How to Become an Actuary: A Step-by-Step Career Path

Embark on the actuarial career journey, a challenging yet rewarding path filled with rigorous exams and promising prospects, combining deep mathematical knowledge with practical business insights to shape future financial stability.

Choosing the Right Subjects to Become an Actuary

It is no secret that this career requires strong academic ability. The only specific subject requirement is A Level Mathematics, however supporting subjects might include Economics or Physics which bode well with the professional exams.

The important thing is to choose subjects you enjoy and are likely to be successful in. University entrance grades for actuarial science are among the highest, so if you are guaranteed top marks in a seemingly unrelated subject, this can still be a great choice.

The best candidates will have impressive grades but also be well- rounded individuals, so having a diverse set of skills can set you apart from other contenders. Practical subjects, such as Art, display creative ability, and modern languages can open up niche opportunities with international companies.

“In order to be irreplaceable one must also be different.”

– Coco Chanel

Essential Soft Skills to Excel in Actuarial Work

This brings me to the importance of soft skills in the eyes of an employer, particularly emotional intelligence. Having the ability to control your emotional responses and the awareness of how they affect those around you is a critical element in communication, and in achieving desired outcomes.

You might spend days number crunching and piecing together an in-depth analysis, but if you can’t condense and portray this in way that is easily understood by board members, they won’t be overly convinced. Always remember – people buy from people, so you need to get comfortable with selling.

If you’ve read this far then I’ll assume that you always did your maths homework first because it was your favourite, and that you’ve been wired to understand it with relative ease. This is the traditional expectation of an actuary – someone with a high level of mathematical and technical ability. They essentially use their analytical and problem- solving skills to identify patterns and quantify risk, so the areas of most importance are statistics, probability and calculus.

The ability to do mental arithmetic quickly and correctly is also important when sense checking numbers. With the increasing advancement of computers, actuaries can now rely on them to perform the most time-consuming and heavily mathematical tasks. This has prompted a new necessity for actuaries to be able to program in statistical languages such as R and Python, making computer skills beyond Microsoft Office essential.

As actuaries work in financial and business settings, a sound level of industry knowledge is also crucial. This is required when applying actuarial judgement, which is a key area where actuaries add value beyond what a machine can do.

Understanding Timeframes and Routes to Become an Actuary

The length of time it takes to become actuary depends on the route followed to get there. For those starting with no exemptions, the average time will be six-to-eight years. Individuals who have completed an actuarial science degree accredited by the IFoA can graduate with up to six exemptions, therefore reducing their time to qualification considerably.

Other courses with a high level of mathematical content may also exempt graduates from at least one exam depending on the syllabus. This means all is not lost for students only discovering the career after they’ve already chosen their university degree.

There are also postgraduate degrees in actuarial science that can gain you the full set of exemptions an undergraduate course would afford. Some companies even generously offer sponsorship for these postgraduate courses, as the demand for actuaries is so high. No matter the route, becoming an actuary takes time – but if you don’t climb the mountain, you can’t see the view.

Exploring Actuarial Organizations and Exam Boards

There are a number of different actuarial organisations through which you can complete exams.

Institute and Faculty of Actuaries

The IFoA is based in the UK and is connected with IFoA accredited universities.

The Casualty Actuarial Society

The Casualty Actuarial Society (CAS) is an American organisation that regulates actuaries working in Property and Casualty (P&C) insurance.

The Society of Actuaries (SOA)

The SOA is another American organisation, however it regulates actuaries working in life, health, pensions and retirement.

You can even become an actuary without a degree at all! If university doesn’t tickle your fancy, there is also the option to enrol in an Actuarial Technician Apprenticeship (Level 4). This involves working in a team to support qualified actuaries and will be the entry point into a career in finance as an Actuarial Analyst.

Afterwards, you may consider a Higher-Level Apprenticeship (Level 7). This will give you formal training alongside your studies for the exams, fulfilling PPD requirements. Apprenticeships are offered to both graduates and non-graduates, with the length of time varying depending on your eligibility for exemptions.

Without IFoA exam exemptions they will typically last for three and a half years, but reduce by six months for every two subjects you are exempt from.

Another option is to become a Certified Actuarial Analyst (CAA). This is a much more flexible route, allowing you to work at your own pace and take exams at exam centres around the world. You can complete the certification whilst working full-time or unemployed, and on average it takes around two-to-three years.

All this entails is registration for exams, passing the modules, evidence of one year’s relevant work experience and a pass in the Online Professional Awareness Test (OPAT). This entitles the CAA designation at the end of your name, and the opportunity to join the IFoA, SOA or ASSA.

