An Actuarial Valuation: What Is It and What Its Used For

Delve into the precision of actuarial valuation, a critical tool in ensuring financial stability for pension schemes and insurance companies by accurately assessing assets and liabilities to inform strategic decisions and secure futures.

An actuarial valuation, simply put, is the process of calculating the present value of a future stream of liabilities and then comparing this to the current assets held so the fund can assess where they are currently at, and make decisions about how they should conduct their business in the future.

Most of the time when we are talking about an actuarial valuation, we are talking about it in terms of a pension scheme, although this is not by any means the limitations of the process.

The actuarial valuation has many important applications in business and industry, such as in financial planning and budgeting, and also many interesting implementations in Investment and Risk Management.

The key purpose of an actuarial valuation for a pension scheme is to inform plan sponsors of the amount that needs to be contributed each year to adequately fund benefits. It is also required by law that schemes undergo an actuarial valuation every so often.

So Exactly How Often Is an Actuarial Valuation Required?

In the UK, pension schemes must undergo an actuarial valuation every 3 years.

This is the law. Failure to submit valuations result in heavy administrative penalties.

Defined benefit pension schemes promise to provide a specific amount of money when someone retires, for the remainder of their life.

These valuations help ensure that the plan sponsors are meeting their funding obligations, and that members pensions are secure.

However, some companies will choose to complete their valuations more often, such as every year.

Why?

This will allow the company to assess the current position of their pension scheme more often. As a result, they are better informed if any changes to polices are required, and they also may notice some investment opportunities if they find they are holding too much in reserve.

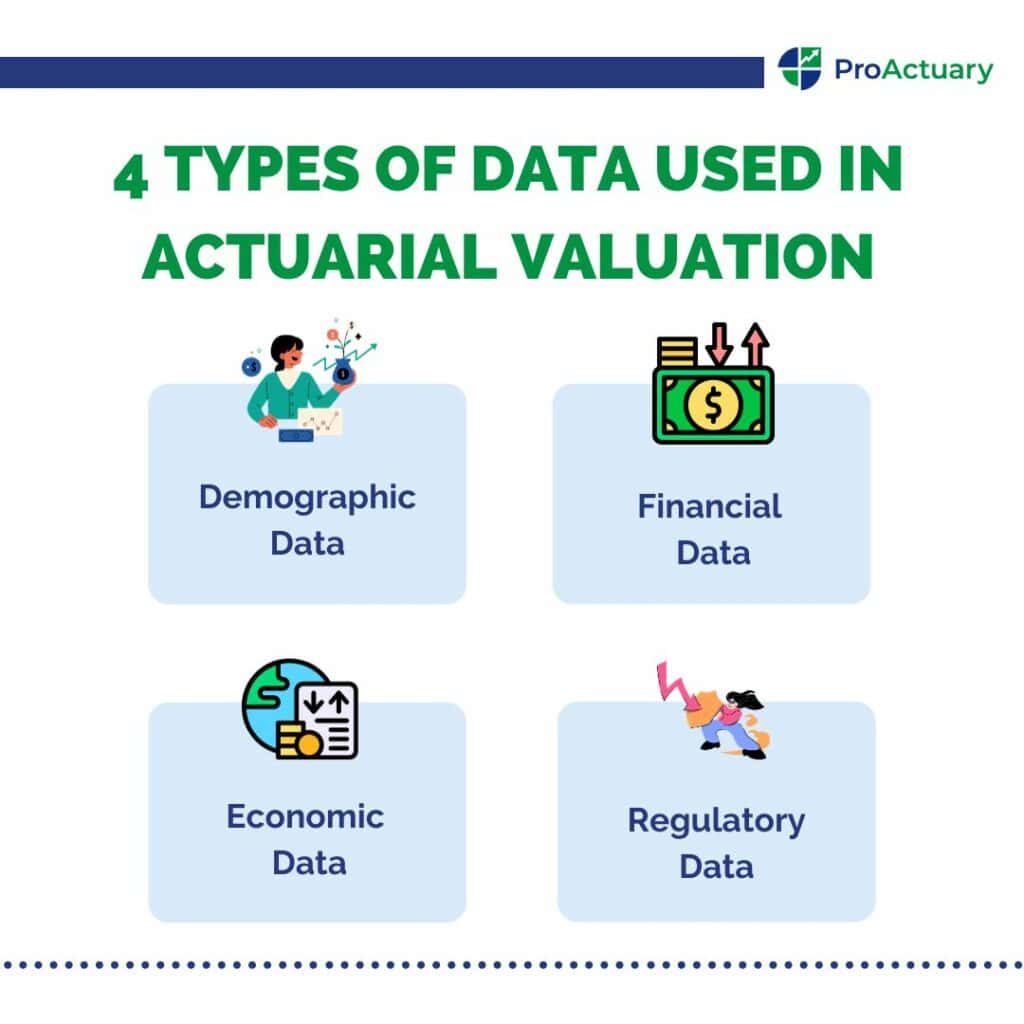

What Data Is Used in an Actuarial Valuation?

As with any valuation, there is a wide array of data needed in order to accurately assess the financial situation of a pension plan using the actuarial valuation. The important data to include is:

- Demographic data: including age, gender and length of service.

