Actuarial Job Market Analysis: Trends and Future Opportunities

Discover the multifaceted world of actuarial jobs, where mathematical expertise meets real-world applications, providing essential insights into financial risks and opportunities across various industries.

In this article, you’ll get an insight into what the actuarial job truly entails. We’ll dissect each aspect of the job from the daily tasks, the skills and education you’ll require as well as the lucrative earning potential and job outlook. So read on if you want to find out more about being the “crystal ball” of the financial services industry.

Exploring the Reality of Actuarial Jobs: A Comprehensive Insight

Last week I had a conversation with an A-level student who was interested in studying an actuarial degree. To try and help him understand what actuaries did in practice, I asked him to consider what the four images below have in common?

At first glance it’s difficult to find a link between a car, a pensioner, a hospital and the stock market. On further thought you will find that the connection is in fact an actuary:

- Car insurance – Actuaries are involved in the pricing of car insurance premiums, modelling the expected cost of claims in the event of a car crash and in the design of new products.

- Pensions – Actuaries use models to ensure pension schemes are sufficiently funded to ensure pensioners receive their retirement benefits.

- Healthcare – During the 2020 pandemic, the COVID-19 Actuaries Response Group was set up and were responsible for predicting the peaks in infection rates of the virus and the impact this would have on hospital bed demand.

- Investments – Actuaries advise on the purchase and sale of assets, assist with portfolio management and restructuring, as well as carry out investment analysis.

A Day in the Life of an Actuary: Understanding Daily Responsibilities

From my experience, the actuarial job is challenging, dynamic and no two days are the same. The daily tasks of an actuary will vary depending on the industry they work and on their level of responsibility. Below I have provided you with a flavour of the tasks an actuary may be involved in at differing levels of experience:

Day-to Day Tasks of an Entry-Level Actuary

- Data collection and cleaning – Working with databases and using queries to extract required information for modelling. Actuaries must also ensure the accuracy of the data by carrying out data quality and reconciliation checks.

- Data analysis – The use of actuarial modelling software to analyse data for patterns and trends.

- Reporting – Entry-level actuaries are typically involved in producing reports for various purposes, such as financial and regulatory reporting. Actuaries typically work for global firms who must comply with multiple regulatory regimes- such as Solvency II in Europe and the NAIC in the US. An actuary may also be responsible for producing internal reports such as those sent to the Audit and Risk Committees.

- Model operation and development – Actuaries are responsible for running models to predict the likelihood of future events or to calculate the expected value of liabilities. They also have the responsibility of maintaining and updating these models. The models are traditionally Excel-based but can be in programming languages such as R and Python or actuarial modelling software such as Prophet.

- Risk Assessments – Actuaries also evaluate the risks and financial outcomes of different business decisions (such as the inclusion of additional features to an insurance product) to aid managerial decisions.

- Collaboration and communication – Actuarial work is typically cross-functional requiring collaboration with other professionals including underwriters, accountants, and IT specialists. Actuaries must be able to explain the complex mathematical and statistical problems they face to their non-technical colleagues in a clear and concise way.

Day-To-Day Tasks of a More Experienced Actuary

- Peer Review – As actuaries become more experienced, they focus more on assessing the reasonability of results rather than the mechanical calculations. They use their expertise to review the work carried out by junior actuaries, ensuring the calculations are performed correctly and the final figures produced are aligned with expectations.

- Assumption setting – Experienced actuaries use their expertise to make informed decisions when setting assumptions, considering changes to mix of business, economic indicators and industry trends. The actuaries also document their justifications for the assumptions chosen.

- Compliance – Senior actuaries are expected to keep track of industry and regulatory developments for any changes that would impact their actuarial calculations. They need to be able to interpret new regulations so they can modify existing processes to account for the changes.

- Management – Typically responsible for mentoring and providing support to a small team of part-qualified actuaries.

- Implementing Risk Management Strategies – For example a risk transfer strategy, where an actuary recommends reduced exposure to a particular risk by transferring some risk to a reinsurer.

Exploring Various Actuarial Job Specializations

An actuary is not one-size-fits-all job- there are many different types of actuary. I have provided a flavour of the main actuarial roles below:

Pricing Actuary – Analyses data to predict the likelihood and amount of a potential claim. The actuary then calculates a premium to be charged which is adequate to cover the potential losses, while allowing a margin for profit.

Reserving Actuary – Uses actuarial methodologies to determine the amount of money an insurer needs to set aside today to cover the expected cost of future claims. Reserving actuaries may also be responsible for calculating regulatory amounts for Solvency II purposes e.g., Technical Provisions, which is the balance of money required to meet all future liabilities.

