with emerging fields such as quantum computing, 5G, brain-computer interfaces, smart pills and smart dust all coming to the fore.

Naturally, these changes provide immense possibilities, but also challenges and potential repercussions for the data-focused actuarial profession. As a forward-looking profession, it seems imperative that actuaries must change with the times and learn to embrace the challenges and opportunities the new technology-focused digital world is creating.

This essay summarizes the current use of technology within insurance (InsurTech) with a focus on wearable technology. Thoughts are provided on new wearable-derived data sources insurance companies may use in the future and the potential advantages of using data from wearables. A summary of opinions are presented on important questions that must be addressed as the use of wearables in insurance becomes more advanced and widespread.

In the era of tightening data regulations and consumer concerns, a blockchain solution is proposed. The essay concludes with thoughts on the important ethical considerations actuaries and other insurance stakeholders should consider, to ensure we are using wearable data in an ethical and responsible way.

The Emergence of InsurTech

In recent years many high profile insurance thought-leaders have argued that the industry has been lagging behind other industries (e.g., banking) which have increasingly embedded technology throughout their business models. However, this is now beginning to change as we witness the emergence of InsurTech – the use of technology innovations within insurance.1

InsurTech has seen many technologies coming to the fore. For example:

- Telematics (e.g., Metromile use telematics to offer affordable car insurance for low mileage drivers)

- Artificial Intelligence (e.g., Lemonade offers ‘zero paperwork and instant everything’ home insurance powered by AI)

- Blockchain (e.g., Insurwave is a blockchain-enabled insurance platform for marine insurance)

- Robotics (e.g., Digital Workforce uses robotics to enable insurance companies to automate processes)

- The Internet of Things (IoT) (e.g., Neos Ventures combines connected home devices and home insurance)

- Wearable Technology (Wearables) (e.g., John Hancock sells interactive life insurance policies that track fitness and health data through wearable devices and smartphones)

Wearables

One of the key technologies to emerge over the last decade has been the Internet of Things (IoT). Our World is now saturated with a vast array of sensors that capture information across many areas including transport, agriculture, healthcare and property.

IoT sensors have also made their way into wearable technologies that collect data across many aspects of an individual’s lifestyle, particularly those relating to health and health-related behaviors. We have also moved beyond wrist-borne devices to now seeing wearable devices in shoes, clothing, accessories and jewelry. Consider, for example, the Oura Ring – a seemingly normal looking ring that incorporates a plethora of sensors measuring various sleep, activity, and recovery metrics with a high degree of accuracy.3

This availability of more bespoke and timely data on biometrics and the ability to understand this data, via machine learning, is having a profound impact, both on the medical profession and on patient care. The ability to detect deterioration in a biometric(s) of choice can lead to a preventative intervention, which can be delivered at lower cost and higher efficiency than a curative response in the absence of the biometric warning.4

Furthermore, research from behavioral psychology and economics confirms that more immediate feedback results in a higher probability of a behavioral adjustment of an individual.5 The early evidence on the use of wearable technology is that it is an effective tool in changing individual attitudes, behavior and ownership of health problems to the net benefit of the subject’s health.6

Wearable data, therefore, provides information that can be conceivably exploited to both improve our understanding of health and mortality-related risk factors, and also used as an indirect channel to incentivize and help improve health behavior for society.

Hence, wearables also hold much promise for the health and life insurance industries to incorporate health and behavioral data to aid insurance underwriting, pricing, product innovation and customer engagement. This is evidenced by some pioneering insurance companies such as John Hancock, Vitality, United Healthcare and Oscar that have already incorporated wearables into their product design.

Wearable Data

The insurance companies currently embracing wearables are typically monitoring activity levels (e.g., via step counts) and rewarding policyholders in the form of discounts and other perks. However, as the technology advances and matures it seems conceivable that other health metrics may be used by insurers to underwrite policies with greater accuracy (see Farrell & McCrea, 2018).7 Health metrics that hold particular promise include:

- Continuous Blood Glucose Monitoring (CGM): CGM is now feasibly monitored by individuals (from both an economic and a practical sense) because of the advancement of sensors such as that offered by The Freestyle Libre System and the Dexcom G6 system. Insurance for diabetics has historically been challenging as insurers’ class these individuals as high risk. CGM may act as a means by which cheaper insurance can be purchased by diabetics that are managing to control their blood sugar levels through means such as exercise and diet.

