An Actuary’s Guide to Overcoming Resistance (Behind the Scenes of the ProActuary Digital Actuary Conference)

The Digital Actuary Conference (Virtual Summit)

4,257 actuaries from across the world recently attended the Digital Actuary Conference (Virtual Summit). Truth be told, the numbers scared the heck out of me! Reputations can be ruined in the online world in one quick swoop.

This actuarial conference event had so many moving pieces. Numerous things to single-handedly take care of and potential things to go wrong. Risk management and contingency plans rarely eliminate all risks.

But to achieve anything worthwhile, there has to be some risk-taking involved. As actuaries, we all know that, right? Risk Vs return and all that good stuff.

And, like many actuarial related principles, the theory can be applied beyond the corporate world to our own personal lives.

Of course this particular actuary conference successfully went ahead and having come out the other end, I’m pleased and proud with how it went. Perfect? No. Good enough to make me feel proud and that it was worthwhile? Heck, yes!

But let me take you behind the scenes and reveal the back story:

I actually first thought about doing a virtual actuarial conference event nearly 3 years before it took place in 2020. 3 freakin’ years thinking about doing it before Covid pushed me on. How embarrassing.

It obviously never happened.

Why?

Because of an invisible force, I’ve started to notice more and more in life…

…Resistance

It’s a clever foe that comes in many forms. Fear, self-doubt, and the background anxiety of failing at something in front of others. Most of us can probably relate at some level:

Imaginary relics from a self-preservation motivated ancient brain?

Excuses and cleverly designed procrastination that protect us from getting hurt?

I’m not entirely sure.

But what I do know is that it’s a fraud. It’s not real. An imaginary enemy that must be slayed. Not just once, but continually, as we travel through this journey called life.

Even now typing these words, I can hear it raise its ugly head:

Don’t publish it. It’s not good enough. Who cares.

He/she never completely goes away, always lurking in the background for a chance to “keep us grounded” and stop us from going out of our comfort zone and moving forward.

Seeing this resistance for what it was, a few months ago, I asked myself what could I do to overcome it. I strongly believe knowing how to ask ourselves the right questions, at the right time, in the right way, can be one of the most powerful levers we can pull in our lives. Recognising this resistance towards the digital actuary conference idea, the simple question I asked myself was:

“How can I overcome the resistance and make this happen?“

Here are 3 answers I came up with, that helped me win this particular ‘resistance battle’.

Hopefully, you’ll find a few of the ideas useful to help you overcome your own particular resistance, where ever you may find it in your own actuarial journey:

1. Taking an agile, lean iteration approach.

One of the actuarial conference speakers was a US Chief Actuary called Tim Fleming. You may have seen Tim’s talk on “The Modern Actuary“. Tim done a stellar job diving into how we have to think differently about the role of the actuary in the changing world and what it takes to be successful. He offered a thought-provoking perspective on how actuaries should work in a modern context, and the importance of learning in our field. Very relevant to those of us looking to embrace the new digital world we are increasingly moving into.

One powerful idea Tim discussed was that of taking an agile approach to projects. The agile approach has its roots in software development and a key part of of the agile approach is getting started and iterating incrementally as you go along. This approach has many benefits. Here are two key benefits:

- You take small steps (experiments), get feedback on what’s working and then iterate. This accelerates the time-to-market.

- You avoid the procrastination trap, where you feel you need all your ducks to be perfectly lined up before you begin.

The first point was important for me, since I knew I wanted to bring this idea to market quickly and get rapid feedback to do it all again, only better (2022 update: this did happen with the 2021 Growth Actuary Conference and the 2022 Disruptive Actuary Conference).