Risk Management/Capital Modelling Actuary – Take on a holistic view of the risk faced by an insurer, projecting the assets and liabilities to assess solvency under a range of scenarios.

Finance & Investment Actuary – Use their knowledge of financial mathematics to evaluate potential investments. These actuaries may work for investment banks, asset management firms or hedge funds.

Financial Reporting Actuary – Preparing reports and opinions for regulatory reporting such as IFRS 17 and Solvency II.

Pensions Actuary – Pensions actuaries provide advice on matters such as employer contributions to a company pension scheme, investment strategies for the funds held by the pension scheme and the form of benefits to be paid to members. Actuaries assist pension schemes with meeting the needs of trustees, employers and scheme members.

Actuarial Consultant – Consulting actuaries offer actuarial advice and services to various clients and depending on the client’s needs, may work in any of the above areas.

Education – Some actuaries choose to share their knowledge with others through lecturing for universities. There are also educational opportunities working for the IFoA such as exam marker and Chief Examiner roles.

Exploring the Diversity within Actuarial Jobs

Actuaries are best known for their work in traditional industries such as:

These are still the dominant industries in which actuaries are employed as demonstrated in the pie chart below from the Society of Actuaries in Ireland’s (SAI) 2022 new student seminar.

Every year the proportion of actuaries working in the pensions industry declines as the change from Defined Benefit to Defined Contribution schemes has shifted the risk from the employer onto the consumer, reducing the required level of actuarial expertise. Actuaries are moving into a wide range of emerging fields and I suspect in 5 years’ time, the “others” section in the pie chart above will look much larger.

Banking

Both Basel III and Solvency II are regulatory frameworks designed to ensure banks and insurers respectively have sufficient solvency. There are a lot of overlaps between the regulation of banks and insurers.

Actuaries are now increasingly in demand in the banking sector, utilising the skills they have used in insurance for years to help banks with capital and risk management. The demand for actuaries in this industry is only going to grow, especially after the recent failure of the Silicon Valley Bank (SVB). John McCrossan wrote an interesting article claiming an actuary could have prevented the collapse of SVB through an actuarial technique called asset-liability modelling as well as through modelling the interest rate risk of the bank.

HealthCare

Actuaries work alongside the NHS modelling demographic changes to assist with financial funding.

Climate Change

Actuaries are becoming increasing involved in dealing with climate related risks to understand the impact it could have on businesses, individuals and products. Actuaries have also been involved in projecting fossil fuel reserves to help advise Governments on long-term energy solutions.

Technology

Actuaries are becoming increasingly involved with new emerging technologies such as blockchain, autonomous vehicles and ride-sharing apps.

No matter the industry, you can be sure an actuary is analysing the data of the past to prepare for the risks of tomorrow.

Actuarial Job Perspectives: Insights from Industry Professionals

It’s difficult to fully grasp what any job truly entails without hearing from those working in the field. Included below are three different perspectives of the actuarial job – from an Actuarial Lecturer, a Pricing Actuary at a Reinsurance firm and an Investment Actuary at a consultancy firm:

“I began lecturing after qualifying and working in consultancy. I enjoy my job a lot, particularly the time spent in the classroom. I enjoy developing students and seeing them progress through their degree. In particular, I like it when students grasp a new technique and appreciate its usefulness outside of the classroom.”

– Actuarial Lecturer

“I work as a pricing Actuary for a large reinsurance company and my role involves underwriting and pricing credit insurance for banks. When pricing a deal I engage with the client a lot- I may work on a specific product for up to 3 months, so conversations start early on before closing a deal. Pricing involves due diligence on the product, client, etc and then I typically run simulations on the deal to ensure an optimal price is quoted. I enjoy the collaborative nature of my role as I work alongside accountants, lawyers and other actuaries. The best aspect of my job is that each deal is different and the steep learning curve ensures I am always professionally developing. However, the role can be stressful at times, especially when I have committed to a deadline with a client.”

– Pricing Actuary

– Pricing Actuary

“Having worked in the area of investments for over 10 years, my actuarial background has been fundamental in providing me with the skillset required to adapt individually, as my role has evolved over the years. I enjoy the collaborative aspect of my role, working with clients (externally) and team members (internally). The actuarial job is a challenging one but knowing you have actuarial colleagues around for advice and support when you experience challenges is invaluable.”

– Investment Actuary

– Investment Actuary

Navigating the Path to an Actuarial Job: Key Steps and Milestones

The road to becoming an actuary is less straightforward than other career pathways because studying continues even after you graduate from university. Actuaries in the UK and Ireland typically qualify through sitting the professional exams set by the regulatory body- the Institute and Faculty of Actuaries (IFOA). University degrees provide a good grounding for sitting the professional exams and depending on the course chosen, can exempt you from sitting certain examinations.

