Actuarial Science 101: An In-Depth Exploration

Do you have an analytical mind that enjoys making sense of messy data sets?

Are you a problem solver, thriving on creating solutions using modelling techniques?

Are you a good communicator, who can concisely explain a wide breadth of concepts while considering a stakeholder’s needs?

If your answer to all three of the questions above is “yes”, then actuarial science is the right field for you.

Understanding Actuarial Science: Basics and Applications

Actuarial science involves applying mathematical methods to evaluate and manage risks. It is an interdisciplinary field that draws on concepts from economics, probability, statistics, and finance to make predictions.

Covering all things actuarial science, I consider:

- How actuaries manage risks in different industries.

- What motivates aspiring actuaries who are pursuing this career.

- Skills one should develop as an actuary.

- Educational pathways to becoming an actuary.

- Actuarial career opportunities, now and in the future.

By the end of this article, you should have a holistic view of actuarial science. If you are considering a career as an actuary, this article should give you an idea of what that would entail.

Actuarial Science in Risk Management: The Core of Actuarial Expertise

Going as far back as to Ancient Grecian times, society required protection against risks arriving from uncertainties. They needed pensions and insurance.

In the past, merchants who embarked on a voyage were financed by wealthy persons. These financiers would not seek repayment if the shipments were lost during the journey. However, if the voyage was successful, a repayment at a high rate of interest was due. This is analogous to general insurance today. The advice provided by actuaries to insurers ensures that insurance remains affordable, while allowing the insurer to make sustainable profits.

While the pensions system has existed since medieval times, actuaries have made significant contributions towards improving the system. For example, John Finlaison, a British government actuary in the 1830s, developed a more cost-efficient way to provide pensions that saved the government a significant amount of money, while also pioneering the use of techniques such as graduation which are used to this day.

Present day actuaries manage risks in a variety of industries. Apart from insurance and pensions, actuaries also play a part in managing risks in:

- Investment – By ensuring that the risk profiles of investors are matched appropriately to a portfolio. For instance, mature pension schemes would have a different risk profile than pension schemes with members who are still in active employment.

- Business strategy – Actuaries can evaluate potential risks that a business may be susceptible to. By using financial modelling techniques, a variety of potential scenarios can be tested. This allows mitigation measures to be put in place for risks such as fire, theft, or bad debt, while also exploiting growth opportunities that have been identified.

- Banking – Focusing on macroeconomic risk and regulatory compliance, actuaries conduct stress testing to establish the potential losses for a combination of damaging events with defined statistical probabilities.

- Emergent industries – This includes cybersecurity, climate risk and Insurtech (innovations in technology that add value to insurance). The financial modelling and risk management skills possessed by actuaries are invaluable in these industries. Using data science techniques and improving on communication skills are imperative in enabling actuaries to break into these industries.

The Pull Factor: What Attracts Professionals to Actuarial Science

As the age of sixteen, I had my first taste of statistics. I was enamoured. Creating a meaningful story out of data that had real world implications was exciting. Mathematical methods made this possible. Much like many others in the field, I landed on actuarial science as a career out of a love for maths.

Here are five other reasons to pursue actuarial science as a career.

