The Pensions Actuary: All About The Role

Uncover the critical role of pension actuaries in securing retirees’ financial futures through strategic fund management, ensuring sustainable benefits in a changing economic landscape.

Pension actuaries are professionals who specialise in the design, management, and analysis of pension plans with a primary responsibility to ensure financial viability. This allows retirees to relax in the knowledge they’ll receive the retirement benefits initially promised. It provides a stimulating, varied, and fulfilling career path.

The Integral Role of a Pensions Actuary in Retirement Planning

Pension plans have two forms:

- Defined Benefit (DB)

- Defined Contribution

DB schemes are employer-sponsored retirement plans. The employer (sponsor) bears the risk, responsible for ensuring the plan has sufficient assets to meet its obligations (known as “Technical Provisions” (TP)). To ensure sufficient assets the employer must make regular contributions.

DB schemes are managed through the appointment of trustees. A mixture of retirees, current employees, and professionals is responsible for ensuring members’ benefits are secure by agreeing to an appropriate contribution level to meet the estimated TP.

Estimated

The key word here. The future brings with it uncertainty. Consider a thirty-year-old employee with thirty-five years ahead of them before retirement. We cannot know how their salary will grow, how interest rates will change, or when they may die. So how do we calculate TP? Appoint a ‘Scheme Actuary’. A pension specialist responsible for assessing the overall valuation of the fund, using actuarial assumptions.

The issue, trustees and employers must agree on these assumptions. With a strong conflict of interest, this can be a challenge. Trustees prefer prudent assumptions, ensuring stability.

Sponsors want smaller contributions. The scheme actuary must balance this power by initiating an early dialogue, showing the willingness to work with each side. Firstly, proposing a base set of actuarial assumptions to start the discussion.

The assumptions are based on five main categories:

- Current Financial Conditions – Inflation rates, interest rates, etc…

- Investment Strategy – Decisions on asset allocation across various classes (e.g. equities, bonds, property, etc). With low-risk strategies requiring higher employer cash contribution but entailing less risk of deficits.

- The Employer Covenant – The sponsor’s financial ability to support the DB scheme now and in the future.

- Population Demographics and Scheme Experience – Demographic assumptions focus on current mortality and future improvements in life expectancy. Since 2000 global life expectancy has increased by 5 years. Therefore, this is an important area of discussion. Relying on key information such as the postcode of members and the size of members’ pensions (the larger the pension, the longer the life expectancy).

- Requirement for Prudence – Pension scheme legislation requires that schemes are valued on a prudent basis.

The initial proposal is critical. If initial valuation results are calculated on overly prudent assumptions, they become an “anchor point” for trustees’ expectations. Affecting future decision-making and causing reluctance to accept any material changes. Pension actuaries must first assess the affordability of any assumptions to the employer to anchor a realistic position. The scheme actuary’s role is to develop a positive working relationship with the trustees and sponsors through effective communication skills. This facilitates positive negotiation of key assumptions to arrive at a mutually satisfactory contribution rate. The use of varied techniques like showing the valuation on a best estimate basis can be useful to set realistic expectations.

Once agreed the scheme actuary will calculate the TP, hence determining the necessary contribution rate. This official valuation occurs at least every three years.

What happens between these three years?

In recent times trustees have adopted integrated risk management. Commissioning their advisors to regularly monitor key risks and set trigger points with pre-agreed actions if crossed. These are continuously monitored by actuarial risk software and increase pension security through a greater understanding of the risks involved. Actions may include activating a de-risking investment strategy following strong performance or increasing the contribution rate after a drop in the sponsor’s credit rating.

Recently pension actuaries have developed techniques to hedge against major risks by taking positions in financial derivatives. Opening up a new future for pension actuaries in the financial markets.

Although the official statuary role is reduced for DC pensions, actuaries still provide a key service. While employees bear the risk of ensuring they have sufficient assets to meet their requirements at retirement age; pension actuaries help them understand, monitor, and manage the risks in their DC pension. Using their expertise, they can illustrate the impact of different contribution levels, investment choices, and management of the pay-out phase to help set up pension plans. The implementation of innovative actuarial software allows this to be done instantaneously.

Beyond Mathematics: The Diverse Skill Set of a Pensions Actuary

Actuarial work provides a great balance between statistical work, report writing, and consulting. Communication is key. To quote Kristen Flynn a Pricing Actuary in Australia,

“There is a big misperception that actuaries are simply number crunchers. But the truth is, if you can’t use words to explain why the numbers matter, they won’t matter.”

