The Chief Actuary: Roles and Responsibilities

Step into the strategic realm of the Chief Actuary, pivotal in aligning actuarial science with business goals through robust risk management, regulatory compliance, and insightful financial planning.

The chief actuary – a vital cog in any organisation that turns the wheels of risk management and financial planning. It could be you someday, so continue reading for information on their many roles and responsibilities.

Exploring the Chief Actuary’s Role in Insurance and Business Strategy

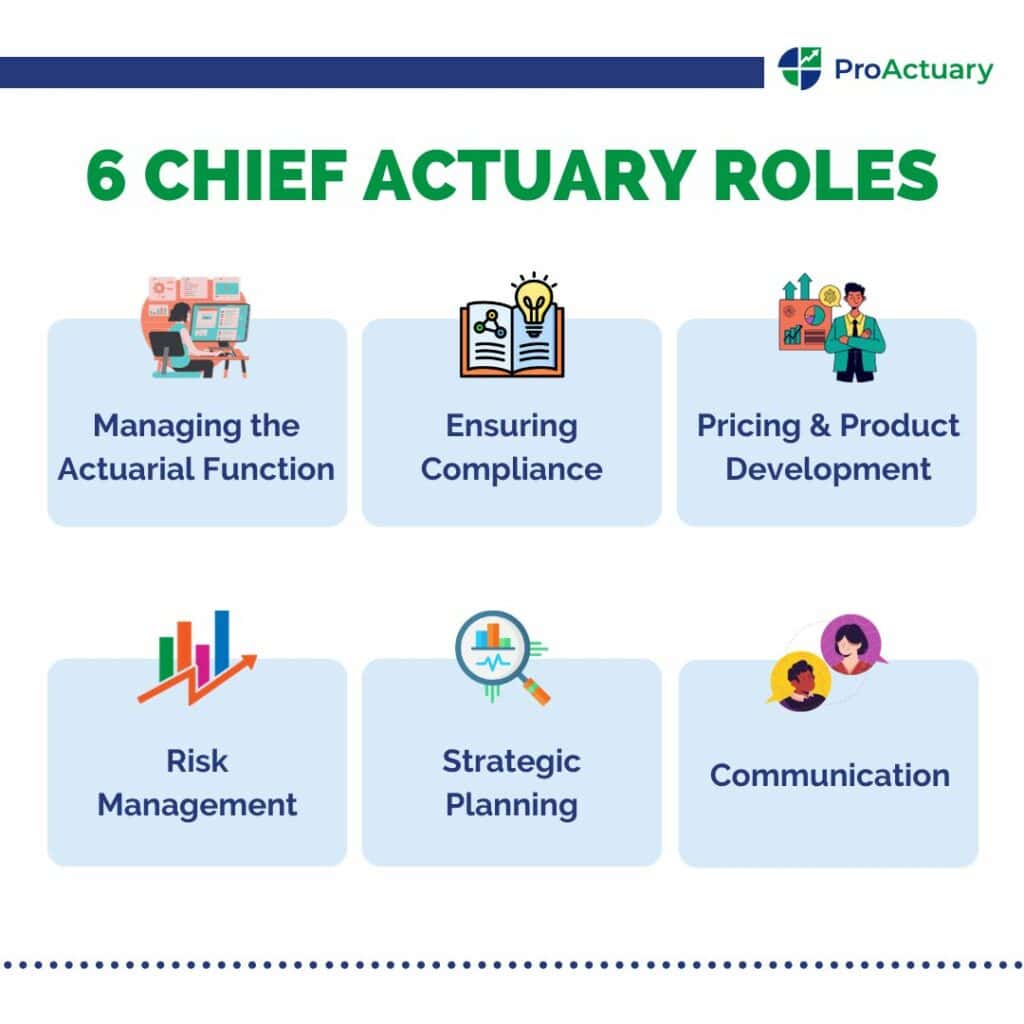

In general, the chief actuary is responsible for managing the actuarial function within an organisation and ensuring it is aligned with the overall business strategy in the following ways:

- Managing the Actuarial Function: Overseeing the actuarial team and their projects, ensuring the department operates efficiently.

