Underwriter vs Actuary: What Are The Key Differences?

Navigate the nuanced distinctions and synergies between underwriters and actuaries, pivotal in risk assessment and management, to understand their essential roles in the insurance sector’s strategic framework.

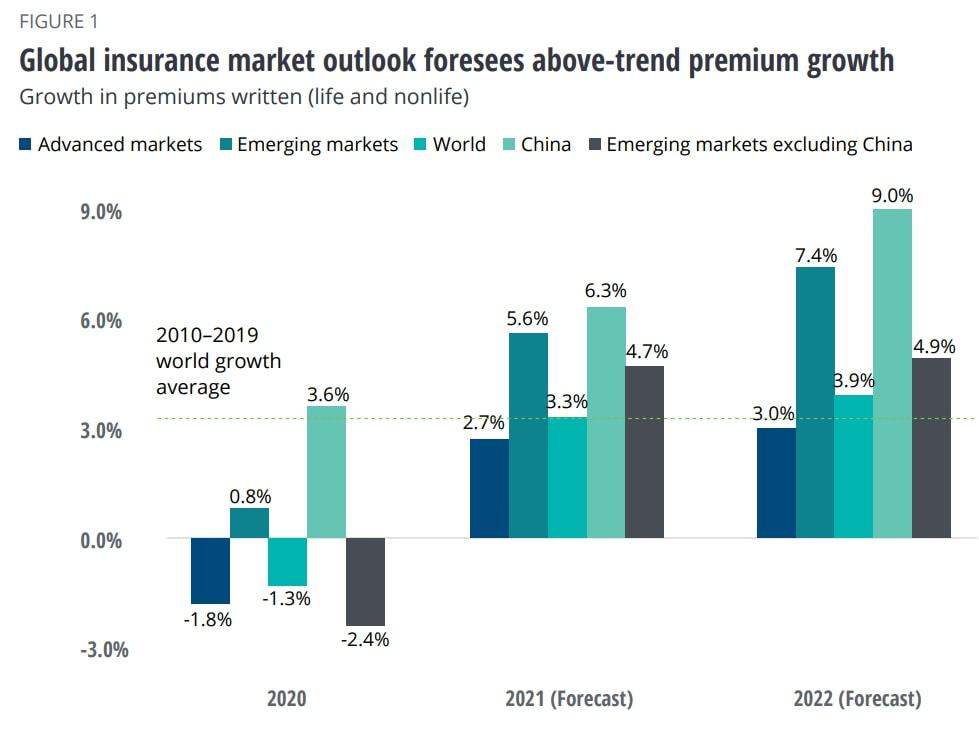

The insurance industry globally is estimated to be around $588 billion in size (International Association of Insurance Supervisors, 2021), with roughly 55% of this concentrated in the US. It has relatively low growth rates, with premiums rising by 2% CAGR over the past 20 years in developed nations (McKinsey), mainly due to stiff competition.

However, there are several opportunities that may lead to better growth rates in the future, which will benefit actuaries and underwriters. These include technological development, the emergence of new insurable risks, and automation. One of the richest men in the world, Warren Buffett, made the bulk of his fortune by investing the premiums earned from insurance businesses! There’s definitely scope for a prosperous career in insurance, but first, let me take a step back to discuss each role in detail.

Understanding the Role of an Underwriter in Risk Assessment

Investopedia defines an underwriter as a ‘professional who evaluates and analyses the risks involved in insuring people and asset. Insurance underwriters establish pricing for accepted insurable risks.’ They typically assess risk and establish the terms and conditions of insurance contracts. They are called ‘Underwriters’ because they receive an upfront payment in exchange for their willingness to pay a potential risk (i.e. underwrite the risk). They create a contract for an individual with a quoted premium they believe accurately compensates for the risk. Given the wide range of risks that need to be managed, underwriters can be found in many industries aside from Insurance, such as Consultancy and Finance.

