Actuarial Exams: The Ultimate (Non-conventional) Guide to Passing

Actuarial Exams: The Real ‘Secret’ to Success

I started writing on LinkedIn a few years ago. I wanted to ‘give back’ a little to the actuarial profession. I also wanted to clarify my thinking. Writing is one of the best tools we have for gaining clarity.

At first, a few hundred would read my posts, then a few thousand and eventually the views morphed into the millions. I never imaged that.

A lot of my writing is about helping trainee actuaries to get through the long arduous journey of passing actuarial exams and getting to the coveted actuarial Fellowship destination.

Why?

Because I’ve been there.

Many years ago I decided to take on the challenge of crossing the chasm from fresh grad (with 1 exemption out of 15 IFoA actuarial exams) towards becoming a qualified actuary.

And…I struggled. I failed. I messed up. I hit low points.

But eventually I did manage to come out the other side.

And like all great journeys in life, I learnt a lot.

I learnt about risk, financial mathematics and advanced statistical concepts.

But more than that, I learnt how to succeed on a difficult journey. How to pick myself up when the chips were down. How to persevere in the face of extreme doubt and uncertainty.

Basically…I learnt about life.

So here’s the thing: if you are here reading this, I’m almost certain that you have the ability to get through the actuarial exams.

The material is difficult.

But not as difficult as some people make out.

The hurdle is only partly technical and learning the material.

The bigger problem is staying the course and having the mental fortitude to move forward, motivate yourself and keep yourself in the game over the long term.

This is a mental game more than anything. It’s the mindset that will get you ‘there’ in one piece.

For that reason, this guide is generally focused on the psychology of actuarial exam success and not so much the technical side.

Are you ready?

Okay. Take a deep breath and let’s dive in. I promise to make it worth your time:

1

Choose Your Pain

Studying for actuarial exams is a pain.

I mean that in a literal sense.

The very act of sitting down (especially after a long day of work or on the weekend), opening the actuarial exam study books and actively engaging the brain in stochastic processes, generalised linear models or whatever, is,…. well… it’s kind of painful.

At least that’s what I remember.

I recall repeatedly thinking how I would much rather be doing something else.

I mean, seriously, who wants to open a set of actuarial study notes on a Saturday evening when you could be playing sport, seeing friends or watching Netflix instead?

But the thing that often kept me going was the notion that if I didn’t endure that small mental ‘pain’ of studying I was increasing the probability of greater pain at a later date.

The emotional pain of regret.

And that stuff really hurts.

From a pain optimisation (minimisation) mathematical expectation formula, choosing the immediate pain of studying made logical sense.

In other words, the probability weighted future pain of possible regret was greater than the immediate pain of discipline.

A bit like how in insurance it makes sense to pay a premium (a definite immediate small price) to avoid a future potential catastrophic loss.

With this in mind, the discipline to start (which is half the battle) became so much easier.

Next time you are struggling to sit down and study for your actuarial exams, take a moment to consider the probable trade-off if you don’t:

The pain of regret.

We must all suffer from one of two pains: the pain of discipline or the pain of regret. The difference is discipline weighs ounces while regret weighs tons.”

— Jim Rohn

2

Optimize Your Life Experiences

I recently read this article in The Times newspaper on the train into London.

My first thought was, crikey £120k (~$145K) starting salary for a law graduate. And I thought trainee actuaries were reasonably well paid!

Then I read the last few paragraphs….

“Ropes and Gray recorded the second latest average finish time of 10.51pm, followed by Weil, where the average finish time was 10.17pm. Speaking anonymously, one junior lawyer, said: “[There is] lots of talk about the need to switch off when working from home, but that doesn’t really happen in practice. It’s become the norm that I will take a short break for dinner, but feel compelled to log back on right up until I go to bed.”

This delayed gratification/sacrifice conundrum is something I remember grappling with when I started my actuarial career.

Trying to decide how quickly I wanted to get through my actuarial exams seemed akin to solving a life optimisation equation:

How do we maximise our positive life experiences considering certain life experiences can only be enjoyed at certain times? For example, I loved travelling the world solo, owning nothing but a backpack and staying in ultra cheap hostels and jungle shacks at age 21.

Now, with 3 kids, that wouldn’t be possible…or even desirable.

Starting out as a trainee actuary I initially (naively!) thought a 3 year qualification time (starting with 1/15 exemptions) was a good goal. In my head, I was sure I would get through my actuarial exams a lot quicker than average (average travel time to actuarial fellowship qualification, if you don’t have exemptions, is about 7 years).

I quickly realised the sacrifice this would mean for me, in terms of giving up much of my early 20s, and readjusted that goal significantly downwards. [side note: I later readjusted my actuarial qualification goal towards the end, when I realised I was at risk of not finishing].

I’m all for delayed gratification, sacrifice and working hard. But there has to be a line somewhere as far as a regret minimisation framework is concerned. Delaying gratification for too long is something rarely discussed in our ‘success’ obsessed world full of stories about kids that resisted eating the marshmallow.

At the end of the day, our lives are the sum of our experiences which is much more than the balance showing in our bank account or the accolades on our CV.

Looking back now, I’m happy with my decision to take the slower approach. But, I admit, I do sometimes wonder what the alternative (more aggressive) path might have looked like.

I think this is an optimisation problem worth thinking about.

Everyone is different in terms of how much time they are willing to sacrifice (most likely in their early 20s ) towards a career,

You should be clear at the outset where you personally want to draw the line.

3

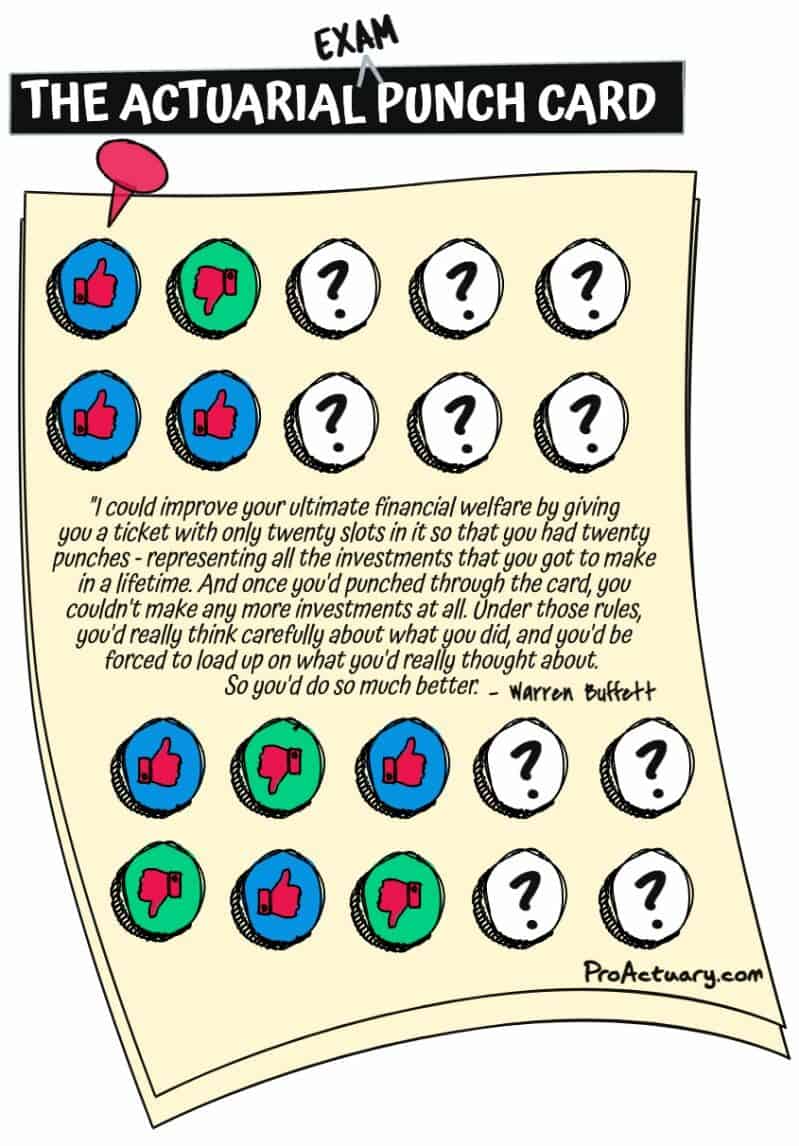

The Actuarial Exam Punch Card

I used to be an actuarial exam constrained optimiser.

Or so I thought.