- Heart Rate Variability (HRV): HRV measures the variation in the time interval between heartbeats. It has been studied extensively in the medical research field and has been shown to be a predictor of morbidity and mortality. As HRV provides a non-invasive and easy way (e.g., measuring via the previously discussed Oura Ring) to measure autonomic nervous system imbalances, it could be potentially used by insurance companies in the future. Insurers could potentially use HRV as a rating factor and also a means to help inform policyholders of insights into their health and to even facilitate healthy behavior change.

Advantages of Using Wearable Data in Insurance

Incorporation of self-quantified wearable health data into insurance product design provides insurance companies with many potential advantages. I discuss some of these below:

1. Product Innovation

The availability of these new technology-driven data metrics opens potential new avenues for health and life insurers to provide cover for previously difficult to insure or uninsurable risks.8 This is aided by the potential to now provide ongoing feedback data to the insurer in a real-time basis, overcoming the historical underwriting of coverage whereby the insurer typically only captures mortality and morbidity related metrics at a single point in time.

2. Reduced Adverse Selection and Improved Underwriting and Product Pricing

By recording data on an individual’s health behavior, the information asymmetry between the policyholder and the insurer is reduced, thus enabling an enhanced granular risk differentiation based on the true risk levels of the drivers to be achieved. This potentially reduces the problems of adverse selection.

Wearable technology may, therefore, lead to the identification of newly available and potentially relevant information and rating factors which are important determinants of health and life related insurance products. This is particularly prevalent in today’s insurance market as insurers engage in a ‘race to simplification’ so that they can offer adequately priced products whilst avoiding having to obtain invasive and time consuming policyholder information.

3. Enhanced Customer Engagement

Insurance company products do not lend themselves well to customer engagement, with most insurance buying viewed as a ‘grudge purchase’. In addition, the industry has suffered from a lack of consumer trust. The traditional insurance model, which typically involves contact at a single (annual) point in time, has arguably held the industry back in today’s customer-centric world.

Incorporating wearables into product design may now help to overcome this as customers are engaged with on a more frequent basis with the potential to reward policy-holders for desirable (i.e., risk lowering) activities. In addition, wearables data might give the insurance company an opportunity to provide policyholders with valuable health information and analysis and motivation (through discounts and rewards) to engage in healthier behaviors.

The Challenges Ahead

Although some insurance companies are already embedding wearables into product offerings, the application of wearables within insurance is still nascent and many opportunities remain to be uncovered and challenges remain to be solved.

Actuaries, as insurance problem-solvers and historic gatekeepers to policyholder premium calculations and insurance product development, are likely to play a significant role, along with other stakeholders, in addressing the many future issues around utilizing wearable data and embedding the technology into insurance. Some issues and questions actuaries may contribute to answering include:

- How can the insurance industry use more timely and rich biometric data to refine their underwriting and pricing practices and provide a more personalized product?

- Can wearable data be used to predict the risk of adverse health outcomes and help incentivize healthy behavior, thus altering the policyholder/insurer relationship?

- What are the socio-economic implications from potentially reducing adverse selection in insurance markets via pricing using wearable technology data? Does more accurate pricing of health insurance open the possibility of extending coverage to those deemed uninsurable or difficult to insure (e.g., diabetics)? Will certain high-risk individuals be penalized as a result? Will they still be able to get insurance? Should regulatory bodies, therefore, provide greater oversight?

- How will customers react to insurers introducing new technology into their products? Will they enter a trusting relationship that encourages data disclosure?

- How can we ensure that we use new novel data sources and artificial intelligence in an ethical manner within insurance?

Furthermore, as the future is likely to move towards more detailed data being captured, on a more frequent and possibly real-time basis, there are various implementation impediments to overcome. Actuaries may also help solve problems in the following areas:

- Data privacy, security and ethical debates have been a central part of the “big data” landscape since its rise to prominence. What are the demographic, cultural, legal and institutional barriers to the sharing of private information? How have users of private data in other technological spheres overcome these barriers?

- What are the technological challenges in the collation, storage, processing and communication of this very detailed and real-time data? Can insurers provide guarantees for the validity and source of the data using technical means?

Blockchain: Part of the Solution?

A major hurdle for insurers’ ability to use wearable data relates to effectively managing policyholder concerns regarding privacy and control of data.

Blockchain, as a distributed ledger technology, holds much potential for the actuarial profession (see Farrell (2018)9). The incorporation of wearable data into insurance may also benefit from blockchain as it potentially allows policyholders to control access to personal records and to know who has accessed them.10 If insurance pricing is to be based on more extensive levels of health and behavioral data, then this data needs to be shared with the insurance company whilst allowing privacy to be maintained as well as adequate policyholder controls (e.g., releasing a certain aggregated level of the data and only for specific purposes) and suitable security mechanisms to be put in place.