Under the IFOA’s new 2019 curriculum, there are three components to an actuarial qualification:

- Examinations – there are 13 exams in total covering a range of topics including probability, financial mathematics, statistics, communication and modelling.

- Professionalism – Throughout their careers, actuaries are bound by a set of principles known as the Actuaries’ Code. To ensure actuaries can apply the code in practice, they must sit an online professional awareness test and a professional skills course.

- Personal and Professional Development (PPD) – To become a qualified member of the IFOA it’s not just about passing examinations, you also must demonstrate your competencies and experience within a work environment.

The road map below shows the typical road to becoming a qualified actuary with the IFOA:

A-Level Qualifications

The first step in the road to becoming an actuary is usually the completion of A-Levels or equivalents. Mathematics is a must-have. It is a requirement for most actuarial degrees in university and it builds the foundation for future exams. Other A-Levels such as Economics and Computer science would also be beneficial.

University Degree

It is not essential to have an actuarial degree if you want to become an actuary, but it does have its benefits as certain actuarial science degrees are accredited by the IFOA, which means they provide you with exemptions from some of the actuarial exams. For example, the BSc in Actuarial science at Queen’s University Belfast can provide students with up to 6 professional exam exemptions. This reduces the exams you have to sit after graduating. For more information on actuarial exam exemptions visit- Exam Exemptions (actuaries.org.uk).

Associateship

Once graduated, you can register as a student of the IFOA and begin working towards Associate membership (the first level of qualification granted). Once an Associate, you will have qualified at the generalist level-having acquired a depth of knowledge and experience- and you can officially call yourself an actuary at this stage (earning the designation AIA or AFA).

To qualify as an Associate, you need to have passed or gained exemption from the 7 Core Principle exams (consisting of 2 Actuarial Statistics, 2 Actuarial Mathematics and 3 Business modules) and the 3 Core Practice exams (Actuarial, Modelling and Communication modules).

Actuaries also have to demonstrate in a written log how they have completed certain competencies within their job role, with each completed competency awarded 1-2 credits. Under the new 2019 curriculum, 24 months of PPD is required to become an Associate with a minimum of 15 awarded credits.

Fellowship

For those who wish to specialise within their chosen field or continue their studies further, the next stage in the actuarial journey is becoming a Fellow of the IFoA. Fellowship is the final stage of qualification and those who achieve it are considered experts within their field, carrying the designation FIA or FFA.

To qualify as a Fellow, you firstly must have completed the Associateship stage as a pre-requisite. Fellowship allows you to navigate your career direction as it offers you the choice of exams most relevant to your area of practice. You must choose 2 specialist principle subjects and 1 Specialist advanced subject, for example an actuary working in General insurance would likely choose:

- SP7 – GI Reserving and Capital Modelling

- SP8- GI Pricing

- SA3- General Insurance

In addition to the exams, you must have completed a further 1 year of PPD and completed the professional skills course to become a Fellow.

Continuing Professional Development (CPD)

For actuaries, learning never stops. Even after becoming a Fellow, the IFOA requires all qualified actuaries to continue their training through CPD, to ensure they maintain their professional skills and industry knowledge. CPD can take the form of seminars, workshops, or even personal reading as long as you can demonstrate that you are professionally benefiting from the activity. Currently qualified members must complete 15 hours of CPD per year (with 2 hours focused on professional skills training).

Actuarial Job Demand and Supply: Analyzing the Job Market

There is a global actuarial shortage and this won’t change.

The demand for actuaries is continually growing- the Bureau of Labour Statistics estimates global demand for actuaries will have increased 24% by 2030- much more rapidly than the average profession.

Supply of actuaries is lagging behind the growing demand due to the emergence of equally lucrative careers in similar fields such as data science and software engineering. It doesn’t help that these careers don’t require the almost decade-long exam process that the actuarial route involves.

The effects of demand outstripping supply can already be seen in the UK, with the CEO of recruitment firm Hoffman Reed admitting his firm alone saw a 7% rise in actuarial recruitment requests from clients in 2022.

The actuarial recruitment market is very hot at the minute as organisations are having to pay more to attract talent from a smaller pool. Read on to learn about the lucrative earning potential for actuaries.