What I mean is, I never wanted to do more work than necessary:

I feared spending more than ‘just enough’ time studying and regretting the opportunity cost.

My pass margin aims were, therefore, small.

With a 70% pass mark, a 72% was a great result. It meant I had optimised my study approach by knowing ‘just enough’ and thus hadn’t unnecessarily sacrificed any leisure time.

Then I read about Warren Buffett’s punch card approach. He tells investors to act as if they have a punch card with only 20 investing slots to improve performance.

In a similar vein to Buffett’s philosophy, I realised I probably only had about 20 actuarial exam attempts before kids, exam fatigue, increasing work responsibilities and life would mean I was at risk of quitting.

And, of course, there’s the significant additional time required to resit an actuarial exam after a fail.

This resulted in a significant mindset shift. I began to view each actuarial exam attempt in a different light.

To think long-term instead of short-term.

Each actuarial exam attempt was a finite opportunity to punch a pass.

I, therefore, put in more hours and pushed to increase my margin.

In hindsight, I made the right decision.

Opportunity cost is real.

But so are missed opportunities, faulty assumptions and short-term thinking.

A strategy based on mediocrity that doesn’t maximise your chances for a home run can be more risky than you realise.

4

Don’t Rely on Inspiration

Actuarial students studying for actuarial exams can learn a lot from successful writers:

I write when I’m inspired, and I see to it that I’m inspired at nine o’clock every morning. ” ― Peter De Vries

5

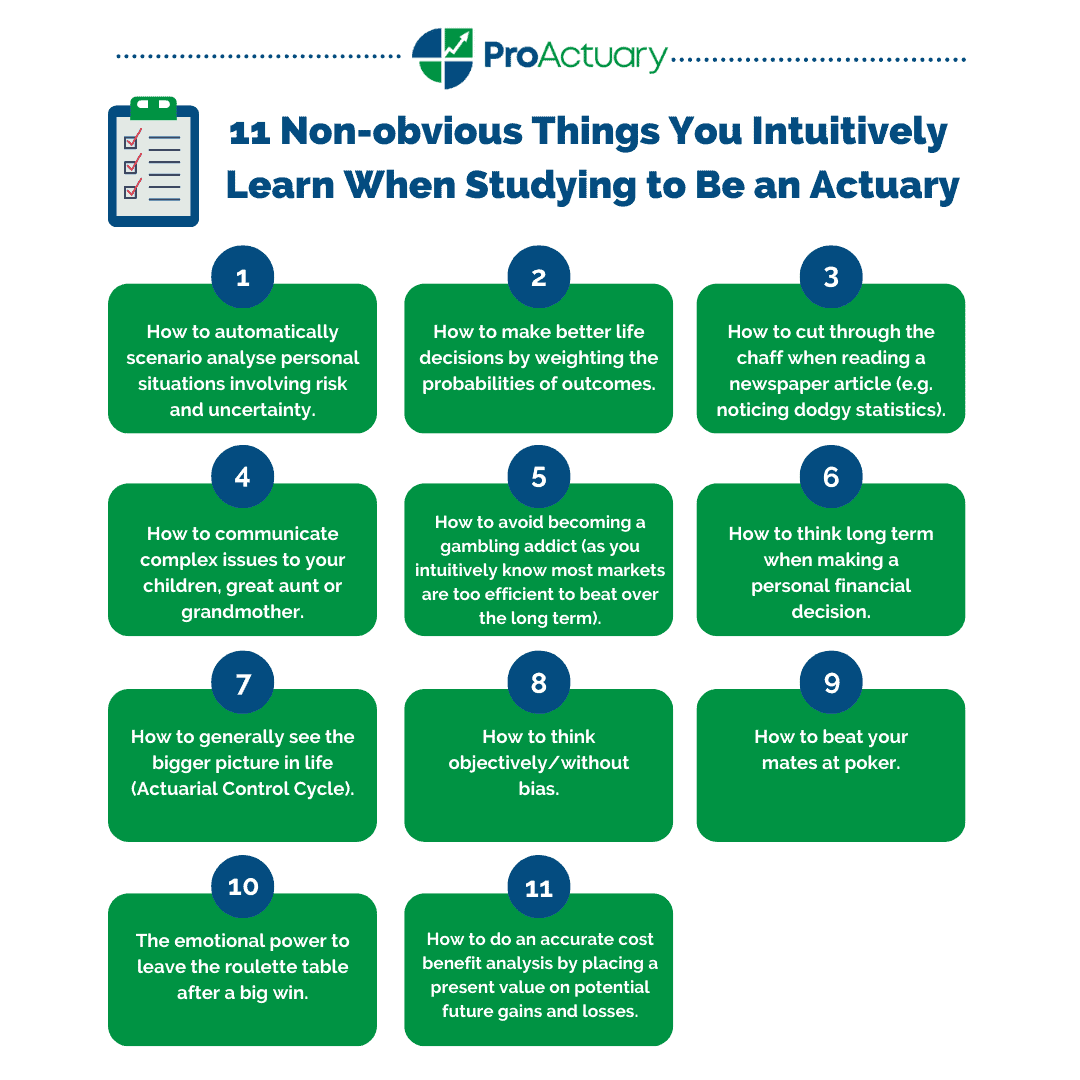

Consider the Tangential Benefits to Actuarial Exams

Actuarial Science teaches us much more than statistics, maths and business.

11 non-obvious things you intuitively learn when studying to be an actuary:

