Actuarial Analyst Job Description

What Is an Actuarial Analyst?

Curious what a typical actuarial analyst job description looks like? An actuarial analyst is a professional who uses mathematical and statistical techniques to evaluate and manage risk in a variety of industries, such as insurance, finance, and healthcare.

Working as an actuarial analyst is one of the steps necessary to become a fully qualified actuary.

Students completing their university degrees and looking to pursue a career as an actuary, start off as actuarial analysts. They need to complete a series of actuarial exams and professional training in order to qualify as a fellow member of their country’s actuarial body.

Actuarial analysts are responsible for analyzing data and making predictions about future events, such as death rates, accident rates, and investment returns, in order to inform business decisions.

They would often report to an actuarial manager, who is a fully qualified actuary.

What Does an Actuarial Analyst Do?

Most actuarial graduates start off in an actuarial analyst job, where they perform a variety of different roles.

An actuarial analyst’s main job description is to use mathematical and statistical techniques to evaluate and manage risk.

They also play an important part in cleaning and analyzing data, running expense analyses, doing profit projections as well as performing experience reviews.

Actuarial analysts play a vital role in the insurance, finance, and healthcare industries, where their work is essential for informed business decisions.

Role of an Actuarial Analyst

An actuarial analyst would usually be a junior member in the actuarial team, reporting to a manager who is often a fully qualified actuary.

The job description of an actuarial analyst includes analyzing data and modeling risk, pricing insurance products and evaluating claims, creating financial projections and budgeting, and assessing the financial impact of potential business decisions.

An example of an actuarial analyst’s job description would be to run multiple cash flow projections on a book of insured lives for an insurance company. The cash flows would include premiums received from clients, expenses and claims on life events. The projections would be based on historical data, incorporating past claims and lapses on the book. This would help to predict the future profitability of the life insurance products sold by the company. These projections would then be presented to senior management who would then make the appropriate business decisions for future life insurance sales.

Part of the actuarial analyst’s job description is to work closely with a number of stakeholders in the insurance ecosystem. They work with professionals such as underwriters, investment managers, and accountants. They also need to work with marketing and legal departments to make sure the products are fit and compliant for the market.

