Understanding Actuarial Analysis: Its Critical Role in the Insurance Industry

Unlock the intricacies of actuarial analysis, a cornerstone in insurance that ensures financial risks are comprehensively assessed, enabling robust policy design, precise premium setting, and effective risk management.

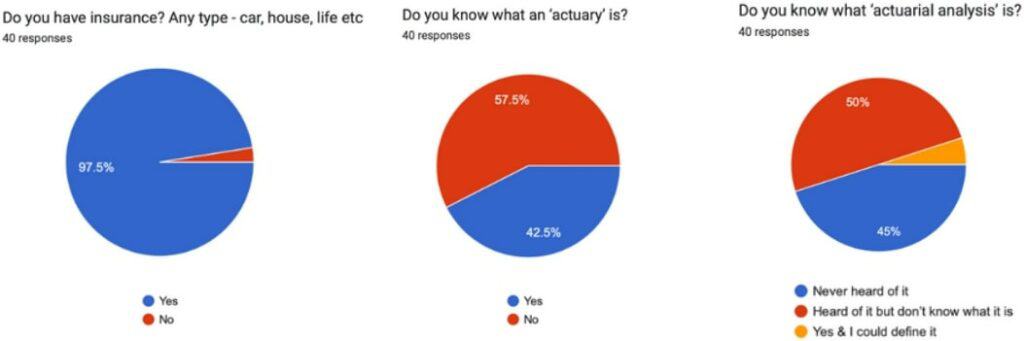

The entire insurance industry relies on this. It affects your day-to-day life and you might not even know it. Out of the 40 people I surveyed, 97.5% had some form of insurance, but only 5% knew what actuarial analysis was. The majority didn’t even know what an actuary was. Actuarial analysis is essential in the insurance industry, and this article explains why.

Actuarial Analysis in the Insurance Industry: Key Concepts and Applications

The insurance industry impacts almost everyone. According to a Forbes survey, over 75% of adults in the US have life insurance. In 2021, only 8.3% of the US population did not have health insurance at any point. Other types of non-life insurance include property and liability.

Insurance involves a contract where the insurer collects a premium and agrees to provide protection to the policyholder against unexpected financial losses. It’s like a transfer of risk that helps to protect the public. To do this, actuaries perform actuarial analysis which plays a crucial role within the insurance industry. It allows insurers to determine insurance premiums, and assess, identify and manage risk.

Everyone can see the tip of the iceberg – the cars insured in a collision, the house insured during a fire, the sportsperson insured after an injury. However, beneath the surface, there are many processes and decisions occurring.

Actuarial analysis can provide answers to the following important questions beneath the surface:

- How much should an insurance company charge in premiums?

- How likely is it that a claim occurs?

- Do insurance companies have enough to pay out on these claims in the future?

What Is Actuarial Analysis?

Definition

Actuarial analysis is defined as “the application of probability and statistical methods to calculate the risk of occurrence of any event […] It may include calculation of the anticipated money costs of such events and of the premiums necessary to provide for payment of such costs.”

Explanation

More simply put, it’s a process used by actuaries to evaluate and manage financial risk. So, what’s an actuary? The “professional who uses mathematical and statistical methods to assess risk and uncertainty in insurance, finance, and other industries.” The person behind the process.

If you asked someone in your family or one of your friends to describe an actuary, they may say it’s a “person that puts a price tag on risk.” Actuarial analysis is a process which allows the actuary to do this. It is used by insurance companies, government agencies and banks and can have different objectives, such as designing insurance policies, and retirement and pensions plans.

Types & Objectives of Actuarial Analysis

There are various types of actuarial analysis used in the insurance industry. The list below includes their objective:

- Product development: Designing insurance policies which meet the policyholder’s needs.

- Pricing: Calculating premium rates to charge the policyholder, such as their monthly car insurance.

- Reserving: Estimating the amount that the insurance company needs to be able to pay out its liabilities in the future.

- Risk management: Evaluating uncertainties and risks that the insurance company could face, such as a pandemic.

- Financial reporting: Analysing data to meet regulatory requirements of the industry. For example, Solvency II and IFRS17.

The Role of Actuarial Analysis in Pricing and Underwriting

Actuarial analysis can be used to determine premiums and assess risk in the insurance industry. For example, the financial risks identified from a natural disaster or a car accident. The process can involve the following steps:

| Analysing historical data and identifying trends | For example, looking at past claims experience and identifying trends in mortality. |

| Determining assumptions | This can involve actuaries working with underwriters. What will the interest rate be? What is the life expectancy of the person? Are they likely to live to 60 years old? 80? 100? What expenses will occur? These are questions that can be addressed. |

| Developing models to project future claims | This can determine the potential financial impact, both in the short and longer term. Premiums are determined to reflect the risk level, and can consider the profit margin of the insurance company. |

| Evaluating and managing the risk | This allows better-informed decisions to be made based on the insights provided by the actuarial analysis. A sensitivity analysis can be carried out, which involves using a range of assumptions to obtain a range of potential outcomes. |

| Monitoring and adjusting the models | This is an iterative process which can be continually updated. For example, using new data or changing assumptions based on conditions in the economy, such as an fluctuating inflation or interest rates. |

Why Is It Important That Actuarial Analysis Is Accurate?

