Actuary vs Quant: Comprehensive Career Analysis

Discover the key distinctions and overlaps between actuaries and quants in financial industries, emphasizing their roles in risk management and investment strategy to inform your career choice between these high-impact analytical paths.

Actuary vs Quant: Defining the Roles

Actuaries are professionals who specialise in managing the risks and uncertainties of future events. In essence, it is the application of probability theory to real world events. Using these results, they can analyse and predict the potential financial impact on companies and clients. Actuaries primarily work in the insurance sector and deal with risks ranging from mortality, illness, and even natural disasters and aviation.

Quantitative analysts on the other hand use their mathematical skills and expertise to model and forecast financial markets. They are mostly involved in financial institutions such as hedge funds and investment banks where they develop investment strategies based on their statistical analysis of the current market data. They analyse risks such as market fluctuations and credit risk, and make a decision of whether a project is worth pursuing.

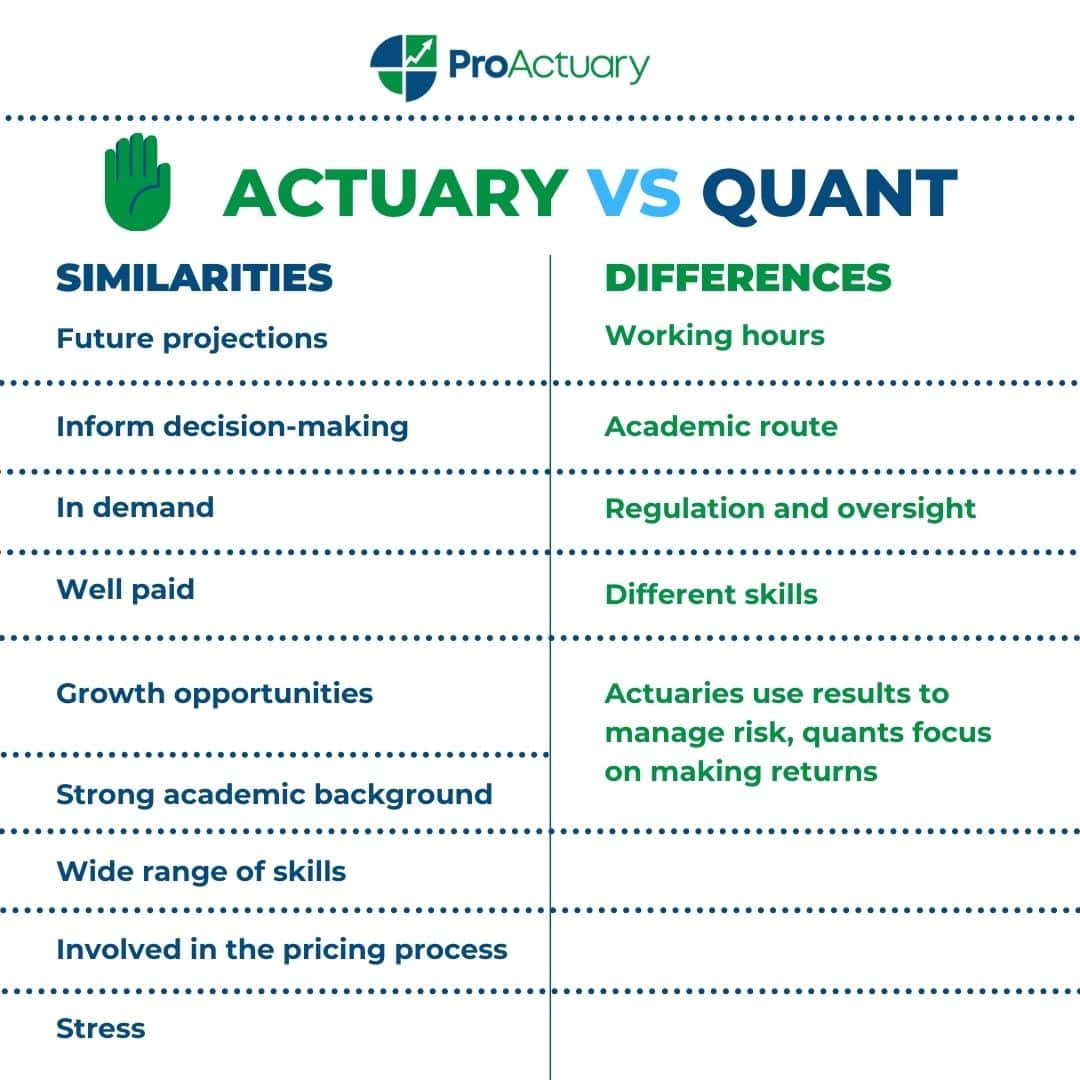

Actuary vs Quant: Exploring Similarities and Differences

Both actuaries and quants work with numbers and data based on historical experience, and use this data to forecast future expectations. They use probability and statistical methods to inform decision-making in the real world. Both careers are in demand, well paid and have strong growth opportunities which I will explore in more detail later on.

To have a career in either actuarial or quantitative analysis, a strong academic background is required and a gift for mathematics and statistics. They require a wide range of skills such as communication, attention to detail, mathematical and analytical skills. Actuaries and quants have an input in the pricing process for financial products. For example, pricing actuaries determine the most suitable premium to sell insurance products by analysing risks and past data, whilst considering a wide range of factors in the external environment. Quants are involved in the pricing process through the development of complex models. These enable financial institutions to price and trade securities along with complicated financial instruments.

