Actuary Vs Data Scientist

Actuary Vs Data Science: Which is better? How do they differ? Which should I choose? These are questions I get a lot from actuarial students these days.

First some background:

About 11 years ago I started introducing data science into one of my Actuarial Science courses.

My rationale was a belief that actuaries of the future would increasingly incorporate a lot more data science and thinking into their day to day jobs and actuaries would also possibly move beyond the traditional realms of insurance, investment and pensions to new areas where analytical skills were becoming increasingly important. I felt that actuarial students should, therefore, be learning more about how to deal with extremely large datasets and how to use machine learning techniques and be able to, when necessary, move beyond the application of more traditional statistical methodologies. That belief has turned out to be true as we have witnessed the explosion of data science more generally and it has also made further inroads into the actuarial profession.

I wanted my actuarial students to gain exposure to data scientists working in different fields so they could really start to think about the possibilities. I would therefore (and I still do) bring in data scientists from different industries and companies to talk about their experience. To tell stories about the various data problems they were solving, the tools they were using, the challenges they were facing and the opportunities that were out there. The idea was to get my actuarial students to think beyond mortality and insurance modelling and to open their eyes to the immense possibilities that were opening up for analytical and data savvy individuals to utilise their skills to help companies extract value from the ever increasing data sets that were becoming available.

At the time of this introduction (2009), data science as a term wasn’t really in vogue. Instead terms such as predictive modelling and predictive analytics were instead often used to describe what we now mainly refer to as data science.

Of course, since then, data science has exploded. Exponentially increasing data combined with enhanced computer processing power, better tools and sharing of knowledge has ushered in what is now often touted as “the world’s most sexy job.” Data maths and statistics becoming sexy! Alexandra Robbins wasn’t too far off the mark when she wrote that “The Geeks Shall inherit the World.”

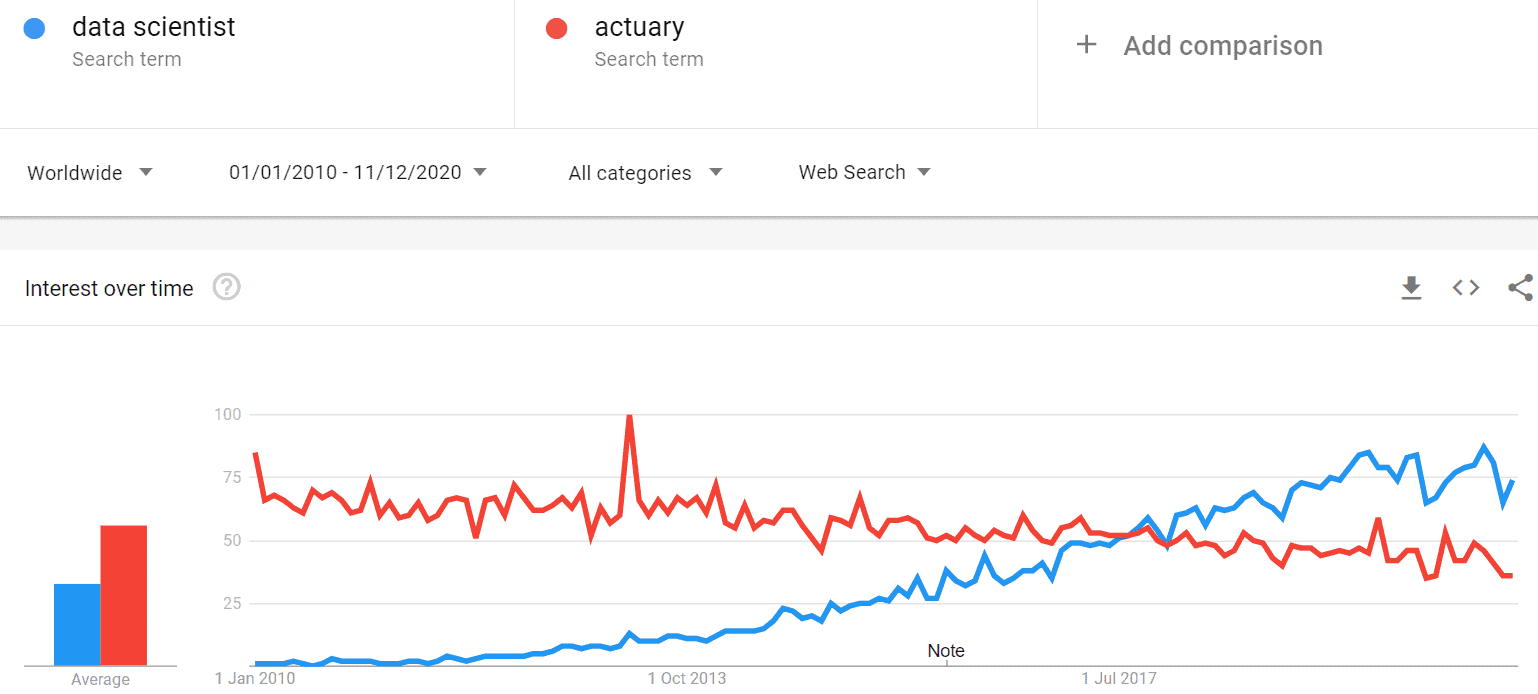

If we compare a simple Google trends search we can see that it has left poor old Actuarial Science in the dust of late!

