Why are Actuaries Paid so Well?

When engaging in small talk with a friend of a friend, a former school classmate, or even estranged family members, many actuaries or students heading down the actuarial career path dread the question “so what do you do for a living?” It is a question that often breeds dread; not due to shame about this career choice, as most actuaries are proud of the hard work they’ve done to get here, but simply because one of two responses usually follows.

Most commonly you will be met with confusion followed by “what’s an actuary? Is it like an accountant?” Rather than getting into the details and explaining the many differences, an actuary will simply respond with a simple summary of the profession (keeping it brief usually helps to avoid further interrogation). However, if caught on a bad day, you could be met with an extensive monologue of exactly why actuaries are not accountants.

The second dreaded response, from those who have some awareness of the profession, is some variation of “you must be rich.” In a society where money is often a touchy subject, this question can be uncomfortable and difficult to respond to, but it often leaves us wondering:

What is an actuary’s salary?

Why are actuaries paid so well?

Actuary Salary? Are Actuaries Paid Well?

The majority of actuaries will have targeted the profession based on a love of maths at school along with achieving top marks all through GCSE and A-Level years. However, it is unlikely that any young student submitted their UCAS application without having a look at expected salaries from each degree programme. Seeing actuary at the top of this list may have been the tiebreaker between a firm choice of Actuarial Science or sticking with a straight Mathematics or Finance degree. Therefore, it’s undeniable that the actuarial salaries are high.

Actuaries’ salaries can vary depending on several factors. For example, location has a large impact as actuaries in London will earn more than actuaries in Belfast due to the cost of living – but this is true of almost any job in these locations, particularly in the financial industry. Salaries may also depend on the type of of actuary. For example, general insurance actuaries are currently in high demand in many parts of the world and very well compensated as a result.

The two main fields in the UK are Insurance and Pensions with insurance being the larger of the two due to the many branches. The salary of a pension actuary tends to be slightly lower than an insurance actuary possibly due to less demand with the increase in Defined Contribution pension schemes over Defined Benefit schemes as peoples’ life expectancy is getting longer. Finally, the size of the company and the company’s profits and expectations will undoubtedly impact salaries across the board.

Actuary Supply and Demand

The main reason actuaries enjoy high financial rewards is because they are in high demand, to a degree that doesn’t seem to be diminishing any time soon. Although it may be a huge additional cost to an insurance company or pension trustees to pay a team of actuaries to price products and value schemes; it will likely save money in the long run as actuaries are experts in mitigating risk and preparing for possible future risks. There is also a legal requirement for actuaries. Insurance companies must employ at least one actuary for financial risk purposes and pension schemes legally must have an actuary for defined benefit schemes’ valuations.

High demand alone does not justify generous salaries but when this is paired with low supply, we know that this will result in an imbalance due to the inefficiency. Therefore, companies must offer competitive salaries, which are often supplemented with benefits such as private healthcare, in order to meet expectations, set by the industry. Actuaries have begun expanding into new fields such as Data Science, Cyber Security, and increasingly Climate Change under new sustainable investment regulations in Europe and the UK. The expansion of these new, possibly more exciting and less demanding fields is further limiting the supply of actuaries in more traditional roles.

The Dreaded Exams

Becoming a Fellow of the Institute and Faculty of Actuaries and gaining the highly sought-after ‘FIA’ post-nominal is less than a simple process and there are a few barriers to entry. It involves years of rigorous study both at university level and for at least a few years beyond this. Queen’s University Belfast estimates that it takes an average of 6 – 8 years to become a qualified actuary without exemptions. With the help of University exemptions, this time will be reduced.

A large portion of the study and exams are done alongside personal and professional development as well as meeting deadlines and expectations of the job itself. Although interest in your profession is almost essential for motivation to complete the professional exams it may not be enough to stop the temptation of a career change, particularly with actuarial trainees. According to Actuarial Lookup, the pass rate for the Specialist Applications (now Specialist Advanced) exams is as low as 39%. Therefore, many companies offer an incentive of a pay rise for each exam passed, and once qualified your salary reflects the hard work that you put in to get there.

The exams are split into core principles, core practices, specialist principles, and finally one specialist advanced exam. Each of these levels as well as each individual exam will test and push the skills actuaries need to acquire as they develop through their career. The core exams cover areas of Business, Actuarial Mathematics, and Actuarial Statistics which provides a foundation of skills and allows you to become an Actuarial Associate. Once qualified actuaries are thought to be specialists in what they do, and the specialist exams indicate their particular area of expertise i.e., Health Insurance, Life Insurance, General Insurance, Pensions, or Investments.