Pensions bring members face to face with some of the most important decisions they’ll ever have to make and one they can’t afford to get wrong. The ability to effectively communicate complex concepts to your target audience sets apart senior consultants from new graduates. An experienced actuary can effortlessly translate complex financial analysis and modeling to jargon-free language their client can understand and act on.

It isn’t just communication and strong technical skills. To excel, pension actuaries need an array of softer skills. From leadership and adaptability to emotional awareness. Scheme actuaries are supported by a multi-disciplinary team and knowing how to get the best out of your team is key. This comes from great leadership and working to each individual’s strengths to achieve exceptional results.

Steps to Becoming a Pension Actuary

Step 1: Is this the right job for me?

Qualifying as a specialised pension actuary is a long, challenging but rewarding path. With under 9,000 qualified actuaries (FIA) worldwide it is a small highly qualified and trusted profession. Taking an average of six to eight years to qualify it is not a decision that should be taken lightly.

First off, is being an actuary right for you? Do you have strong numerical and statistical skills? Able to identify and solve problems with high levels of determination and willpower? Then this career might just be for you!

The UK professional body of actuaries is the Institute and Faculty of Actuaries (IFOA). They are responsible for accrediting the title, “Fellow of the Institute and Faculty of Actuaries” (FIA). The pathway to becoming an actuary varies greatly. Most begin by doing a maths-based degree followed by a journey through their actuarial exams in a graduate role. But this isn’t the case for all. If you are without a maths-based degree you must first sit the IFOA’s non-member entry exam.

An alternative is choosing a university degree such as actuarial science or financial mathematics and achieving exam exemptions through accredited courses. Exemptions offer recognition of prior learning for students who have completed a qualification equivalent to the exams. Undergraduate degrees can offer up to six exemptions. Achieving exemptions is difficult but can take years off your qualifying time.

Step 2: Secure a graduate role as a trainee actuarial analyst.

Several important decisions should be made at this stage. The size of your employer can play an instrumental role in your career. The UK Pension consultancy world has three major players, Willis Tower Watson, Mercer, and Aon Hewitt. Each provides excellent opportunities and attracts many ambitious candidates. They provide opportunities to:

- Learn from a variety of colleagues – Being part of a diverse team of specialists opens doors to learning from highly experienced colleagues. Offering rotation programmes between groups to develop strong technical skills. While working alongside a cohort of students studying for actuarial exams will aid your education.

- Work with big clients – Providing invaluable experience through working on multi-billion-pound pension schemes. Creating a strong CV.

- Travel – With client teams spread across the globe, this opens up an opportunity for international travel with a multitude of other opportunities.

- Progress – Typically offering a strong rate of pay with a generous study package. Clear career progression charts unlock greater opportunities to earn and learn.

Like anything in life, it’s a give and take. Larger firms typically demand higher workloads impacting work-life balance. You should consider your options with no one size fits all approach in terms of career development. Mid-size and smaller firms do come with their advantages:

- Improved work-life balance – Focusing less on billable hours and considering a broader range of performance metrics.

- A more personal working experience – Smaller workforces make getting to know teams easier. Creating a familiar working environment eases the transition to the working world.

- Faster route to seniority – Small teams give rise to greater opportunities to stand out by taking on more responsibility. Greater access to senior stakeholders allows for opportunities to build relationships, often leading to faster progress.

Consider your career aspirations and priorities to find your right match.

