What Do Actuaries Do? Unveiling Their Crucial Role

Unravel the multifaceted world of actuaries, whose expertise in risk analysis and management is critical to insurance, pensions, and beyond, shaping the financial landscape through data-driven decisions.

As an actuarial student, I have at times been apprehensive to the question “What do you do?”. The responses to “I am a student actuary” can vary widely. Some people are immediately impressed, commenting “Oh, you must be smart!”. Others seem to instinctively stick a boring label to my forehead. I have even been asked “How much is there to learn about using a bow and arrow?” However, by far the most frequent reply I get is “What is that? What do actuaries do”. This does not surprise me. The industry of an actuary is a small one. It is a niche segment of the ever-growing financial sector.

Actuaries are all about risk. Their job is to identify, measure and manage risk. By examining data from the past, they can gain insight into the likelihood of future events. They can then use their expertise of maths and statistics to evaluate the impact of such events. As a result, insurance and pensions are the bread and butter of an actuary. However, with the rapid rate of change in our world today, new avenues are opening. Actuaries can now use their broad skillsets in less obvious areas, which we will touch on later.

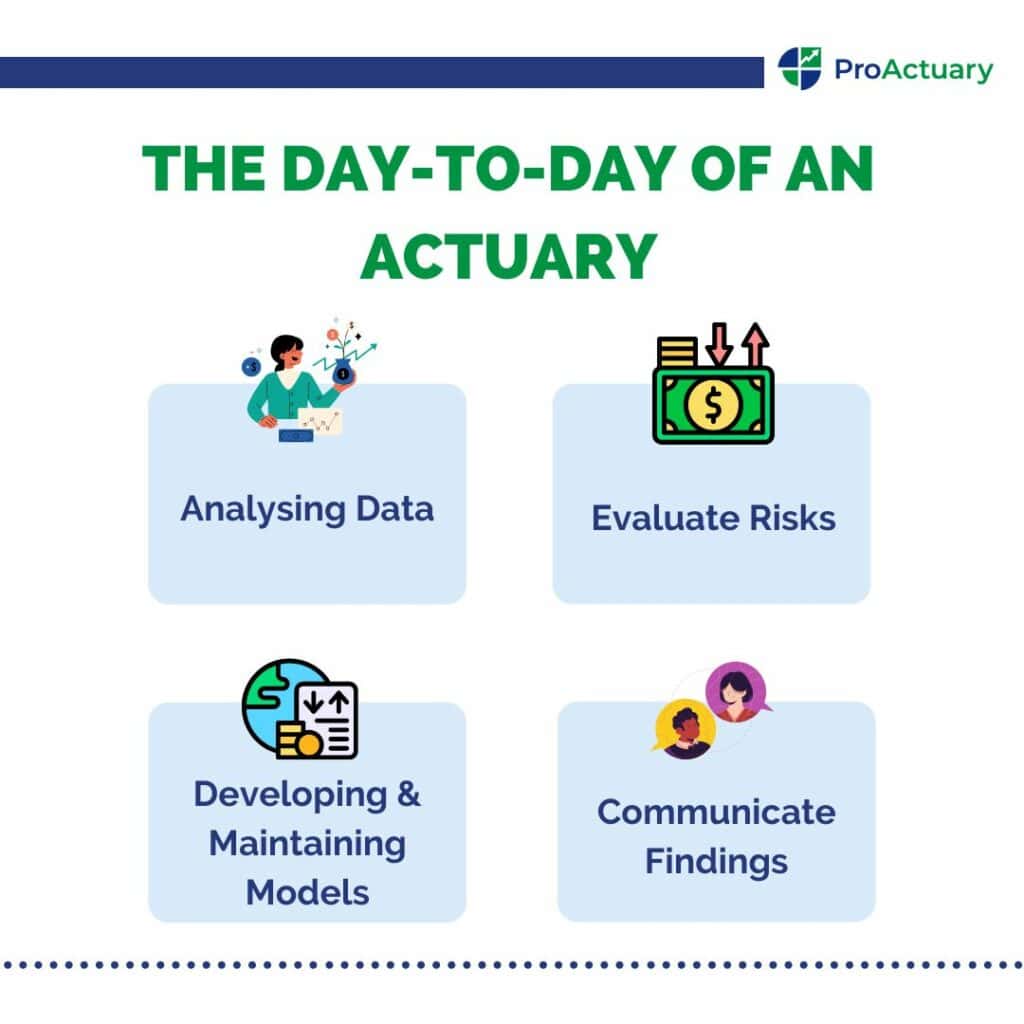

Exploring What Do Actuaries Do: A Look at Their Daily Responsibilities

Gone are the days of actuaries working out long numerical sums with pen, paper and calculator in hand. The profession has evolved with the digital age. While it is unlikely that two actuaries will have identical daily routines, there are some common tasks that they may share:

