Actuary Exams: A Comprehensive Preparation Guide

Master the rigorous and rewarding journey to becoming an actuary with this essential guide to actuarial exams. Discover expert tips, study strategies, and insights to navigate through the challenging exam process effectively.

You’re here because you have heard of the Actuarial Professional exams and want to learn more about them and how you can pass them. These exams allow you to become a fully qualified actuary, allowing you to take on added responsibility and gain promotions in your career. There are different examination boards such as CAS, SOA and IFoA and in this article we will give you some more background and help you to choose which of these is best for you.

As a UK-based actuary, I am going to focus on the IFoA exams. These total 13 exams and are split into 4 sections. The first 10 are compulsory and once completed along with 2 years of professional development, you are considered an Associate of the IFoA. The next 3 are specialised and you have options on which exams to take based on your chosen area. This structure is new since 2019 so if you hear that there are 15 exams, this is pre 2019 and since then, some exams have been combined.

Skip forward to the section on different exam boards if you are only interested in SOA or CAS exams. I’ll give a little background on these and some pointers on where to find more information if this is the route you’d prefer to go!

Actuary Exams Process and Curriculum: From Start to Fellowship

This next section is split into two parts:

- Advice for those in school thinking about becoming an actuary.

- Advice for those who have completed their degree and are now considering a career in Actuary.

Skip to the section which applies to you!

School Students

For that first group, there are a few important things to consider. Firstly, address exemptions. There are a limited number of universities which offer Actuarial Science Degrees. The main benefit of these is that they often offer exemptions from the professional exams. This means, by planning ahead and picking one of these degrees instead of a related subject like maths or finance, you will save yourself time in the long run and have less exams to do on leaving university to qualify as an actuary.

Also, take a look at any placement opportunities. Some degrees will have an in-built year in industry or placement year. As well as working towards that time in industry quota to become qualified, it also gives you that edge when applying to jobs post university. Think about it like this, you will go through an interview process, you will be introduced to a team at work, you will be given tasks and responsibilities and you will be given feedback.

The obvious benefit from this is when you are applying for jobs and have to complete interviews, this won’t be your first rodeo and you can build on your past interview experiences to ensure when you are going for your dream job, you are at the top of your game and give yourself the best chance at success.

The second benefit is your CV. Put yourself in an employer’s shoes. What would you find easier; working with someone who has proven they can deal with responsibility, has a track record of getting work done and can accept feedback and use it to improve themselves or someone with no experience? The answer is easy. That isn’t to say if you have no placement that you will not find a job, you will just have to think outside the box to show in your CV and interview that you possess these skills through other methods.

Graduated

If you have left university upon completing either an Actuarial Degree or one in a related field and are looking to progress into a job in the field, another important consideration is the exam package offered by each company. Ensure you find a setup that works for you. Some companies will financially cover several attempts at the exams, others fewer so this is an important consideration.

Some companies also have larger training programmes with more structured help. These give you the opportunity to learn from actuaries who have already completed their exams and have previously been in the same place as you. Some will give you regular study days and some will even have designated areas in the office for study.

Exploring Different Actuarial Exams

The IFoA exams are split into 4 sections.

- Core Principles: 7 total, all compulsory

- Core Practices: 3 total, all compulsory

- Specialist Principles: 9 total, must pass 2

- Specialist Advanced: 6 total, must pass 1

Once you have completed the first 10 exams (Core Principles and Core Practices) and have 2 year Personal and Professional Development, you are considered an Associate of the IFoA.

Now you are on the path to becoming a Fellow. The steps for this are to complete 2 of the Specialist Principles exams and one Specialist Advanced Exams. These exams go into further detail about different specialties such as Life Insurance, General Insurance and Pensions. By this stage, you will have a better idea as to which area you would like to specialise in, and you should complete the exams which are relevant to your chosen specialty. You must also have three years professional work experience in an Actuarial profession to become a fellow.

Understanding Different Actuary Exam Boards: CAS and More

The other exam boards are the Casualty Actuarial Society (CAS) and the Society of Actuaries (SOA). Whilst the IFoA is mainly UK and Commonwealth countries, these are more for actuaries based in the US and Canada. There is some room to switch as exemptions can be carried across exam boards if the relevant equivalent has been completed so the best option is to start with the exam board where you would like to work in the beginning.

If you do decide to go to the US or Canada, you then should look at your desired field of work. CAS deals with property and casualty (P&C) insurance whereas SOA deals with life and health insurance, and pensions and retirement. If we delve even further, CAS has only one path to becoming a Fellow, whereas SOA has 6 different paths.

Similarly to the IFoA exams, the exams to become an Associate of the SOA are all the same, it is only in the final exams to become a Fellow that you must specialise. The one thing in common is that both CAS and SOA has 10 exams. The general advice is to go down the route of your first job i.e., if it is in pensions, choose the SOA exams.