- Ensuring Compliance: As the insurance industry is highly regulated, the chief actuary must ensure the actuarial models, methodologies, and assumptions they choose are appropriate and in compliance with regulatory guidelines.

- Pricing & Product Development: Analysing risk and profitability, designing pricing models, and developing new products that meet the needs of the market.

- Risk Management: Developing risk management strategies, modelling and quantifying risk, and ensuring that risk management practices are integrated into the overall business strategy.

- Strategic Planning: Providing the senior management team with insights into the long-term financial and risk management implications of various strategic options.

- Communication: Communicating complex actuarial concepts and analyses to non-actuarial stakeholders within the organization. This includes presenting findings to senior management, developing reports for the board of directors, and communicating with regulatory authorities.

The knowledge of chief actuaries may differ slightly if they work in different areas of insurance (Life/General), but communication remains essential for all chief actuaries. In the view of Janet Fagan, former Chief Actuary of Sentry Insurance (USA), being the chief actuary is like being an interpreter:

“We have to interpret what the business areas are doing and communicatewhat our staff is doing in terms that other people can understand.The roleof chief actuary includes being an interpreter–an important link in the entiremanagement process.”

Why Is the Chief Actuary So Vital to the Insurance Industry?

Without the chief actuary, the insurance industry would crumble like a poorly constructed Jenga tower. With years of experience and the keenness to keep up with the ever-changing regulations in the industry, the chief actuary behaves like a glue holding the blocks together. Their duties in the insurance industry include:

- Assessing Risk: Chief actuary is responsible for quantifying and assessing risk across the organization. This involves analysing data, developing models, and using actuarial techniques to determine the probability and severity of various risks.

- Pricing & Product Development: The chief actuary is responsible for pricing insurance products and developing new products that meet the needs of customers. They use actuarial techniques to determine appropriate premiums, taking into account risk factors, such as age, health status, and driving history.

- Financial Management: The chief actuary is responsible for determining appropriate reserves and ensuring that the company has adequate financial resources to meet its obligations to policyholders.

- Compliance: The insurance industry is highly regulated, and the chief actuary is responsible for ensuring that the company complies with regulatory requirements related to actuarial work. This includes ensuring that actuarial models, methodologies, and assumptions are appropriate and in compliance with regulatory guidelines.

The Path to Becoming a Chief Actuary

Now that you’ve heard what a chief actuary does, it is time to learn how to become one. The good news? The pathway and objectives are clear in achieving the role of chief actuary. The bad news? It’s like trying to climb a mountain – a long and difficult journey that requires a lot of dedication and hard work. However, we have broken it down into a few more simple milestones:

Complete a Maths-Based Degree

The typical actuary will earn a bachelor’s degree, with the most common degrees being in actuarial science, mathematics and statistics.

Get a Graduate Job

They will then gain practical experience by working in an entry-level position, which may include actuarial analyst or assistant.

Complete your Professional Exams

Many companies now offer a study package to graduates where they have time during the week to study for the actuarial exams administered by professional organisations such as the IFoA (Institute and Faculty of Actuaries). These exams test your knowledge of mathematics, statistics and other relevant subjects. Upon completion of 2 years of Personal and Professional Development (PPD) and Professional Skills Stage 1 & 2, you are now an Associate. Pass all the remaining exams and you are now a Fellow. Congratulations!

Continue Working Hard!

Now as a qualified actuary with the exams all behind you, the next step is to continue gaining more experience by seeking out leadership positions or work on high-profile projects to demonstrate your expertise and potential as a chief actuary. Over the years (and trust me, it will take years), continue networking with other professionals in the actuarial field and stay up to date with industry trends and developments.

