What to do with an Actuarial Science Degree?

Explore the versatile career pathways available with an actuarial science degree, highlighting how this specialized education opens doors not only in traditional actuarial roles but also in diverse fields like finance and data science.

A specialised degree often thought to have the primary objective of preparing students for the actuarial profession. Whilst most graduates of a degree in actuarial science tend to continue along the actuarial route, this may not be best suited to everyone.

As an 18-year-old student, choosing a degree to study at university can be very daunting. This single decision has the power to determine your lifelong career path. However, at such a young age, can we really conclude that one specific profession is right for us? This leads to the main questions of thisessay…

- Does an actuarial science degree present a career as an Actuary to be the ultimate end goal for its graduates?

- Does an actuarial science degree fail to highlight the endless possibilities presented to graduates given their exceptional skillset and intellect?

This essay will explore various routes available to actuarial science graduates. Yes, it may be true that many graduates choose to take the traditional path of undertaking the professional exams to qualify as an Actuary. These individuals can move forward, utilising skills learned from the actuarial science degree in numerous traditional actuarial roles as well as pushing the boundaries and moving into new areas of work.

Although targeted, the skills developed throughout an actuarial science degree are not specific to a career as an Actuary. There are many other stimulating career opportunities that I believe should also be encouraged to those with the skillset obtained from an actuarial science degree.

From Actuarial Science Degree to Qualified Actuary

Universities offering a degree in actuarial science can be found all over the world. Many of these universities have designed modules in accordance with the professional actuarial exams set by the Institute and Faculty of Actuaries (IFoA). To date, the IFoA have accredited 44 universities across the globe. This allows students at these universities to obtain a number of exemptions from the professional exams upon graduation.

The university one attends alongside the modules undertaken will determine the number of exemptions one can obtain. Students complete several (generally) maths-based modules each year, including subjects such as: pure maths, economics, finance, and statistics. As a graduate of a specific actuarial science degree, you will have a head start on the actuarial exams, hence continuing along this route may be seen to be the ‘easiest’ option. However, anyone that has gone through the process knows that it is far from easy.

Working through professional exams is exceptionally challenging. Student actuaries are required to study for these exams in their own time. Although most companies may grant study days for each exam, balancing exams with a demanding workload is not an easy job.

Under the new IFoA curriculum that began on 2 January 2019, students are required to take at least 13 professional exams.

To become an Associate member of the IFoA, students must complete all of the following exams, as shown below (Source: IFoA website):