6

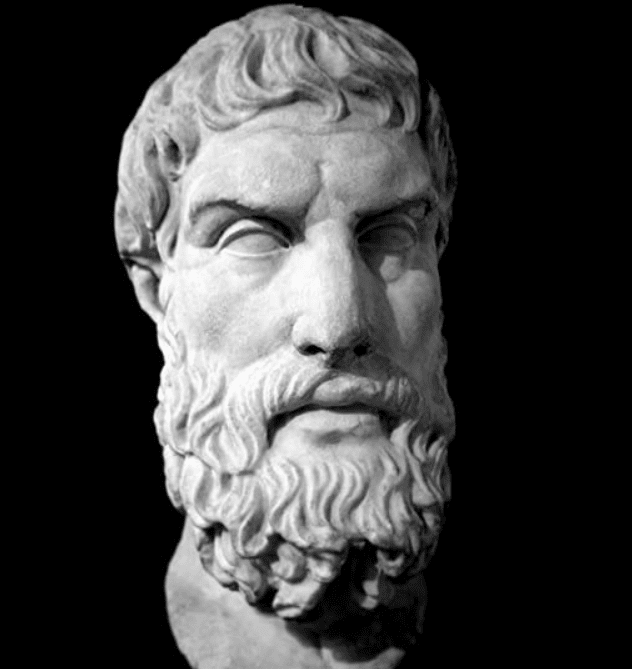

Fully Commit to Your Actuarial Exams

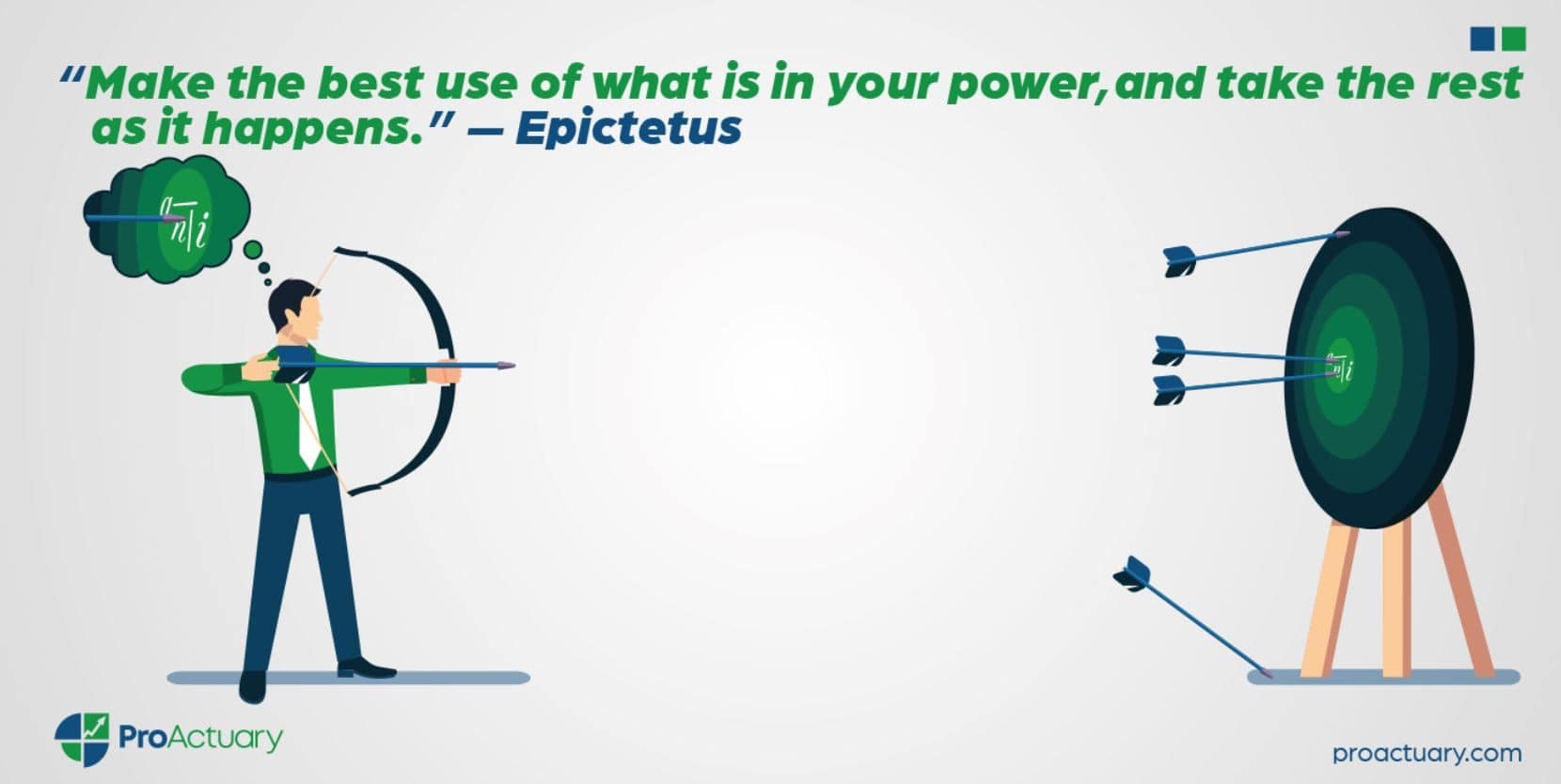

New actuarial students, embarking on actuarial exams, should read and ponder on the words of one of the greatest Stoic philosophers, Epictetus:

Think things through and fully commit! Otherwise, you will be like a child who sometimes pretends he or she is a wrestler, sometimes a soldier, sometimes a musician, sometimes an actor in a tragedy. A half-hearted spirit has no power. Tentative efforts lead to tentative outcomes. Average people enter into their endeavors headlong and without care. Perhaps they meet with an exemplary figure like Euphrates and become inspired to excel themselves. It is all well and good to do this, but consider first the real nature of your aspirations, and measure that against your capacities.”

7

Be Prepared for the Actuarial Challenge Ahead

The actuarial dream:

Actuarial study books for sale. Used once.

The reality:

Actuarial exam books for sale. Used many times. Some over many years. Scuffed, worn, and tattered throughout. May contain multiple coffee, sweat, and tear stains. Genuine sale (selling for emotional reasons). Text only.

8

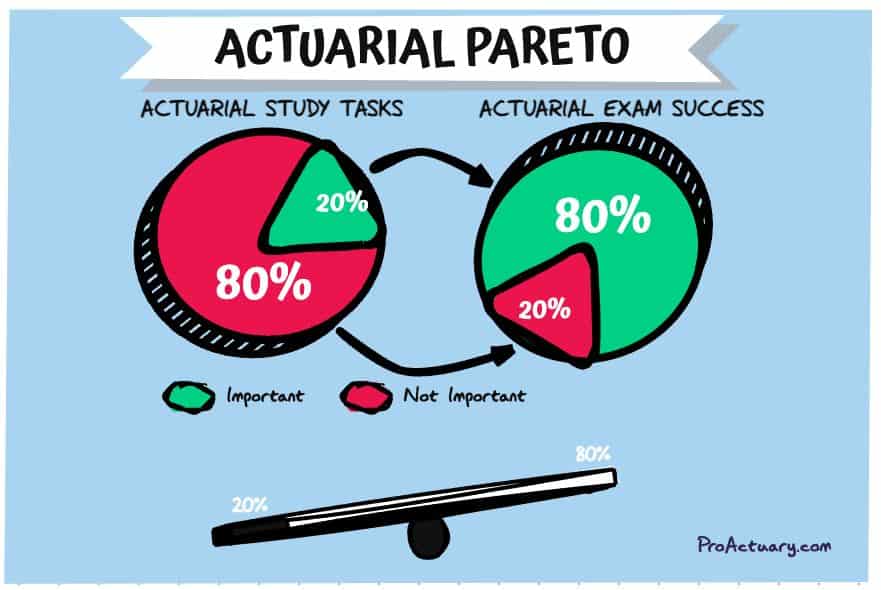

The Actuarial Pareto

Every year I discuss the Pareto distribution with my actuarial students.

This inevitably brings us on to discussions of the Pareto Principle or 80/20 rule as it’s such a useful rule for life.

Every actuarial science student should be aware of it.

It tells us that, for many events, ~80% of the effects come from ~20% of the causes.

Italian economist, Vilfredo Pareto, first noticed this unequal distribution in land distribution (~80% owned by ~20% of the population).

It has since been recognised across many other fields, such as:

- In business management, ~80% of sales often come from ~20% of clients.

- In athletics, ~20% of the exercises and habits having ~80% of the impact.

When faced with choices of what to do next, it’s often helpful to recall this unequal distribution.

Get into a habit of asking yourself, which tasks (causes) will bring about the greatest results (effects)?

Actuarial exam study is a good example where this principle applies.

Ask yourself:

- What’s my highest value activity right now?

- What’s the 20% activity that will give me an 80% ‘effects’ value? Is it learning new material, doing past actuarial exam questions or going over old material? Spoiler alert: it’s probably the thing that feels most uncomfortable, such as doing past papers!

It’s such a simple and easy, yet effective, habit to optimise our approach to learning.

If you have 10 study items on your list, think carefully about which 2 to do!