Analysing Data

The rate of data collection today is lightning fast. The emergence of big data and the internet of things means that there is no shortage of data for actuaries to examine. For example, the introduction of wearable technology (such as smart watches) has led to potential innovations in the life and health insurance industry. Insurance companies may now be able to use data collected from these wearables to estimate the risk of an individual more accurately. Regardless of the industry they work in, however, actuaries will be analysing data. It allows them to identify patterns, relationships, and trends. This leads to better predictions for risks or future events.

Evaluate Risks

As we previously mentioned, actuaries and risk go hand-in-hand. Actuaries will use the tools they have at their disposal to help them evaluate risk. These tools can vary depending on the industry or context in which they work. Some of the most drawn upon would be:

- Probability theory

- Statistical analysis

- Mathematical models

- Financial mathematics

- Risk management software

- Computer Programming

An actuary will use these to estimate the likelihood of certain events. The potential impact will then be considered. For instance, a pensions actuary will be interested in valuing longevity risk. This is the risk that people will live longer than expected. While this would clearly seem like a good thing to most people, pension funds cannot afford to make pay-outs forever (as morbid as that sounds)!

Developing and Maintaining Models

We mentioned that models are a key component of most actuaries’ repertoires. It is usually the brain of an actuary behind said models, too. Models in Excel were previously the norm. However, this is becoming less frequent as time moves on and the industry advances. Excel is slow to calculate repeatable processes. It is also prone to error due to the human intervention often required. As such, software programs such as Alteryx, Tyche and Psicle are beginning to replace them.

Alternatively, actuaries may use programming languages such as R or Python to build their own models. These programming skills have become gold stars on a modern-day actuary’s CV. Employers want candidates who can add value to their firm, with new techniques. Programmers can do this.

Communicate Findings

Actuaries will use their personal judgement, industry knowledge and analysis to draw conclusions. Once done, they will communicate findings to the relevant stakeholders. Actuaries need to tailor the delivery of information to their audience. This is why communication is such a critical skill for succeeding in the career. Not all stakeholders are maths lovers/experts. Actuaries must therefore be capable of condensing technical information into an accessible format. On the flip side, some audiences may be interested in the methods used to come to a verdict. For example, a junior actuary presenting work to their boss. For these cases, it is more necessary to double down on the technicalities.

The communication can be verbal. Think PowerPoint presentations to a client. It can also be written, such as a summary report. In both cases, there are similar techniques that actuaries use to drive home their points:

- Simplify technical language and jargon.

- Provide context to the analysis of how it will affect the business.

- Use visual aids e.g., graphs, tables and charts.

- Use of examples (can help to ground more theoretical analysis).

- Solicit feedback – Allows more explanation to be given where needed.

The Practice Areas of Actuaries: Understanding Their Impact

In today’s world, actuaries are key to maintaining a stable and well-functioning society. They use their refined expertise to solve real-world problems. Those hard sums are not all for nothing. They help to safeguard businesses and people against adverse future possibilities. The direct impact an actuary has, though, will depend on their practice area. There are a number of these, highlighted below:

Traditional Areas

Actuaries have been around for hundreds of years. These are the most traditional areas they have worked in, to date.

Life/Health Insurance Actuary

Life and Health insurance actuaries help to develop and price insurance policies. They do this by estimating how long an individual is expected to live or how likely they are to need medical treatment. This is based on various risk factors. Some examples are:

- Age

- Sex

- Weight

- Medical History

- Height

- Tobacco use

- Occupation

Life insurance creates some stability for a family in the tragic event of a death. The money they receive can help support them after their loss, at least financially. The benefit that health insurance provides is similar in nature. It creates certainty. There is relief in knowledge that people will have access to the healthcare they need, when they need it. Hence, it is easy to see the value of these actuaries.