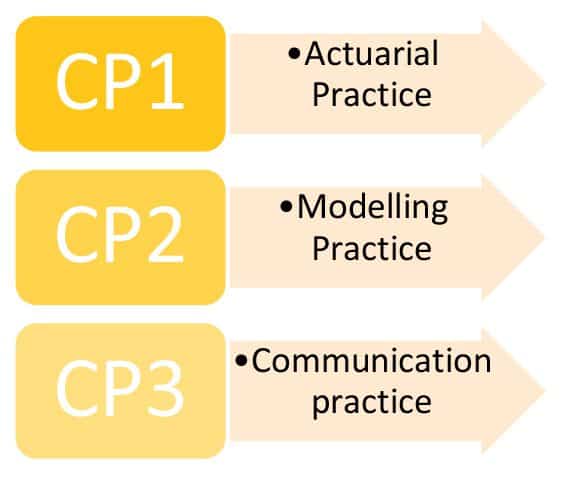

‘Core Principle’ Exams

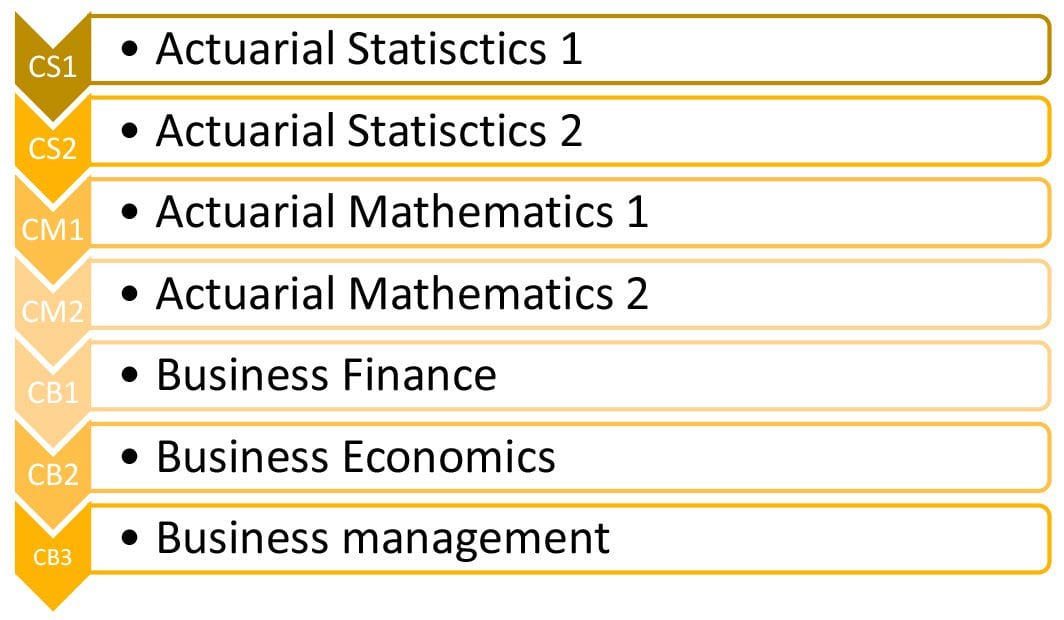

Actuarial and Business Exams

Moving forward to become a Fellow member of the IFoA, students must complete:

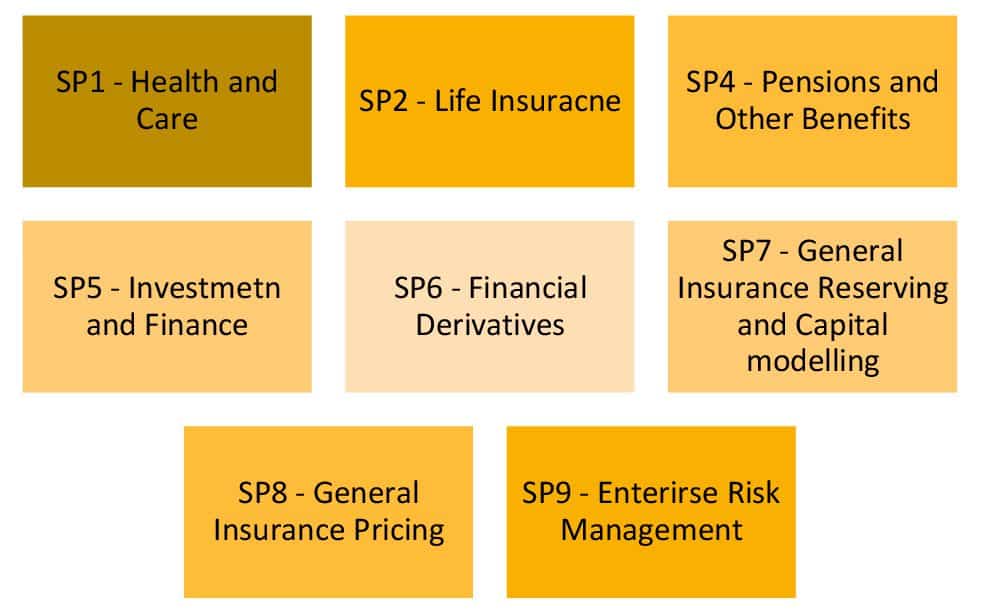

Two ‘Specialised Principle’ Exams to Determine Career Direction

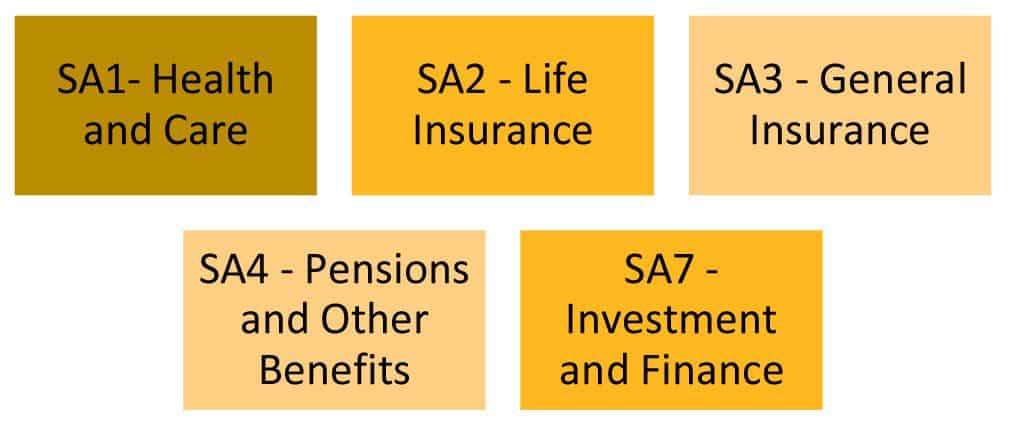

One ‘Specialised Advanced’ Exam to Reach Fellowship

This is the general route taken by numerous actuarial science graduates aiming to become a qualified Actuary. Although this is a very common path taken, the way in which graduates follow this pathway may vary.