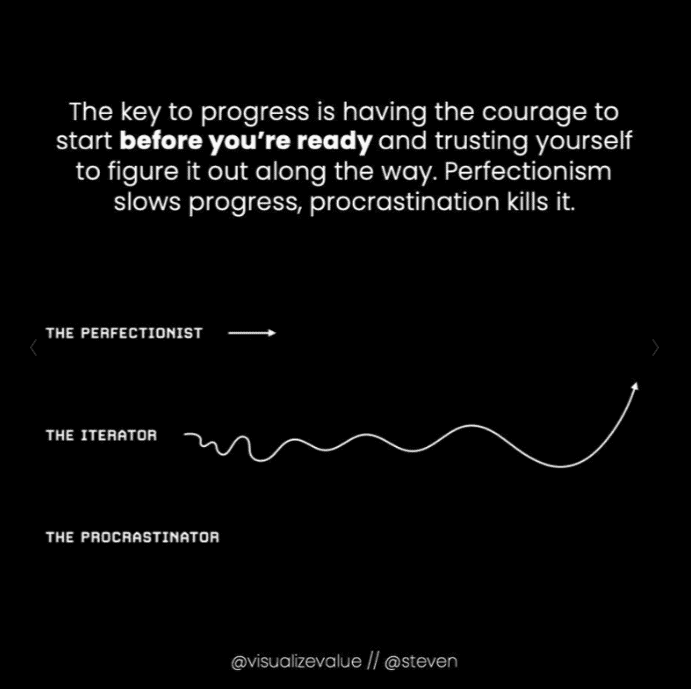

The second benefit was also crucial to my project and this visual sums it up perfectly:

How many times in life have you fallen into the trap of waiting and waiting for everything to be right?

Perhaps you are going to start your actuarial study plan, or learn a new skill, but you think you need to wait until you feel more motivated, have more energy or maybe more time.

And on and on it goes.

Waiting and waiting.

I know this mindset and thinking has stopped me umpteen times. The harsh truth is, there is rarely a perfect moment to get started with anything in life. A much better tactic, therefore, is to simply start.

Start and then iterate as you go along. This is the thinking I applied to the Digital Actuary Conference event. And it worked. I figured the stuff out as I went along. If I’d waited for the right moment, I’d probably still be cautiously waiting and stalling. Sad, but true.

2. Setting Realistic Expectations.

The Roman emperor Marcus Aurelius was the most powerful man in the world, during his reign from 161 to 180 AD. He was also one of the most reflective, philosophical and intelligent men to have ever lived. I highly recommend Meditations – one of the most genuinely life changing books I have ever read. And, trust me, I don’t say things like that lightly.

Marcus had an unusual morning ritual. Upon wakening each morning he would remind himself of the following:

“When you wake up in the morning, tell yourself: The people I deal with today will be meddling, ungrateful, arrogant, dishonest, jealous, and surly.”

– Marcus Aurelius

But why is this worthy of mention?

Well, Marcus was aligning his thoughts for the day ahead so as not to fall prey to unrealistic expectations.

From my experience, our expectations about life can truly determine our resilience in the face of adversity. Worthwhile endeavours are rarely easy. Hard things are hard (another highly recommended book). They take time, patience, grit, determination and resolve.

Unforeseen obstacles appear, things take longer than expected, and people don’t behave the way we think they should. Expecting things to go smoothly and expecting people to act in the way we think they “should” can be a recipe for frustration and disappointment.

Aurelius was smart. He knew this particular expectation was an impediment to progress and happiness. And, thus, he created an effective habitual routine to avoid the pothole.

Again and again, throughout my own life, I have found that misaligned expectations can not only be a perfect recipe for frustration in life but also a significant hurdle to making progress. When we expect things to be easier than they are, we set ourselves up for disappointment and lower our resilience and resolve.

Again, let’s take actuarial exams, as an example:

Who is more likely to succeed?

- The actuarial student embarking on his exam journey, expecting to blitz his/her way through exams with minimal effort and commitment, or

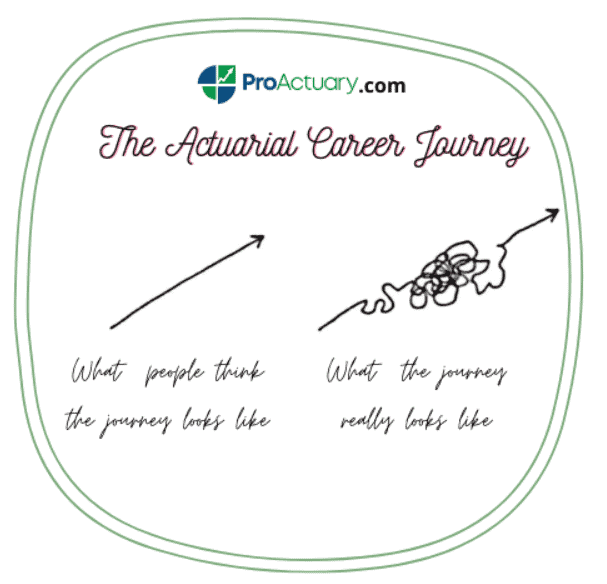

- The trainee actuary who expects the journey to be full of obstacles to overcome – foreseeing there will be big sacrifices and probably a need to overcome failure, difficulties and resistance on his/her actuarial exam odyssey?