Actuary Vs Data Scientist: Source Google Trends

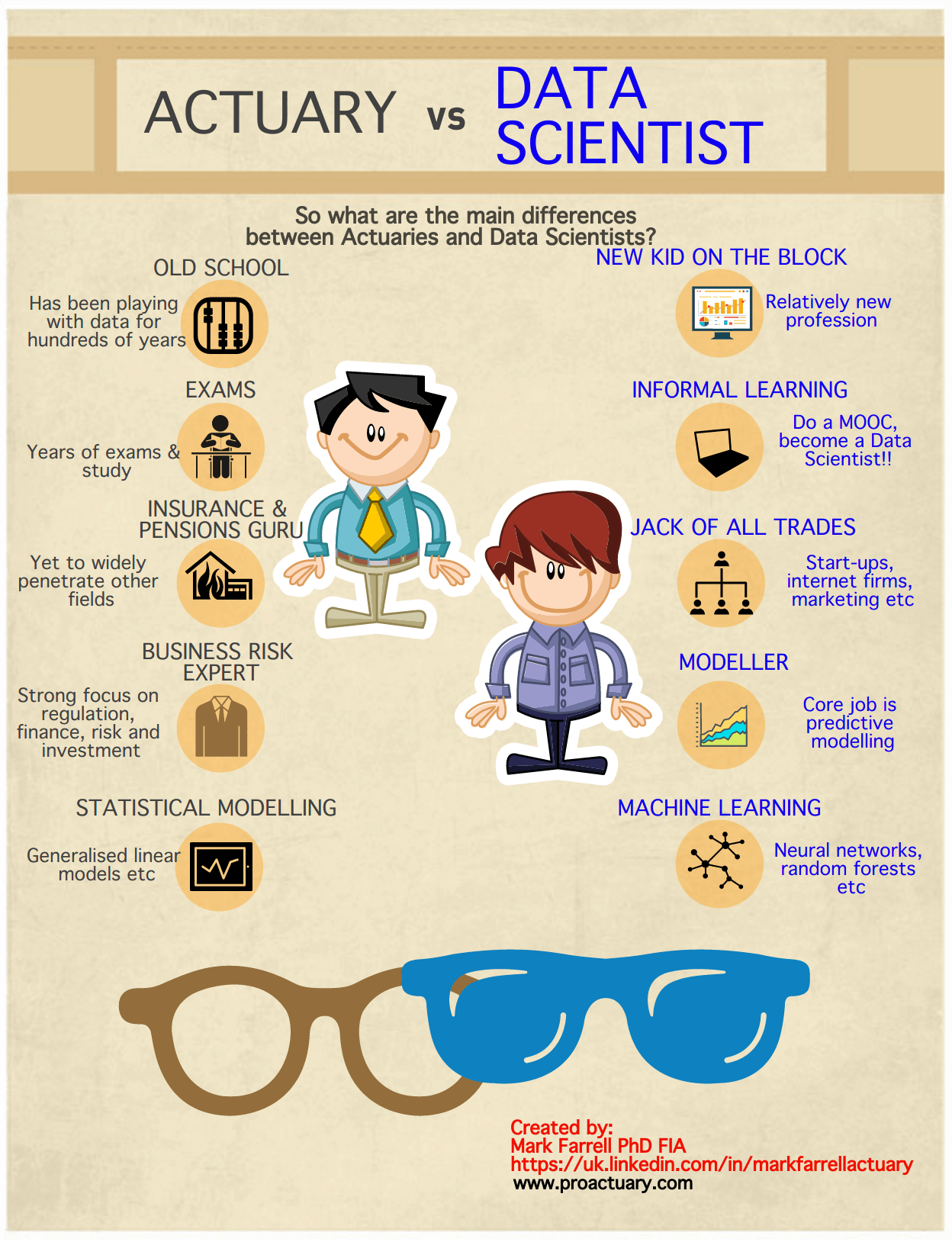

The process of speaking with and listening to many different data scientists over the years really made to think about and consider what the key differences were between data scientists and actuaries. My students wanted to know as well. In many ways, the difference is vague and grey. Actuaries are, after all, generally considered to be the very first data scientists when we began using data to make predictions in the insurance world over 200 years ago.

This infographic is my attempt at trying to capture some of the key differences between the two fields at present. I think the differences will become more blurred over time. When I posted this on LinkedIn back in 2017 it received a fair bit of interest and generated some very interesting debate, some of which I’d like to highlight and discuss further below (to be updated).

1: Old School Vs New Kid on the Block

Actuarial Science roots go back to the late 1600’s and the 1700’s when pioneers such as John Graunt (a London draper who showed there were predictable patterns of longevity and death in cohorts of lives), Edmond Halley (not just famed for “Halley’s comet,” he also constructed a life table for premium calculations) and James Dodson (pioneered work on long term insurance contracts) led the way. Actuarial Science has, therefore, evolved over many years and as such it has in place many global professional standards, certifying professional bodies and regulations.

Actuarial Science also has a well defined educational curriculum with globally agreed knowledge requirements facilitating mutual recognition agreements, such as that between the IFoA and various other actuarial professional bodies (e.g. the Society of Actuaries, the Actuarial Association of Europe, the Actuaries Institute (Australia), the Actuarial Society of India, the Actuarial Society of South Africa, the Canadian Institute of Actuaries, the Casualty Actuarial Society, the Institute of Actuaries of Japan and the Israel Association of Actuaries.

Data Science, in contrast, is generally viewed as a new career and has not been “professionalised” to the same extent.