The Insurance Actuary: Ensuring Security and Managing Risks

Step into the strategic and analytical world of insurance actuaries, who play a crucial role in financial forecasting and risk management, helping companies navigate the complexities of policy-making and pricing.

The Essential Role of an Insurance Actuary in the Industry

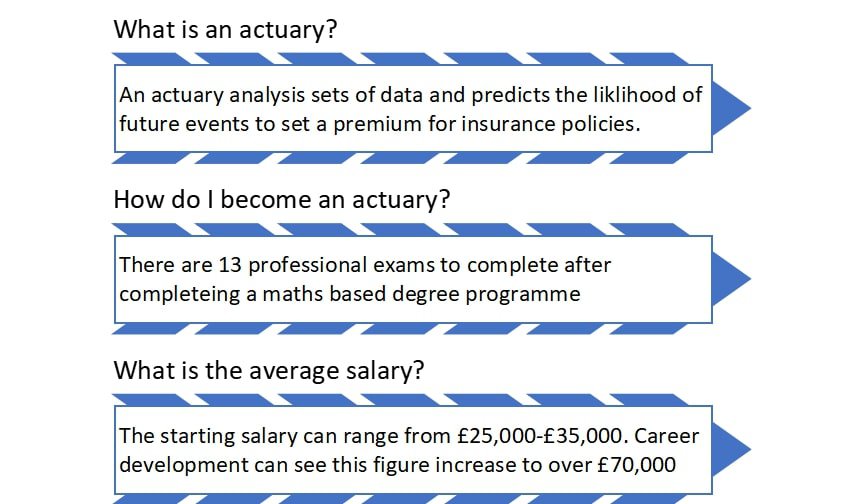

What Is an Insurance Actuary?

An insurance actuary analyses financial risk, using different techniques to determine the probability of something happening, or in short, the chances of a claim being made. The actuaries create categories used to determine the price of policies. These categories are based on different inputs and probability factors. The underwriters are responsible for sorting the customers into these categories and the pricing actuary sets a premium that is enough to cover any claims that are made whilst staying competitive and not making a loss for the company. Actuaries work in a variety of business sectors including the traditional life, pensions and general insurance companies and branching into banking, finance and investment.

Overview of Duties and Responsibilities

- Actuaries analyse different sets of data in order to predict the likelihood of certain events happening in the future.

- They build complex models and processes to evaluate the potential risk of insuring customers in order to predict the future gains or loss for their firm.

- Work on developing new insurance products that are relevant to the public,

- Offer advice on how to reduce risk for companies or how best to avoid it through different strategies.

- Communicate their findings to management and clients.

- Most importantly they need to stay up to date with the developments in the business world

Why Do We Need Insurance Actuaries?

Some may question the importance of insurance actuaries but if we take a look at the world around us there are very few aspects of life that don’t require an input from an actuary.

Take for example the recent devastation in Turkey and Syria. Countries that are prone to earthquakes or other natural disasters. Insurance actuaries work behind the scenes predicting the likelihood of such an event and how to cover the cost of repair afterwards.

Take car insurance for example, no one enjoys receiving their renewal letter in the post. Famous last words … “When am I ever going to use this?” It is clear how important car insurance is with €97,364m being paid out in motor insurance claims alone in Europe in 2020 (source, Statista.com).

The actuary is an important part of the premium pricing aspect of insurance, by predicting the likelihood of you making a claim your premium is reduced or increased specifically for you. This means you are receiving a fair and competitive quote.

By helping the company mitigate risk and assessing potential financial impacts the company is less likely to suffer economically and be able to pay out any claims granted.

Key Duties and Responsibilities of Insurance Actuaries

No two days are likely to be the same for an insurance actuary depending on what project they are working on. Here is an idea of what they might get up to:

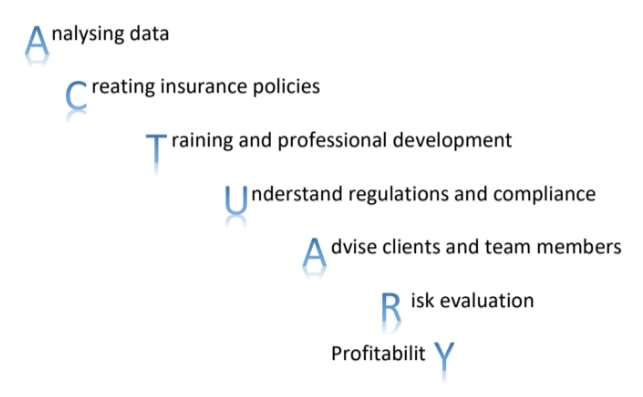

Analysing Data

As mentioned before a key part of an actuary’s role is analysing and evaluating large sets of data to identify and trends or patterns and predict the likelihood of future events. The analysis takes into account a number of different factors including; health, where you live, occupation and many others.