9

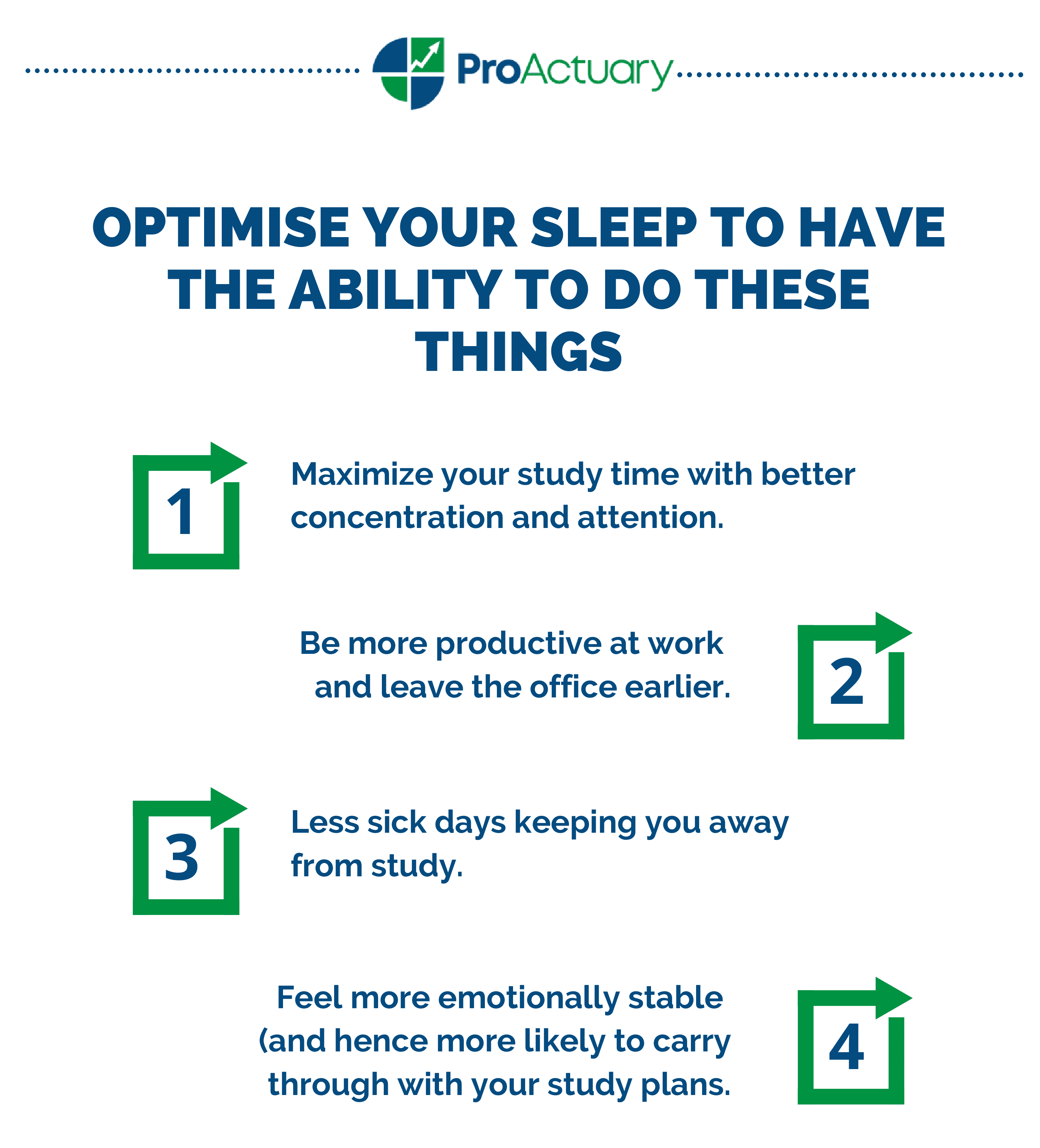

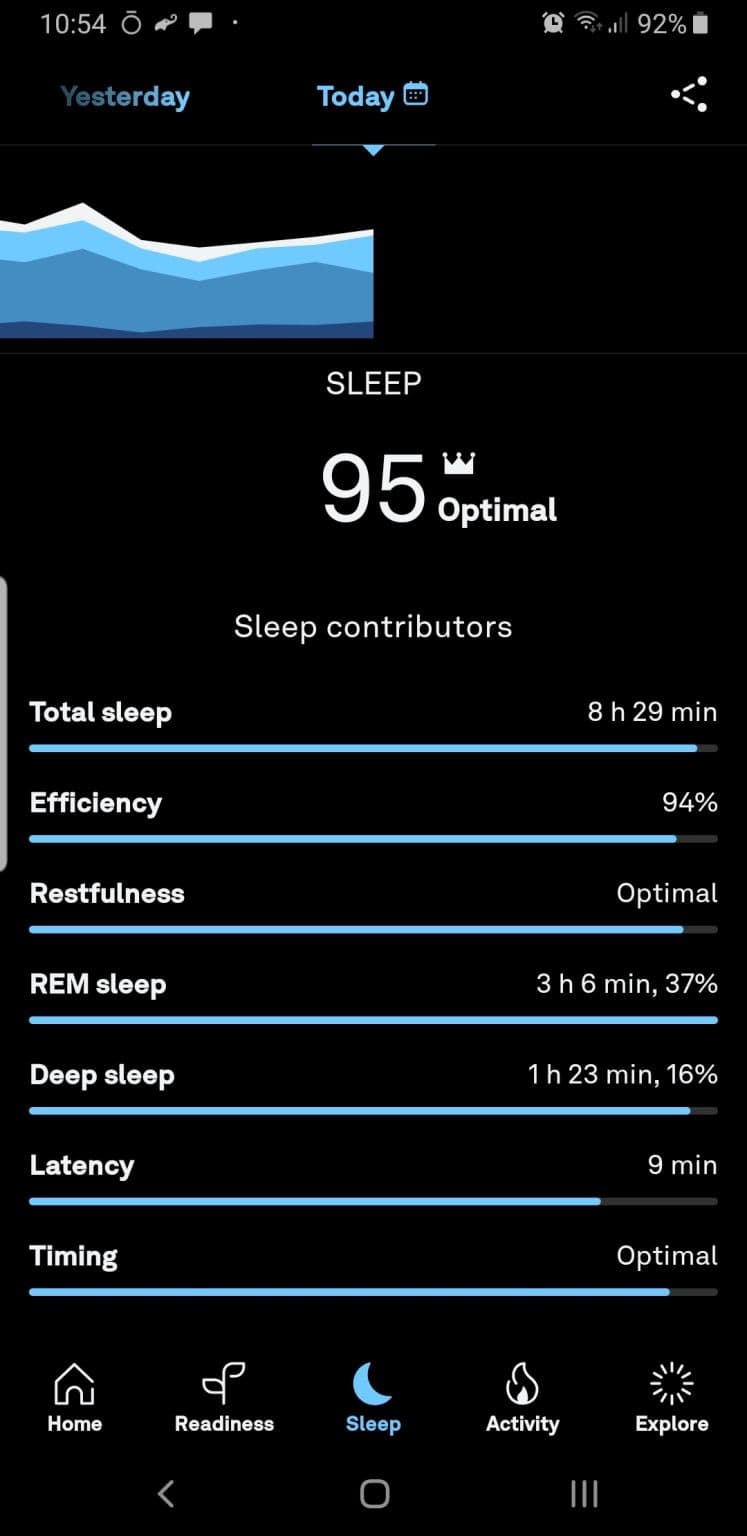

Sleep Can Be Your Actuarial Exam Superpower

Want to maximise your chances of passing actuarial exams and succeeding in your actuarial career?

Here’s a super power you can develop you maybe haven’t considered:

Optimise your sleep.

Better sleep = more energy.

More energy = enhanced ability to do almost everything:

Good sleep is one of the biggest (and under appreciated?) levers we can pull to improve all parts of life.

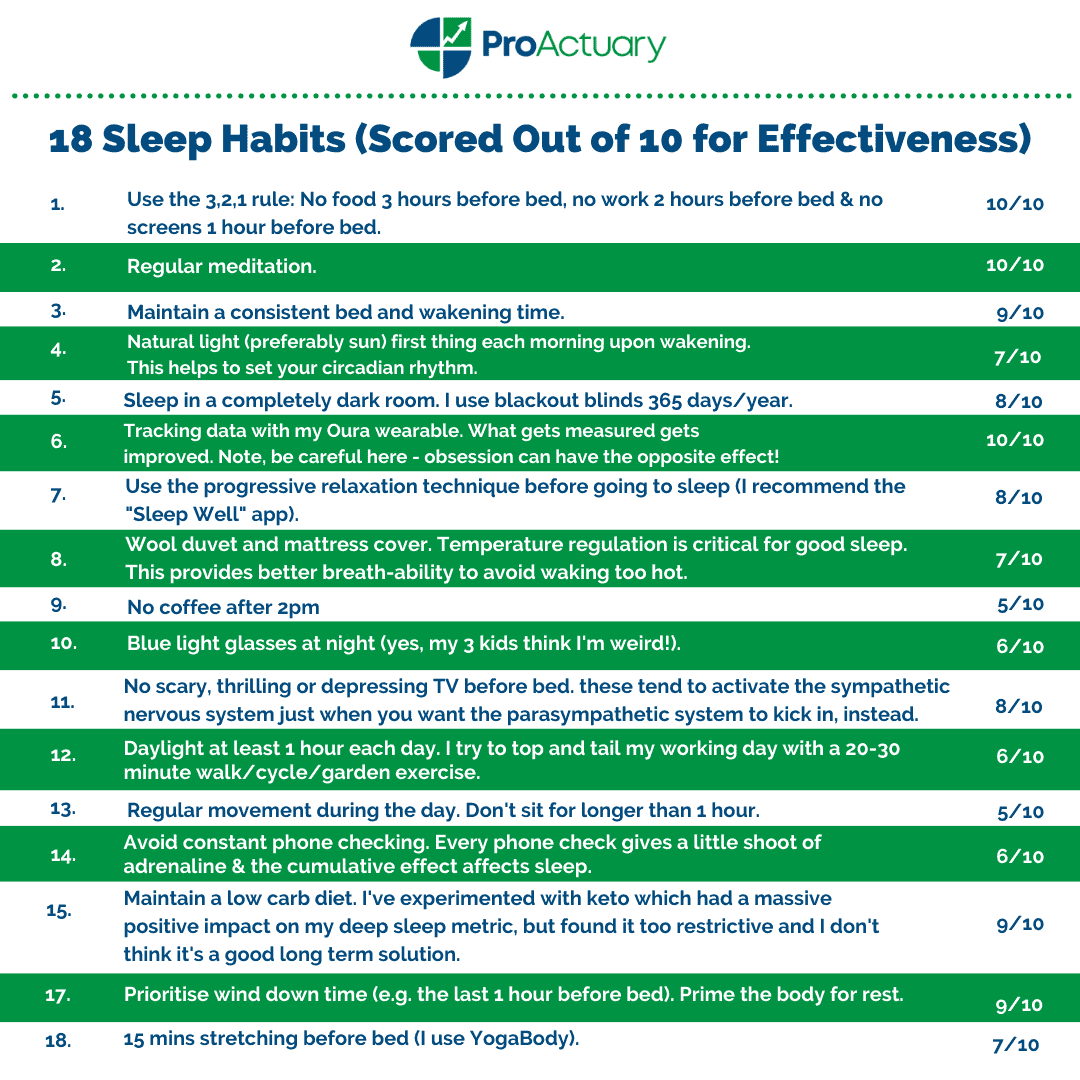

I’ve been using an Oura ring sleep tracker to experiment, test and continually tweak and iterate my sleep habits over the last 5+ years.

