Should All New Actuaries Learn Data Science and Programming?

Discover the pivotal importance of programming and data science for actuaries, skills that are revolutionizing the field by enabling more efficient data analysis and risk management, crucial in a data-driven world.

Actuaries should learn programming and data science because technology and data science are becoming more important in the field of actuarial science. Most actuarial employers expect new actuaries to have data science skills such as writing code and using statistical software.

Actuaries use programming and data science skills to minimise risk and predict future events in industries such as insurance. Programming skills are also useful for building models and analysing data. Actuaries are expected to learn programming languages such as Python and R to stay competitive in the job market.

This article discusses what data science is, where actuaries and data scientists differ and why new actuaries should learn data science.

It is the 21st century, the world and humans continue to evolve every day. We are living in the Information Age, where humans can access information and knowledge easily. Technology such as internet, computers and smartphones are changing our lives daily and improving efficiency, almost taking over our lives.

Big data, machine learning and artificial intelligence have been making headlines across industries everywhere, so it shouldn’t be surprising to see the impact reach the field of actuarial science. It is vital for new actuaries to understand how this profession can be influenced by data science and they must be ready to embrace both the threat and opportunity of the data science world.

Computer programming is significant today in light of the fact that so much of our world is automated. Since computers and machines can execute instructions and accomplish tasks so proficiently and precisely, we use programming to tackle that computing power.

In this Digital Age, software and programming are key parts of day-to-day work as actuaries. Models and programming languages are often used by actuaries to store and evaluate large amount of data. In this profession, not only are Microsoft Office skills essential, but the ability to program in a statistical programming language is also increasingly becoming a necessity.

Actuarial employers in Singapore are increasingly demanding their employees to have equivalent skillset as data scientists. According to the Singapore Actuarial Society’s latest survey of actuarial employers, half of them expect new actuaries to write code, manipulate data, and utilise statistical software. In the US, data scientists are rapidly being recruited for typically actuarial positions.

What is an Actuary?

It has been described that actuaries were the original data scientists. Is this an overstatement? Looking back at the beginning of actuarial science in the 17th century, actuaries involved in trying to find truth and insights from large data sets around longevity and extrapolate into the future, as well as drawing conclusions. That’s the essence of what data scientists do!

An actuary is a professional who uses mathematical skills alongside financial knowledge to assess and minimise risk, measure the probability of uncertain future events and estimate the financial impact of these uncertainties on businesses or clients.

Actuaries operate in a variety of industries, but the majority of them are employed by insurance companies or businesses that handle financial risk. In insurance, actuaries involved in managing financial reserves, monitoring the funds required to provide the benefits promised, designing and pricing policies using various types of data to determine the risk factors in order to minimise risk and maximise profitability.

What is Programming?

A programme is a set of logical, mathematical, and sequential functions. These roles perform a task when they are grouped together. Writing computer code to construct a programme or solve a problem is referred to as programming. Algorithms are implemented using programmes and they may be interpreted as pseudocode or a flowchart, and programming is the process of converting these representations into computer programmes.

A programme must be written in a way that tells a computer or software precisely what to do and how to do it. If an algorithm has been created, the programme will follow it step by step, telling the computer exactly what it should do.

Why Should New Actuaries Learn Programming?

Technology plays a significant role across industries everywhere, and the actuarial profession is no exception. A good knowledge of various programming software is extremely vital to obtaining an actuarial position and success on the job. Actuaries deal with large amount of data daily and use different techniques including statistics, data visualization and pattern recognition to anticipate future uncertainties and determine required funds to recompense for events that may randomly occur in the future.

Actuaries used to spend hours poring over pages looking for trends in the figures from their data before computers and algorithmic programming. Today, actuaries rely on statistical processing software to determine patterns. Actuaries interact with computers and software using these specialised languages to get them to perform a series of unique tasks.

Actuaries with programming skillset can create and test code that instructs how an application, or software program performs effectively, allowing them to construct a set of instructions for a computer to facilitate specific actions and review the outcome of the data for accuracy and reasonability.

In this day and age, programming plays a vital role in the actuarial profession by organising and analysing large amount of data. Microsoft Excel and VBA are essential skills, and many employers consider knowledge or even mastery of it as one of the job requirements. In order to succeed in this profession, actuarial graduates are expected to learn a variety of additional programming language.

A number of programming languages used by the actuaries are briefly described as follows:

- Excel – Data analysis and summarization

- VBA – Automate tasks in Excel

- SAS and R – Statistical analysis and data visualization

- Python – Automate tasks in Excel and data analysis

- SQL – Pulling, editing and adding information to databases

Actuaries deal with large data sets. For example, when evaluating a policy, actuaries require a range of information of the policyholder such as gender, age, premiums paid, number of years insured etc. What if the given project has 100,000 policyholders and the valuation has to be done every quarter?

Needless to say, it would be tough to manage such large amount of data and to obtain useful pieces of data from it. It would be disastrous for one actuary to manually accomplish this onerous task quarterly. Is there a way to save the actuary? Absolutely! An actuary equipped with programming skills can create a code that instruct the software to perform the tasks, saving time and costs.

Besides that, programming is used to automate recurring tasks that would otherwise need to be done manually. For example, valuation work tends to be more repetitive as these tasks often need to be completed monthly, quarterly or yearly. It would be more convenient and efficient to construct a range of code for the system to execute specific tasks, rather than having to repeat those steps manually each time.

This would not only save actuaries a significant amount of time when most tasks have tight deadlines, but also reduce errors which would in turn ensure sensible outcomes. In this case, programming benefits all parties by increasing work productivity and effiency as well as reducing the company’s costs.