My money is on student actuary #2.

And again, I applied this same thinking when pulling together The Digital Actuary Conference Virtual Summit.

On the face of it, running a virtual actuarial conference doesn’t seem so hard. Come up with an idea, approach some speakers, put it all on a website, tell people there’s an actuary conference event happening and voila!

However, like most things in life, the reality is very different. There were a lot of moving parts and disparate things to think about. A nice playground for someone who prefers to play in the realm of being an actuarial generalist, rather than a specialist.

Now, I can’t begin to tell you how many unforeseen obstacles arose:

- Conference speakers that had committed but then mysteriously disappeared off the face of the planet (my final 22 committed speakers were all amazing).

- Videos that weren’t playing correctly after editing.

- Technology that wasn’t working the way it should and fixes that ended up costing much more than I had budgeted for.

- Friends that doubted the effort was worthwhile.

- Family emergencies that needed taken care of.

- The list goes on… and on… and on.

But this was all okay. Even though I didn’t know in advance what issues would crop up, I knew and expected there to be obstacles and that things wouldn’t always go my way. This expectation allowed me to both consciously and subconsciously factor in margins of safety via appropriate resources (e.g. time and expense buffers) and stay calm in the face of arising challenges. To stay motivated when things weren’t going my way. To see things through to the end.

Seriously, it reminds me of studying for actuarial exams, or any big challenge we face in our actuarial careers and even more generally in life.

From my experience, so much unseen effort, below the iceberg surface, goes into “big efforts” in life.

I’m skeptical of a lot of self help advice out there, but I do think the self-help gurus are right about one thing they sometimes spout: “there is no growth on easy street.” As cliché as it sounds, my 45 years of experience on planet earth tells me it’s true.

I, therefore, believe that if (before embarking on a significant undertaking such as organising a large global actuarial conference) we apply Aurelius’ idea of thinking through the challenges in advance, and setting our expectations appropriately, we can mentally prepare ourselves to deal more optimally with navigating the road ahead.

3. Creating Accountability

In many ways, life is a game of continually shifting the odds in our favour. Trying to create a probability edge in as many ways as possible. Then leaving the law of large numbers to work its magic, allowing our edges to hopefully bring us out ahead. A simple probability shift hack to nudge the odds of following through with any goal in life is to make yourself accountable.

Accountability is the ninth wonder of the world. Think about your work:

Have you ever made a promise to someone (e.g. your boss or a client) that you would have a report or piece of work finished by a certain date? Chances are you damn well made sure you got it done. And it all comes back to the power of social accountability. According to a study undertaken by the American Society of Training and Development (ASTD), accountability can increase your chance of success by up to 95%.

I would laugh and turn my nose up at this statistic if I hadn’t experienced it myself.

Going back to my Digital Actuary Conference as a case study, I knew that if I asked speakers to present, there was no going back. Once I’d told them of the date and the fact it was happening, I had, like Hernán Cortés in 1519, effectively burnt my ships and reached a point of no return via multiple accountability partners.

This accountability was magnified further when I started writing about it on an IFoA blog post and eventually social media. That ASTD statistic seems a lot more believable now.

So there you have it. Three ways I used psychology and mindset to help me create a large scale Digital Actuary Conference and some ideas for you to try in your own life.

Of course, like anything in life, the key is to actually use the information.

“Without knowledge action is useless and knowledge without action is futile.”

– ABU BAKR

If you are interested in hearing more about how mindset applies to actuaries, here’s a snippet of the interview I done with the IFoA president, Tan Suee Chieh, as part of the Digital Actuary Conference.