Over 15 thousand sleep data points later, here are 18 things I’ve found work for me (scored out of 10 for effectiveness):

I don’t stick to these all the time, but if I notice my Oura sleep score dipping below 85, I go back to this list and make a few changes.

10

The Zen Actuary

The actuarial exam journey is a mental game as much as anything.

The thing is, you may well fail an actuarial exam somewhere along the road (especially if you don’t have exemptions).

If (when?) this happens it’s easy to go into a negative thought spiral:

- If only I’d spent more time on topic X.

- Why, oh why, didn’t topic Y come up?

- I can’t believe I only missed out by a single mark. I have such bad luck.

- I’ll never get through these actuarial exams.

And round and round it goes.

In my opinion, the best approach is to instead focus on the process (what you can control). Do the best you can with what you have and where you are at (avoiding striving for perfection). Then take a very Zen approach to the eventual outcome.

This story drives the Zen point home:

There was a farmer who woke up one morning to find that a wild horse had wandered onto his farm. He captured the horse, and his neighbors came over to congratulate him on his amazing good luck. He simply shrugged his shoulders.

The next day, his son tried to ride the horse but was violently thrown and broke his leg in several places. The neighbors came by to offer their condolences on this stroke of bad luck. The farmer simply shrugged his shoulders.

The next day, the army marched through and conscripted all the young men to go off to fight a war in a distant province. Because his son had been injured, he was spared. The farmer’s neighbors came by to congratulate him on his good fortune. He again shrugged.”

11

The System Isn’t Perfect

Actuarial exams.

Is there a better way?

Love them or loathe them, they’ve been a central focus for trainee actuaries for many years.

It’s the price of admission to the profession.

I believe actuarial exams are, in many ways, necessary and have their place.

But I also think exams are a double edged sword.

Some of my issues with (traditional) exams:

- People that are really smart and potentially good actuaries (e.g., having strong business acumen, superior emotional intelligence, great communication skills and even good mathematicians/statisticians) end up leaving the profession just because they haven’t quite mastered the right exam technique or aren’t good at cramming.

- Exams can kill curiosity. Students sometimes (or often?) just want to know, “what do I need to know to pass the exam?” rather than, “what knowledge/understanding do I need to gain to help me be a great actuary over the long term?”

- The opportunity cost of learning stuff you never use. This is becoming a bigger issue as we are exposed to an increasing number of alternative options (data science anyone?).

- It is difficult to test certain desirable traits of an actuary. Things such as attitude, leadership ability, ability to work in a team and face tough situations, facing situations requiring high emotional intelligence etc.

- Exams tend to place too much focus on short term knowledge retention (& regurgitation) rather than longer term skill development and understanding.

I think the recent developments in the actuarial curriculum (e.g., more computer based assessment and the IFoA’s new learning change programme that takes a modular approach) are a step in the right direction.

Regardless of your thoughts on how fit-for-purpose actuarial exams are, it’s a barrier that you will need to overcome. So instead of getting frustrated about the system, focus your energy on what you can control and play the game accordingly.

12

Actuarial Grit

A lot of actuaries I’ve spoken with have told me they think the road to actuarial qualification is far too long.

I can see their point:

- You have to give up a significant part of your life to actuarial exams (typically your 20s when you are in your prime for sports etc).

- It creates a big barrier to entry, especially for career changers.

- Some (or in some cases, much) of what you learn may never even get used.

- The opportunity cost is increasingly large, in a world of endless opportunities.

There’s probably some truth to all these points.

However, I believe there are many other, often forgotten, benefits (besides the accumulation of knowledge) one gains from getting through the long arduous actuarial qualification journey.

One of the key benefits is the mental fortitude you build.

Or, quite simply, the ‘grit’ you develop along the way.

Grit, in my opinion, is one of the most valuable personal attributes you can develop for all aspects of life.

Consider this from Angela Duckworth, author of Grit:

Each was chasing something of unparalleled interest and importance, and it was the chase—as much as the capture—that was gratifying. Even if some of the things they had to do were boring, or frustrating, or even painful, they wouldn’t dream of giving up. Their passion was enduring.

In sum, no matter the domain, the highly successful had a kind of ferocious determination that played out in two ways. First, these exemplars were unusually resilient and hardworking. Second, they knew in a very, very deep way what it was they wanted. They not only had determination, they had direction. It was this combination of passion and perseverance that made high achievers special. In a word, they had grit.”

When you come out the other side of the actuarial exam system, consider the grit you will have developed along the way. One of life’s most valuable skills.

13

For Actuarial Exam Success, Get the Simple Things Right

Want to pass more actuarial exams?

Try this:

One of the simplest, most effective things an actuarial student can do to pass their actuarial exams, is to create a non-negotiable actuarial study calendar.

That’s it.

Create a calendar with the right things in it.

Then make a commitment to stick to it, no matter what.

Sounds simple and boring.

And it is.

But it’s effective.

And also surprising how few students do this.

Without a calendar, with pre-planned thought out activities, it’s too easy to:

- Fool around doing the wrong things. Going over knowledge you already know instead of moving ahead with learning the next topic. Re-reading notes when you should do past paper questions, etc.

- Not get started at all. The brain is amazing at coming up with 101 reasons why studying may not be a good idea:

- I need rest.

- I’ll feel more in the zone tomorrow.

- I’ll watch 10 minutes of Netflix first (yeah right!).

However, if you have a pre-commitment to study in your calendar and you treat it like a non-negotiable meeting, you can bypass the mental decision making.

If it’s on the calendar, you just do it. End of story. No need to think about it.

Often, getting started is the hardest thing.

A non-negotiable calendar forces you to start despite how you feel. Don’t allow feelings to dictate whether you do something important.

14

Actuarial Exam Goals

I recently spent 3 days planting hundreds of trees with my youngest son.

Our goal was to plant 1,000 trees in 3 days.

It turns out that planting trees is hard work. Like sitting actuarial exams hard. Or maybe not.

This photo is tree #925. The last one we managed to plant. Mission failed? I guess so. The numbers don’t lie.

But looking back, I’m proud of our little accomplishment. We didn’t quite hit our ‘stretch’ goal. But an accomplishment none the less.

If we had aimed too low (e.g. 500) we probably would have hit that target and stopped. Or been very inefficient with our approach.

If we had aimed too high (say 1,500), chances are we would have become disillusioned and demotivated, slowing progress.

However, with our just out of reach stretch goal, we continually iterated and optimised our approach.

Motivated to find a tempo and rhythm that kept us going to the end, striving to reach our goal.

Actually, maybe planting trees is a bit like taking actuarial exams.

Stretch the rubber band, but don’t break it.