Intellectually Stimulating

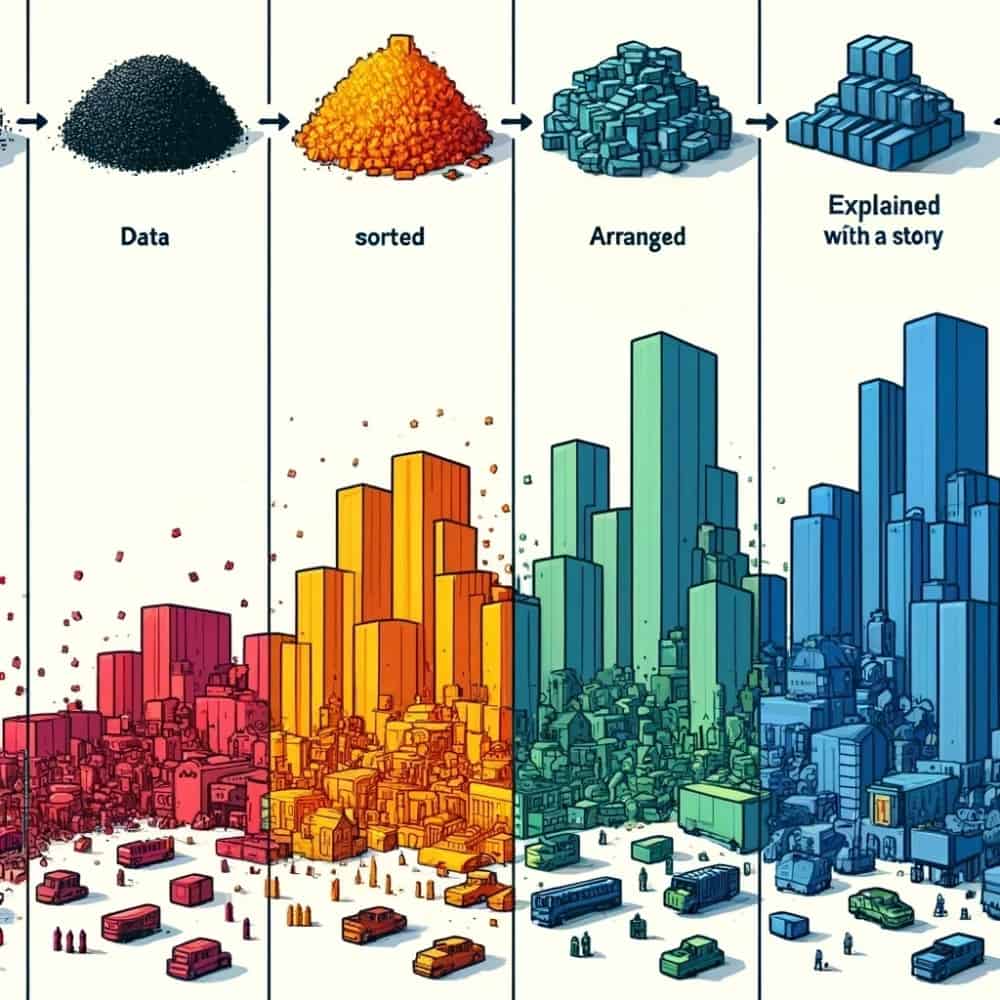

Most actuarial work begins with data. Often, this data will need to be reformatted, tidied, and analysed for it to be useful. This is a significant challenge. However, overcoming this to obtain ‘clean data’ enables actuaries to build models which are fit-for-purpose.

Presented with a specific problem, actuaries formulate a plan that investigates the problem using the data provided. With good communication skills, the results of the investigation can be communicated to stakeholders. This informs decision-making. The process of taking a seemingly messy dataset, sorting and arranging, communicating findings, and deciding next steps is what makes the role of an actuary intellectually stimulating.

High Earning Potential

Graduate actuaries can expect to earn, on average, between £25,000 and £40,000 annually, depending on location and industry. Qualified actuaries with about 5 years of experience take home an average of £90,000 yearly. Salaries also rise steadily depending on exam qualification status and years of work experience. Money may not buy happiness, but it is certainly a ‘pull factor’ that attracts math enthusiasts to this field (and makes us a little happier!)

Giving Back to Society

Helping people retire securely. Safeguarding their health and personal assets. Ensuring loved ones are cared for after a death. These are noble endeavours that actuaries have historically been involved in. As climate change, equity and inclusion, and technology continues to shape the world we live in, actuaries have the unique opportunity to act as positive influences. By quantifying climate risks and using technology to provide insurance to those who are most in need of protection against emergent risks, actuaries can honour public interest in their everyday jobs.

Opportunities for Career Progression

The first 3 – 6 years of a trainee actuary’s life will be dominated by actuarial exams.

You’re probably thinking, I’ve spent 3 – 4 years taking exams at university, just to take more exams?!

This isn’t the most exciting aspect at first glance. However, having a structured path for career progression with clear milestones drives success. With each exam passed, actuaries can unlock pay increases, a higher level of responsibility and more bargaining power. Passing exams for career advancement is meritocratic and goal driven.

While exam progress is a significant determinant in an early actuarial career, it is not the be-all and end-all. Some actuaries take breaks from exams for important life events or stop taking exams all together. This does not get in the way of a rewarding actuarial career, especially if engagement with lifelong learning takes other forms. This may be through learning a new programming language or participating in process improvement in the workplace.

Work-Life Balance

The typical actuarial work week is about 40 hours. This may vary slightly during busy periods with overlapping deadlines, where you may be expected to work a little more. Long workdays are the exception and not the norm. Managers are also receptive to feedback on workload and will often reallocate work if a team member has too much on their plate.

With the rise of remote working, most actuaries would not typically spend more than 3 days in the office. Hurrah for less commuting!