There are many different possible job prospects for student actuaries.

Traditional Actuarial Roles

The IFoA define actuaries as “problem solvers and strategic thinkers, who use their mathematical skills to help measure the probability and risk of future events.” They then “use these skills to predict the financial impact of these events on a business and their clients.”

The skills and qualities of an actuary are becoming increasingly sought out by different businesses and industries. As the world is developing more rapidly than ever, the need for companies to predict and manage risk is becoming ever more important. This is where actuaries come in. Conventionally, the main fields actuaries are associated with include pensions, consultancy and of course insurance! The insurance industry is a major employer of actuaries, historically employing more than any other industry.

Pensions

- Actuaries in this field traditionally advise companies on how their pension schemes should be managed based on their employee structure. This includes advising on the calculation of their liabilities and advice on funding the liabilities as well as what assets to invest in.

- Government agencies often employ actuaries to operate pension, retirement, and insurance programs.

Consulting

- Consulting firms acquire actuaries to advise clients on financial decisions such as pension, retirement or other employee benefit schemes involving risk.

- Consultants must be able to analyse the risk at hand and communicate their results efficiently and effectively to the client.

- More client-based projects are involved, utilising the softer skills obtained from the actuarial science degree: communication and presentational skills.

Consulting offers a lot of variety and personal interaction with clients and colleagues. You can become an expert in your particular domain and move across different assignments making the day to day role a very exciting actuarial role. Consulting roles do tend to come with more pressure and longer hours however.

The Insurance Industry

- Comprises of several areas including life, health, and general insurance.

- Actuaries are employed to develop insurance products which they then price and monitor in all areas of the industry.

Although these sectors are all diverse, the basic strategic methods and skills used will be similar, stemming from methods taught in the actuarial science degree. A few of the commonly used actuarial practices are highlighted below:

- Valuation – involves calculations and modelling aimed to advise an insurance company on the amount of capital and reserve that should be held.

- Product Development and Pricing – devising insurance products and an adjacent pricing strategy for that product.

This gives us an idea of a few traditional roles presented to actuarial science graduates today. These jobs apply the strategic thinking skills and actuarial techniques they have learned to the real world.