15

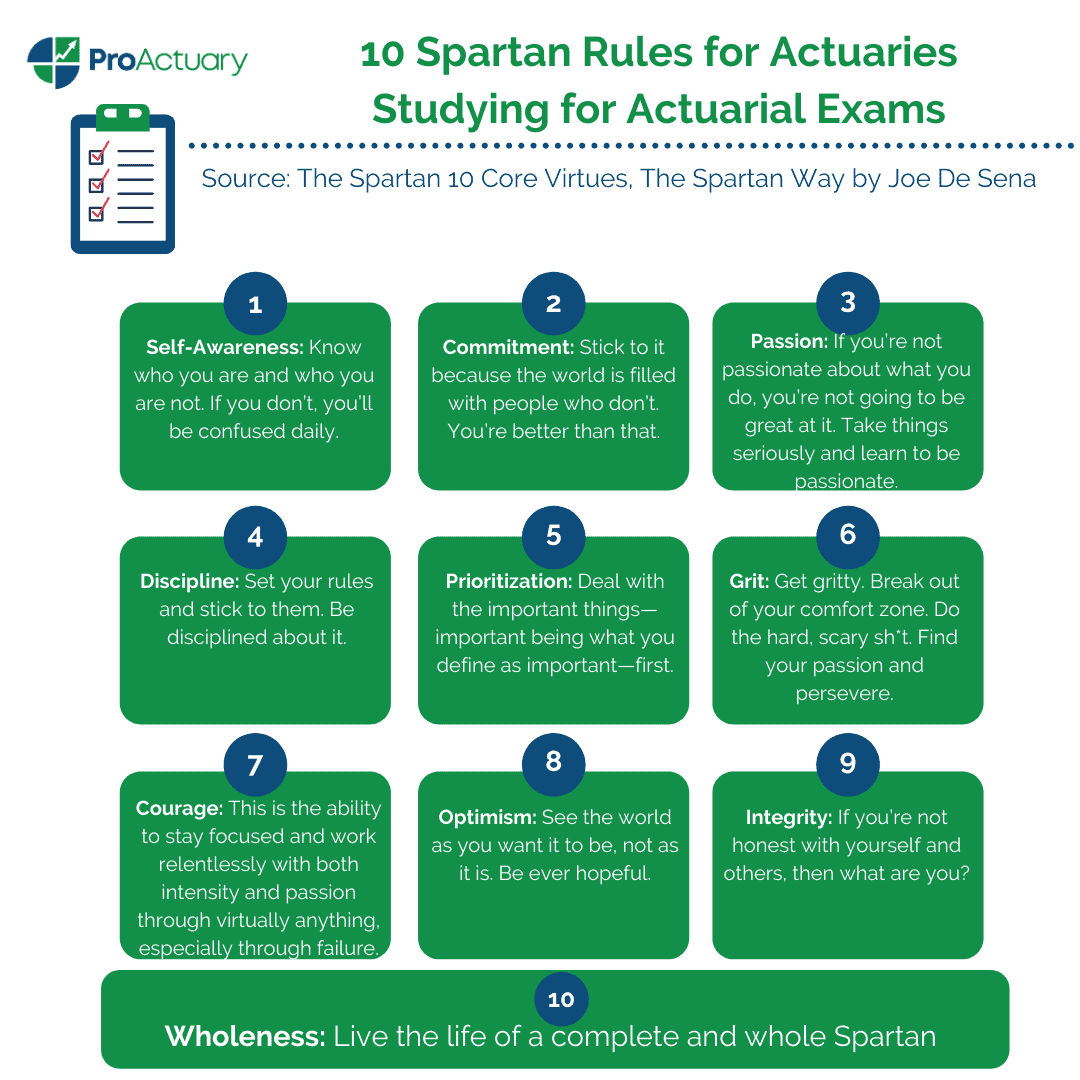

The Spartan Actuary

If you are sitting actuarial exams, you might want to check out Joe De Sena’s Spartan 10 Core Virtues from his book, The Spartan Way:

16

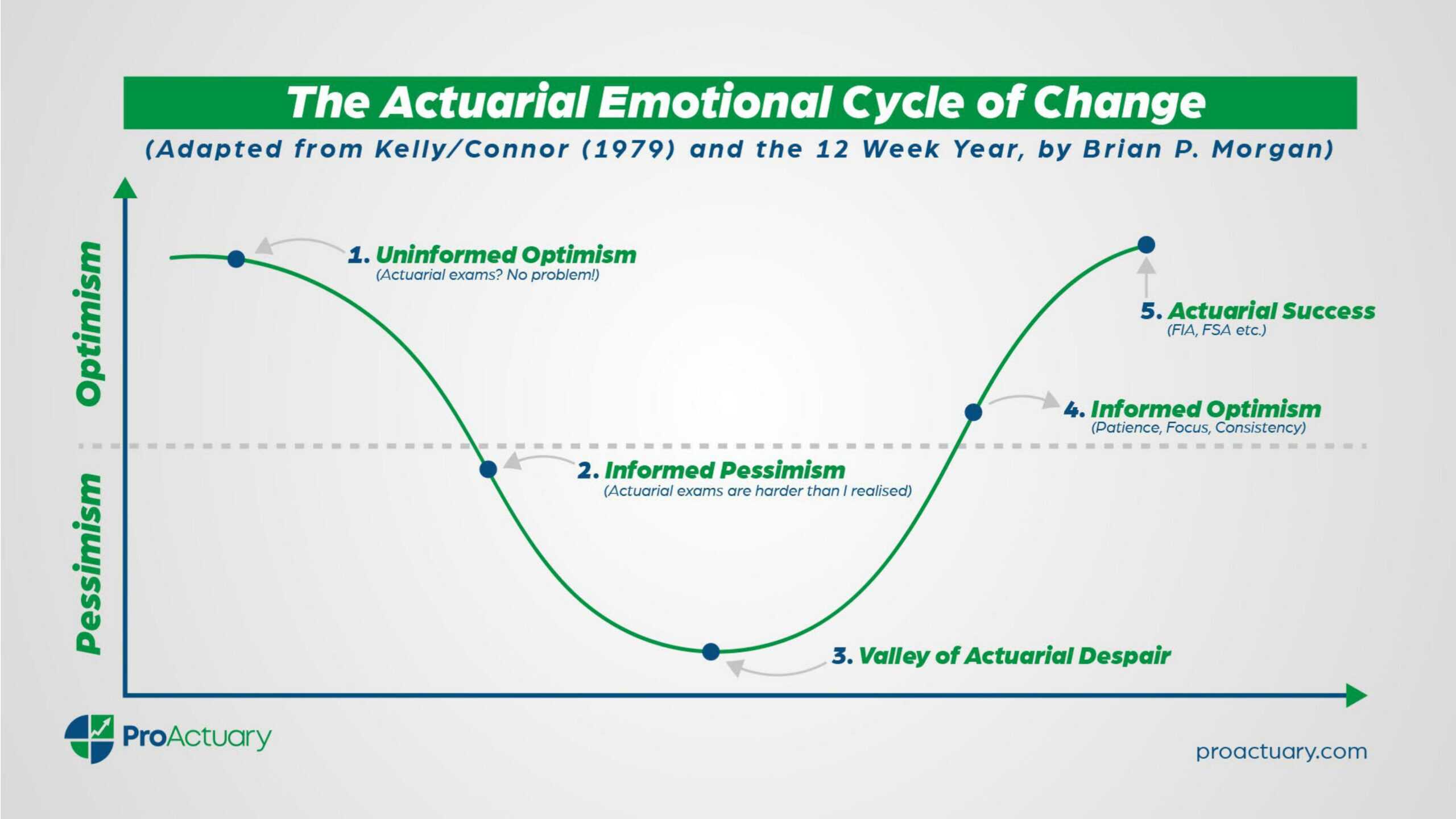

The Actuarial Emotional Cycle of Change

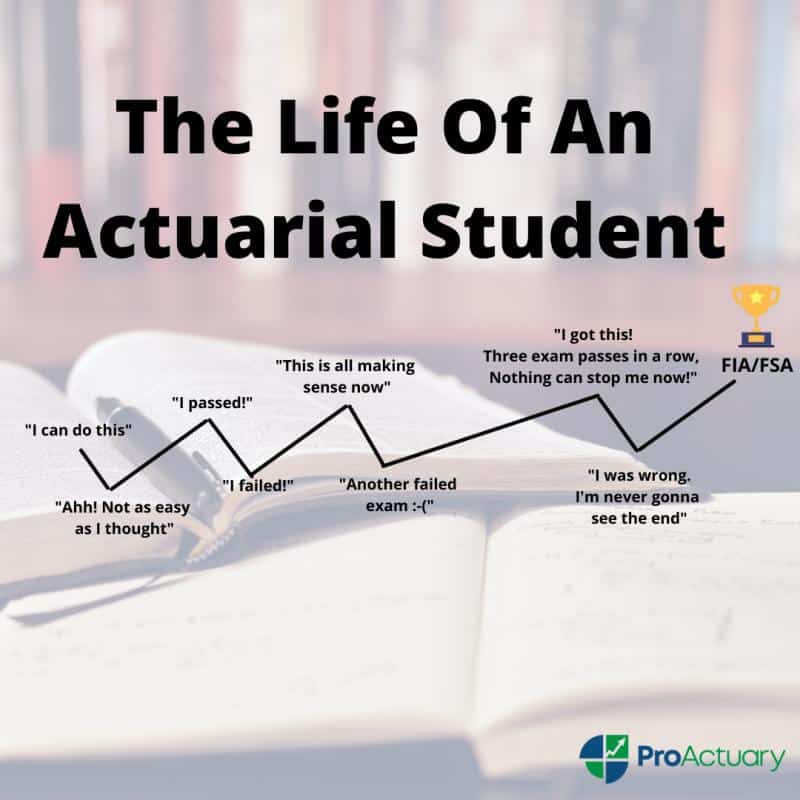

Getting through actuarial exams, for most actuaries, is emotionally tough.