Links to their websites for more information:

SOA: https://www.soa.org/

Innovative Study Techniques for Actuary Exams

Let’s not beat around the bush, anyone who wants to become a qualified actuary will likely have to work and study for the exams simultaneously. This is tough. What we need to do is identify some common challenges and the best way of overcoming each of these.

First, let’s look at how you study. A common misconception is that there is a set way of revising and trying to understand things. This couldn’t be more wrong! Phrases like “there is more than one way to skin a cat” sound cliché but this attitude is crucial when coming to exam revision. There are many techniques such as writing notes, past papers, chatting about topics, listening to YouTube videos and making flashcards. These are all different techniques and can be grouped into different categories based on how each of us learn as individuals.

I have attached a link to a quiz which can help identify how you learn best. (http://www.educationplanner.org/students/self-assessments/learning-styles-quiz.shtml) Additionally, think back to your last big set of exams be that A-levels, university exams or past actuarial exams. Can you identify which methods helped you in the past?

Another ground-breaking idea is to make studying as enjoyable as possible. Don’t get me wrong, we’d all love to be outside in the sun rather than studying, however, don’t force yourself to use methods you find tedious. You will take in more from a 10-minute YouTube video than trying to force yourself to sit and make notes from one hour. Equally, if making notes is how you learn, add some colours or symbols which will trigger memories in your exam.

Let’s also try and be self-aware. If you are working in an office and they offer rooms to study in – USE THEM! We can all tell ourselves, “I’ll stay at home and be equally productive and, and, and……” Don’t fall into this trap! You will find some method of procrastination be it Netflix or rearranging every shelf in your house. If you go to the office on your study day and get some productive work in, you can then take your home time as a break (and do all the Netflix watching and shelf rearranging you want).

Another thing to ask yourself – when is my head most clear? If you know you wake up in the morning, ready to focus, try and fit that hour of study in before work and then it’s done. If you know getting up for work at 9 is already a struggle and you are more of an evening person, capitalise on that. Schedule in an hour after work and then switch off. Whatever you do, don’t sit staring at a computer screen when nothing is going in. It’s not productive studying and will most likely leave you feeling drained.

Organizational Tips to Streamline Actuary Exam Preparation

Another crucial thing to do is assess at your time management and planning skills. If you are completing these exams while working – the most common situation, chances are, you will be extremely busy. We also know that our heads and bodies need breaks from time to time. It is unreasonable to expect yourself to work full days and come straight home and start to study. You may manage this for a week, however, we are looking for sustainable and attainable techniques and methods which we can maintain throughout the year.

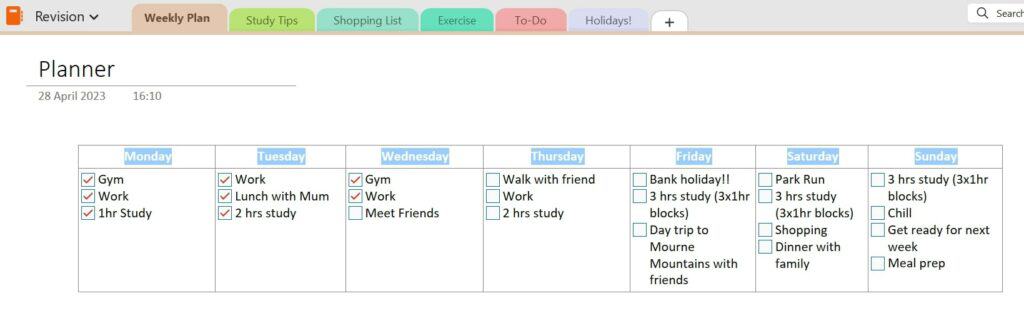

The tried and tested way to do this is with planning. Let’s take a weekly planner. Each week, we have things which stay consistent: work, hobbies such as sports training or language lessons and any other club. Let’s put these on our planner in blue. These things don’t change and we have to fit in other things around them.

Now let’s look at this for this week. Maybe you know you have a catch up with friends planned or a family dinner. Pretty soon it can feel very overwhelming and sound impossible to get any additional study done. But let’s take another look at that weekly planner. Let’s stick in a 2-hour study block on Tuesday evening. Maybe an hour before work on a Wednesday. Then another hour on a Thursday evening. Let’s set aside one weekend morning for a 3-hour study block and take the other as a lie in.

Pretty soon we have 6 hours of study pencilled in. That’s not to say the exact times can’t change if extra plans come up, however, if we do try and stick to small sections here and there throughout the year, it will make the months before the exam significantly easier.

One tool which is extremely helpful for planning is OneNote. It has all sorts of useful tools. They have different templates so you could pick a weekly planner. You can add tick boxes to give you that dopamine hit we all get when we finally tick that item off our list. You can also move things around easily so if plans change, your plan can change too, and you don’t have to scribble over it like you would on paper.