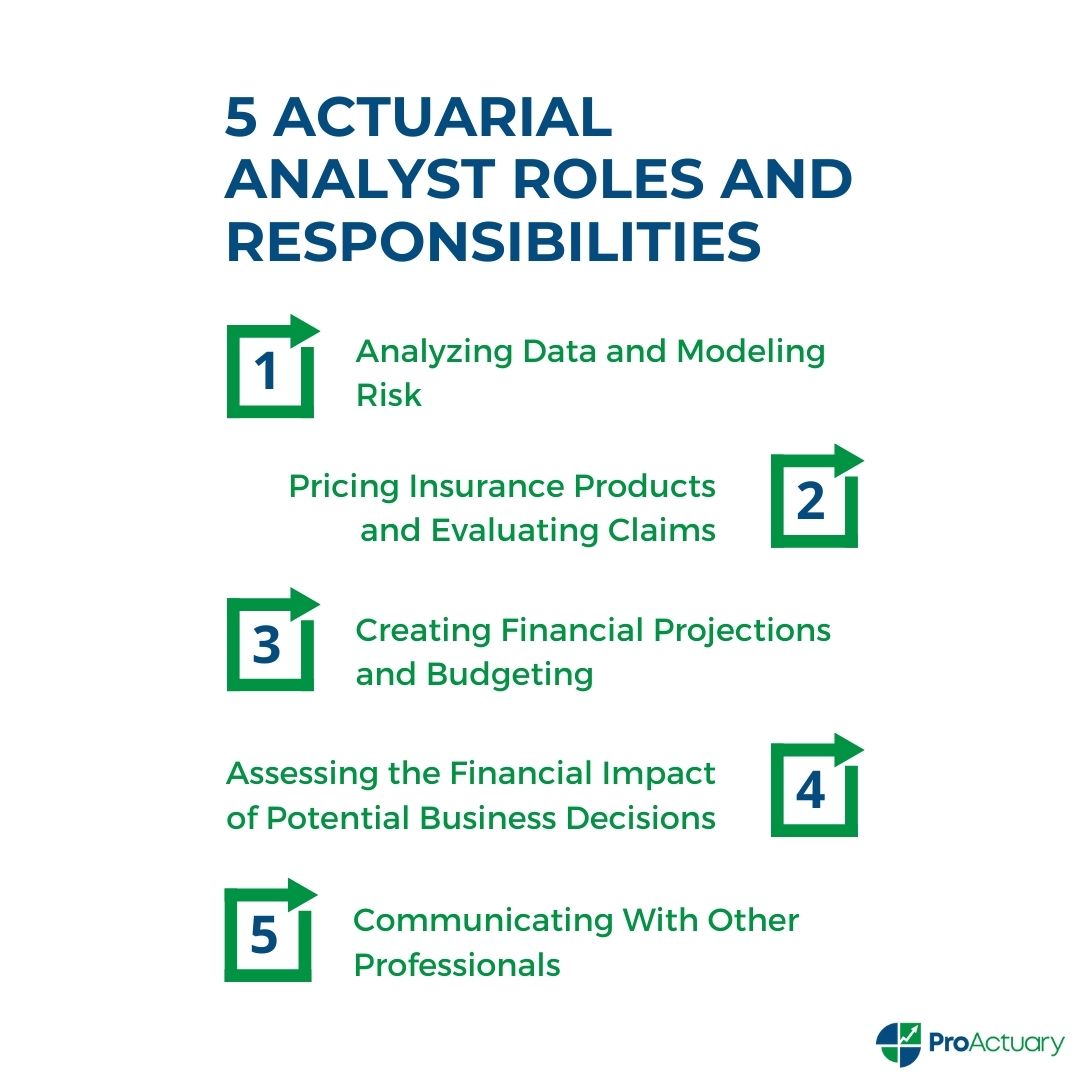

Actuarial Analyst Roles and Responsibilities

The actuarial analyst job description covers a wide range of roles and responsibilities. These roles and responsibilities can vary depending on the industry the actuarial analyst works in.

The five most common roles & responsibilities are:

- Analyzing data and modeling risk: Actuarial analysts employ mathematical and statistical methods to evaluate data and model potential threats in order to advise managerial decisions. This involves recognizing potential risk elements, examining the probability of certain incidents occurring, and calculating the possible budgetary outcome of those events.

- Pricing insurance products and evaluating claims: Actuarial analysts use statistical analysis to set prices for insurance products and evaluate claims. This part of the job description of an actuarial analyst is closely related to point 1 above. They use their understanding of the likelihood of certain events occurring and the potential financial impact of those events to determine how much an insurance company should charge for a particular product and how much they should pay out in claims.

- Creating financial projections and budgeting: part of the actuarial analyst job description is to analyze data and risk to create financial projections and budgets for their clients or employers. For example, they can create a profit projection for a book of insured lives. They use their understanding of the likelihood of certain events (for example, people defaulting on bank loans) occurring and the potential financial impact of those events (for example, the bank having to write of bad debt) to inform financial planning and budgeting decisions (for example, what interest rates to charge and how much money to borrow to clients).

- Assessing the financial impact of potential business decisions: Actuarial analysts use their analysis of data and risk to assess the financial impact of potential business decisions. As an example, the actuarial analyst’s job description could include making changes to the features of an insurance product to attract more sales. They use their understanding of the likelihood of certain events occurring and the potential financial impact of those events to inform decisions about investments, mergers and acquisitions, and other strategic business decisions.

- Communicating with other professionals: Actuarial analysts work closely with other professionals, such as underwriters, investment managers, and accountants. The nature of their work is often technical and difficult to explain in layman’s terms. They must be able to communicate effectively with other professionals and present their findings and recommendations in a clear and concise manner. Additionally, the job description of an actuarial analyst includes being able to explain complex mathematical and statistical concepts to non-technical colleagues and clients in a way that they can understand.

Apart from these roles & responsibilities, the actuarial analyst job description requires a number of important skills to perform their work effectively.

Actuarial Analyst Skills

To be effective actuarial analysts, candidates must possess a strong understanding of mathematics, contingencies, economics and statistics, as well as the ability to analyze large amounts of data and think critically.

