What Does an Actuary Do? A Deep Dive into the Profession

Delve into the realm of actuaries, strategic guardians of financial risk management, whose mastery in statistical foresight secures the economic backbone of industries, from insurance to pensions, through rigorous analysis and innovative solutions.

This article explores into the fascinating world of actuaries, exploring the demanding education and training to the unique difficulties and rewards. So, grab your calculator and prepare to discover the invaluable contributions made to the world by these unsung heroes.

What Does an Actuary Do: The Impact of Actuaries in Risk Management

Actuaries possess a unique blend of strategic problem-solving and mathematical prowess, which enables them to forecast the future by examining data from the past and present. They are experts in identifying risks, estimating their chance of happening and calculating their potential financial effects. However, their work does not end there. Actuaries also develop strategies to mitigate these risks, ensuring companies don’t incur unnecessary losses.

Simply put, actuaries manage risk.

Beyond their technical expertise, actuaries must also be skilled communicators able to explain complex concepts in simple terms to non-experts. While machines can perform calculations, it takes human insight to turn data into compelling stories and make informed decisions. That’s why actuaries are essential to the success of insurance companies and why they’re going nowhere soon.

An Overview of Roles and Responsibilities

Regardless of their expertise, actuaries often follow a similar approach when starting a project. The typical process is as follows:

- Meet clients or company representatives to discuss the scope and objectives of a project.

- Gather and analyse statistical data to determine the likelihood of unwanted events.

- Create reports, tables, or charts that clearly and concisely explain their calculations.

- Present findings to relevant stakeholders, offering insights and proposed solutions.

An actuary’s exact role depends on their industry and specialty, which I explore later in this article.

In essence, the work of an actuary is a multistep process that involves careful data analysis and clear communication of findings to help clients and organisations make informed decisions.

Exploring the Role: What Does an Actuary Do in Different Industries?

Regarding the actuarial career path, there’s no one-size-fits-all answer. In actuality, the career path of an actuary is quite diverse and dependent on the field in which they choose to specialise – similar to medical professionals choosing between specialising in anything from neurology to pediatrics. As a result, each individual’s journey remains distinct but with one consistent thread; solving intricate problems while evaluating potential risks resulting in pragmatic solutions that genuinely transform individuals’ lives.

“Actuaries are to risk what doctors are to disease.”

– Neil Chriss

What Does an Actuary Do in Different Types of Actuarial Work

According to the Institute and Faculty of Actuaries (IFoA), there are over 30,000 members worldwide, with the majority (72%) in the UK and Northern Ireland. Of these, 65% work in the Pension, Life, and General Insurance sectors. The rest can be found in diverse fields like banking, enterprise risk management, investments, emerging markets, and even healthcare. Therefore, whether you’re interested in a traditional actuarial role or seeking adventure in a less common area, there’s plenty of exciting paths to pursue in this dynamic profession.

Traditional Types of Actuarial Work

Pension Sector

Pensions are crucial for helping people save for retirement throughout their employment. Actuaries are responsible for designing, testing, and evaluating a company’s pension plan to ensure it satisfies the needs of trustees, employees, and scheme members.

Actuaries are guardians of the pension system, constantly monitoring investment risks and navigating complex legislative obligations to ensure that the system remains financially sound.

General Insurance Sector

We all know that life can throw some unexpected curveballs our way, and that’s where insurance comes in handy. A safety net is provided by non-life insurance products like home, auto, and travel insurance to help shield us from potentially catastrophic financial losses. But who’s behind the scenes making sure these insurance products are reasonably priced, that reserves are set aside for future claims, and that the company remains financially stable? That’s where actuaries come in!

Actuaries fall into three main categories: pricing, reserving, and capital modelling.

- Pricing: Actuaries calculate customer premiums based on risk factors like age, location, and occupation. This entails making sure that the premium is sufficiently high to keep the insurance firm financially stable while remaining competitive in the market and discouraging high-risk clients.

- Reserving: Actuaries forecast future claims and obligations for the insurer using statistical methods and existing data, ensuring enough funds are set aside to cover them.

- Capital modelling: Actuaries project the insurer’s future liabilities and assets to determine the insurer’s solvency and capital requirements, which are necessary to meet regulatory requirements like Solvency II.

In summary, actuaries help insurance companies manage financial risks by providing insights and recommendations related to pricing, reserving, and capital modelling. This helps ensure that insurance products remain accessible, affordable, and sustainable and that consumers can have confidence in the financial protection provided by insurance companies.