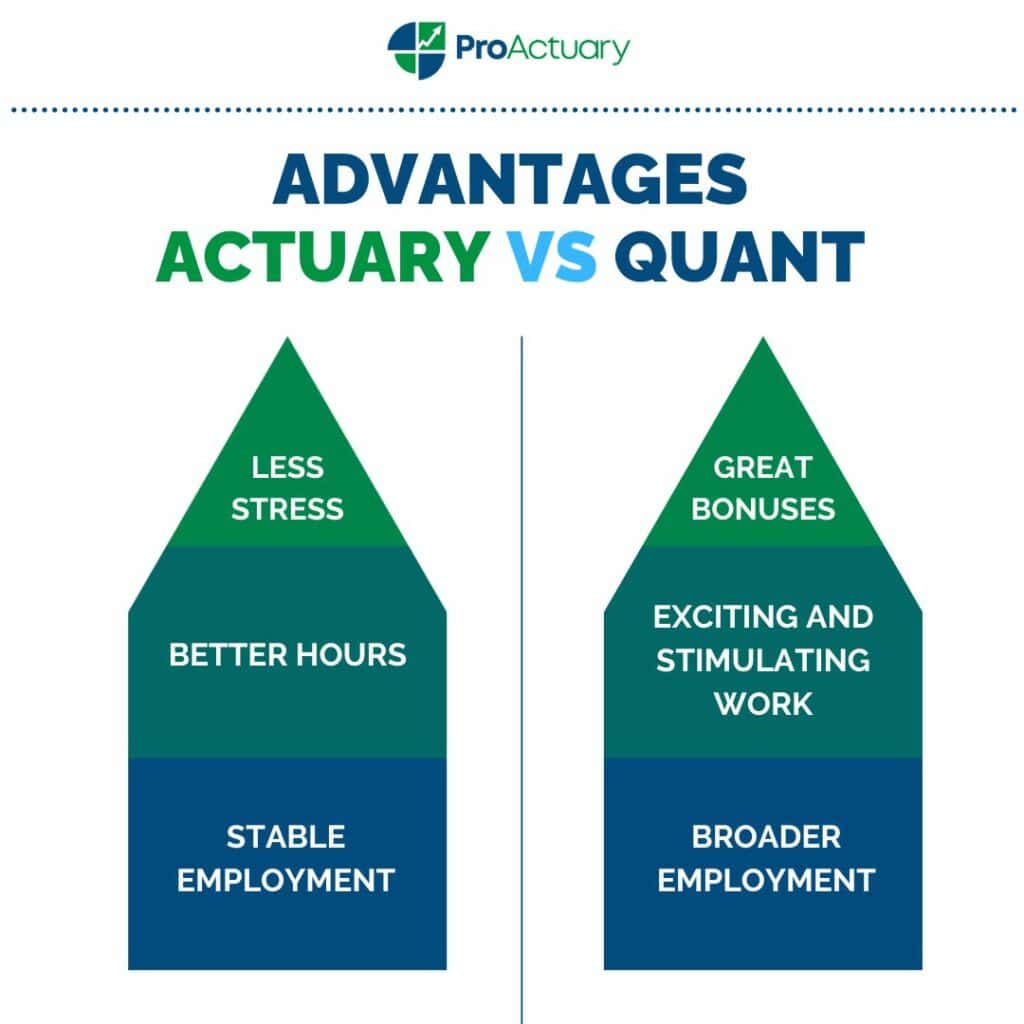

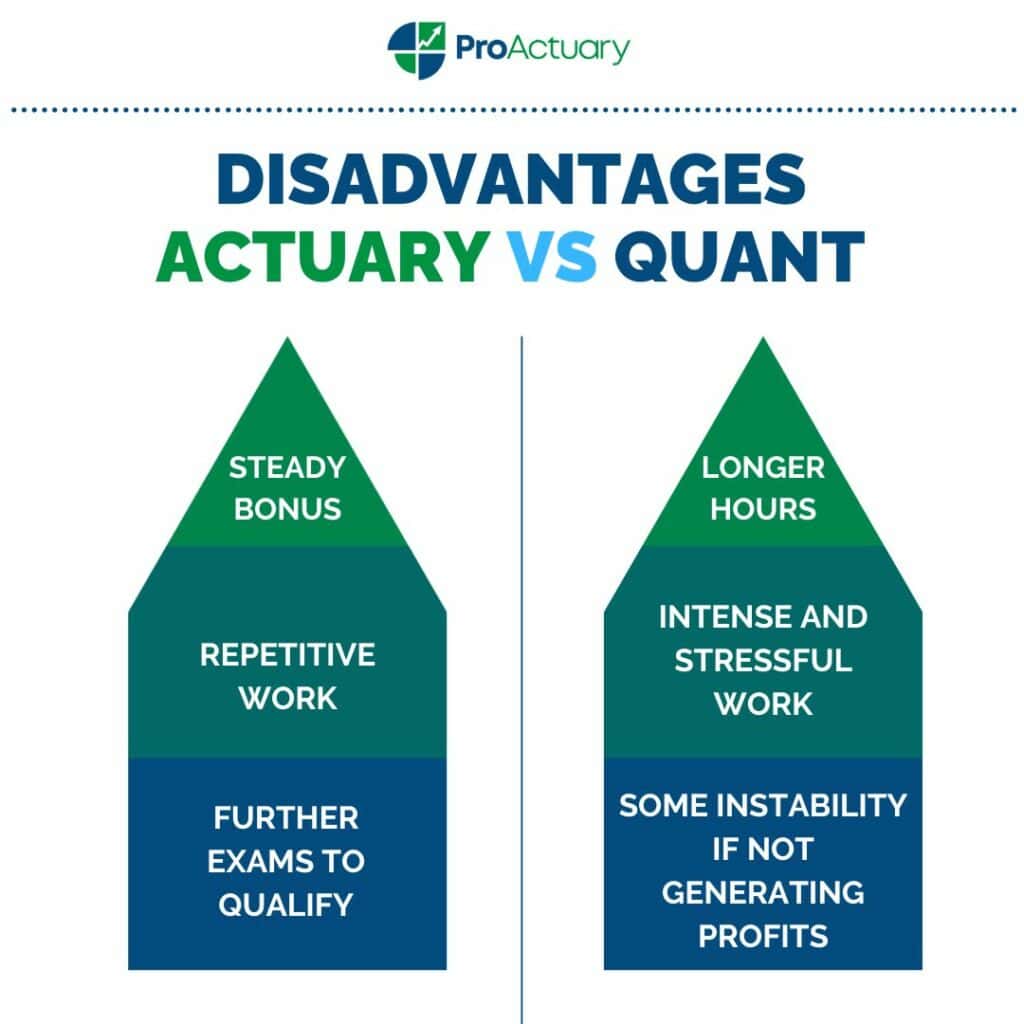

One downside to both careers is the level of stress involved. Actuarial careers can include periods of intense, high pressure and difficult work. Studying whilst working can also add to the level of stress experienced by many. Working as a quantitative analyst can be very challenging and competitive in nature, especially during periods of market volatility. Strict deadlines must be met which often require working overtime.