Creating Insurance Policies

Insurance actuaries are involved in the development of new products and also pricing insurance policies for customers based on their personal data and needs. This will include documenting insurance policy terms and creating premiums.

Training and Professional Development

Every day’s a learning day for an actuary. A key part of being an actuary is lifelong learning, I will discuss this in greater detail later. There is also the PPD aspect of qualifying as an actuary that will be discussed.

Understanding Regulations and Compliance

There are national and international standards that actuaries must comply with. The actuaries study changes in these regulations and standards as they are released to stay up to date to continue producing high quality and ethical work.

Advise Clients and Team Members

A large part of an actuary’s day will be spent in solitude however, working on a project requires close communication with other team members or other teams in the company. Actuaries also communicate with stakeholders and clients to update them on evolving risk factors or any other relevant changes.

Risk Evaluation

Evaluating risk in an insurance firm may include working with others such as underwriters or pricing actuaries. The actuary evaluates the risk of the customer and determines the potential impact on the insurance policy.

Profitability

The actuaries are responsible for providing insights to the firm on how to increase profitability whilst remaining competitive in the market. There is a fine line between the firm remaining competitive and being able to cover expected claims. They also need to ensure that the companies solvency ratio is sustainable.

Specialized Areas in Insurance Actuary Practice

The traditional role of an actuary is evolving every day. The typical life, general and pensions industry is expanding into banking, investment among other industries. The three main types of actuarial work include, pricing, risk management and investment.

I have touched on the pricing actuary before now. A pricing actuary is the actuary who is involved in the setting of premiums. The pricing actuary works closely with the underwriters to ensure the premiums they are setting are competitive.

Risk management is an important aspect of the actuarial world. Risk management is used to reduce losses, control uncertainty and improve performance by optimising decision making. This is carried out by:

- Taking the objectives of the stakeholder under consideration

- Determine how to reduce this uncertainty

- Develop a model to consider the possible outcomes

- Output your end scenario

Two of the initial areas that actuaries can enter into in investments are asset and liability modelling and risk management. They can both be treated in the same way essentially. Asset and liability modelling is key to long term investing. The techniques involve creating a model to forecast the future assets and liabilities which is instilled in actuaries from the beginning. The actuarial tools fit for risk management in banking and portfolio risk are endless but include; knowledge of pension liabilities, statistics and sensitivity analysis of parameters.

As you can see the industry is expanding rapidly and the opportunities are endless. Do you have what it takes?