There are times it feels like an emotional roller coaster with ups and downs.

I think actuarial students should keep in mind the Kelley/Connor Emotional Cycle of Change during their actuarial exam journey.

There are 5 stages, we pass through when attempting to make change:

I. UNINFORMED OPTIMISM: Really, how hard can these actuarial exams be? Bring it on!

II. INFORMED PESSIMISM: Crikey! These actuarial exams are actually pretty damn hard!

III. VALLEY OF DESPAIR: What! I’ve just failed an actuarial exam. This has never happened to me before! Should I give up?

IV. INFORMED OPTIMISM: Wow, I passed another actuarial exam. My actuarial study plan and hard work has paid off. Maybe I can get all the way to the end and qualify? I just need to focus, consistently work hard and be patient.

V. ACTUARIAL SUCCESS: It was worth it! I’m glad I stuck it out.

Being aware of this ECOC, and seeing the bigger picture, helps us move through the valley of actuarial exams without giving up. It’s easier to persevere, as you can anticipate your emotional response and know that things will improve.

When in the valley, remember to keep going and keep your eye on stage 5.

17

Letting Go

I remember failing one of my early actuarial exams. I had done everything right, including a meticulously planned and executed actuarial study plan. I had paid my dues and expected a pass.

But I didn’t feel great on the day of the exam and the questions threw me off course. More qualitative than I expected.

The perfectly shot arrow (actuarial exam prep) had been blown off course by things out of my control (feeling poorly).

Then a few years later I sat one of my last actuarial exams abroad in Toronto.

Again my actuarial exam preparation was impeccable. But this time I also nailed the exam. I came out with that feeling. You know, the one where you just feel the pass in your bones.

A few weeks later I opened my work emails and was greeted with a surprise email: “I’m sorry to inform you that your actuarial exam papers have been lost on transit back to the UK.”

The actuarial invigilator was meant to take photocopies.

He didn’t.

Hours and months of study for those pesky actuarial exams down the drain.

Again the perfectly executed arrow, destined for the bulls-eye, had been diverted off course. Both those episodes hurt. They hurt mainly because my expectations differed from the outcome.

Since then, I’ve learned that much of life is beyond our control. My job is, therefore, to simply shoot the best possible arrow and… Let go.

Whether it hits the bulls-eye, or not, is not my concern. Life is easier with this mindset.

18

Urgent Vs important

One of the biggest challenges someone taking on actuarial exams to be a qualified actuary faces is limited time.

So much to learn, yet so many other things to do. The day job, fitness/health and perhaps even some social life!

With so many things competing for our most valuable and finite resource, one of the most useful things an actuarial student typically learns is distinguishing between what’s urgent and what’s truly important.

The problem with the urgent tasks is that they shout louder than the important ones. Screaming for your attention, attaching a disproportionate weight to their importance.

The reality is often that some of our ‘urgent’ tasks just aren’t that important. And they often don’t lead to meaningful results.

Getting started on a study plan for an actuarial exam 4 months down the line can easily take a back seat to responding to emails and messages that seem important.

But if we discard the scream of the urgency, we often find that they are really things that can be delegated or simply deleted.

Studying for actuarial exams forced me to gain better clarity and ability to focus on the ‘important but not urgent.’

With the benefit of hindsight, I can see that I learnt a lot more than technical actuarial content while studying actuarial exams.

19

Zoom Out

The actuarial exams journey is unique in many ways. It’s typically long, demanding and full of (sometimes emotional) ups and downs.

Rarely do things go exactly as planned.

Doubts can easily creep in, especially if others around you are suddenly “getting ahead.”

Disappointment, frustration and even fear are often part of the course.

Sometimes it helps to zoom out.

Remember actuarial exam passes are not the be all and end all and they definitely do not define you.

Zooming out also helps you to think long term, to expect the unexpected and to keep your eye on the prize.

20

Honesty

One night four actuarial university students stayed out late, partying and having a good time, instead of studying for the actuarial exam they had the next day.

The following morning they hatched a plan to get out of taking their upcoming actuarial exam. They covered themselves with grease and dirt and went to the lecturer’s office. Once there, they said they had been to a wedding the previous night and on the way back they got a flat tyre and had to push the car back to campus.

The lecturer listened to their tale of woe and decided to offer them a retest 2 days later. The actuarial students thanked him and accepted his offer.

When the test day arrived, they went to the lecturer who put them all in separate rooms for the test. They were fine with this since they had all studied hard.

Then they saw the test.

It had 2 questions:

1) Your Name __________ (1 Points)

2) Which tyre burst? __________ (99 Points).

Redemption question: If the story was concocted, what’s the probability that I will never know?

21

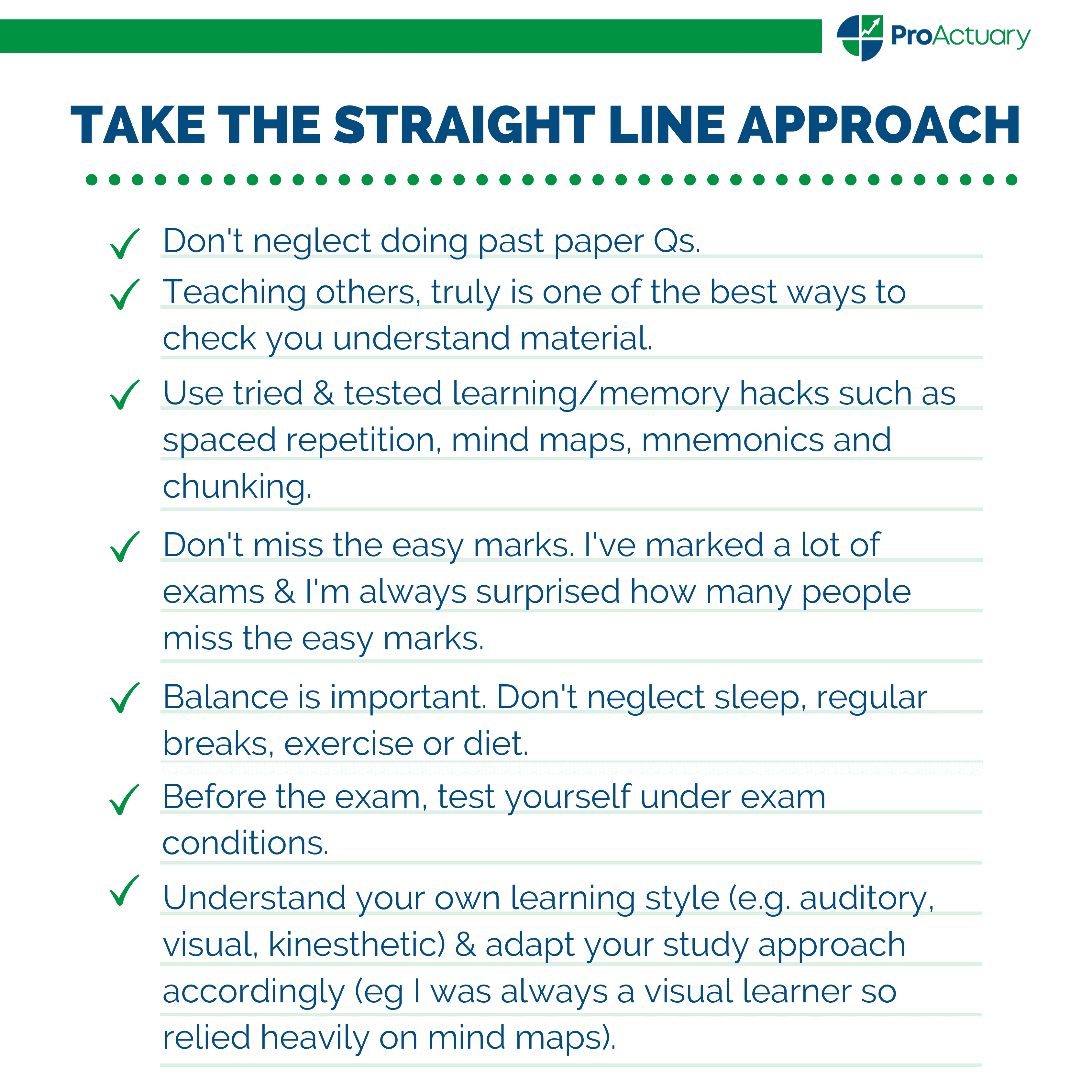

Take the Straight Line Approach (part 1)

I don’t remember where I heard this story, but it stuck with me. It has a simple, yet powerful, message that can be applied to actuaries studying for actuarial exams…

A yogi goes off to live in a remote cave to learn how to walk on water. After many years he returns and proudly shows his guru master the feat. The master asks “how many years did it take you to learn how to do that?” The yogi tells him it took him 20 years. His master replies, “you fool, you could have taken the boat.”