One practical example is how Investment banks will underwrite the issuance of new shares during an Initial Public Offering (IPO – when a company first lists its stock on the stock market). This investment bank will decide the price (valuation) of the stock. If the investment bank settles on a valuation that is too high, there may not be enough demand for the shares and the investment bank will be forced to hold the shares and sell them into the market, potentially leading to a loss on the deal. In this scenario, the Investment Bank has ‘underwritten’ the issuance of shares.

Underwriters are also used in the housing market, where they ensure that a loan applicant meets all of their requirements, and they subsequently approve or deny a loan. This turned out to be a very important role preceding the Financial Crisis of 2008!

Clearly, there is a wide variety of insurance risks an underwriter can be involved in. Broadly, they fall under the headings of general, life, health, and reinsurance. This can include anything from car and climate insurance, to theft and protection against default on financial products. Such products are often complex derivatives, which require a team of very intelligent people in order to accurately price. This is one of the biggest challenges of the role.

In order to make sure that the insurance company is successful and able to pay claims, the underwriter’s duty is crucial. Much like my previous example with an IPO, the insurance provider may lose clients to rivals if the underwriter sets premiums too high. On the other hand, if the underwriter sets premiums too low, the insurance company may not be able to cover claims and will suffer a financial loss, sometimes a significant one.

One great example is AIG, which filed for bankruptcy during the 2008 financial crisis and needed to be bailed out by a consortium of institutions. Anyone who has watched ‘The Big Short’ will know all about this! AIG underwrote a large amount of debt through a financial derivative called a ‘Credit Default Swap (CDS)’. These essentially gave the debt lender an insurance policy, where if the borrower (often a high-risk company) went bankrupt, AIG would pay the lender back.

However, these CDSs didn’t require AIG to post collateral (cash) in order to back these claims, so when a large number of these companies defaulted during the Financial Crisis, AIG was left with too many liabilities and not enough cash to pay the claims. This highlights how important the role of an underwriter is in accurately drawing up contracts on insured risks.

With the role of an underwriter clearly defined, we now move on to the role of an actuary.

Defining the Actuary’s Role in Predictive Risk Analysis

Actuaries, much like underwriters, are involved in the business of insurance. The Institute and Faculty of Actuaries (IOFA) defines actuaries as ‘problem solvers and strategic thinkers, who use their mathematical skills to help measure the probability and risk of future events. They use these skills to predict the financial impact of these events on a business and their clients.’

The main role of an actuary is the accurate calculation and management of risk. This involves analysing lots of data from many different sources in order to decide on a probability of an event occurring. Once they have calculated these probabilities, they decide on the best strategy in order to mitigate risk for an insurance company i.e. minimise financial loss. They are involved in all aspects of business, including modelling reinsurance reserves, pricing commercial and individual policies, and managing financial assets and liabilities.

A major part of actuarial work is calculating adequate reserves, so an insurance company has enough cash to pay claims. One recent example would be managing a pension fund’s future liabilities following the collapse of bonds alongside stocks during the current stock market decline, and especially the recent UK Gilt collapse in 2022 following Ex-Prime Minister Liz Truss’ mini-budget release! They are also involved in many emerging fields, such as data science, cyber security, and climate change.

Similar to underwriters, you’ll often find actuaries working in insurance, corporate finance, banking, consultancies, investment management, and healthcare. Although the business is changing, number crunching has been a significant part of the role of an actuary in the past, so strong mathematical/statistical skills are necessary.

However, the ability to communicate with clients is a key skill that actuaries must possess because if someone can’t effectively convey results to clients, their work will have little meaning. It’s also important to understand business management in order to help businesses grow. This includes following demographic trends, legislative changes (e.g. IFRS 17 compliance), and fluctuations in the financial market. Therefore, some actuaries may decide to pursue more advanced qualifications following their degree in order to reach more senior levels. My manager during placement year was studying for an MBA while working!

It’s clear that both roles are extremely important to several industries, but what are the differences between the roles?

Underwriter vs Actuary: Key Distinctions

It should be clear by now that the roles of an underwriter and an actuary are fairly similar and relate to the same industries. The necessary skills are also similar. Since they deal with figures and models, actuaries and underwriters both require strong numerical and analytical abilities.