There are opportunities for part-time and contract work too. As there is a large market for project work with a fixed timeline, experienced actuaries have the flexibility to fit their personal lives around work. Actuaries are thus empowered to excel in their careers while leading fulfilling lives outside work.

Essential Skills and Qualifications for Actuarial Science

An actuary’s most valuable asset is their ‘toolbox’ – this is the unique skillset each actuary possesses.

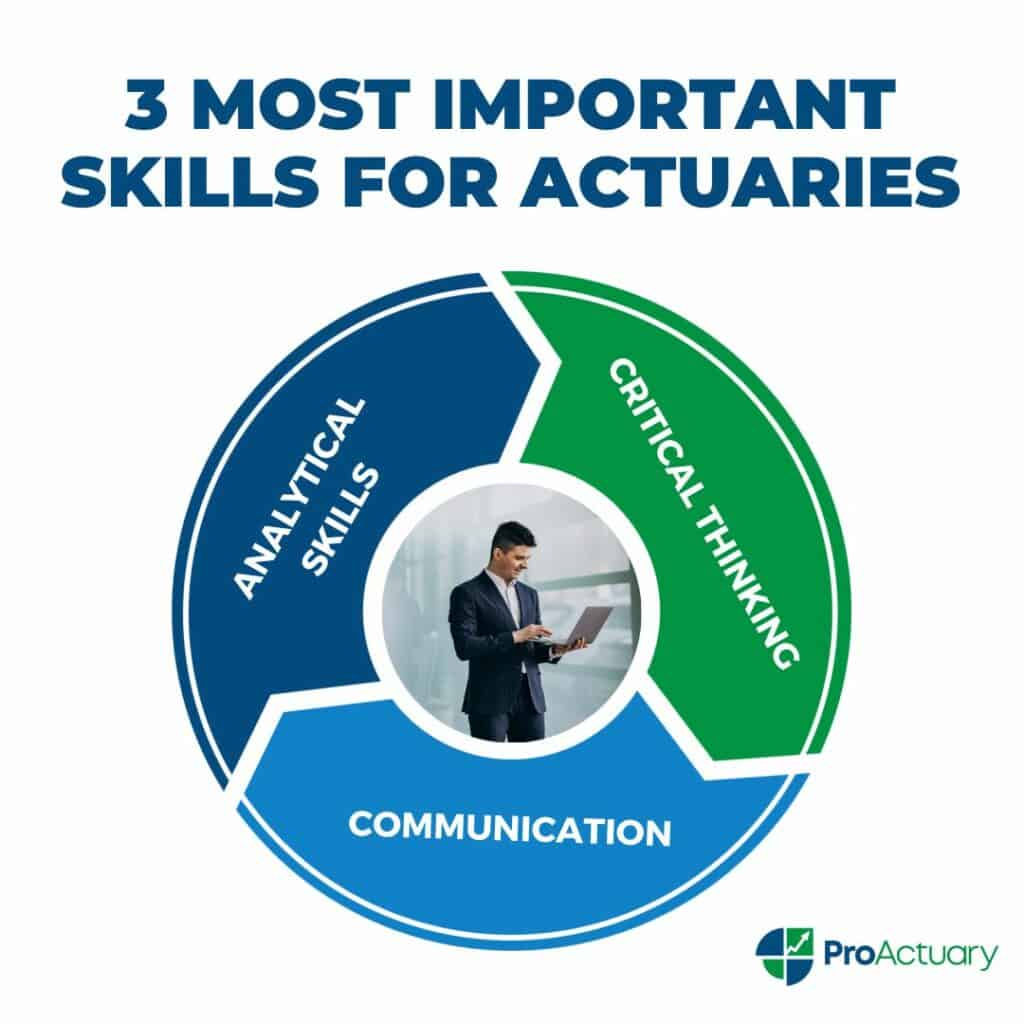

An Institute and Faculty of Actuaries (IFoA) working party asked life insurers what the most important skills for actuaries are. Analytical skills topped their list, followed by critical thinking and communication.

Analytical Skills

Numerical analysis is at the heart of actuarial work. Using software such as Microsoft Excel and VBA, actuaries perform calculations. To answer a fundamental question, such as “How much money does this insurance company need to pay out claims to their customers?”, actuaries consider a range of economic factors, demographic assumptions and regulatory requirements to come to a conclusion.

Programming languages make data analysis better. Excel and VBA are most widely used in the actuarial profession. VBA code automates calculations and manual tasks, saving time and improving accuracy. Many actuarial firms also have their own in-house software.