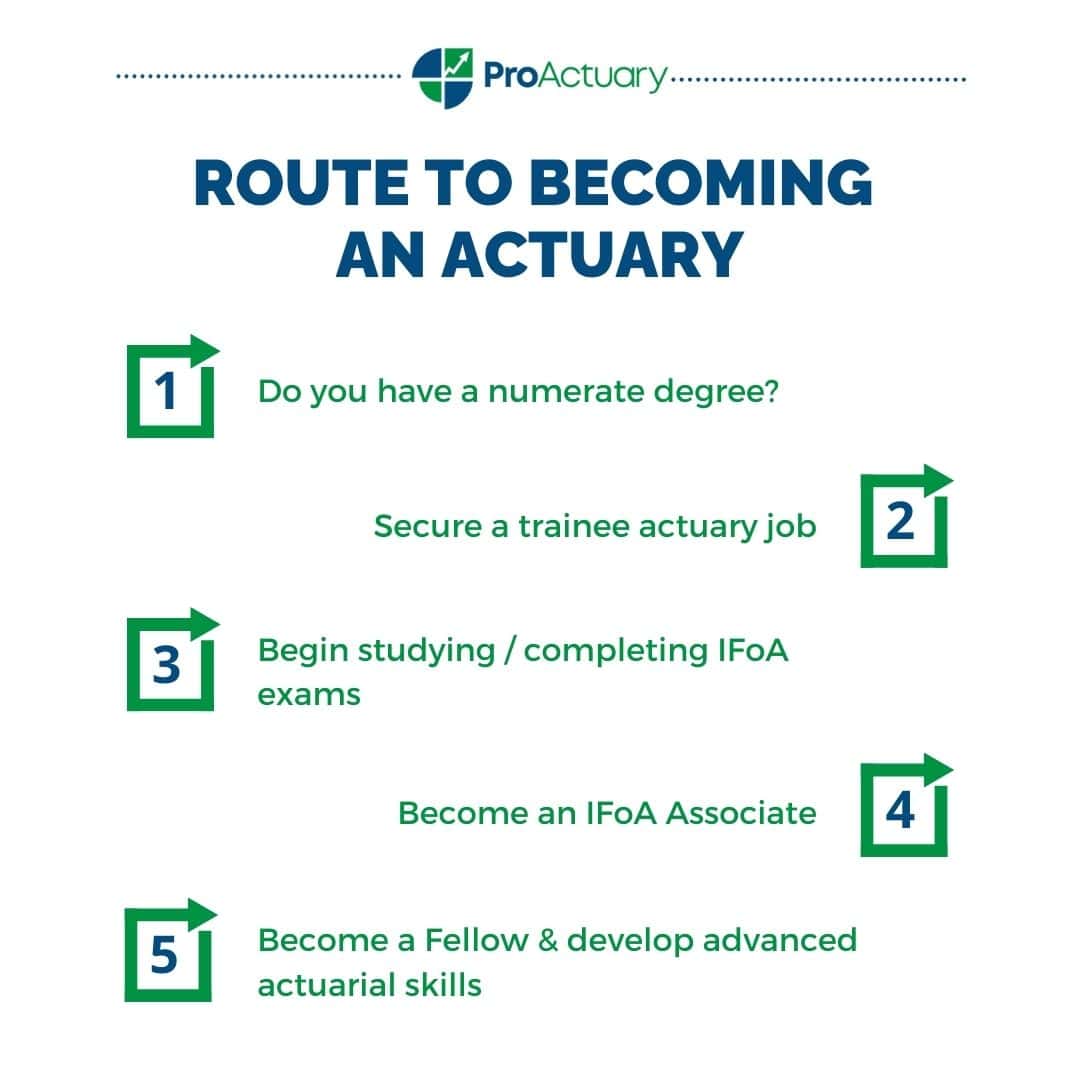

Step 3: The Dreaded Exams

After securing a graduate role now begins the task of passing the exams. The actuarial qualification has two levels, associates and fellows. Associate actuaries have passed their core exams. This requires the competition of ten exams combined with two years of personal and professional development (PPD). All actuaries independent of their future specialty sit the same ten exams.

Once an associate, the path to specialisation begins. This involves the selection of two subject principle (SP) exams followed by a final specialist advanced subject (SA). With one further year off PPD, you receive your qualification as an FIA.

Specialising as a pension actuary involves selecting SP4 ‘Pensions and other benefits’ and one other SP exam, typically SP5 ‘Investment and Finance’. Followed by SA4 ‘Pensions and other benefits’ as your final exam.

For further information, I recommend reading the IFOA outline on the Route to Becoming an Actuary.

Step 4: Not Done Just Yet

After qualifying as an FIA surely I’m done, no? Not quite yet. Scheme actuaries require the practising certificate (PC) ‘Scheme Actuary to a pension scheme’. Allowing them to provide actuarial services directly to the public. This ensures they meet professional standards including ethics, professionalism, and technical competence. Demonstrating the ability to carry out work with significant public interest.

There are four criteria required to achieve this certificate:

- Being a current fellow of the IFoA.

- Completing the UK Pensions Practice Module within two years of your application.

- Demonstrating a strong level of competency as set out in the competency framework by the IFOA. Including areas such as communication, leadership, accountability, and professionalism.

- Completing the Continuous Personal Development (CPD) requirements. Entailing thirty hours off CPD each year.

Congratulations, you can now practice as a scheme actuary, but don’t worry this isn’t where the learning ends. Actuaries believe in continuous learning and education with endless opportunities to develop. Multitudes of courses and certificates are available such as a certificate in data science or a course on climate and sustainability. With ever-changing legislation and financial landscapes, the importance of staying up to date cannot be overstated.