Key Skills and Qualifications for a Chief Actuary

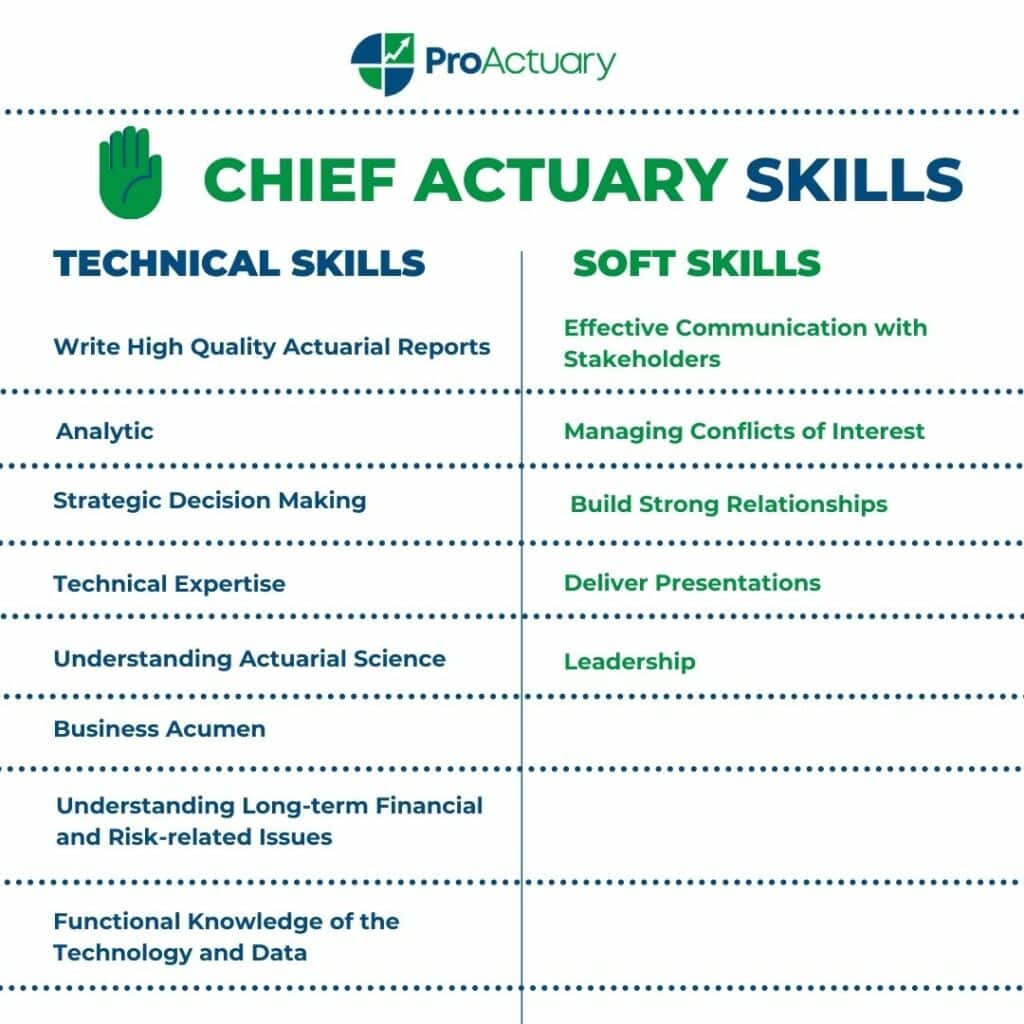

An actuary will continue to build on their skills, both soft and technical, during their time in the profession. The following skills, however, are crucial for making a great chief actuary:

Soft Skills

- Effective Communication with Stakeholders: Communicate complex concepts clearly and concisely, accounting for differences in knowledge and expectations.

- Managing Conflicts of Interest caused by different objectives of stakeholders that the actuary serves.

- Build Strong Relationships and engage proactively with Board members, key individuals within the firm, and other professional advisors.

- Deliver Presentations with effective summaries of extensive actuarial analysis, addressing key factors in relation to the advice being provided and decisions under consideration.

- Leadership: Be able to inspire and motivate their team by setting goals and expectations, providing feedback and create a culture of innovation and collaboration.

Technical Skills

- Write High Quality Actuarial Reports: Identify key issues, explain the actuary’s conclusions clearly, detect weaknesses and limitations in any analysis, adjust style and technical level to audience knowledge.

- Analytic: Pays attention to details and asks questions about their own analysis and that of others.