While all the formula and code can seem daunting, trainee actuaries get plenty of time to ease into this. Working on spreadsheets that have been developed by experienced colleagues, trainees build their understanding of the software. Practice is essential. So is asking questions.

With actuaries thinking about how to incorporate data science in their work, there has been a push to diversify our programming knowledge into languages such as R and Python. Whatever the language, the key takeaways are to:

- Understand how it works. Analysis is only meaningful if it can be contextualised.

- Make it fit-for-purpose. Fancy tools aren’t useful if you can’t explain it to your colleagues.

- Embrace the unknown. Learning new programming language is a new skill in your toolbox, so invest in it.

Critical Thinking

New regulations, clients’ demands and ever-changing funding positions create actuaries who are critical thinkers. When faced with these problems, actuaries build models. Modelling involves breaking down complex problems into bite-sized pieces. Forming a solution then becomes more manageable, as models assess the impact of real-world actions.

“All models are wrong, but some are useful”

– George Box

As an actuarial science student, this quote has come up countless times throughout my university life. Critical thinking skills enables actuaries to appreciate the limitations of models. Hence, we conduct sensitivity tests on model inputs. When communicating results, we discuss the outcome of sensitivity tests to provide a well-rounded analysis of the problem, without solely depending on one model.

It is imperative that actuaries can identify potential shortcomings in their own models. While modelling abilities are a cornerstone of a critical thinking actuary, it is equally important to realise that models are fallible.

Communication

Both written and verbal communication ranked highly as key skills. The stereotypical actuary is a number-crunching introvert. Even if there is some truth to this, it is not an excuse to be a bad communicator. Communication is important at every stage of an actuarial career.

- Early stage – As an actuarial trainee, you start to hone your communication skills. Mistakes will happen. Ask for feedback from senior colleagues and peers. Without this line of communication, learning how to write and speak to clients becomes difficult. Writing emails and participating in discussions with colleagues also provides good practice for external communication and improves integration into the team.

- Intermediate stage – As an actuary with a few years of experience, you are tasked with writing to clients and presenting in external meetings. Thankfully, you built your confidence as a newbie and you’re now a confident cool cucumber! Training new hires is now a routine task.

You also begin to appreciate the importance of listening to others as a form of communication. You fully digest any new regulatory guidance. You begin to fully appreciate your colleagues’ opinions during knowledge sharing sessions, and even contribute your own opinions when you are informed enough.

- Senior stage – You’re now a fully qualified actuary. You manage a team. These management responsibilities include conducting performance review meetings with your direct reports. Providing constructive feedback and maintaining team morale is a key part of your work.

You pitch to clients for new business. The company trusts you. You lead knowledge sharing sessions, presenting opinions to your colleagues and fielding questions.

Climbing up the corporate ladder, you have become a part of senior management which means that you have a say in the company’s business strategy. Navigating all these responsibilities is a juggling act. Having polished your communication skills from the start of your career, you know that you’re up to the task.

Educational Pathways in Actuarial Science

There are different routes to a successful actuarial career. Whether you had a calling for actuarial science at a young age, or if a career switch has led you here, a path to success lies ahead.

This diagram from the IFoA, a professional governing body in the UK, shows each step of the route to qualification. A bachelor’s degree in actuarial science can provide up to six or seven exemptions from some of the exams on the first two ‘steps’ below. A master’s degree in the subject could provide similar exemptions and may include a thesis or dissertation which would grant an exemption in one of the upper two ‘steps’.

An A-Level in Maths and a degree in a numerical subject such as mathematics, statistics, finance, economics or even engineering and physics will place you in good stead for the actuarial exams. No matter your educational background, securing a graduate or trainee actuarial role gets you started on your journey to becoming an actuary.

Qualified actuaries enjoy a range of benefits, including the opportunity to forge a career abroad. Several international actuarial associations have mutual recognition agreements with the IFoA. Through this, IFoA qualifications are recognised by actuarial associations abroad, and vice versa. The global mobility provided by the profession increases the appeal of qualifying.

The Future of Actuarial Science: Trends and Developments

Actuaries are problem solvers in several industries. Technological advancement is a double-edged sword, but the actuary who adapts is well-placed for the future. Rather than being replaced, actuaries can use technology to streamline tasks.

Pensions

A pensions actuary advises either the employer sponsoring the pension scheme, or the trustees who represent the employees of a pension scheme. They are responsible for triennial valuations, which determines if more funding is required so that the pension scheme can meet its’ obligations. Pension actuaries also provide advice on investment strategies which best match the scheme’s risk profile and required returns. Other day-to-day responsibilities include assessing the impact of:

- Options exercised by scheme members.