General Insurance Actuary

As opposed to dealing with people, these actuaries tend to protect possessions from financial loss. General insurance itself covers a broad basis. It incorporates motor insurance, property insurance, travel insurance, theft insurance, marine insurance… And the list goes on. Similar to life and health insurance, general insurance actuaries are responsible for forecasting expected losses. They also use risk factors to help predict this. However, these factors depend on the product being insured. Based on this, they advise what level of premiums should be charged to adequately cover expected expenses.

Actuaries in this field help people and businesses recover from unfortunate events. For example, the recent Türkiye and Syria earthquakes. It is estimated that a total of $1bn of losses were incurred.

This does not come close to covering total losses, however, due to the low insurance coverage in the area. Fitch Ratings estimates that the economic losses will likely exceed $2bn. Events like these demonstrate the importance of the industry.

Pensions Actuary

Everyone wants a relaxed retirement. Pensions actuaries can play a role in providing this. Their prime responsibility is to provide financial guidance to pension plan sponsors and trustees. Through this, they protect the retirement security of millions of people across the globe. To form their opinions, these actuaries assess the risks the pension scheme is exposed to. Risks can include, but are not limited to:

- Poor pension plan design

- Deterioration of employer covenant (a measure of the ability of an employer to meet its obligations to a pension scheme)

- Underperforming investments

- Demographic changes

- Fraud

A pensions actuary will weigh up a pension plan’s assets against its liabilities. This allows them to determine if the pension plan is sufficiently funded for the long term. The liabilities will be based on expected pay-outs to the pensioners of the future. Alternatively, the assets will be the investments that the pension scheme holds. At times, a pensions actuary may be sceptical of the sustainability of a scheme. In these cases, they will make suggestions on how the financial position could be balanced.

Less Traditional Areas

Today’s actuaries are no longer restricted to the above areas of work. Due to the highly transferrable skillset of the profession, new career paths have emerged. Some are outlined below:

Finance/Investment Actuary

Actuaries in this area are focused on the risks of investment products. They often use models to evaluate the impact of changing economic factors on investments. These models will include parameters like interest rates, market volatility and inflation. Through this, these actuaries assist in portfolio management. An appropriate investment strategy is chosen. This strategy will usually reduce exposure to risk. For example, an actuary may suggest more diversification in the portfolio. Diversification would protect the portfolio’s total value when certain components of it perform poorly.

Actuaries can also work in banking. They help to evaluate risks associated with lending, investing and other financial activities within a bank. A recent article by the Society of Actuaries in Ireland presented an interesting idea. It asked the question of whether an actuary could have helped to prevent the failure of Silicon Valley Bank (SVB). The writer, John McCrossan states:

“Based on very approximate calculations it would seem that the duration of assets on SVB’s balance sheet was about 6 years longer than its liabilities. I am sure that our Actuary would have raised the red flag.”

This event and hypothesis may prove valuable to the career prospects of actuaries with their sights on the banking industry.

Fintech/Insurtech Actuary

Insurtech is the use of innovative hardware, software and other technologies to tackle inefficiencies in the insurance value chain. The same applies to fintech but for finance. These are both rapidly growing industries in today’s world. People have become more reliant on the internet and their mobile phones than ever. These technologies are implemented everywhere you look, and the finance and insurance sectors are expected to keep up.

Actuaries can help these companies to harness the power of big data and predictive analysis to create value. This can include moving to data-driven decisions to avoid bias for insurance. Additionally, their work may help to improve customer experiences. Currently, one of the biggest Insurtech companies in the UK is Zego. They provide pay-as-you-go insurance for couriers, food delivery drivers and fleet managers.

Government Actuary

Actuaries have qualities than can support key decision makers at the top levels of government. In the UK, there is a GAD (Government Actuary’s Department). This department uses their skills to overcome challenges faced by the UK public sector. Their recent work on minimising the effects of the pandemic certainly stands out. The GAD was crucial in supporting the NHS test and trace service, through modelling and analysis. They also assisted in creating a COVID-19 population risk assessment. This was used to identify clinically vulnerable individuals, who were added to a Shielded Patient List (SPL). Steps were then taken to protect these people from infection.

Career Prospects for Actuaries: What Do Actuaries Do and Where Can They Go?