Whilst both actuaries and quants are involved in making predictions about the future, for example best estimates and quantifying uncertainty in projections, actuaries are more focused on using these results to manage the overall risks of the company and inform decision making of directors. This can include which investments to make in order to mitigate risk, or how much capital to hold to decrease the risk of insolvency.

Quants are more focused on making returns and coming up with trading strategies and investment products solely to make profits. This would be done for customers with different risk appetites. It could be argued that actuaries are wider thinking. For example, when evaluating a product, a quant might only calculate the potential future returns, whereas actuaries would go a step further and consider wider factors to inform their decision making. This could include diversification with other products and the effects on risk and capital requirements.

The working hours of an actuary and quant may appear similar at certain times of the year, however at an overall level, quants work longer hours. The academic route differs as actuaries’ study on the job to complete the remaining actuarial examinations, whereas a quants academic requirements end once they complete their degree/masters/PHD. The level of regulation and oversight faced by actuaries and quants differ.

Actuaries work with very sensitive data and are therefore subject to complying with a strict code of professional standards. They must keep up to date with continuous regulations coming out, for example Solvency II and IFRS 17. Quants operate in a more flexible environment as they are encouraged to be innovative, and do not have a tight code to follow like actuaries.

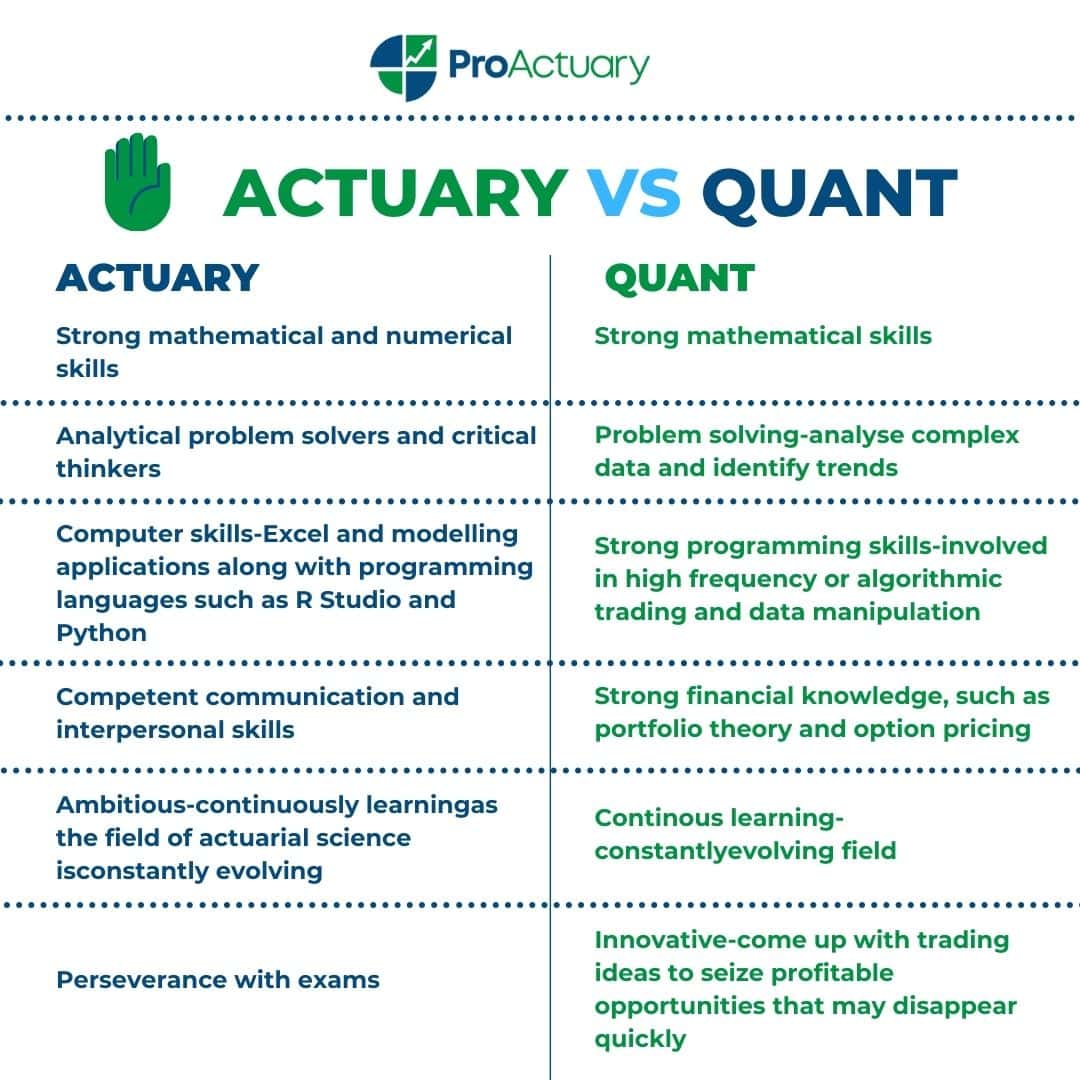

The skills required to be an actuary and a quant may appear similar as they both require a strong mathematical and analytical background, however there are a few distinctions. In addition to the skills above, communication and interpersonal skills are key for an actuary. The ability to deliver complex technical and statistical facts to a wide range of audiences, including non-actuaries, is crucial to become a successful actuary.

As an actuary, you must be willing to constantly evolve and continuously learn in an ever-changing world. As Frank Mitchell Redington once said, “An actuary who is only an actuary is not an actuary “. For quants, a high level of programming skill is vital along with the ability to work under pressure and make important decisions quickly.

Another difference between actuaries and quants is the data they work with. Actuaries tend to deal with historical data, such as past claims experience and mortality rates, to make assumptions and estimate projections into the future. In comparison, quants use both historical and real-time market data such as stock prices and interest rates to identify trends and make an analysis on optimal trading strategies to implement for their company and clients.

Educational Pathways: Becoming an Actuary or a Quant

There are a variety of different paths one can take to become an actuary. The most common way is through completing an Actuarial Science or Maths-related degree, and then begin to undertake the remaining actuarial exams once a graduate position is obtained. There are 13 exams in total as set out by the Institute and Faculty of Actuaries (“IFoA”), with the opportunity to sit these exams twice a year. There are seven actuarial and business exams to avail of the skills and techniques required for the career, followed by three core practice exams to extend your general actuarial knowledge.