Actuarial students sitting actuarial exams should take the direct, straight line approach.

Here are some thoughts on the actuarial exam straight line approach:

Get the simple things right. Don’t make the journey longer than it has to be!

22

Take the Straight Line Approach (part 2)

Some light relief and profound wisdom for all actuarial students…

Actuarial student asks his professor: “Why can’t I pass these actuarial exams? I keep failing them.”

The professor, reflective and thoughtful, answers: “Have you seen the clouds in the sky, and considered their infinite permutations?”

“Yes, I have.”

“And that prime numbers can be thought of as the atoms of the math world, yet their distribution amongst integers is still a mystery?”

“Yes, I have. I have pondered this for many hours.”

“And the many natural patterns of the world such as trees, spirals, meanders and waves that can be modelled mathematically?”

“Yes, I have seen these things many times and marvelled at them with deep thought.”

“That is the problem. You keep watching and thinking about all this **** instead of studying your actuarial material.”

23

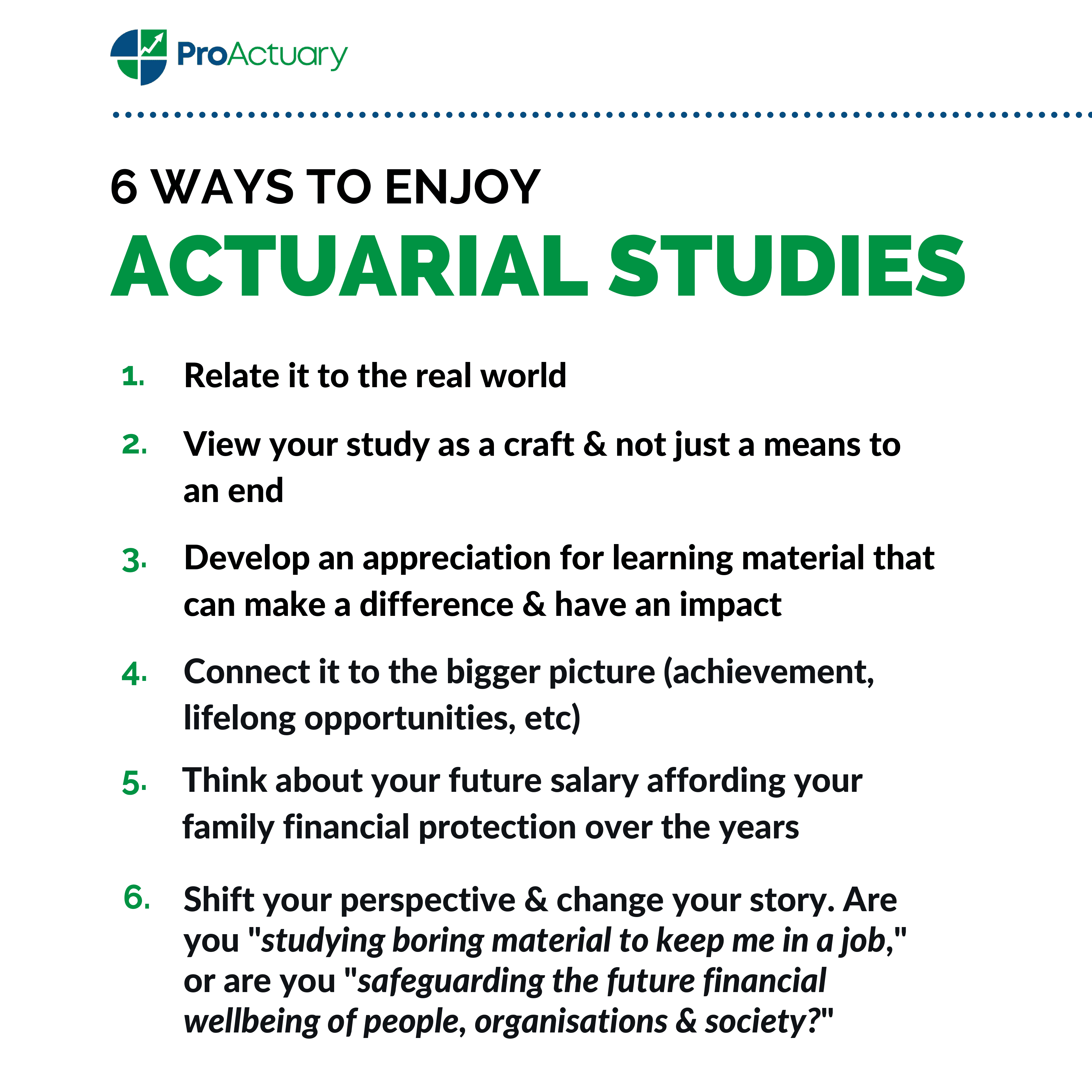

Learn to Enjoy the Process

As an actuarial student I never really subscribed to the “putting your life on hold” approach (other than the few weeks before actuarial exams), but I do believe there is merit in Roald Dahl’s advice:

I began to realize how important it was to be an enthusiast in life. If you are interested in something, no matter what it is, go at it at full speed ahead. Embrace it with both arms, hug it, love it and become passionate about it. Lukewarm is no good”.

Actuarial students should find a way to uncover meaning and enjoyment in their studies.

Here are 6 ways you can do this:

Do whatever it takes to find some meaning and develop enthusiasm.

Life becomes much easier.

24

The Worst Comes First

“The worst comes first,” is a saying I repeatedly find myself telling my 3 kids as they were being home-schooled during Covid lock-down.

It’s my kid version of the Mark Twain/Brian Tracy frog eating quote:

If it’s your job to eat a frog, it’s best to do it First Thing in the Morning. And if it’s your job to eat two frogs, it’s best to eat the BIGGEST one first.”

— Mark Twain

25

Commitment

Many of us want to set goals and change habits on 1 January.

Two things I’ve observed over the years:

- Ironically, being 100% committed to something is actually much easier than being 95% committed. That way I don’t need to expend any mental energy deciding whether or not to do something. It’s clear cut.

- It’s best to commit to something for a short period of time, at least initially.

Committing to something for life or a long period (eg studying 1hr/day for 12 months) often eventually leads to giving up.

The brain is sneaky and will convince me that it isn’t possible/worthwhile etc. It will rationalise why “giving up” is the right thing to do (e.g. it doesn’t work, it’s too difficult, it’s not worth it, there’s a better way etc).

However, if I commit for a short period (e.g. 1 month) it’s much more likely I’ll see it through for the short period and then continue on anyway.

I can counteract the rationalising brain with the simple thought that I committed for a month regardless.

So what if it doesn’t work.

Or if there’s something better.

I made a short term commitment.

I can re-evaluate and change course after the short time period. The cost of the trial is less. The only important immediate goal is that I should honour the short term commitment I made to myself.

26

The Battle Against Our Feelings

I think actuarial students studying for their actuarial exams should note what Geoff Colvin has to say in his “Talent is Overrated” book:

A study of figure skaters found that sub-elite skaters spent lots of time working on the jumps they could already do, while skaters at the highest levels spent more time on the jumps they couldn’t do, the kind that ultimately win Olympic medals and that involve lots of falling down before they’re mastered.”

Make sure you are optimising your actuarial exam study time by getting the balance right between going over questions and theory you don’t know (which doesn’t feel so nice) versus material you already know well (which feels better!).

The actuarial exam journey is often a battle against your emotions.

Just because something feels bad doesn’t mean it is bad.

—————————————————————————————————————————————

So you’ve reached the end. Well done!

I hope you’ve enjoyed reading this article and picked up a few thoughts for helping with your future actuarial exams. I plan to add more content to this post in the future. Thanks for reading!

TO BE CONTINUED…