Life Insurance

In the case of the insured person passing, life insurance provides financial support to their families. Whole life and term life are the two main types of life insurance. Whole Life provides coverage for the policyholder’s entire life, while Term Life Insurance offers protection for a specific period of time.

Your job as an actuary will be pretty immersive because you’ll be involved in practically every aspect of life insurance products. This covers the development of new products, their marketing, an assessment of the risks involved, and the pricing of the insurance policy (based on a customer’s mortality risk factors like age, smoking status, and occupation).

Your work as an actuary will help ensure that life insurance policies remain accessible and affordable for all, providing the financial protection that families need during challenging times while still ensuring profit for the company.

Health Insurance

In the realm of health insurance, actuaries play a crucial role in assessing morbidity rates, which refer to the probability of an individual falling sick, getting disabled, requiring medical attention, or recovering from an illness. Such analysis is indispensable for various health insurance products, including disability, critical illness, and medical insurance. Disability insurance compensates workers for lost income if a disability hinders their ability to work. In contrast, critical illness insurance aims to cover the expenses associated with major illnesses such as cancer and stroke. Medical insurance, on the other hand, covers the costs of medical care in case of an illness, including expenses for prescription drugs, doctor visits, and laboratory tests.

Finance and Investment

Actuaries in the financial and investment sectors operate in banking, consulting, and investment management. Actuaries frequently hold top management and advisory positions. They are qualified to work in financial reporting, corporate finance, and mergers and acquisitions due to their depth of technical skills and expertise in asset/liability management. In addition, they employ statistical techniques like insurance and pension actuaries to forecast investment returns by examining past data.

The role of actuaries in the traditional sector has been well established; however, with the changing times, the demand for actuarial skills has expanded to various other industries. Emerging fields include but are not limited to:

- Climate change risk

- Data science

- Cyber risk

- Health and wellness

You can delve further into all of the above points here: https://proactuary.com/resources/what-do-actuaries-do-2/

The Future Role of Actuaries: What Work Will Actuaries Do Going Forward?

The field of actuarial work is undergoing a significant transformation due to the emergence of big data and advanced analytics, including machine learning and robotic process automation.

Actuaries can now streamline their duties by automating mundane tasks to focus on more vital assignments requiring sophisticated analytical skills. With modern data sources such as mobile phones, wearable tech devices and social media, insurance companies can utilise previously untapped datasets to obtain crucial insights about potential risks facing their clients.

The development of data science has provided numerous benefits across industries, but perhaps none have had a more significant impact than insurance. Risk assessment is an integral part of the underwriting process; if done accurately, it reduces uncertainty for companies while ensuring customers pay appropriate rates based on their expected future claims history.

With vast datasets now available through advanced analytics techniques like predictive modelling tools coupled with artificial intelligence or machine learning capabilities- underwriters can better anticipate individualised probabilities tailored specifically towards each customer’s unique situation rather than generalisations used in traditional actuarial models.

Additionally, data science empowers actuaries to expand into emerging areas such as health, climate change, and agriculture, where extensive data sets can facilitate reaching new customers, exploring new markets, and enhancing marketing strategies. This presents exciting opportunities for businesses to leverage data science for growth and innovation in previously untapped areas.

According to a recent survey conducted by Valerie du Preez, companies where data science has been implemented successfully had ready access to high-quality and quantity of internal and external data, were able to fit and interpret models with better predictive power and achieve a higher benefit versus effort outcome compared to traditional methods.

You can find the article here: https://www.theactuary.com/2022/01/28/built-skill-embracing-modern-data-science-tools-and-techniques

By upskilling alongside technological developments, actuaries will be ideally placed to solve critical business challenges in the future. Traditional skills, such as using professional judgment to choose, justify, interpret, validate, and communicate models, can be applied to new techniques. Actuaries don’t need to become data scientists but should acquire a sufficient understanding of the skills and tools available.

Insights from Practicing Actuaries: Understanding What Does an Actuary Do

“During my time as an Actuarial Intern at Willis Tower Watson, a leading consultancy firm, I accomplished a range of tasks that contributed to the development of actuarial models and analyses for clients in the life insurance industry. I conducted data analysis, assisted in report preparation, and collaborated with team members on client projects and industry developments gaining valuable experience using actuarial software and an understanding of the regulatory environment. Under experienced actuaries. I received constructive feedback on my performance, ultimately preparing me for a successful career in the field.”

