The General Insurance Actuary

Delve into the world of general insurance actuaries, key figures in assessing risks and crafting policies that ensure robust financial safeguards within the insurance industry, and explore the qualifications necessary for this vital role.

60% of actuaries work in general insurance, making it the largest industry within the actuarial profession. The UK insurance market was valued at £79 billion in 2020, with motor insurance having 34.5million policies in force accounting for 45% of premiums, and home insurance having 27million policies in force, accounting for 30% of premiums.

The Role and Impact of a General Insurance Actuary

The broadest definition of general insurance, also called non-life, or property and casualty insurance generally covers all insurance that is non-life, including motor, household, public/private liability and employer liability.

General insurance actuaries provide expertise in 3 main areas;

- Pricing/ underwriting: this involves using statistical modelling to assess the risks of various products or individual clients to determine the cost of premiums for a range of coverage and to assess the appropriate level of cover. Pricing actuaries also model the profitability of strategies to attempt to avoid making losses on premiums.

- Reserving: this is assessing the likelihood of general insurance outcomes and calculating what provisions of capital are needed to cover such outcomes as well as what provisions are necessary to comply with reporting standards such as Solvency II and IFRS.

- Capital modelling/ risk management: actuaries involved with capital modelling project movements in the value of assets and liabilities for the future to assess solvency.

Path to Becoming a General Insurance Actuary: Exams and Qualifications

It is commonly noted that the path to becoming a fully qualified actuary can be involve extensive studying and years of exams, but the structure of the qualification route allows for future actuaries to have a broad knowledge base which is key for success.

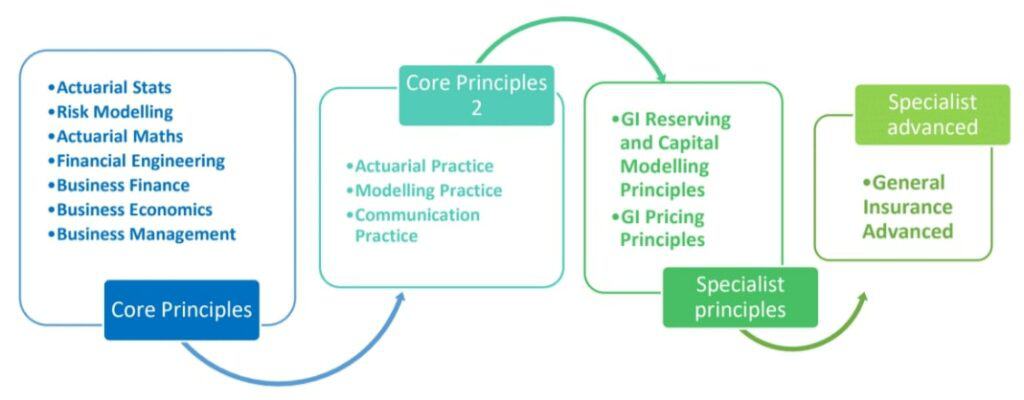

The internationally recognised IFOA qualification route is the most common, and involves 10 exams for the associate path, with 24 months continuous personal development (CPD), or 13 exams for the fellowship path, with 36 months CPD.

Generally, if you are working in the general insurance field whilst completing the IFOA exams for the fellowship path, you will undertake the GI specific exams; SPP7 (GI Reserving and capital modelling principles), SP8 (GI Pricing principles) and SA3 (GI Advanced).

As well as completing the necessary exams a practising general insurance actuary must have the following in place. Once becoming a fellow of the IFOA, to practice as a GI actuary, a practising certificate is also needed in the UK from the IFOA. It is also a requirement for all actuaries to have professional indemnity insurance. This protects the actuary from any claims of errors or negligence.

In addition to obtaining necessary qualifications to become a practicing actuary, there is an increasing demand for actuaries who have experience or expertise in coding and machine learning so this can also be desirable or necessary for working in some departments within general insurance. Programmes such as R, Python and PowerBI are frequently used by general insurance actuaries today as the data available becomes greater. Indeed, it is almost always required that you have proficiency in Microsoft Excel as this is the most frequently used programme for modelling.

The actuarial profession, whilst traditionally intellectually focused, has seen a shift in recent years towards widening skills sets, including a need for business knowledge, teamwork and most importantly communication. It is not just about being able to create models and solve calculations, it is also a highly desirable skill to be able to explain results and possible outcomes to a range of knowledge bases, from senior colleagues, to clients to regulatory boards, both in written and verbal forms.

Salary and Career Progression for General Insurance Actuaries

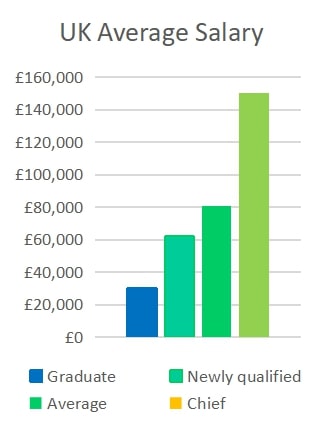

The average salary for a fully qualified general insurance actuary in the UK is £81,000. A graduate level trainee actuary starts on around £30,000 however this can differ depending on the cost of living in the location and the number of exemptions or exams completed. As more exams are completed, salary rises and you may obtain a bonus/ benefits depending on employer. Chief actuaries or those in senior positions can earn in excess of £150,000.