- Strategic Decision Making: Take a rigorous approach to achieving optimum results.

- Technical Expertise: Extensive knowledge of advanced mathematics, statistics, and financial theory.

- Understanding Actuarial Science: Including calculation and assessment of risk based on mathematics and statistics.

- Business Acumen: Knowledge of the broader business context, including market, competitors, and regulatory environment, thereby aligning the actuarial function with the organisation’s strategy.

- Understanding Long-term Financial and Risk-related Issues facing insurers and being able to assess these issues at a high level before analysing them in more detail.

- Functional Knowledge of the Technology and Data used by a business to acquire or administer the contracts the actuary is advising on.

It can be argued that the softer skills like communication and leadership are the key differentials when comparing an actuary with a chief actuary, with Matt Saker, IFoA President 2022/2023 stating:

“In some sense the people you are communicating to – the ultimate decision makers – don’t really care about the 95% of the brilliant technical work that goes into it, which they typically take for granted. What they care about is the 5% of analysis that gets presented to them in the board or committee meeting.”

The advancement opportunities for a chief actuary can vary depending on the organization, the industry, and the individual’s goals and ambitions. However, if a chief actuary would like to move on to something else, they could:

- Be Promoted to a Higher Executive Position: A chief actuary could use their expertise in actuarial science to provide strategic guidance to the organization in higher executive positions of Chief Financial Officer (CFO) or Chief Risk Officer (CRO).

- Move into Consulting or Advisory Work: They can use their expertise to help other organizations manage their financial risks.

- Be Appointed a Board-Level Position: Provide guidance and oversight to the organization from a strategic perspective.

- Move into Academia or Research: Contribute to the development of actuarial science and mentor future generations of actuaries.

Chief Actuary: Salary Expectations and Job Outlook

It is no secret that actuaries are paid well, but they would get paid even more if they actually had some friends to split the bill with! According to salary data from Glassdoor, the average base salary for a Chief Actuary in the UK is £121,000 per year.

However, this can vary depending on factors such as the size and industry of the company, years of experience, and qualifications. Salaries can range from around £88,000 to over £160,000 per year.

In 2021-2031, the U.S. Bureau of Labour Statistics projects that actuaries will have a 21% employment increase, which is much faster than the average for all occupations. Maybe they will finally find someone to split the bill with after all!

Actuaries are in greater demand across the globe, with the typical actuary these days more involved in analysing data and utilizing technology rather than completing calculations on paper. This in turn means the actuarial function for many organisations will increase in size and importance, with the role of chief actuary becoming even more significant.

In general, an organization will only have one chief actuary. However, a more prevalent actuarial function could result in smaller companies employing multiple chief actuaries to oversee the company’s operations just as larger organizations with more complex risk exposures do.

Concluding Perspectives on the Chief Actuary’s Role

Being a chief actuary is no piece of cake. It’s like being the conductor of an orchestra, but instead of instruments, you’re dealing with numbers, probabilities, and statistics. You need to be the captain of the ship, the one who knows the way and charts the course, all while navigating the rocky waters of risk and uncertainty. But don’t let that scare you. Get started along the pathway previously outlined, and on your journey, you will learn the right skills and knowledge to steer your organization towards a bright and prosperous future. So, release your inner actuarial geek and embrace your responsibilities to the fullest!

Future Trends Affecting the Chief Actuary Role

The role of chief actuary is expected to continue to be important in the insurance industry and other fields where risk management is critical. With the increasing complexity of financial markets and regulatory environments, the demand for professionals with strong analytical and technical skills is likely to remain high. Thus, the role of the chief actuary will expand to become even more strategic and forward-looking as companies seek to navigate ever-changing risk and opportunity landscapes.

A chief actuary’s role may be impacted by the rise of big data and the increasing use of artificial intelligence and machine learning in the insurance industry. Chief actuaries may need to have a solid understanding of these technologies and their applications in order to effectively manage and mitigate risks.

It appears that the role of the chief actuary will flourish in the coming years, as long as the profession adapts and evolves to meet the changing needs of businesses and society in general.