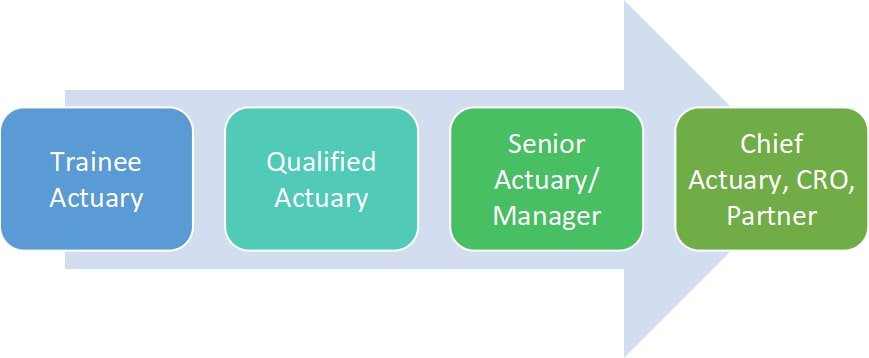

Typical Career Progression in Actuarial Jobs

- Trainee actuaries typically progress through the levels of actuarial analyst to senior actuarial analyst as they gain experience and pass more exams.

- Upon qualification, actuaries progress to positions such as Group Actuary. They typically take on more responsibilities and are increasingly involved in the review of actuarial work than the mechanical processes. They may also mentor a small team of trainee actuaries.

- As actuaries gain more experience, they typically are promoted to more senior roles (Senior Manager, Senior Actuary) where they would manage projects and oversee an entire team.

- For those actuaries who are experts in their field, they can go on to take up the most senior positions within their industries. In a consultancy firm, this would be an Actuarial Partner who would be responsible for managing many clients. Enterprise Risk management is a developing area allowing senior actuaries to take up Board roles such as a Chief Risk Officer (CRO). Senior actuaries can also progress to the Chief Actuary position– which involves the management of the entire actuarial department and implementing the strategic initiatives of the company.

Actuarial Job Earnings: Potential and Growth

On average actuaries earned 83% more than accountants in 2022

According to Indeed’s 2022 survey, the average actuarial salary was £64,580. Actuaries aren’t just top-earners in the financial services industry; they also feature on Indeed’s list of highest paying UK jobs – in the same list as neurosurgeons and CEOs.

Once qualified, actuarial salaries can reach as high as £300k+.