At this stage you are now an Associate. It is then down to the individual to choose two specialist principal subjects to determine which area to specialise in, followed by one specialist advanced subject. The final step is to complete three years of Personal Professional Development. Once these steps are all completed, you can now call yourself a Fellow!

In order to become a quant, one must complete a Bachelor’s degree in a mathematics related subject. However, due to the increasing competitiveness of the trading industry, it is highly recommended to further your education and obtain a master’s degree, for example in financial engineering or computational finance.

One may even complete a PHD after this to extend your knowledge even further and stand out from the crowd. It is also key to be skilled in different programming languages as these are the main drivers in a quant’s day to day work. There is no overall organisation governing the education of quants, therefore one might say becoming a fellow is a lot more respectable and tougher than becoming a quant!

Career Opportunities in Actuarial and Quantitative Analysis

Actuaries

- Insurance Companies (Life and General) – help insurers determine the risks associated with different products and derive appropriate policy premiums.

- Pensions – provide advice on the management of pension schemes to trustees and companies.

- Consultancies – provide actuarial services to clients such as other insurance companies or businesses.

- Financial institutions – assess risks with lending and investments for financial institutions such as banks or investing firms.

- Government agencies – provide advice on financial risks such as pensions and student loans.

- New and upcoming areas, such as the aviation industry and data science.

Quants

- Investment banks and hedge funds – use statistical techniques and modelling to make investment decisions and trades.

- Technology companies – develop algorithms for data analysis and AI.

- Energy and commodity trading firms – develop and execute quantitative models for trading purposes.

- Consulting firms – work on highly quantitative and innovative projects, and provide analysis to clients in different industries.

Essential Skills for Actuaries and Quants

Now on to comparing some of the skills required to be an actuary and a quant, in addition to the points made above in the similarities and differences section:

Actuary vs Quant Responsibilities: A Comparative View

Actuary

- Modelling and analysing statistical data

- Managing risk

- Developing insurance products

- Preparing presentations and financial reports

- Communicating results to clients, managers and stakeholders

- Keeping up to date with developments in the financial world

Quant

- Researching financial data to identify trends in the market and scope out opportunities

- Developing financial models that accurately describe the market to forecast trends

- Implementing and testing trading strategies that optimise return and minimise risk

- Monitor performance of their models and strategies

- Managing portfolio risk

- Reading and keeping up to date with academic literature to help ground trading strategies in theory

Salary Expectations in Actuary and Quantitative Analysis Fields

According to Jobted UK, the average salary for an actuary in the UK is £51,500 and can range from £35,940 to £174,300 based on the level of experience and qualifications the individual has.