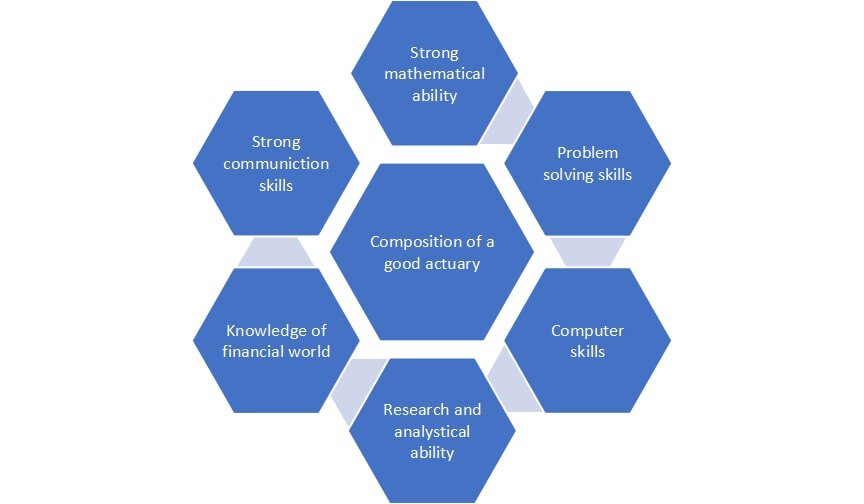

Key Qualities of a Successful Insurance Actuary

The Pathway to Becoming an Insurance Actuary

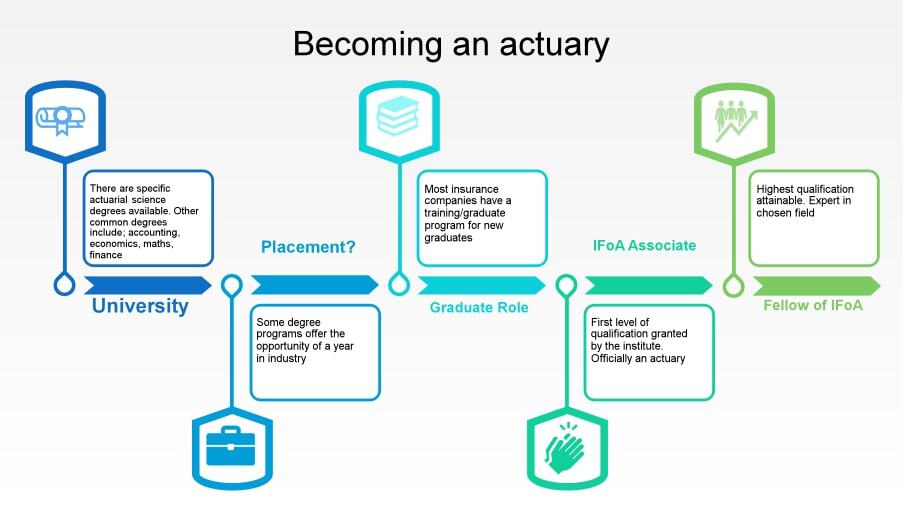

No two actuaries you meet are going to have the same pathway into the industry. However here is a typical representation:

University – Although there are specific degree programs for actuarial science any maths-based degree is a good starting point. One of the key benefits of the actuarial degrees is the possibility of up to 6 exemptions from the professional exams.

Placement – A year in industry or a summer placement is the perfect opportunity to get a grasp of the industry you are entering into. It provides the opportunity to see how different teams within the insurance companies work, this exposure will help you decide where you want to apply when you have graduated.

Graduate Role – Graduate or training programs in an insurance company provide the analysts the chance to work and study for their professional exams at the same time. Most insurance companies will assist with the exam process providing students with study days and assisting with the financial aspect. A breakdown of the exams will follow.

IFoA Associate – Once you have completed the first 9 professional exams you can officially call yourself an actuary.

Fellow of IFoA – There are 3 specialist exams separating Associates and Fellows. The benefits of being a fellow include voting rights on matters regarding the future of the profession and the opportunity to be involved in membership forums, events and research.

IFoA Professional Exams

There are 13 professional exams to become a fellow:

- 7 Core Principles subjects (CS1-2, CM1-2 and CB1-3) – 6 of which can be gained through exemptions

- 3 Core Practices subjects (CP1-3)

- 2 Specialist Principles (SP)

- 1 Specialist Advanced (SA)

According to the IFoA “On average, you will spend between 15 and 20 hours a week studying for your qualification.” However, they reiterate the point that you will be well supported by employers with regards to study leave and mentorship programmes. There are a wide range of resources available from textbooks and e-books to block tutorials to participate in.

Personal and Professional Development (PPD)

On top of the professional exams there is also the PPD element to complete. This is the practical element to becoming an associate or fellow. It is essentially a record of how you are developing your skills in the workplace, focuses on application of knowledge and on how reflection is an important part of improving.

A detailed log of work-based activities that you have worked on throughout the year. The objectives you are expected to meet and reflect on in every piece of work are the following:

- Effective Communication

- Problem Solving and Decision Making

- Professionalism

To gain associate status you are required to submit 24 months’ worth of PPD and have completed 4 hours of formal learning.

Career Growth and Earnings Outlook for Insurance Actuaries

The Traditional Route

As set out by the exams section above the traditional route for an actuary starts with their degree, followed by years of training and exams to get the top of the pyramid. It is common knowledge that it is not an easy road to become qualified and afterwards it’s even harder to stay on top of evolving industry. It begs the question: Is it worth it?

Average Salaries and Earning Potential

As a graduate the pay ranges from £25,000 to £35,000 in the UK. As you pass your exams your pay will increase in increments to around £55,000. Once you are a senior qualified actuary you could see your pay check rise to anything over £70,000. This is one of the many benefits of the job. Of course, if you have your sights set on the sky partner salaries can be seen to breach £200,000.