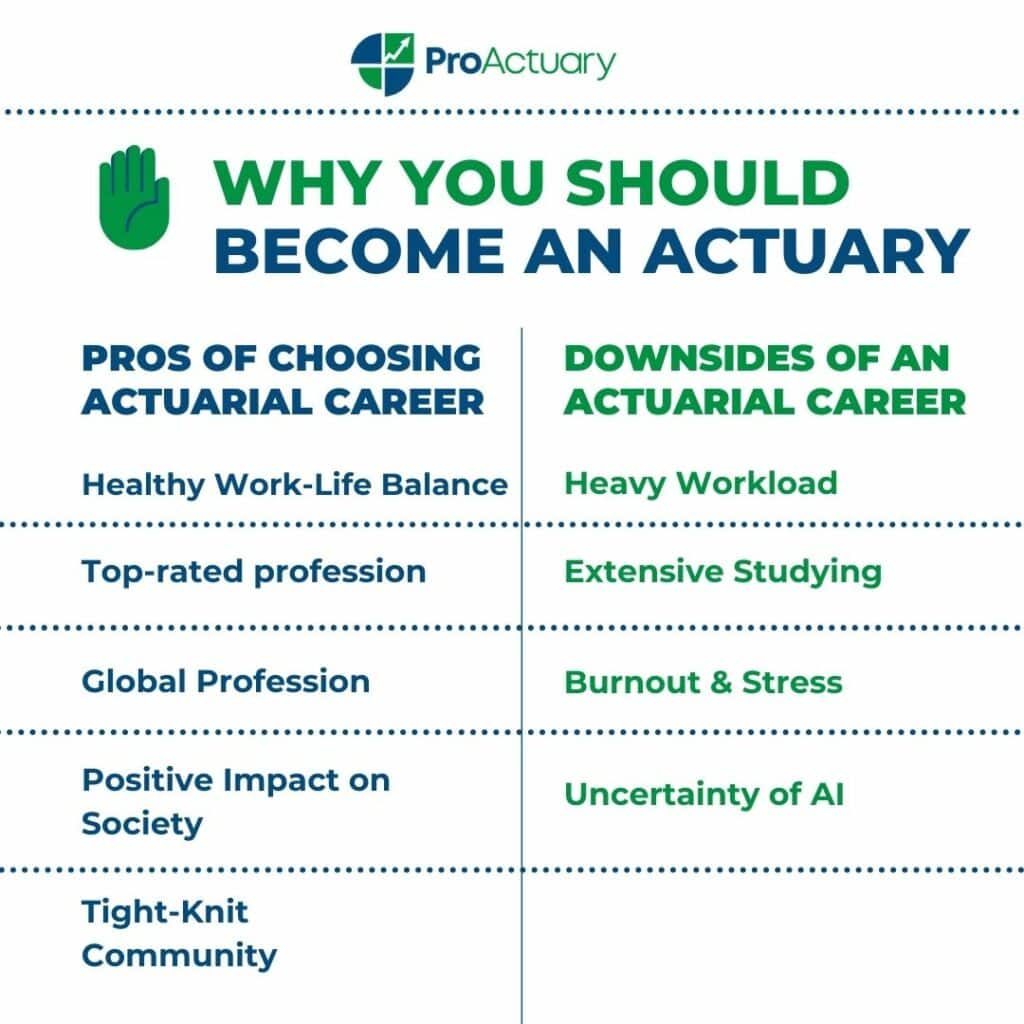

Advantages of Pursuing an Actuarial Job

In addition to the high earning potential, positive job outlook and natural career progression, the actuarial job has the following additional benefits:

Healthy Work-Life Balance – Actuaries usually work 40 hours per week (9-5 Monday to Friday). Many actuarial employers offer flexible working arrangements e.g., flexitime, allowing the employee to choose when they fulfill their working hours.

Top-rated profession – Consistently voted one of the best careers to pursue, not only financially but for job security and overall job satisfaction – ranked 8th best job in the Business category by The US News 2023 Best jobs survey.

Global Profession – The IFoA qualification is internationally recognised. There is a mutual recognition agreement between the IFOA and most of the other global professional bodies, which allows actuaries to practice anywhere in the world.

Positive impact on Society – By managing risk, actuaries protect businesses and individuals against financial loss and they help to ensure financial stability. Actuaries are increasingly working in new areas that will be beneficial to society- working alongside the NHS and addressing social issues such as climate change.

Tight-knit Community – There are over 30,000 members of the IFoA meaning actuaries have a strong community to network with and learn from.

Mentally stimulating – Actuarial science is often considered one of the hardest fields to study- it is a challenging but very rewarding career.

Considering the Challenges of Actuarial Jobs

From what you’ve read so far, it may seem like an actuary is the perfect and obvious career choice for you. However, there are some downsides to the job to be aware of:

Heavy Workload – Actuaries typically work on multiple projects simultaneously and face rigid deadlines from regulators and clients. To ensure deadlines are met, actuaries may have to work longer hours in the busy periods such as year-end.

Extensive studying – According to the SAI, 1800 hours of studying are required to become an Associate and an additional 700 hours of study are recommended to achieve Fellowship. However, most employers have generous study packages which typically equates to 1 day off work per week to study (exam-dependent).

Burnout & Stress – A study carried out in 2020 revealed 24% of actuaries admitted facing high levels of stress – with workload given as the main contributor. Actuaries may also face burnout trying to manage the competing demands of the job alongside their studies.

Uncertainty of AI – AI is likely to disrupt almost every industry in the future with its ability to automate repetitive tasks and increase efficiency. Insurer, Zurich, is already experimenting with AI tool, ChatGPT. Actuaries need to ensure they are adequately up-skilling to keep up with AI innovations or they risk being left behind.

Deciding on an Actuarial Job: Is It the Right Fit for You?

We’ve now dissected every aspect of the actuarial job- what the role entails, the educational journey, the earning potential and the benefits and drawbacks of the career. You have also got a unique insight from three actuaries working in the field.

I hope you can now appreciate that there is more much to an actuary’s role than just calculators and spreadsheets. One day an actuary could be working on a complex model and the next, they may be meeting clients to communicate the impact of those results. Every day in the actuarial world is different.

Now that you know what the actuarial job involves, you may be wondering if it would be the right fit for you? Ultimately, the answer to this question depends on you. To find out if you have what it takes, try the IFoA’s actuarial personality quiz here- Actuarial Quiz.

That being said, if you love problem-solving and mathematics and are interested in a career that offers a lucrative salary, opportunities for growth as well as a healthy work-life balance, then it doesn’t take an actuary to predict that this is the right job for you.

Actuarial Job FAQs

Josh Frew

“Josh Frew is a Trainee Actuary at Canada Life Reinsurance. Prior to that he was an Actuarial Intern at PartnerRe. Josh graduated from Queen’s University Belfast in 2023 with a BSc degree in Actuarial Science. You can connect with him on LinkedIn.”