– Finn McQuillan, current QUB intern at Willis Towers Watson

“I have been working in the local Ireland pricing team over the last year and have seen an exponential increase in my roles and responsibilities over that time. Thus far, I have analysed historical data to identify rate solutions to meet growth targets and even supported in the process of having these pricing changes approved by senior management and stakeholders. I have assisted in deploying a new motor GLM (generalised linear model), using a multitude of software daily such as SAS, RADAR, and MS Excel. I am also, expected to communicate complex information effectively daily through presentations, meetings, and executive summaries.”

– Sean O’Neill, a recent UCD graduate at Liberty Insurance

“As a pricing actuary at Liberty Insurance, my job involves using predictive modelling to analyse past data and identify factors that differentiate customers based on their expected cost. These factors, such as age, location, and car type, are then used to calculate a personalised price for the customer. Ensuring fairness and competitiveness in pricing is crucial, and as actuaries, we constantly evaluate and adjust our prices to strike the right balance.

My day-to-day work as a pricing actuary varies and involves working on multiple projects at once, as well as attending meetings and training sessions. I typically spend three to four hours daily analysing loss and premium trends, retention analysis, estimating catastrophe exposure, and assessing rates for different classes or groups of risk. The insurance industry and marketplace are constantly evolving, so these analyses are also subject to change.

In addition to performing the analyses, I spend another two to three hours a day communicating the implications and results of my work to sales leaders, colleagues, and product managers. It’s important to communicate complex information effectively, both in writing and in meetings.”

– Malachy Toner, Senior Pricing Actuary (Motor) at Liberty Insurance

If this type of work interests you, the following section will outline how you can become an actuary.

Educational Path to Becoming an Actuary

Becoming an actuary is a challenging feat. It requires a unique combination of mathematics, statistics, and business skills and an unwavering commitment to lifelong learning. Candidates must meet specific educational and training requirements to become a certified actuary with the Institute and Faculty of Actuaries (IFoA) in the UK and worldwide. I have summarised this into a 4-step process below.

Education

Typically, candidates need a degree in mathematics, statistics, actuarial science, or a related field with a strong foundation in mathematical and statistical concepts. However, for those particularly eager, there are specific actuarial science degree programs accredited by the IFoA that offer exemptions for some of their exams. Employers typically look for a minimum 2:1 grade, so choosing a course you will enjoy and excel at is essential.

Exemption (n)

Actuarial exams you do not have to take if you have already co ered the same material in your university course.

Individuals with no interest in pursuing traditional university education may take advantage of various actuarial apprenticeships available today. Among these is the Level 4 actuarial technician apprenticeship, which prepares candidates for careers as actuaries or similar positions. After completing this program, one can proceed to a Level 7 apprenticeship leading to a formal qualification as an actuary.

Don’t worry if you need help figuring out where to start; the IFoA website has plenty of information about accredited degree programs and apprenticeships, including exemption options for actuarial exams you may have already covered in your university course.

Professional Exams

The IFoA’s exams are categorised into four areas:

- Core principle exams

- Core practice exams

- Specialist practice exams

- Specialist advanced exams

The Core Technical exams provide a foundation in actuarial science, while the Specialist Technical exams cover more advanced and specialised topics.

In total, 10 exams must be passed to qualify as an Associate, followed by an additional 3 exams to become a Fellow. That’s a lot of exams! And to make things more interesting, there are only two exam sittings per year, with the average person taking between 6-8 years to become a fully-fledged Actuary (assuming no exemptions.)

Now, these exams are no joke. They’re notoriously tricky, and failing along the way is common. Plus, unlike university exams, these must be studied on top of a full-time job. Talk about a challenge! But don’t worry; firms offer support by giving you study days, mentors, and money for materials and tutorials.

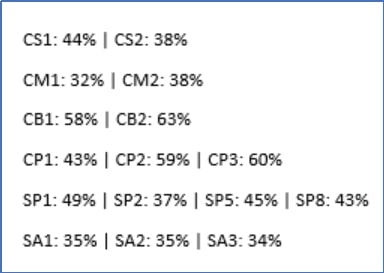

To provide some context on the difficulty of these exams, pass rates tend to be below 50% for later exams, with a few exceptions. For example, the pass rates for the April 2022 exams were as follows:

You might wonder, what’s in it for me?

Well, the answer is simple: passing actuarial exams can be extremely rewarding, both personally and financially.

Actuaries may enjoy an immediate pay increase or bonus for each exam passed and a qualification bonus upon certification.

“An investment in knowledge pays the best interest.”

– Benjamin Franklin

Passing these notoriously difficult exams also represents a significant personal accomplishment that unlocks a range of job opportunities and career paths. It’s worth noting that these tests are formidable in nature; many later exams have pass rates below 50%. Nevertheless, through sheer dedication, unwavering effort, and an unflinching resolve to succeed, one can surmount the daunting task of conquering all 13 exams. And when you finally do, you’ll have the satisfaction of knowing that you’ve achieved something truly difficult and impressive.