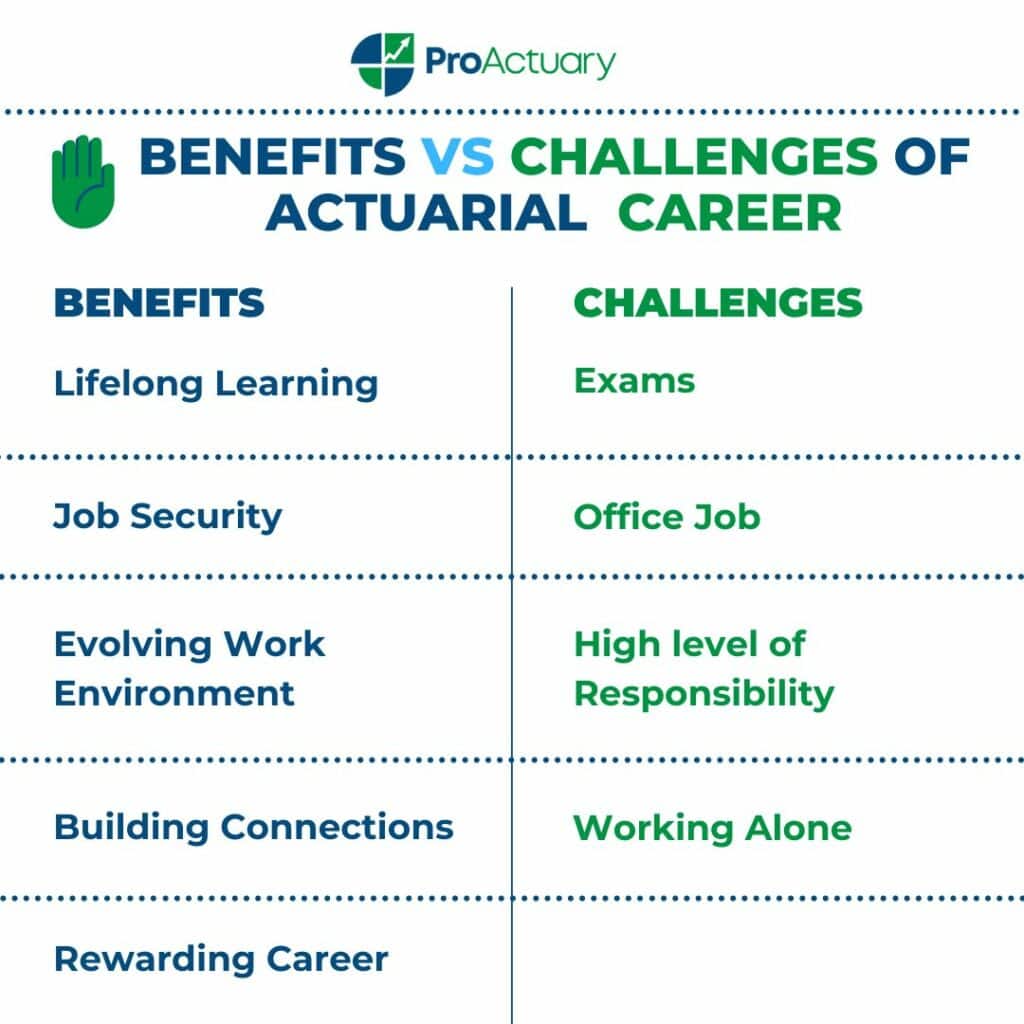

Benefits and Challenges of the Career

Some of the other benefits of the career include:

- An evolving work environment – there is a vast number of opportunities for actuaries to expand into different industries.

- Challenging career – everyday will bring a new challenge. You will be able to apply your mathematical knowledge to solve real world problems.

- Lifelong learning – with the technological advances and a more in-depth AI world, actuaries will continue to challenge themselves to learn more about these concepts and how they can benefit from the use of them.

- Job security – although there may be concerns about technological advances diminishing certain careers, this is not the case for actuaries. In the US it is expected that “Employment of actuaries is projected to grow 21 percent from 2021 to 2031” according to the US Labor of statistics. The demand for actuaries is there and is evidently increasing.

- Rewarding career – The decisions actuaries make have a positive impact on people’s lives by solving a wide range of problems. By impacting other people’s lives there is more job satisfaction.

- Building connections – The actuarial world is a small community, and it is inevitable that through social events or work that you will meet a wide network of fellow actuaries that you have a lot in common with.

The challenges include:

- The obvious study periods and exams as previously mentioned.

- High level of responsibility – there can be the added pressure of making recommendations to clients or ensuring the premium charged is correct. Any error in either of these could have a drastic effect on the company.

- Working individually – although there will be a team around you working on the same project you will be working alone on the majority of your pieces.

- Office Job – in today’s society there are many non-traditional work environments that may be more appealing to some people. Actuaries spend a lot of their time sitting in front of a computer screen.

Concluding Perspectives on the Insurance Actuary’s Role