Already working in a related industry? Direct application could mean that you may even be able to switch from an associated profession such as risk management, financial services or business analysis, if your skills and experience align.

The Role of Placements and Internships in Actuarial Training

For those enrolled in an actuarial degree, there may be the option (or compulsion) to carry out a year in industry. The university placement office is usually heavily involved in connecting students to companies with whom they have built strong relationships, and prepare them thoroughly for the application process. If successful, students can impress these employers through their diligence and production of high quality of work, increasing their chances of a graduate role offer.

If a job offer is not on the cards however, universities often organise careers fairs, company talks and send students endless communications about upcoming graduate roles. Having this valuable industry experience under your belt is a great advantage when applying for work. For those not enrolled in an actuarial specific programme, it is important to show enthusiasm for the profession and a strong desire to learn more about it.

Many actuarial companies take on graduates from backgrounds in maths, finance, economics, physics and engineering; so if students from these disciplines can impress employers, there is a high likelihood of being offered a position. Regardless of the degree, becoming a student member of the IFoA requires a 2:1 or above. To gain an understanding of the mathematical level required to become an actuary, you can take one of the IFoA’s non-member entry exams.

Navigating Actuary Exams: A Roadmap for Aspirants

Now for the fun part. Before you can begin exams, you will need to become a student member of the IFoA and this will provide access to a range of resources. IFoA exams are sat twice a year – in April and September. The number of exams taken during one sitting is at the discretion of the individual, although more than two would be difficult to juggle alongside a full-time actuarial role.

Studying for such challenging exams whilst simultaneously navigating a new analyst role may sound daunting, however, most companies provide a generous study package. This usually consists of all relevant materials, tutorial classes, mentors and study buddies. It is also common for the company to fund exams and include a pre-determined pay rise for each exam pass – a great motivation to stay focused!

For those graduating from an accredited degree, the aggregated exam pay rises are evenly distributed alongside the first few exam passes achieved at the company.

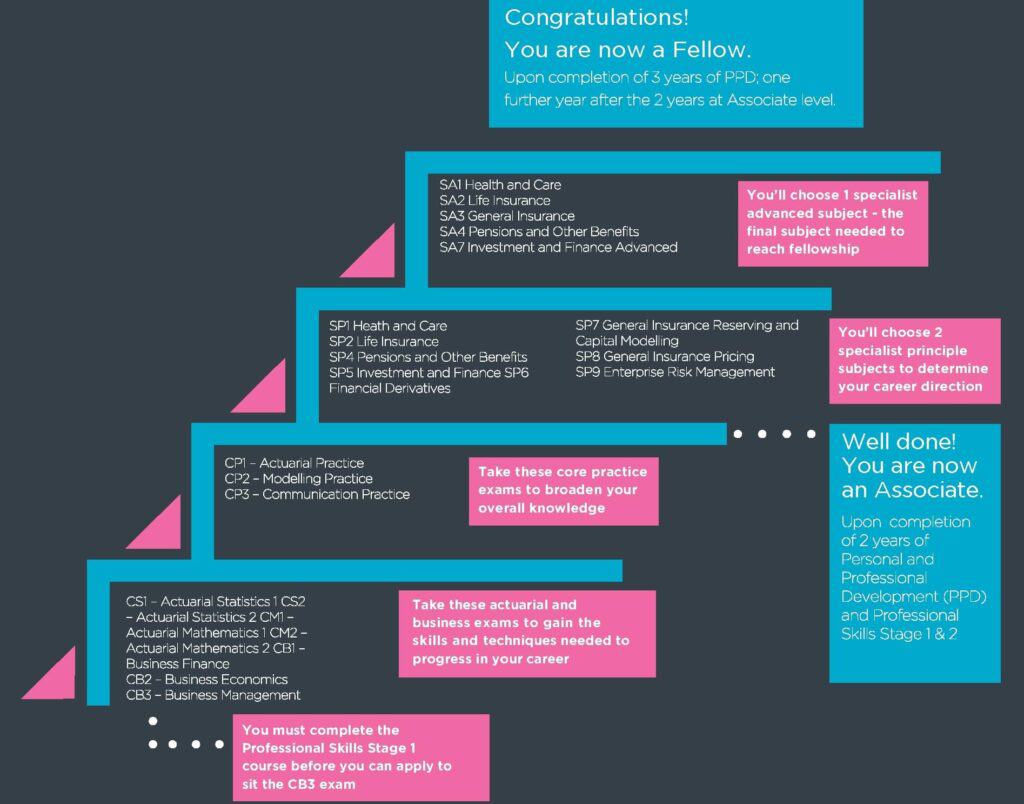

To qualify as an actuary under the IFoA, there is a total of 13 exams that must be passed. The first stage involves seven actuarial and business exams – CS1, CS2, CM1, CM2, CB1, CB2 and CB3 (which requires you to complete the Professional Skills Stage 1 course beforehand). These will provide the foundation of skills and techniques for progressing in your career.