Career Opportunities for Pensions Actuaries: Pathways and Prospects

The industry is constantly changing. With high levels of uncertainty surrounding current volatile markets, a growing recessionary economy, and new legislation. Trustees and sponsors alike are relying now more than ever on actuaries for guidance through difficult decisions. Creating a high demand for skilled actuaries.

Actuarial technology continues to evolve through the applications of machine learning and artificial intelligence (AI). This has created the opportunity to use advanced systems to integrate actuarial models with automated data for better risk management. Leading to exciting prospects for new graduates. With a unique opportunity to combine actuaries’ subject matter expertise with modern data science tools and techniques.

The movement from Excel to coding languages such as R or Python has created space for a new generation of actuaries to utilise this data revolution and create new and improved solutions to traditional problems. This includes AI automation of data gathering, the use of machine learning to identify previously unseen trends and relationships, or optimising the predictive power of valuation models. Overall, this has created an extremely exciting environment for the best and brightest among us.

The industry also faces several challenges. Most notably the decline of DB pension schemes. In the UK in 2012 there were 7,297 schemes. This has fallen dramatically over the last ten years to just 5,522 in 2021, a decline of 24%, creating long-term uncertainty over the future of scheme actuaries. However, with their expertise in investments and risk management, there is a great opportunity to move from traditional roles into new areas such as banking and enterprise risk management (ERM).

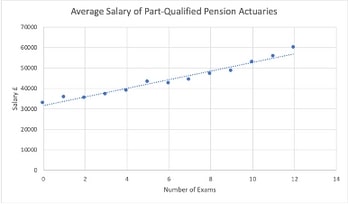

Pensions Actuary Salary Insights: Understanding Earning Potential

Pension actuaries are well-paid. It’s no secret. This reflects their high level of skill and responsibility and puts them among some of the most well-paid professionals in the financial industry. Let’s take a deeper look:

Actuarial Salaries depend on three main factors:

- Level of Experience

- Number of Exams

- Contracted Office Location

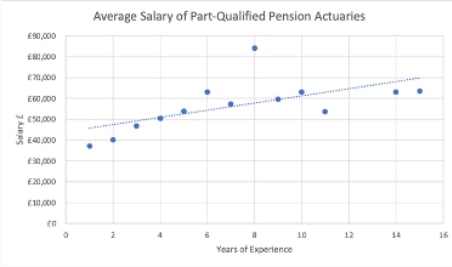

First, let’s look at part-qualified pension actuaries. Exam progress is the limiting factor. A part-qualified actuary who has either 25 years of experience or who has completed twelve exams averages the same salary of £60,000. Salaries increase steeply throughout exam progression. Doubling from zero to twelve exams. The effect of years of experience can be seen on the graph. With average salaries levelling off at £60,000 after 10 years without full completion of exams. Contracted office location has a strong correlation to salary. Causing a variation of up to 44%. Belfast has the lowest average salary of £37,013, England and Scotland (excluding London) average £45,185. With London salaries averaging the highest at £53,282.

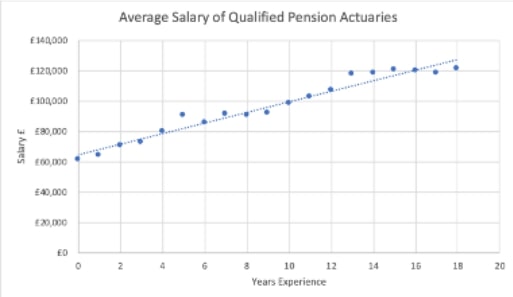

With exams out of the way, years of experience become the largest salary driving force. Doubling from £61,312 to £120,506 in the first 15 years. An annual increase of nearly £4,000. While also depending on a wide range of other factors including:

- People management

- Scheme Actuary

- Responsibility for generating new business

Each of these factors can cause the average salary to increase by around 16%.

92% of pension actuaries receive an additional performance-related bonus of which 64% is greater than 10% of their salary.

Pursuing a Rewarding Career as a Pensions Actuary

Pension actuaries are the unsung heroes of retirement planning. They continue to provide financial stability and security to millions. Their role is crucial in the financial industry. Being responsible for a fund’s financial viability is not an easy task. They must balance the power of trustees and sponsors. With both strong technical and soft skills, pension actuaries are up for the task.

Opportunities for the future are continuously evolving. Using innovative actuarial software and the development of risk-management strategies have opened up new opportunities for pension actuaries in the financial markets. Creating exciting prospects for this small profession.

Being a pension actuary is challenging but rewarding, requiring dedication and a long-term commitment. But where would we be without them?

Do you have what it takes?