Professional Experience

The IFoA requires candidates to have at least three years of professional experience in an actuarial role, including work in areas such as insurance, pensions, investments, risk management, and consulting, in order to fully qualify.

4. Continuing Professional Development

But the journey doesn’t end here! Beyond this initial requirement lies an ongoing commitment to continuously sharpening skills and knowledge through Continuing Professional Development (CPD), ensuring that actuaries are equipped to confront all obstacles.

Continuous Professional Development (CPD) (n)

Refers to any activity that involves learning relevant to a member's actuarial work or professional development. These activities include seminars, workshops, personal reading, and research.

The pursuit of becoming an actuary requires significant diligence and perseverance, yet the potential payoffs make it a worthwhile endeavour. The upcoming section will explore the various advantages that come with this profession.

Choosing the Actuarial Profession: What Does an Actuary Do to Succeed?

Actuaries Have Endless Opportunities

Once confined to the insurance industry, actuaries are now branching into various non-traditional roles, including consulting, financial services, and more. Over half of the IFoA members have followed suit, and the trend is only growing. Plus, with the UK actuarial qualification, the world is your oyster – 45% of UK-qualified members work outside the UK, with many exciting destinations like Australia, New Zealand, India, and South Africa.

The Actuarial World is a Challenge Like No Other

Prepare to tackle complicated financial problems that test your analytical thinking, commercial and economic understanding, and communication skills. But don’t worry; you’ll be ready to face anything with your rock-solid expertise.

Job Security

The demand for qualified actuaries in the UK is consistently strong, with a 27% increase in 2021 and an expected 9% growth in 2022.

Plus, with a career in actuarial science, you’ll always be in high demand. A sustainable society will always need pensions and insurance; as an actuary, you’ll play a vital role in ensuring their stability. Although technology has impacted the profession, embracing these changes and advancements will only lead to success.

With a membership base of just over 30,000 in the Institute and Faculty of Actuaries, individuals who choose to pursue this profession will be part of an esteemed and exclusive group. While there may be some fluctuations in employment opportunities, actuaries who possess adept skill sets and remain well-versed in current industry developments will be proficiently prepared for long-term success.

A Good Work-Life Balance

One significant advantage of pursuing an actuarial career is achieving a healthy equilibrium between work and life. Many actuaries proclaim that they can give attention to their personal lives without any detraction from their occupation goals.

Excellent Study Support and Training

Employers recognise the dedication required to obtain an actuarial qualification and often offer generous study support, such as paid study leave and covering the cost of exams and tuition. Mentorship programs are also available to help guide aspiring actuaries through their studies and career progressions.

Financial Rewards

For those with aspirations towards becoming an actuary in the UK – the financial rewards that await are undoubtedly compelling! Actuaries are among the highest-paid professionals in the UK, with starting salaries for fresh graduates typically ranging between £25,000 and £35,000 per annum. But this is just the beginning. As you progress in your career and pass exams, your salary can increase substantially, with newly qualified actuaries earning between £40,000 and £55,000. Climbing further, senior actuarial analysts can earn up to as much as a whopping £110,000, culminating with executive leadership possibilities allowing successful professionals to earn beyond even £200,000.

Although salaries vary by location, high financial rewards and excellent benefit packages are common in the actuarial profession. So, if you’re looking for an intellectually stimulating and financially rewarding career, actuarial science is definitely worth considering.

Actuarial science is an incredibly rewarding career path; however, like any profession, there are a few challenges to overcome.

Not surprisingly, the demanding education and training serve as a common complaint amongst those in the field. However, other gripes include a high-stress environment, inadequate room for creative expression, and the potential of working independently or in small teams- which can limit social interaction and may not appeal to those who thrive in a more social collaborative setting.

Data source and to delve further into all of the above pros and cons: https://www.indeed.com/career-advice/finding-a-job/pros-and-cons-of-being-actuary

Final Thoughts: Understanding the Essence of What Does an Actuary Do

While some people may compare them to mystical fortune tellers with their crystal balls, actuaries are nothing short of analytical geniuses in the field of risk management.

However, actuaries use their expertise in statistics and data analysis instead of relying on mystical powers as their crystal ball. The primary objective of an actuary is to help identify potential business risks by analysing historical trends to predict possible outcomes accurately. Communication skills also play a crucial role as they must translate complex numerical data into meaningful insights to share with decision-makers.