In order to express their work to others who mightn’t be familiar with the technical jargon, both must also be effective communicators. Because of some similarities in the skills needed as an underwriter, this can be a good experience for someone who aims to be an actuary. It will also help them understand the insurance market better. Although both manage risks and work in the insurance industry, there are significant differences between the two roles.

Underwriters evaluate risk and determine the terms and conditions of insurance policies. They need to be able to determine the appropriate level of coverage for each policy. Therefore, underwriters need strong knowledge of the intricacies of insurance/financial products.

On the other hand, actuaries analyse data and use statistical models to predict future events and calculate premiums. Actuaries require strong mathematical and statistical skills, as well as the ability to analyse data and make predictions based on that data. This means, from an educational standpoint, actuaries need to be more qualified in technical aspects of insurance and modelling, which means they need to complete more rigorous examinations and testing. This is evident in the many exams needed to become a qualified actuary, a long and hard road I am told!

While actuaries are required to hold a degree in actuarial science, mathematics, physics, or other quantitative disciplines, underwriters often hold a bachelor’s degree in business or a related field. This difference in degree, and the many exams actuaries are required to complete to become fully qualified, justifies the pay differences between the roles.

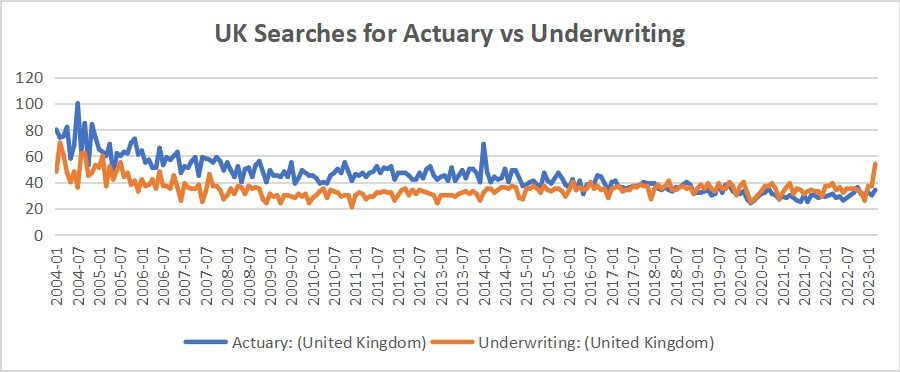

According to the IOFA, an actuary can expect to earn around £32,000 coming out of university, which can increase considerably as you complete exams and rise in seniority. Once qualified, many actuaries go on to specialise in a traditional field, such as insurance or finance, often earning well into six figures. However, underwriting assistants coming from university can expect to earn around £20,000, with a salary of around £45,000 expected for qualified and senior underwriters (Prospects.com). Surprisingly, even with the salary difference, recent Google Trends show that underwriting has been searched more over the last year in the UK.

Alongside this, the sorts of data that underwriters and actuaries use differ. The precise attributes of each policyholder, like health status or driving history are what underwriters concentrate on. Actuaries concentrate on overall statistics such as the frequency and severity of claims over a particular period in order to model probabilities and stress-test scenarios.

Bright Prospects: The Evolving Future of Underwriters and Actuaries

In previous generations, actuaries would compute math on huge paper sheets when calculating risks. Today, actuaries are moving from the ‘nuts and bolts’ work of maths to the analysis and interpretation of data to uncover its meaning for insurance companies. They then need to explain this to clients in a concise and understandable manner.

Technological developments, especially following the COVID-19 pandemic, are disrupting every aspect of our lives, the insurance industry included. The roles of both actuaries and underwriters are constantly changing, and the ability of students to adapt to these changes will be the key determinant of future career success.

Because underwriting is a more manual role, underwriters should expect to see more automation of tasks previously completed by humans. Automation is becoming a key growth area for many businesses today, especially in the midst of the higher inflation we’re currently experiencing, as companies seek new ways to reduce costs and maintain profit margins. One key method to achieve this is by increasing automation through AI and Machine learning in order to reduce longer term labour costs. This brings career risks to individuals who previously worked in number crunching and manual roles.