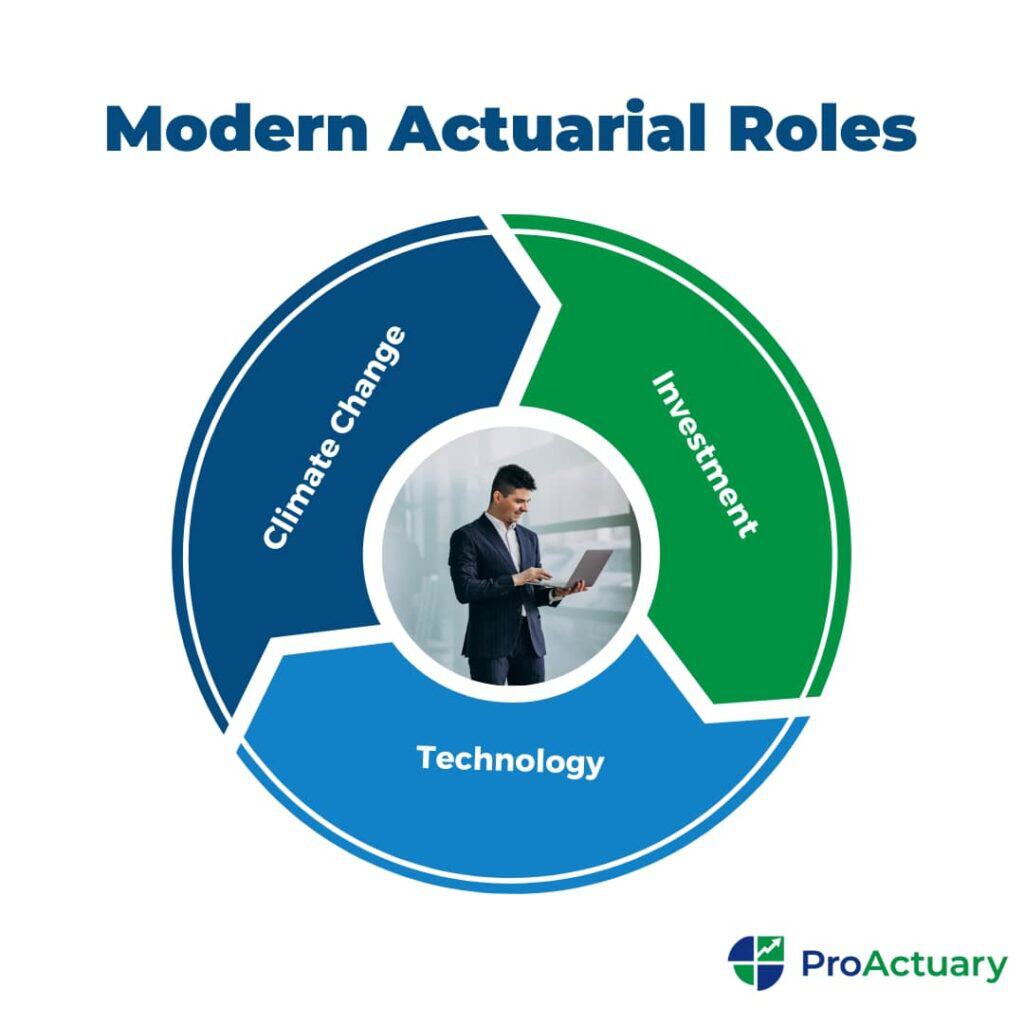

Modern Actuarial Roles

Many years ago, the duties of an actuary may have been largely confined to these select few career paths.

Fast forward to 2022 and we can see that modern actuaries have started to push the boundaries and show the world how powerful their knowledge and skills can be.

Industries which originally had no ‘need’ for actuarial intervention are beginning to see the positive impact that predicting financial risk may have on their success. Not only are they involved in prediction of financial risk for insurance, but actuaries are also beginning to lend their expertise to other areas of prediction such as: Investment, Technology, and Climate Change.

The world as we know it is ever changing. Luckily for actuaries, changes in the world bring about new risks and with them new actuarial opportunities. As different fields begin to recognise the value of risk assessment in this new volatile, uncertain and complex world, the employment opportunities for actuaries become endless. Actuaries are more in demand than they have ever been before, leading to boundless global opportunities for actuarial science graduates.

Climate Change

Climate change is an obvious ongoing change that we are confronted with as an entire population.

From the risk of extreme weather to global warming and a rise in sea levels, this phenomenon has already made a huge impact on earth.

Actuaries have a social responsibility to use their expertise in quantifying risk and managing forecasts to provide high quality advice to the ultimate decision makers within our governments.

The International Actuarial Association (IAA) are a globally recognised organisation which aim to progress the development of the actuarial profession. In September 2009, The IAA set up the ‘Resources and Environment Working Group’ (REWG) to help combat climate change.

This group have been involved in ongoing projects such as:

- Carbon pricing,

- Flood risks,

- Insuring vulnerable populations,

- Government budgetary impact.

Investment

Actuaries are becoming increasingly involved in the world of Investment.

Investment management consist of investing client money in the stock market with the aim of making a target profit for a set level of risk. This involves trading in a selection of ‘safe’ and ‘risky’ stocks.

Choosing the correct portfolio of assets for the clients’ needs is a tricky job, traditionally executed by the investment manager.

However, actuaries have more and more often found themselves lending their analytical skills and profound understanding of asset interaction to the field of investment management.

Technology

As our world evolves, becoming ever more data-driven, the rapid technological advances we face are infinite.

Autonomous cars for example. An idea that in the past, seemed somewhat a gadget of science-fiction has been realised in today’s world. Although becoming more credible, there are many risks and ethical issues related to this new technology which must be measured before becoming publicly available. This is where companies such as Tesla require actuaries to assess and manage the risk of their products.

Actuaries face a new problem…

The shift of liability from person to product.

Actuaries will be required to adapt their risk profiling calculations in future to allow for this problem. The calculations of insurance premiums will also be affected whilst a car is driving in autonomous mode.

Insurance premiums may no longer be calculated based on the individual characteristics of the driver, alternatively based on the technology behind the vehicle itself. Although this concept is still a grey area, actuaries have an opportunity to play a key role in developing a solution to this problem.

Non- Actuarial Career Paths

Each career path mentioned so far stems from the actuarial profession. At the beginning of this essay, it was mentioned that actuarial science was the main route chosen by actuarial science graduates. I have highlighted how this ‘one route’ can open many diverse opportunities which may interest graduates.

However, there may still be many who after an actuarial science degree find themselves uninterested in any of these actuarial career prospects.