It is crucially important that you look after yourself mentally as well as physically. Here are some tips on how to do that:

- Ensure you drink enough water and make nutritious meals throughout the week. A takeaway on a Friday night can be a treat but every night will not give you the nutrients your brain needs to operate at its best and too much processed food and sugar can leave you feeling sluggish and unproductive.

- Fresh air is your friend! Get outside on a long study day, maybe take a walk at lunch time or even open your windows if it is raining. That little bit of air will help avert fatigue and keep you sharp and focused.

- Again, as much as we may think we can be productive for hours at a time, our bodies can’t. Studies show that the average human can only concentrate on one task for 15-20 minutes without becoming distracted. One good suggestion is that after every 20 mins you stand up and stretch or do a loop of your room and then sit back down. Then after every hour take a 10 minute long break, maybe go outside, get a drink or something that will help to switch you off even briefly.

Think of your body as a car, it will stop if it doesn’t get enough petrol and every so often it needs some TLC. You need to look after yourself to get your best performance on exam day.

The Role of Communication Skills in Actuary Exams

Communication is crucial.

- Firstly, communicate with yourself. If you had planned a study session after work but something stressful came up and you don’t have the energy to refocus, listen to your body and take the needed rest. Trust me, you will not feel better for sitting in front of a computer for 1 hour and achieving nothing. At least if you take the rest, even if you didn’t get work done, you have prepared yourself better for the next time you try to study.

- Secondly, communicate with your boss and co-workers. They have been through the exam process and fully understand how challenging it is. If you have an exam coming up and feel extremely stressed, they may be able to offer some advice and also be able to allocate you some less stressful work that perhaps requires less brainpower. If you have a good work ethic, people will be happy to help out as they know you will more than make up for it in the future!

- Finally, communicate with friends and family. Don’t put pressure on yourself to socialise if you have run out of steam. Anyone who cares about you will have no issue with giving you space or postponing plans. They would rather let you rest and recuperate and see you on a day which works for you. Equally, if you fancy some company but the idea of dinner or going out for drinks seems too much, communicate this. Watch a movie or go for a walk instead. It’s important you spend time with people doing things that add to your energy metre and not things that will drain it and leave you in a worse place.

Why Should I Become an Actuary?

Becoming a fully qualified actuary is no mean feat. It takes most people some time to qualify. This can be sped up if you do a degree which leads to exam exemptions. For the most part, people aim to complete one exam per sitting with these sittings taking place twice per year. These can be difficult and not many will complete them all first time around so to get there you must be hard-working and committed. Jobs themselves are busy and often highly pressurised.

You may be wondering why, after all this, you should still consider taking a role in the Actuarial Profession. Here are the reasons it is worth it:

Salary

It is well known for being a very well paid profession. You often will get pay rises for each of your exams passes compared to other graduate rolls, starting salaries are usually higher. This makes the hard work seem worth it.

Challenging

Chances are if you are even considering a career in Actuary, you enjoy a challenge. This is a fast paced, dynamic career which is constantly changing. This means it is never boring and you will always be able to find interesting work and new opportunities. Currently a big challenge in the profession is using ever improving technology to make our jobs easier and to allow us to minimise or time collating large data files and other mundane tasks that have been necessary in the past.

Diversity

Not many careers have this level of diversity. In Actuarial Science, there is such a wide variety of career opportunities. You can go into life or general insurance, pensions, re-insurance and that’s just to name a few. If we then delve into any of these areas more deeply, we can see a wide variety of roles. If you prefer numbers and computers, you can focus more on the data side of things. If you love interacting with people, you can veer towards the client facing side of things. If you like research, you can look into new fields and techniques and continue to develop the tools we already use. And you can also do a bit of everything.

Working With Other Passionate People

This career as said above is challenging. It means if you have made it past the initial steps you are driven, motivated and intelligent. By default, so are your co-workers. This creates an exceptional work environment where you will feel inspired and encouraged to continually improve and this will ultimately help you become a better Actuary.

Actuarial Science is a difficult career; there is no questioning that. It is a lengthy and challenging process to become qualified and even once qualified, there are many ongoing assessments and lessons to learn. At times, it may seem too difficult or like there is no end in sight to the exams, but for the reasons mentioned above, it is well worth sticking it out. It is also a dynamic field and as such, Actuaries must continue to learn and keep up to date with new methods and information. Becoming a fully qualified actuary is no small feat, however if you follow the tips in this guide, you can make it happen!

Actuary Exams FAQs

Aoife Colleary

“Aoife Colleary is an Actuarial Trainee at Spence & Partners Limited. Aoife graduated from Queen’s University Belfast in 2023 with a BSc degree in Actuarial Science and Risk Management. You can connect with her on LinkedIn.”