A career as a GI actuary is challenging but can be very rewarding not just in terms of a generous salary, but many employers also offer competitive benefits such as bonuses, flexible working and health insurance. There are also many opportunities for working across different areas and many employers do understand the benefits of utilising outside knowledge if you decide to change to a different type of insurance so there are opportunities to do so alongside advancement in a chosen area which is also ideal.

Although the road to qualifying can be very difficult and will require significant dedication, as noted above, the work life balance and rewarding benefits can be a great motivator.

Pricing and Reserving in General Insurance Actuary: A Comparative Analysis

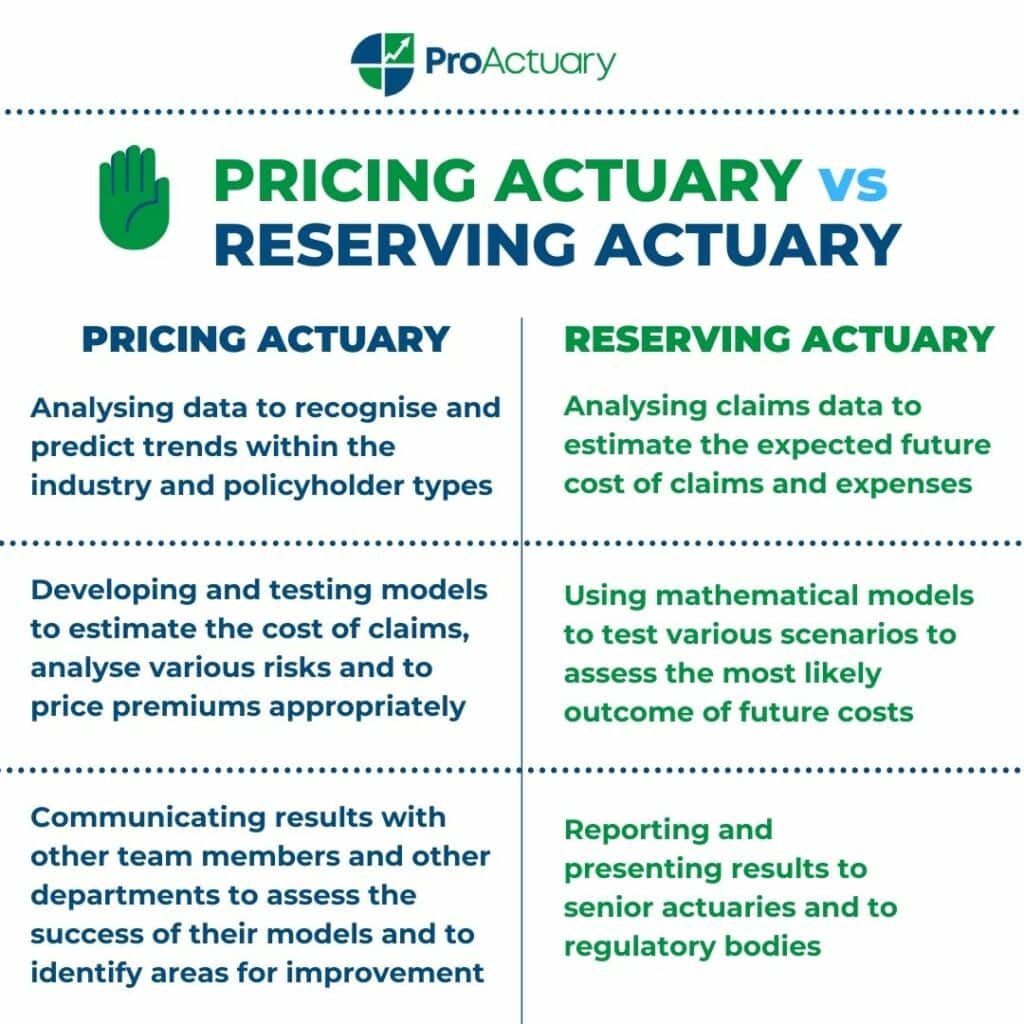

Pricing actuaries in general insurance use mathematical models to analyse data in order to estimate the cost of a risk and calculate the price of the associated premium. Although tasks may differ day to day and between different departments, some common tasks include;

- Analysing data to recognise and predict trends within the industry and policyholder types

- Developing and testing models to estimate the cost of claims, analyse various risks and to price premiums appropriately

- Communicating results with other team members and other departments to assess the success of their models and to identify areas for improvement

Frequently used in general insurance, Generalised Linear Models, Generalised Additive Models, ruin theory, run off triangles and one-way tables.