‘Softer’ Skills

As well as the exam side of things, qualifying as a fellow requires undergoing personal and professional development (PPD) which expands the skillset further in terms of both practical skills for the workplace and softer interpersonal skills which are highly sought after, particularly for actuarial consultants. If an actuarial consultant presented their Excel spreadsheet to a client using technical jargon and expected them to interpret and understand it there would be a lot of back and forth and inefficiency. Hence, actuaries cannot just be Excel wizards and stay behind a computer all day but must also be able to communicate effectively.

Consequently, actuaries must be able to translate their complex technical calculations and results into lay terms. The sixth principle of the Actuaries’ Code is Communication, and it states, “members must take reasonable steps to ensure that any communication for which they are responsible or in which they have a significant involvement is accurate, not misleading, and contains an appropriate level of information.” Therefore, in order to comply with this, actuaries must have a deep understanding of the work they have done and how it will be perceived by a non-technical audience.

Accountability

Generally, any job with a high level of personal responsibility will be paid well as an incentive to be willing to be liable when something goes wrong. A comparison would be a medical doctor whose daily decisions can be life or death and so doctors are seen to be paid reasonably well partly for accepting this risk. Similarly, actuaries may be working with millions of pounds at a time and a small mistake can have huge ramifications for companies. For example, if a scheme actuary signs off on an actuarial pension valuation that advises the trustees of its liabilities and the advice given is incorrect, the scheme may not be able to cover its liabilities in a matter of years.

With a high level of responsibility comes a high level of trust from employers. Insurance companies trust that actuaries’ methods of pricing insurance products are based on accurate methods and are checked thoroughly. Similarly, pension trustees and employers expect valuations and accounting reports to be based on assumptions that are chosen to reflect the current economic climate as well as the financial position of the pension scheme. Essentially, actuaries are being trusted to handle the future planning of millions in a way that limits any risk. Putting this level of trust in an individual or team of individuals allows employers to justify the high salaries they award to their actuarial teams.

Actuary Salary: Devil’s Advocate

Some actuaries may feel they aren’t actually paid that well when you weigh up the costs and benefits of an actuarial career. For example, most young students look forward to graduating, putting their life in academia behind them, and enjoying their twenties.

However, actuarial students can only look forward to a step-up in their exam level as well as the difficulty of balancing this alongside their day-to-day job. The starting salary for an actuarial science graduate is similar to that of many degrees of a similar calibre which don’t have the added downside of years of additional study.

This sacrifice may feel like it deserves more than a higher wage band. However, this argument often comes from trainees who are struggling through their exams and passing them all seems like a lifetime away.

Generally, the grass is always greener on the other side, and once qualified the years of study don’t seem quite as gruelling.

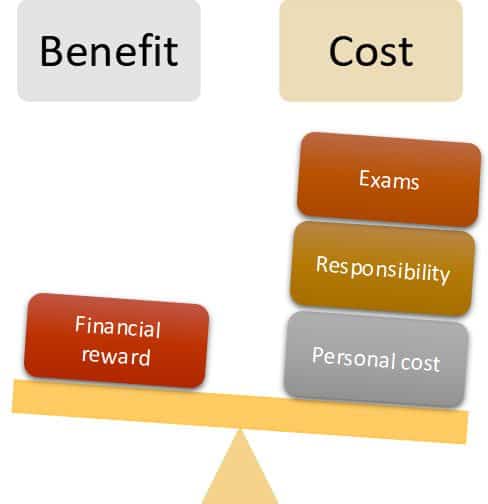

Overall, actuaries are paid so well primarily due to the personal sacrifices associated with both training and working as an actuary. As with everything in life, incentive comes from weighing up the cost and benefit of a decision. When deciding to embark on the actuarial journey the thought of a well-paid job could be one of the many benefits which balance the decision scale.

Actuary Salary FAQs

Roisin Flannery

“Roisin Flannery is a Retirement Actuarial Analyst at Willis Towers Watson. Prior to that she was an Actuarial Intern at Invesco Ltd. Roisin graduated from Queen’s University Belfast in 2021 with a BSc degree in Actuarial Science. You can connect with her on LinkedIn.”