- Financial data: including assets, liabilities and investment performance.

- Economic data: including interest rates, inflation rates etc.

- Regulatory data: including any relevant legal or regulatory changes.

The data that goes into the actuarial valuation is not limited to that stated above.

Depending on what is being valued there are many other possible data that will need to be taken into consideration, and the actuary at hand will have to take their initiative and decide what is useful and what is not.

What Are the Assumptions Used in an Actuarial Valuation?

There are, of course, a lot of uncertainty in all types of valuations, whether it be the value of a house, a car, a business or even more arbitrary assets like a professional soccer player.

Actuarial valuations are no different, and also carry a certain level of uncertainty.

To try and minimise this uncertainty, the actuary at hand takes great care into the assumptions they have to make about future events.

Take a pension scheme as an example. The actuary must make assumptions about things like salary increases, future inflation rates, member mortality rates… the list goes on.

All these things can vary quite significantly. Take inflation rate for instance. Who would have guessed a few years ago that in 2023 we would be looking at an inflation rate in excess of 10%? Not me!

This will have a significant effect on the actuarial valuation which the actuary will have to account for in their updated valuation.

Identifying and Managing Risks in Actuarial Valuation

There are many risks which have the potential to greatly impact the actuarial valuation that the actuary may just not be able to take account of.

- Investment Risk: What is the current performance of the scheme’s investments? Many pension plans will hold a large portion of their investments in government bonds, which we know are generally stable investments. However, some schemes may hold other types of investments which carry their own risks.

- Data Quality: Is the data supplied to the actuary correct? Is it up to date? Even so, unexpected data changes can have significant material effects on the accuracy of a valuation.

- Liquidity Risk: Is the company at risk of liquidation? This can come when we least expect it. Take Debenhams for example. A superpower in the UK Department store market for over 200 years, but was forced to close its doors in 2021. Nothing is certain! However, even if the company supplying the contributions to a pension plan goes bust, you’ll be glad to hear that the employee’s pensions are protected. Don’t worry… they don’t just disappear.

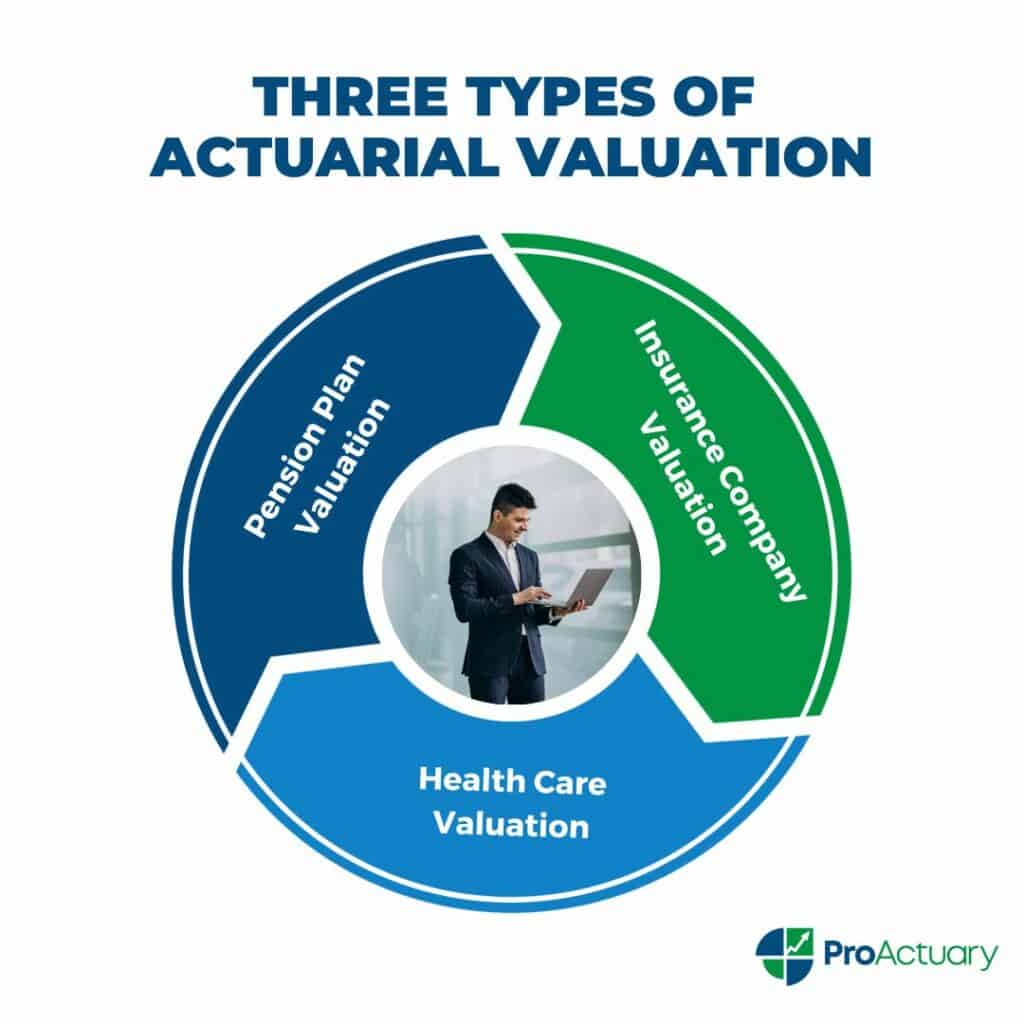

Discovering the Various Types of Actuarial Valuations

As we said earlier, when we are talking about an actuarial valuation often is the case we are referring to a pension scheme – but we have many different types. Let’s delve deeper into a few of the more common ones, and how they can be carried out.