In addition, the actuarial analyst job description requires excellent problem-solving skills and the ability to think analytically and creatively. Strong communication skills are important, since actuarial analysts often need to present their findings and recommendations to non-technical colleagues and clients.

In summary, the actuarial analyst job description requires you to have:

- a high level of mathematical skills

- excellent communication skills, including the ability to break down complex, technical information into layman’s terms

- problem-solving skills

- analytical and math skills

- Strong people and listening skills

- Software and data analysis skills

- Good writing skills

- Can-do attitude and the ability to take ownership of projects

- High ethical standards

- Commitment to complete studies

These skills will strengthen the resume of an actuarial analyst candidate.

Actuarial Analyst Career Path

The career path for actuarial analysts includes opportunities for advancement, specialization and even moving into related fields. The salary is competitive and there are opportunities to climb the corporate ladder.

Actuarial students aiming to become fully qualified actuaries, start off as actuarial analysts. Usually they work in insurance firms, consulting companies or at banks or investment firms.

Coursework or a bachelor’s degree in actuarial science or actuarial mathematics, business or finance, economics, engineering, mathematics or statistics, risk management and science, e.g. physics and chemistry provide an excellent foundation to become an actuarial analyst.

Actuarial analysts who want to become actuaries, write a series of professional examinations while working. These exams are offered by their country’s professional actuarial body. Examples of these bodies include the Society of Actuaries or Casualty Actuarial Society in North America or the Institute and Faculty of Actuaries in the United Kingdom. A degree in actuarial science may grant you exemption from some of the core principle (CP) exams and make it possible to qualify in a shorter time while working.

As actuarial analysts gain experience and pass more exams, they can become an Associate or a Fellow of their country’s actuarial body.

Actuarial analysts must often complete their studies while working full time. Some companies give their actuarial analysts study leave in order to prepare for the taxing actuarial examinations. After passing these exams, they can eventually take on more senior actuarial positions such as a Scheme Actuary or a Chief Actuary.

There are various different types of actuary and each route comes with a different actuarial analyst job description. An actuarial analyst may rotate between different departments at a company in order to see the inner workings of each department before choosing a field of specialization. For example, an actuarial analyst may gain work experience in the life insurance department of an insurance firm before joining the short-term insurance department to see if it is a better fit.

Once they have gained enough experience, actuarial analysts can choose to specialize in a particular area, such as life insurance, health insurance, pensions or investments, and climb the ladder accordingly.

Some actuaries move on to become managers or directors of actuarial departments, or even become partners in consulting firms. Many actuaries with several years of experience move into roles such as chief risk officer, chief financial officer, or chief actuarial officer. The job description of an actuarial analyst will change as they progress through the ranks of their company.

Actuarial analysts also have the option to pursue additional qualifications, such as the Chartered Enterprise Risk Analyst (CERA). They can then further specialize in the area of risk management and become Enterprise Risk Managers.

Overall, the career path for an actuarial analyst is filled with opportunities for growth and advancement, both within the field of actuarial science and in wider fields. The path can be challenging, but actuaries who are determined and possess the required motivation and skills can achieve success and eventually reach leadership positions in their companies.

Actuarial Analyst Job Description Template

We have also created an actuarial analyst job description pdf template outlining the key responsibilities, requirements and skills and qualifications for an actuarial analyst candidate. This may be useful for you if you are a hiring manager seeking to hire an actuarial analyst. This pdf template can be downloaded from here.

Download the Actuarial Analyst Job Description Template Here

Actuarial Analyst Job Description FAQs

Additional Actuarial Analyst Job Description Links

Actuarial Analyst Jobs Worldwide

Actuarial Analyst Jobs Birmingham

Actuarial Analyst Jobs Belfast

Actuarial Analyst Jobs Edinburgh

Actuarial Analyst Jobs München

Actuarial Analyst Jobs New York

Actuarial Analyst Jobs Chicago

Actuarial Analyst Jobs Detroit

Actuarial Analyst Jobs Hartford

Actuarial Analyst Jobs Kuala Lumpur

Actuarial Analyst Jobs Singapore

Actuarial Analyst Jobs Hong Kong

Actuarial Analyst Jobs Bangalore

Actuarial Analyst Jobs Gurgaon

Actuarial Analyst Jobs Johannesburg