Blockchain has already shown promise, within healthcare, in the facilitation of sharing medical data without the need to turn the data over to another party.11 It also, therefore, seems to have potential to be used to help manage wearable data for insurance companies of the future.

Ethical Considerations

With great power (to ‘nudge’) comes great responsibility

Wearable technology has the potential to change the insurer and insured relationship to a more continuous risk-management support role where the insurer helps to prevent adverse conditions taking place by alerting policyholders and also nudging them in the right direction. However, this shift towards ‘predicting and preventing’ and influencing behavior has many potential repercussions that should be considered. To highlight this, consider the following examples:

- An insurance company rewards policyholders for activity via recording steps. As a result, the policyholder goes for a run rather than doing yoga (which they would enjoy more and would have a better marginal impact on their overall health).

- A health insurer offers a policyholder a free watch with heart health monitoring capability. The policyholder willingly accepts it as they expect the data, from their rigorous fitness lifestyle, to reduce their premium. The data reveals a heart issue. The insurance company withdraws cover.

An Ethical Example: Adverse Selection – Friend or Foe?

As ‘big data’ continues to increase, the insurance world appears to be moving towards more individualized, granular pricing. With both increasing and more accurate data availability (e.g., via wearables) it is likely that the asymmetry of information between the insurer and the policyholder will decrease, in the absence of regulation. This situation will inevitably lead to a decrease in adverse selection as the pooling of risk involves pooling lives of a more similar nature and hence fewer lives leave the risk pool because of a pricing mismatch between risk and premium.

There are many socio-economic implications from potentially reducing adverse selection in insurance markets. The traditional view is that reduced adverse selection is advantageous and desirable since policyholders are paying a premium closer to a statistically ‘actuarially fair’ price, that truly represents their level of risk.

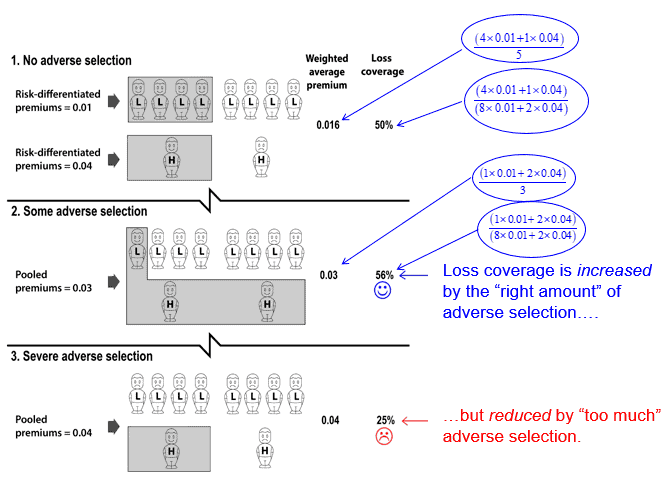

However, this traditional belief provides a good example of a situation where insurance companies and regulators may now need to reconsider traditional views considering the new data rich world we inhabit. For example, British actuary, Guy Thomas (2018), argues that some adverse selection may actually be good for society if we consider the social value created from insurance coverage as a probabilistic ‘loss coverage’.12 I show this situation below (diagram reprinted with kind permission from the author):13

The Potential Impact of Adverse Selection on Insurance Loss Coverage

This example helps to highlight how some groups of consumers (in this case, the low risk insurance policy holders) may benefit from enhanced personalized pricing and other individuals may be potentially disadvantaged (in this case, the high-risk individuals – who are arguably most in need of insurance – who were previously being subsidized by the lower risk policyholders).

This serves as just one example of how insurance companies, regulators and actuaries must carefully consider the implications of incorporating new data into pricing models to help ensure that we are using data responsibly in an ethical manner.

Concluding Thoughts

In an era where data is growing at an exponential rate and machines are progressively more capable of out-performing humans at many tasks, the actuarial profession (like many professions) is facing unprecedented change. Novel data sources, such as from wearable devices, combined with more sophisticated and powerful analysis, is one example of how technology is altering some areas of traditional actuarial work. As we continue to move into this new digital data-rich paradigm, new opportunities and challenges will emerge. Technology is creating a new world before our very eyes, providing actuaries with an opportunity to capitalize on our strengths of technical expertise, problem-solving ability and professionalism to ensure we remain relevant and trusted business professionals in the future.

This essay was awarded first place in the Society of Actuaries’ Actuarial Innovation and Technology Essay Competition in 2020. It has been republished here with kind permission from the Society of Actuaries. The original essay and other entries can be read in full here.