Pension Plan Valuation

We’ll look at the pension plan actuarial valuation first.

The actuary performing the valuation will generally follow these steps:

- Project Benefit payments – Using the data that the actuary has collected based on members age, gender etc. they will project the payments that the scheme will have to make over time.

- Determining assets – Any investments, such as bonds, stocks and physical assets the company owns. This should be able to be taken from the company’s books.

- Perform calculations – Based on the assets and future payments needed to be made, the actuary will assess the pension plans current financial situation

- Final analysis – With all the data the actuary now has, they will be able to assess the pension schemes financial position and determine if they have sufficient reserves to cover their expected future outgo.

After the valuation, the scheme can take measures to alter their financial position.

This could involve for example a change in contributions or a new investment strategy.

Insurance Company Valuation

The actuarial valuation for an insurance company is performed in much the same way as for a pension scheme. Only this time the purpose of the valuation is to ensure that the company has sufficient funds to pay out claims and meet any obligations it’s made with policyholders.

The actuary performing the valuation will generally follow these 4 steps:

- Determining liabilities – This is the expected future claims that the company will have to pay out to its policyholders.

- Determining assets – Again, this will include any investments, such as bonds, stocks and physical assets the company owns.

- Calculation of future cash flows – The actuary will forecast future cash flows, taking into account interest rates and inflation.

- Final analysis – With all the data the actuary now has, they will be able to assess the insurance company’s financial position and determine if they have sufficient assets to cover its liabilities.

Similarly to the pension scheme, after the valuation the insurance company can then take measures to alter their financial position to where they want to be.

This could involve a change in premiums, reserves or a more/less aggressive investment strategy.

Health Care Valuation

The actuarial valuation process in health is quite similar to the two we have just discussed.

Of course, if we were to get into the nitty gritty of it and breakdown the data, assumptions and calculations made then all 3 will look vastly different, but the processes follow the same structure.

Who Performs These Valuations?

You might not be surprised to hear, but the actuaries that perform these valuations are called valuation actuaries… talk about hitting the nail on the head.

These actuaries’ primary role will be performing these valuations for pension plans and insurance companies.

Exploring Actuarial Valuation Report: Insights and Analysis

So now we know we know how to carry out an actuarial valuation.

But what next?

The actuary must take everything they have calculated, and all the analysis they have made and create a detailed report.

The report will inform the company on the current position of the scheme, providing an update since the last valuation.

The actuary will provide their analysis on these updates, allowing the scheme to infer what it should do regarding contribution rates.

In the report they should show some of their workings, and any assumptions they have had to make or update, and of course the conclusions they have made.

It’s important that the actuary provides information on what data they have used and where they got it.

This is not just important for report users, but also would be necessary as part of an audit process, and for when the report is checked for legal reasons.

If you want to find out more about what an actuarial valuation report looks like, and what exactly goes into it, here’s an example report for the Local Government Pension Scheme for Northern Ireland.

You can access it through the link below:

The Future of the Actuarial Valuation

In recent years, advancements in technology and data analytics have brought about some significant changes in the actuarial valuation, and it stands to reason that we can expect this trend to continue.

One of the larger more recent trends in actuarial valuation is the increasing use of big data analytics and machine learning algorithms.

Another promising trend is the use of automation and AI in the actuarial valuation. AI is already being incorporated into many other fields, and it won’t be long until actuaries are seeping the rewards. This will free up time for actuaries to focus on other tasks. Sounds great all round!

However, Like I said before. Nothing is certain. But one thing we can be quite confident of is the use of the actuarial valuation in the future.

For as long as people are seeking out pensions, and insurance companies are giving us peace of mind, then the actuarial valuation will have its part to play.

With all the stigma about AI taking over everyone’s jobs, valuation actuaries will be glad to hear this news, although, I may have said this before, nothing is certain…

Actuarial Valuation Summarized: Key Concepts and Takeaways

So what have we learned? An actuarial valuation is the process of calculating the present value of a future stream of liabilities. It allows a pension schemes or insurance companies to check if they have sufficient funds to meet the expected future outgo.

We know by law that the valuation must be performed at least once every 3 years.

We’ve looked at all the different data that goes into the valuation, and we took a look at some of the assumptions needed to be made.

We also assessed some of the risks that an actuary must be aware of when completing their analysis.

We went into some detail about how to perform an actuarial valuation for a pension scheme, an insurance company and also for health care.

Following that we took a deep dive into what goes into the actuarial valuation report and lastly, we looked at what the future beholds for the actuarial valuation.