The next stage involves three core practice exams – CP1, CP2 and CP3 – which broaden overall knowledge. Upon completion of these, plus two years of PPD and Professional Skills Stage 1 & 2, you will be classified as an associate.

At this level you can technically call yourself an actuary and attach the letters AIA or AFA to the end of your name. Beyond this point, you can decipher your career direction by choosing 2 specialist principle subjects and then a further specialist advanced subject which is the final exam required to reach fellowship. This must be paired with 3 completed years of PPD, and your surname can finally be followed with FIA.

Managing Exam Stress and Study Techniques for Actuary Exams

Becoming an actuary is by no means easy, but nothing worth having ever is. It requires discipline, dedication, and true enthusiasm for the profession – but it can also be done at your own pace. When it comes to studying for exams, some prefer to focus on one at a time or even take a break in between for a better work-life balance.

Others sacrifice their social life in the short term in order to pass the exams as quickly as possible. Either method, however, does not distract from the fact that actuarial exams are notoriously hard and require more than just time to navigate. Pass rates are also dauntingly low, so the likelihood of nailing every exam first time is minimal. However, as Albert Einstein once said, “You never fail until you stop trying.”

Every person learns differently, so what works for me may not work for you and vice versa. Therefore, it is important to be aware of the four different types of learning – visual, auditory, kinesthetic and reading/writing. Depending on the teacher’s style, a tutorial class may be of great value to an auditory learner, however it won’t be of much use to someone who processes information through writing it out by hand.

Personally, I can make connections much quicker by visualising mind-maps that I have independently created, or by remembering a similar question that I previously practised. This is much more beneficial for my recall when compared to the struggle I face in maintaining focus throughout a lengthy lecture. To make the process as smooth as possible, it may be more productive to firstly figure out what works best for you.

It is also important to manage the stress of exams by getting enough of the basics – sleep, exercise, and eating healthily. All three of these crucial elements can drastically impact the brain and its performance, so trying to manage external factors as much as the amount of time spent studying can make the process much easier. Revising in small chunks rather than intense long periods of time can also be much more productive.

The pomodoro technique is a famous method used by many, splitting your workday into 25-minute focus periods to instil a sense of urgency and reduce time spent procrastinating. This is a perfect example of short term pain – long term gain!

“We must all suffer from one of two pains: the pain of discipline or the pain of regret. The difference is discipline weighs ounces while regret weighs tons.”

– Jim Rohn

Actuarial Salary Expectations and Career Opportunities

Now for the elephant in the room. Through many interactions involving the question, “What do you do?”, I have discovered that there are two main facts known by those who have actually heard of an actuary before. The first is that they are mathematical geniuses, and the second is that they make a tonne of money. The topic of earning potential is often a taboo subject and not one discussed in any level of detail by professionals, however a quick look at a few recruiters’ LinkedIn profiles and you’ll soon perk up to the sight of many thousands.

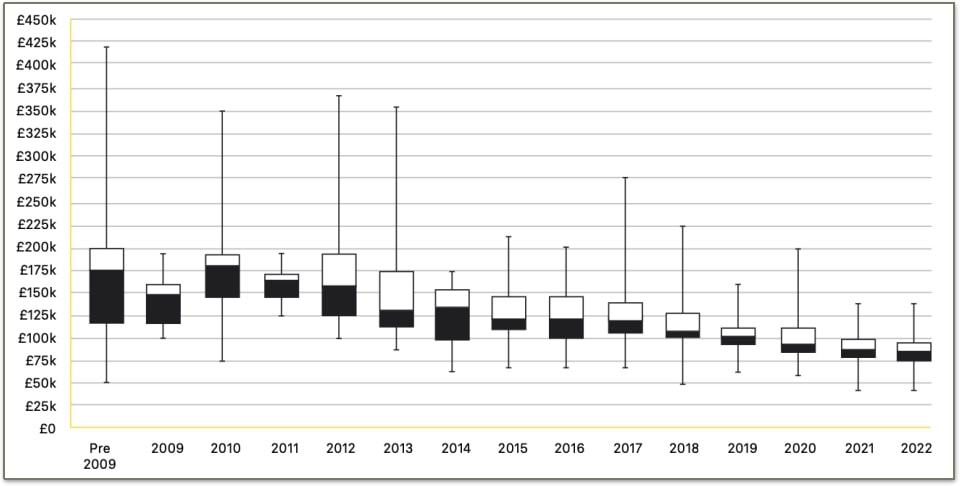

Salary, of course, depends on location. Actuaries in London are paid the highest salaries in the UK, however London also exhibits the highest cost of living in the UK, so it is important to remember that remuneration is all relative. It also depends on the sector, with the latest survey finding that Reinsurance had the highest maximum salary of £415,000. The current average base in the UK is £70,795, with an average additional cash compensation of £8,433.