An essential skill of a pricing actuary is to ensure the correct risks are identified and valued appropriately for policyholder in question, of which these can vary significantly by insurance line. Motor insurance categories could include age, number of years of experience, previous claim history, the age of the car and the location. In contrast, for home insurance this may be based on the house price, the value of belongings and the likelihood of extreme weather events.

Whilst the typical tasks of pricing and reserving actuaries are similar in methodology, they are based on different concepts. The work of a reserving actuary involves estimating the amount of money that the company will need to cover future claims and other expenses, as well as to ensure compliance with relevant regulations. Some daily tasks include:

- Analysing claims data to estimate the expected future cost of claims and expenses

- Using mathematical models to test various scenarios to assess the most likely outcome of future costs

- Reporting and presenting results to senior actuaries and to regulatory bodies

Reserving actuaries must have an awareness of the current economic climate and the history of policyholders in order to carry out sensitivity analysis for factors such as inflation, foreign exchange movements, rates of policy withdrawal, climate chance and new regulations.

An essential part of all actuarial work is ensuring awareness and compliance with all relative regulations for their line of insurance and region. This could include US GAAP, IFRS and Solvency II directives.

Risk Management in General Insurance: The Actuary’s Role

The main role of an actuary working in risk management concerns identifying, assessing the magnitude and providing solutions to mitigate such risks that a company may face in that line of insurance.

The risks faced by each respective insurance type can differ widely and so will the impact so it is important that each risk is tested extensively for extensive results. This can range from extreme weather threats like flooding or hurricanes for home insurance, to a building collapsing causing huge claims for employers’ liability.

Risk management actuaries typically work on the following areas:

- Identifying risks that impact their line of insurance. The risks faced by each respective insurance type can differ widely and so will the impact so it is important that each risk is tested extensively for extensive results. This can range from extreme weather threats like flooding or hurricanes for home insurance, to a building collapsing causing huge claims for employers’ liability.

- Assessing the likelihood of the risk event occurring and what the consequent impact will be for the policyholder and client. This is usually done using statistical models which can be adjusted easily to provide outcomes for different scenarios

- Developing strategies to manage risks. This could include establishing policies to cover specific risks which may have a higher premium associated to cover the high cost of the potential risk, implementing plans for the cases of unexpected risks and monitoring the status of current risks.

The Influence of Solvency II on General Insurance

Solvency II is an EU directive introduced in 2016 which underlines regulatory requirements for all insurance and reinsurance companies operating in the EU. The main focus is to ensure that the companies have adequate solvency to protect policyholders and beneficiaries should there be a case of unexpected losses.

Solvency II regulations centre around 3 pillars; quantitative requirements, qualitative requirements, and public discourse.

A crucial part of the work in general insurance is implementing sufficient analysis of data through developing and testing models to ensure they have solvency ratios that comply with Solvency II requirements. Mainly this involves valuating assets and liabilities and predicting future movements of claims to ensure they have sufficient capital reserves. It is also critical that they produce accurate and frequent reports detailing risks and calculations undertaken so that this is available for regulators and other relevant bodies.

Solvency II has had a major impact on the general insurance industry as it has introduced a higher standard of regulations to comply with. This has led to significant increases in operation costs due to the having to hold invest more resources in data analysis, more complex models to undertake comprehensive analysis, production of in-depth reports, and having to hold more capital reserves.

Although Solvency II may appear to have had negative consequences for the industry, at the same time it has led to increased product innovation and improvements in the standard of risk management and the level of transparency of companies which benefits both policyholders and insurers as it means that the risk of insolvency is reduced.

As the UK is no longer a member of the EU, there are currently plans being developed for 2024 to adopt a hybrid model which would include using parts of the current Solvency II regulations but also allow for relaxations of the rules surrounding “matching adjustment portfolios”, which would allow insurers to swap assets for more economically productive ones.

Data Analysis and Trend Prediction in General Insurance

In recent years, there has been an introduction of data science techniques such as AI and machine learning in the general insurance industry, especially in the motor industry to further analyse consumer behaviour, detect fraud, better target products, and understand policyholder risks. In fact, the EIOPA found that AI and ML is being actively used in 31% of firms. It is still something new to the industry, and many firms may be undecided about implementing such techniques due to the concern regarding regulation, but it is fast growing and is expected to continue to do so.

General insurance is the largest industry for actuarial work and covers all non-life insurance lines, and working as an actuary in general insurance can provide an exciting career with a broad range of opportunities in a number of fields, whether it is motor, pet or home insurance.

The tasks of a general insurance actuary can vary from pricing, reserving or risk management but of course a high level of mathematical skills and problem solving is necessary. The road to qualifying can seem daunting but it provides all the essential skills and knowledge for a successful career in general insurance for the future.

General Insurance Actuary FAQs

Aislinn Kearns

“Aislinn Kearns is an Associate Actuary at KPMG Ireland. Prior to that she was a Valuations Intern, L&H Corporate Actuarial at Hannover Re. Aislinn graduated from Queen’s University Belfast in 2023 with a BSc degree in Actuarial Science and Risk Management. You can connect with her on LinkedIn.”