However, there is good news! I asked ChatGPT if it could replace the role of an underwriter, and here was its response:

AI can assist in certain aspects of underwriting, such as data analysis, risk assessment, and document review, among others. However, it cannot replace the role of an underwriter entirely. Underwriters need to consider a variety of factors that may not be easily quantifiable or measured by AI, such as an applicant’s character, reputation, and past behaviour. They also need to take into account changes in the market, trends, and other external factors that may affect the risk profile of a particular insurance policy or investment.

Emerging Markets: New Opportunities for Underwriters and Actuaries

As technology continues to take over various aspects of job roles, underwriters will need to adapt. As more data is collected and interpreted by machines, underwriters will be required to analyse and communicate these results with clients. However, the benefits of this will be astounding, as predictive machine learning technologies will be able to analyse risks and set premiums more accurately as a result. Moreover, by employing predictive analytics to foretell the future and spot trends, underwriters will be able to make better judgements. By doing so, underwriters will be able to create better risk management plans and increase their profitability.

The future for actuaries is likely to be marked by a rise in the use of big data and predictive analytics. This was confirmed by the President of the IOFA, Matt Saker, who spoke to us a few months ago! Actuaries will be able to create more precise and comprehensive risk models as the amount of data at their disposal keeps expanding. They will be able to create more effective risk management strategies as a result of being able to anticipate the possibility of future events better.

Technology will also allow actuaries to examine data more rapidly and accurately than ever before with the development of increasingly complex algorithms and machine learning techniques. This will bring value-add for clients but will also mean actuaries may move from a number-crunching role to a data scientist and software engineering role in some sense and to a consulting role in another.

The rise of big data and machine learning will also open up the insurance market to price new risks, benefitting actuarial and underwriting roles. The rise of alternate risks such as cyber and climate risk will become increasingly prominent for insurers and a source of future growth. This is evident with the recent Turkey-Syria earthquake. Also, demographics and differing growth rates globally will play a role in the future of both underwriting and actuarial work. The Western world has an aging population and lower growth rates, meaning health and life insurance will become more prominent going forward in these regions.

However, emerging markets like Vietnam and other parts of Asia are experiencing faster GDP growth and improvements in standard of living, so insurance will begin to play an increasingly important role in these nations, benefitting both underwriters and actuaries. This growth is shown below, supplied by research from Deloitte.

Navigating AI Risks: The Impact on Underwriting and Actuarial Work

The rising use of AI in underwriting and actuarial doesn’t come without its own set of unique challenges. The difference between AI and traditional computing is that the computers are ‘trained’ rather than programmed. The algorithms therefore continually learn and get better, much like a human. One problem with this is that the quality of AI outputs depends on the data inputs, as poor inputs can lead to biased models. As a result, underwriters and actuaries may make poorer decisions. To guarantee they are making accurate and ethical judgements, underwriters and actuaries must acquire the skills required to interact with and assess the capabilities of this new technology.

One good example is highlighted in The Actuary: What’s in the Box? Useful findings on black box models. It conveys the potential issues with the use of AI and machine learning in actuarial models, as the research found that simple machine learning techniques (such as Linear Regression or Classification) were just as difficult to interpret from an outsider’s perspective as complex methods (e.g. Gradient Boosting). This means the role of actuaries in communicating their results to auditors, insurance boards, and clients will become even more important in the future.

Concluding Insights on Underwriter vs Actuary in Risk Management

To conclude, both underwriters and actuaries are crucial to many industries, especially the insurance sector, but their roles and responsibilities differ. Actuaries create and update models in order to calculate accurate event probabilities, but underwriters decide the terms and conditions of insurance contracts. For students considering a career in either field, developing IT and coding skills will become ever more prominent as technology continues to advance. New and interesting niches are constantly emerging in this field, with climate and cyber risk being the most prominent, so these are areas students could research further!