The average base pay of an analyst is lower at around £39,694, however this figure quickly increases in these early years as pay rises are awarded for each exam pass. Once qualified, experience will continue to boost total remuneration, with the sharpest rise occurring every 3-4 years. Combine this with annual bonus entitlements and other company benefits packages, and its fair to say that you won’t be disappointed with your compensation.

UK General Insurance Actuary Salaries by Qualification Year

Emerging Fields and Expanding Roles in Actuarial Work

The demand for actuaries is expected to increase 21% from 2021 to 2031 alone, so job security will be the least of your worries amidst the ever-expanding powers of machine learning and AI. It is, however, a true concern that many other jobs may be replaced in the near future. As discussed earlier, soft skills cannot be replicated by a computer, nor can professional actuarial judgement, which is the product of confidence and experience.

It is important to view technological advances in a positive light, and how they can improve the efficiency of actuarial work by replacing mundane, every-day tasks. An example is the use of neural networks to learn complex features from data without the need for human intervention. This allows actuaries to focus on interpreting these models rather than manual manipulation.

Confinement to pensions, general, or health and life insurance is no longer the case for an actuarial career. The historically limited role is now expanding into the new territories of banking, risk, sustainability and data science. Companies are realising the value of data insights in assessing risk more accurately and using this information to differentiate themselves from competitors. Who else is better equipped to analyse these statistics and solve complex problems other than an actuary?

Even Elon Musk made a statement declaring that he wanted “revolutionary actuaries,” and that he has “great respect for the actuarial profession.” If the second richest man in the world can trust them to do a good job, anyone can.

These new areas don’t take away from the demand that still persists within traditional fields. The insurance industry continues to grow with an expected global CAGR of 3.5% until 2030, driven largely by the general insurance sector as new risks are introduced and old risks remain. Cyber risks in particular have become an increasing concern, with this market projected to grow at a CAGR of 25.7% from 2022 to 2029. As for pensions, life and health insurance; people still won’t work forever nor become invincible – so this sector shows so no sign of slowing down either.

There is also the option to complete a Master’s degree in a specific discipline if you plan to take your actuarial career down a different route. The extensive variety of programmes includes risk and investment management, data analytics, and artificial intelligence, enabling you to expand your skillset into a particular area of interest.

Become an Actuary: Is a Career in Actuarial Science Right for You?

Aside from the above, the most important question you should ask yourself before committing to the actuarial journey is whether this is really for you. If you chose the profession because it was the first result from googling, “highest paying job,” then it probably isn’t. Perhaps a better search bar entry would be, “personality traits of an actuary.” This is one I used.

As an anecdotal example, the process I followed to pick my career was a heavily research-based one. I took a hard look at myself to figure out what I genuinely enjoyed, where my strengths lay, and the industries that aligned with my favourite subjects. Few decisions of mine were ever made on a whim, or without a spreadsheet to back them up. I was behaving like an actuary before even knowing what one was!

Whilst occupied by a piano lesson one day during school, the rest of my year group attended a careers talk by a visiting university from Edinburgh. Convinced that they offered the perfect degree for me, a friend from maths class attempted to describe some sort of mathematical job which “involved a lot of statistics” and “made a lot of money”. Intrigued by this vague interpretation, I began researching and soon found my pot of gold, which was indeed actuarial science.

Still afraid to take any ounce of risk however, I delved deeper to figure out the type of person it took to become an actuary. Many of the descriptions that appeared included “mathematical”, “analytical”, “independent”, “creative” and “self-motivated” – all of which I related to. Collating these factors together is what has sustained my drive thus far in the journey to becoming an actuary, and the more I learn; the stronger this passion becomes.

So if you’re certain this path is for you, persevere and stay resilient. Four years of solid graft later, and I wouldn’t change my decision for the world.

How to Become an Actuary FAQs

Samantha Crawford

“Samantha Crawford is an Actuarial Analyst at Allianz Insurance. Prior to that she was an Actuarial Placement Student at Allianz. Samantha graduated from Queen’s University Belfast in 2023 with a BSc degree in Actuarial Science and Risk Management. You can connect with her on LinkedIn.”