From a survey carried out by Glassdoor, the average salary in the UK for a quantitative analyst is £81,000. This ranges from £47,000 to £141,000 depending on the company and level of experience. However, when bonuses are added in, the salary can be even higher depending on the quant’s performance for the year.

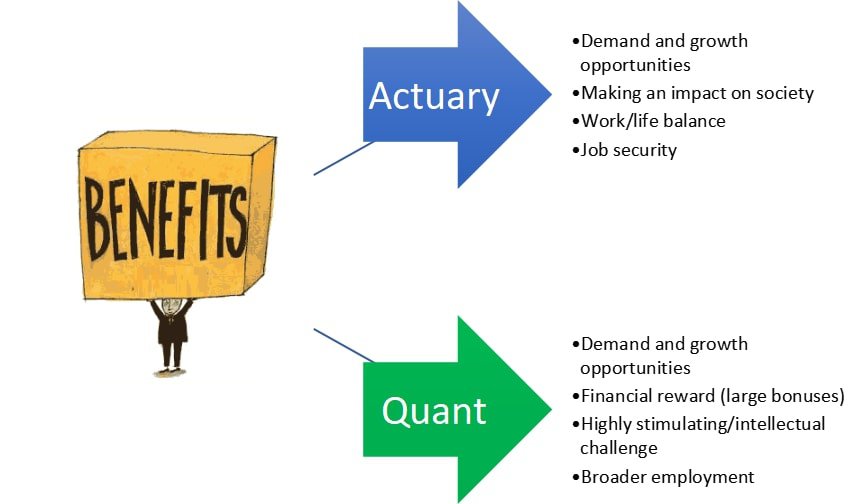

Actuary Vs Quant Benefits: A Comparative Analysis

Growth and Development: Future Prospects for Actuaries and Quants

Actuaries have very strong growth potential. According to a report by CareerCast, the actuarial profession ‘has a growth outlook of 22% by 2026’. There is an increased demand for actuaries to carry out risk management, especially as the world now moves into a new era of machine automation and artificial intelligence with exposure to new risks. Also, the expansion of insurance and financial products and services reiterates the need for actuaries to design, price and manage these products. Actuaries are always planning for the future, and as the world continuously evolves, more and more opportunities will become available to minimise risks.

Quants are becoming increasingly in demand with their ability to generate profits and reduce risk. The recent trend of rapid growth of hedge funds and automated trading systems, and complexity of securities/financial markets have made quants extremely valuable. Quants, with their highly valued skills, are at the forefront of the growing importance of technological advancements with analysing data and trends.

Transition From Actuary to Quant?

If you are thinking of transitioning from an actuary to a quant, the good news is that it is possible. However, it could potentially be a long route. To become a quant, you would be required to go back and do a masters/PHD in a relevant degree before being considered for employment in the quant world. The same goes if you’re transitioning from a quant to an actuary, the actuarial exams would have to be completed to constitute being a fellow. Since there isn’t much overlap between the careers with regards to education, a smooth and quick transition is not to be expected.

Conclusion: Choosing Between a Career as an Actuary or a Quant

If you are contemplating a career in either actuary or quantitative analysis, have a think of the advantages and disadvantages I have discussed for both. Equally, they are very prosperous and exciting careers, with a lot of demand and growth opportunities out there. At the end of the day, it’s down to what the key priorities are in an individual’s lifestyle. If a well-paid, stable job with a work/life balance suits you better, then actuary would be the better option. If salary is your main motivation and you thrive off an intense, fast paced environment then a quant is something to keep in mind.

Actuary vs Quant FAQs

Ciara Mullan

“Ciara Mullan is an Actuarial Analyst at Fidelis MGU. Prior to that she was an Actuarial Intern at CNP Santander Insurance. Ciara graduated from Queen’s University Belfast in 2023 with a BSc degree in Actuarial Science and Risk Management. You can connect with her on LinkedIn.”