After completing an intellectually demanding degree such as actuarial science, one may find themselves wanting to take a break from exams. Perhaps they wish to use their new skills in an alternative, equally stimulating profession. Although the degree itself may be specialised, the skills that students learn can be utilised and adapted in almost any profession.

A few career prospects compatible with someone graduating from an actuarial science degree are discussed below.

Financial Analyst

As previously mentioned, actuaries have started moving into the world of investment management.

An actuarial science degree provides students with basic knowledge of the stock market and the interaction of assets and derivatives. This field is not commonly emphasised; however, some graduates may wish to focus on the financial information rather than the risks involved. A financial analyst is similar to an actuary in that they analyse data guiding businesses and individuals to make the best decisions for them.

The main differences are:

- Actuaries deal with risk making decisions whereas financial analyst’s deal with the financial data.

- The qualification route differs – financial analysts work towards becoming a ‘Certified Financial Analyst’.

This route may be preferred by graduates who are more financially orientated. However, for those seeking a rest from exams, this may not be the desired direction for you!

Data Scientist

Although an actuarial science graduate can be employed to a multitude of professions, their analytical skills and ability to solve complex technical problems have recently been well matched to the modern role of a Data Scientist.

Data scientists use large datasets, often developing their own programs and algorithms to find trends and come up with innovative solutions across all industries. Making use of both qualitative and quantitative data, data scientists tend to use more modern and imaginative methods of analysis than the traditional methods employed by actuaries.

Data science is in many ways like actuarial science. However there a few key differences which may make this career more attractive to some Actuarial Science graduates.

- Data scientists employ a more informal nature of learning. There are no set professional exams.

- They are however subject to ongoing learning e.g. via ‘Massive Open Online courses’ and developing a portfolio of models is common practice.

- Predictive analytics and modelling are the focus of data science. There is less emphasis on risk modelling.

- Although actuaries are beginning to branch into non-traditional fields, data scientists are a relatively new career option, and their skills are already being utilised in a wide variety of industries.

As many of the skills required of an actuary and a data scientist overlap, this could be a perfect position for an actuarial science graduate. Possibly offering a broader set of opportunities.

Is Actuarial Science Hard?

Actuarial Science has a reputation of being a very difficult degree course.

Actuarial science is indeed a highly specialized field that involves using complex mathematical models and statistical analysis to manage risk and uncertainty. As such, it requires a strong foundation in advanced mathematics, including calculus, probability theory, and statistics.

How difficult you find these topics is very relative. Some people can do calculus with their eyes closed and other people balk at the sight of an integral sign! However, most qualified actuaries that have gone through the process often highlight that whilst it may seem challenging, and a high level of perseverance is required, with dedication and hard work, anyone with a good foundational level of maths, statistics and finance can excel in actuarial science.

It’s important to stay motivated and committed to the learning process, seeking help and guidance from professors, mentors, and peers when needed. With practice, perseverance, and a passion for problem-solving, actuarial science can be both rewarding and fulfilling.

I would however suggest you ask yourself the following questions before making a decision:

- Am I interested and enthusiastic about mathematics and a potential career as an actuary?

- Do I have a natural ability towards quantitative subjects such as mathematics, statistics and finance?

- Do I truly want a career where numerical skills are highly regarded and used every day?

- Do like the idea of using maths and statistics to solve complex and challenging business problems?

- Do I want a highly regarded career with excellent employment prospects and that is financially rewarding?

If you answer yes to these questions then you will most likely have the ability to pass the actuarial exams and eventually become a qualified actuary.

Actuarial Science Degree: What’s Next?

It is easy to say that an actuarial science degree is a career specific degree. However, I believe that someone with this opinion has not done their research!

On a closer look, we see that this degree provides students with a skillset which can be adapted to an endless number of innovative and stimulating careers.

Yes, the prospect of following the traditional path to become a qualified Actuary is most certainly a front- line contender, nevertheless it is by far the only career path presented.

The world as we know it is advancing every day and risk is becoming ever more prevalent and complex and so actuarial science graduates are in demand globally, now more than ever!

So, if you are an actuarial science graduate, do not let anyone else forecast your future. The distribution of opportunities available to you is perpetual. Lucky for you, it is your job to predict the outcome!

Actuarial Science Degree FAQs

Amy Kelly

“Amy Kelly is an Actuarial Analyst at VHI. Prior to that she was an Actuarial Intern at VHI Health Care. Amy graduated from Queen’s University Belfast in 2021 with a BSc degree in Actuarial Science. You can connect with her on LinkedIn.”