In 2021 in the US, the total premiums across life and P&C insurance totalled over $1,351 billion. This is a huge amount. Inaccuracy in assessing premiums could result in millions of people globally being affected.

Overpricing of premiums could result in potential and current customers moving to competitor insurance companies who offer lower prices. However, underpricing could result in insurance companies not being able to cover claims, and becoming insolvent.

Accuracy helps the insurance company remain competitive in the market, but also to survive and be profitable. For example, there are over 31 million registered cars in Great Britain, which are all legally required to have insurance. Inaccuracy could lead to a loss of customers due to unnecessarily high quotes, or the insurance company taking on more risk than it can cover.

Underwriters can use the data from actuarial analysis to inform their decisions on accepting or refusing an application. It’s therefore important that this analysis is accurate to better-inform their decision and level of premium set.

Insurance companies need to comply with regulations, and accuracy is essential in financial reporting to ensure the law is being followed.

Actuarial Analysis Techniques in Risk Management

Risk management is defined as “involves considering the risks of the enterprise as a whole, rather than considering individual risks in isolation.” It involves managing the risk. Actuarial analysis is used to identify and manage risk in the insurance industry.

For example, a company wanting to protect themselves against cyber risk. There are various factors to consider. How likely is a cyber attack? What could the potential cost be? Is there an insurance policy which could cover this?

Actuaries play an important role in developing and implementing risk management strategies. The Institute and Faculty of Actuaries (IFoA) have set out a framework for the actuarial approach to risk management, which can involve the following:

Considering the Context

- Defining the aims of the stakeholder

- Identifying the risks

- Considering the time scale involved in the risk management approach

Describing the System

- Identifying the risk: By discussing with stakeholders and experts, current and potential emerging risks can be identified. This can involve collecting data on the risk, and identifying the drivers, considering their potential likelihood. The IFoA recognises the importance of prioritising the risks “that really matter to stakeholders” to improve decision-making for risk management.

- Understanding the connections between risks: Mathematical models can be used to analyse what causes the risks, and any factors that could increase their likelihood. For example, actuaries would have considered the correlation between Covid-19 pandemic and the rise in mortality rates over this time period.

- Developing a model: Using assumptions and drivers of the risk to model into the future. This shouldn’t be unnecessarily over-complicated as the outputs may not be understood by the stakeholders.

Measuring the Risk

- Considering the potential outcomes: Actuaries use models to generate an expected outcome, but also consider a wider range of outcomes. This includes “the tails” which involves the extreme outcomes, both positive and negative. In insurance, this means ensuring the insurance company has enough funds if they had to pay out on extreme events. This can be done by changing assumptions and carrying out stress testing. For example, modelling a high frequency of accidents on the road due to automated cars.

- Considering the risk over a longer-time frame: Uncertainty can increase as we look further into the future, and this can be accounted for in the model.

- Adapting to changes: Updating assumptions using stress testing and scenario analysis to consider a range if potential outcomes that could occur.

- Awareness of limitations and any biases: No model will be a perfect representation of reality as they include simplifications. Humans involved in the process means bias can be involved, so the process should be reviewed to try minimise this. Actuaries should always work in line with the Actuaries Code, which is an code of conduct they must adhere to. This includes ensuring that their judgement is not compromised by bias or any conflicts of interest.

Managing the Risk

- Developing a risk management strategy: Actuaries can be involved by identifying the risks, determining the potential cost and resources required to manage the risks and considering the most cost-effective way to reduce the risks.

- Controlling and monitoring the risk: Continuing to analyse the risk and considering potential new risks emerging. At KPMG, for example, actuaries are contributing to important business decisions across a range of areas as they are not limited to working in just one area.

Exploring Recent Advancements in Actuarial Analysis Techniques

There have been recent advancements in actuarial science and technology. This can impact actuarial analysis and the future of the process. We’ll look into a few interesting advancements and their impact on the insurance industry.

Wearables

InsurTech has advanced in recent years. This involves insurance companies using technological innovations. For example, the rise of the Internet of Things (IoT) includes wearable devices, such as glasses, shoes, clothes, and wristwatches which make up 90% of total wearables. Their use has increased significantly over the past decade, with the number of units sold rising from 70 million in 2014 to 190 million this year.