- Changes in the structure of the scheme.

- Business mergers and sales.

Pension actuaries also work in government. Their role is to help regulators understand the impact of decisions on the provision of retirement benefits. Through this role, they can influence policy making.

Insurance

Insurance actuaries work in either life or general insurance. Actuaries in life insurance evaluate the risk of a pay-out upon death or survival within a predetermined time period. General insurance actuaries are concerned about personal and commercial risks. Personal insurance includes home insurance, motor insurance and phone insurance which are sold at a high volume to individual customers. Commercial insurance involves insuring large business entities from public liability and professional indemnity, for example. Reinsurance is another aspect, where insurers transfer some of the risk assumed to a reinsurer. In exchange, the reinsurer receives a premium.

Insurance actuaries work within the following areas:

- Reserving – Determining how much money is required to pay off expected claims from policies that have been sold.

- Pricing – Calculating an estimated premium for policies. Using historical data and observing trends in the timing of claims, actuaries can establish a fair price for insurance.

- Capital modelling – Future capital requirements are assessed by projecting forward assets and liabilities using financial models.

Banking

Actuaries can translate their traditional expertise in insurance into banking roles. With some knowledge of banking jargon and an insight into how banks operate, the financial modelling and risk management skills possessed by actuaries are value creators. Actuarial training also equips us to communicate across silos that are naturally present in a bank. This is a potential leadership opportunity for actuaries outside the traditional fields of pensions and insurance.

Health and Care

Applying actuarial techniques creates health and care solutions. The Covid-19 pandemic has magnified issues in the health and social care system, while also affecting mortality projections. By delving into the data on the pandemic, detecting trends and modelling the effects of various decisions, actuaries can identify best practices in real-time and for the future. Population health management is another area where significant contributions are possible. Assessing the outcomes of different health interventions and their impact on the population enables actuaries to optimise healthcare strategies, balancing fiscal requirements with social good.

Sustainability

Climate change has impacted many areas of actuarial work. Claims experience in general insurance has changed as a result of climate disasters such as increased flooding and droughts. In pensions and life insurance, mortality trends have changed, and climate costs are now priced into investment returns. Environmental, social and governance (ESG) based investing and green finance are increasingly in the spotlight. Actuaries can further promote these practices by evaluating their impact on mitigating climate risk. By advocating for comprehensive disclosures on climate risk by our clients, and incorporating this information in the actuarial advice provided, actuaries can support the transition to a net zero society.

The Way Forward

Data science is changing the actuarial landscape. While predictive analytics – the practice of using historical data to inform future behaviour – has always been used in actuarial work, this can be extended further to data science.

The wider concepts of artificial intelligence, machine learning and deep learning complement data science, and together, these fields can improve the work of actuaries.

One of the benefits of data science in insurance is the use of telematics – devices that monitor driving habits – in insured vehicles. Telematics data has made pricing insurance more accurate, as it incentivises good driving practices with lower premiums. Insurtechs have also benefitted from telematics use.

- FitSense – A data analytics provider that shares data from wearable technology with life and health insurers.

- Cuvva – Offers flexible, short-term insurance that can be used on borrowed vehicles for as little as an hour.

- Metromile – Provides “pay-per-mile” insurance on vehicles.

Traditional insurers are embracing these new technologies, as evidenced by Zurich Insurance’s acquisition of FitSense. While there are privacy and other ethical concerns from the use of telematics, good communication practices enable customers to make informed decisions.

Conclusion: The Impact and Importance of Actuarial Science

An actuarial career is one that is rewarding in all aspects. It is well suited to math enthusiasts who are keen to apply themselves in risk management and solve real-world problems. Strong communication skills coupled with a solid technical background are the stepping stones into a successful actuarial career.

While the journey to becoming a qualified actuary is arduous, it builds resilience and helps chart out early career progression.

Actuaries are involved in a wide range of industries, primarily within financial services. Where there is risk, there is an actuary.

Technology is changing the way we work, and embracing this will create value for our customers. Tedious tasks can be automated, giving us more time to focus on innovating, further developing the industry.

Interested in starting your journey in actuarial science? The IFoA website is a great starting point to learn more. Resources can also be found on the websites of actuarial institutes worldwide in the United States, Canada, Australia, South Africa, and India, to name a few. Despite our reputation as introverts, actuaries are a friendly bunch who are willing to share, so get in touch on LinkedIn. There are also actuarial blogs and YouTube videos with a wealth of advice and personal musings. A vibrant community awaits you, so take your first step to an actuarial career now.