When I was completing my placement with a Life and Pensions company in Dublin, the tasks accomplished relied heavily on SQL and Excel.

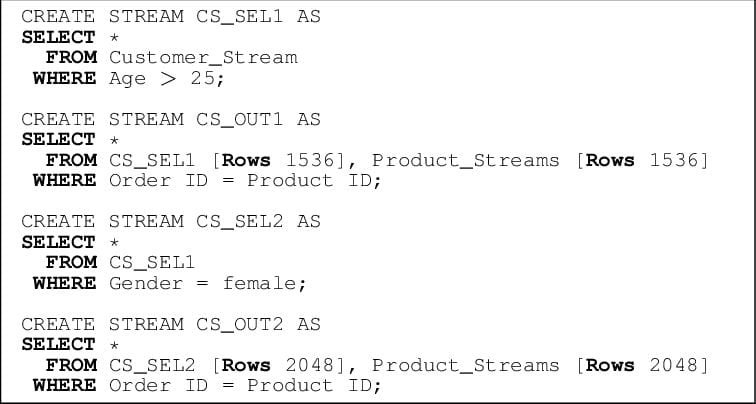

The diagram above illustrates a small piece of a much larger piece of code from SQL. The first set of instruction instructs the software to select from the database, “Customer Stream”, where the age of the customers has to be over 25 years old. This may not seem much but this alone could save actuaries a fair amount of time.

The tasks were largely performed by writing a variety of queries, which involved the CRUD (Create, Read, Update and Delete) operations. As I had no experience in any programming language, I spent the first few months learning different codes and familiarising myself with the software, which were no easy tasks.

Moving forward, I believe institutions should provide students with a more comprehensive programming experience, in order to equip them with the foundational knowledge in programming, and thereby better prepare actuarial graduates for the workplace.

What is Data Science?

Data science is now one of the most hotly discussed topics in the industries. Businesses have begun to use data science techniques to expand their operations and improve customer satisfaction. There is so much data in the world we live in today. Data science aims to gain insights and extract economic value from any form of data in the most efficient way. Data science is a field of study that uncover hidden patterns, extract valuable data and make business decisions from a large amount of data.

Advanced research, statistics, machine learning, and computer programming are all part of data science. Small data, big data, and all types of data are all dealt with in data science. Unlike actuaries, who specialise in numbers and statistics and primarily work in the insurance industry, data scientists work with a wide range of data forms, including numbers, surveys, and a variety of other types. They organize and refine massive volumes of unstructured data to make it into understandable information to corporate boards and others. They identify market patterns and provide a connection between corporate and IT.

Where Actuaries and Data Scientists Differ?

Actuaries and Data Scientists share many of the same responsibilities and skill-sets, where they rely on in-depth data processing and utilise the generated outcomes to comprehend the present and anticipate the future events. There are some differences between actuaries and data scientists. In particular, a data scientist’s responsibilities are much wider than those of an actuary, whereas an actuary is more familiar with statistical probability complexities than a data scientist.

Data scientists create programs to aid in the processing of data, while actuaries rely on programs to assess risks. In addition, actuaries specialise in financial risks and have a significant advantage, as their expertise is very unique to the insurance and pensions industry, while data science can be applied to any area involving high volumes of data.

Why Should New Actuaries Learn Data Science?

Given the vast quantities of data generated today, data science is an important part of every industry. Data science, AI, and machine learning are becoming increasingly important to businesses. Organizations that want to stay competitive in the age of big data will develop data science capabilities to avoid being left behind. Therefore, it is just a matter of time that data science will transform industries such as insurance and finance. Understanding and learning data science are crucial for new actuaries, so that they can play an active role in shaping the future and not fall behind the times.

There are many similarities between actuaries and data scientists, both of which deal with modelling, programming, data bases and statistic. As the only skillset that differs is machine learning, it is not impossible for an actuary to become a data scientist. While programming is a must-have skill, data science also requires a strong understanding of mathematics. When moving to a data scientist position, actuaries have an advantage due to their statistics and mathematics backgrounds. Having knowledge of data science not only allows actuaries to re-engineer what they do in traditional fields, but also allows them to branch out into new areas.

The Best of Both Worlds for Actuaries…

Actuarial data science is an extension of traditional actuarial science that refers to the use of machine learning techniques to solve problems like pricing and claims prediction. Actuarial data scientists place a greater emphasis on programming and advanced statistics in order to derive patterns from data and make more reliable predictions.

Actuarial data scientists are very rare in the modern society as traditional actuaries fall short in terms of programming ability and analytical skill. As a result, new actuaries who possess these abilities will no doubt be provided with lots of possibilities in this Digital Age.

Conclusion

With rapid advancement in technologies, new actuaries should not only keep learning and improving their computer and programming skills, but also gain exposure in data science, so that they will not fall behind the times. Institutions that offer Actuarial Science courses should include modules that involve programming or other computer software related to this profession, by providing lectures that will help to bridge the gap between actuarial theory and practical application. Practical experience of working with various programming languages would be an excellent addition to their curriculum vitae. This will not only boost the students’ graduate employability, but also enhance their ability to compete in a turbulent graduate recruitment marketplace.

Job markets are getting more competitive in the period of recession due to the Covid-19 pandemic. Data science and programming skills will be a good addition to have under the belt in order to stand out from the crowd in this competitive job market. Taking into account the importance and benefits of having equipped oneself with both programming and data science, it is with confidence that new actuaries should learn programming and data science.