Wearables track and store data including heart rate, sleep data (such as the number of hours slept and the quality of it), and number of minutes spent exercising.

Insurance companies can use this information in actuarial analysis to determine premiums for example. In a report produced by a global reinsurer, Hannover Re, the following examples show how the use of wearables and offering incentives had positive impacts:

- A life insurer in China with 1.5 million policyholders uploading activity data

- A life insurer in the UK who provided heavily subsidised smartwatches to individuals who achieved certain activity points and health status

- A South African insurer who encouraged a healthy lifestyle by rewarding it with free cinema tickets and discounted gym memberships.

The research evidence suggested that physical activity rates increased by 34% overall, and was even higher for certain groups of people, such as those who had an existing illness or were obese. This can be used as motivation for people to improve their health, and reduce the risk factors which are considered by insurers. This can lead to more personalised insurance products being offered, and offering lower premiums for healthy lives. Therefore, wearables data can be used by both the policyholder and insurer.

Data Science

Data science has also had recent advancements. This is defined as “the study of data to extract meaningful insights for business.” It relates to ‘big data’ analytics, which involves data too big to be managed by traditional software.

A survey of 222 firms found that big data analytics, such as machine learning and artificial intelligence, is used by 31% of insurance companies, with an additional 24% showing proof of concept. It is mainly used in claims management, pricing and underwriting.

Big data analytics can be used by insurance companies in a range of areas and can provide the following benefits:

| Product design and development | – Analysis of data can match customers to more personalised products. For example, by analysing their search history. – New products designed, such as in cyber insurance. |

| Pricing and underwriting | – Better-informed risk assessments. – Uncover new rating factors, which are used to determine premiums. |

| Claims management | – Automation of processes than would otherwise be manual. – For example, customer payments or invoices, and estimating the cost of repair through analysing photos. |

For insurance companies, the advances in data science can contribute to:

- Improved consumer targeting and product design, which can make them more competitive in the market.

- Increased accuracy of risk assessment, underwriting and pricing. For example, by now being able to identify previously hidden relationships in data, and analyse data in more detail than before.

- Stronger engagement with policyholders, leading to higher customer satisfaction.

- Better claims management, such as improved fraud detection. For example, in an article produced by TheActuary, machine learning processes identified 0.83% of claims as being fraudulent.

- Reduced costs and improved customer experience, as claims are prioritised and can be fast-tracked.

Black-Box Use in Motor Insurance

Advancements in technology means that data can be collected by insurance companies using ‘black-boxes’ installed in a policyholders’ vehicle. This can collect data on the drivers’ speed, acceleration, deceleration, location, distance and time of journey.

The increased data from this source can allow insurance companies to offer incentives for policyholders to reward good driving habits. Alternatively, premiums could be increased as a result of ‘bad’ driving habits. This would be incorporated into the actuarial analysis process when determining premiums. As a result of insuring ‘safer’ drivers, the insurance company can also benefit if there are less claims.

Ethical Considerations

Whilst the recent advancements in actuarial science and technology has had positive impacts on the insurance industry, there are also ethical concerns particularly surrounding the use of personal data. The following issues should be considered:

- There could be price discrimination towards the more vulnerable groups in society when applying for insurance.

- Insurance could potentially become unavailable for some people due to the automated processes declining their applications, such as young or elderly drivers.

- There may be less pooling of risk within each area of insurance. A certain level of risk pooling is often deemed necessary by society.

- There could be questions raised over who owns the data – the insurer or the insured?

The IFoA has released a guide for actuaries working in this field to work to minimise these issues, which involves actuaries maintaining their professional competence and oversight on the processes, and adhering to GDPR.

Concluding Insights on Actuarial Analysis

Actuarial analysis is fundamental to the insurance industry. The majority of survey respondents pay their insurance premiums and most likely have never considered the processes that go on behind it or considered why they pay the amount that they do. But now you can! You now know that actuarial analysis is used in a range of areas within insurance to determine premiums, design policies, estimate reserves, evaluate uncertainties and the cost of future financial risks.

However, the future of the insurance industry is uncertain and it always will be. This is the same for the future of actuarial analysis and the impact on the insurance industry. With the recent advancements of actuarial science and technology, the skills of actuaries and the process of actuarial analysis will have to keep evolving and adapting to the changing world. And that’s what makes it so exciting.

Actuarial Analysis FAQs

Jenna McKearney

“Jenna McKearney was an Actuarial Intern at Hannover Re. Jenna graduated from Queen’s University Belfast in 2023 with a BSc degree in Actuarial Science and Risk Management. You can connect with her on LinkedIn.”