Benefits of Becoming an Actuary

Job Security

Actuaries to date have never struggled to find work. It could be argued that this stems from a short supply. In the UK, the IFoA (Institute and Faculty of Actuaries) is the professional body for actuaries. According to its 2021/22 annual report, there are only 32,697 members. The skills and expertise of an actuary are also highly specialised. They are vital to many businesses too, as previously discussed.

Demand for actuaries is higher than ever in our post-pandemic world. Vacancysoft CEO James Chaplin said in May 2022:

“The pandemic was a challenging period for insurers. Many faced losses and uncertainty about the validity of their policies. The potential scope for new market products also broadened. Actuaries play a key role across both aspects, so it’s little surprise that hiring for these specialists grew steadily over the last calendar year”.

This is not the only global event where actuaries could have made a difference. The financial crisis of 2008. The current rate of global warming. The recent collapse of the Silicon Valley bank. These are all events that have increased the perceived need for actuaries. Their huge implications, both financially and otherwise, seem to have led to companies to place more value on the skillset of an actuary.

This supply and demand differential is the cause of great job security and low unemployment rates in the profession.

Salary

For similar reasons, actuaries are also well compensated. The assumption that actuaries are ‘in it for the money’ therefore at least has some logic behind it. Actuaries can be very well-paid with top earners earning over £300K pa in the UK. However, actuarial salaries vary according to different factors like location, industry and employer. They also omit additional compensation of actuaries. These include bonuses, profit-sharing and stock options, which can be common in benefits packages.

Good Work-Life Balance

This one could be slightly more debatable. However, compared to other top professions, the actuarial career stacks up well. As an actuary, you probably won’t be regularly doing twelve-hour shifts through the night, like junior doctors. Most actuaries tend to work forty-hour weeks. Typical stuff. Even compared to other financial careers this is reasonable. However, this approximation does not hold as well for consultants. Their hours can be much more unpredictable due to the demands of a client. Clients do not really care how long it takes to do their work. They want it done, when it needs done. Another contradiction to this is the actuarial exams, which we will get on to.

Potential Drawbacks

As you have likely already concluded, a career as an actuary can be highly rewarding. But be warned. Just like every industry, there are challenges:

Regulation

First off, actuaries are heavily regulated. In the UK, they must follow the standards set by the IFoA. This professional body has the power to discipline breaches of these standards, too. They are essentially the big brother of us UK actuaries. As a profession, we are therefore more liable for our actions. Certain situations may be difficult to handle when keeping these standards in mind. However, due to the nature of the industries we work in, strong ethical guidelines are essential.

Requirements to Retain Certification

Another potential drawback for some could be the CPD (continuing professional development) that is required. Actuaries in the UK must complete a minimum of fifteen hours of CPD each year. This includes at least two hours of professional skills training content. To maintain the professional certification, a record of this must be kept. While some may view this as a potential drawback of the job, most actuaries will see the purpose/benefit. Completing this training keeps actuaries on the ball. The profession is filled with curious minds so keeping up with industry developments and emerging trends will likely interest IFoA members anyway. It is a win-win, really.

Exams

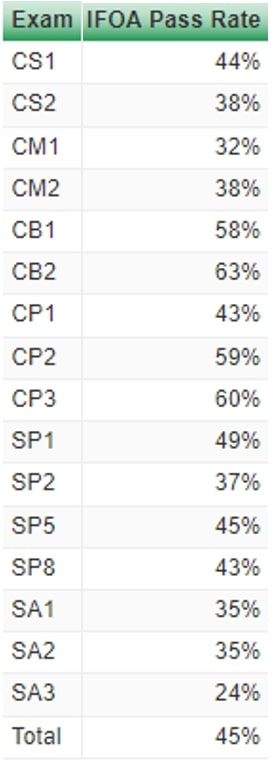

The last, and most obvious drawback of the career path are the exams. Nobody likes exams. And for actuaries, there are a lot of them. There is often a fear among students that the work-life balance we have come to expect with university will evaporate after leaving. The idea of a long day at work followed by an evening of studying would put a pit of dread in anyone’s stomach. The pass rates of these exams don’t help to ease this anxiety either, as shown below:

This progression style would not be for everyone. Nevertheless, there is plenty of support given to help members succeed. Companies almost always offer comprehensive study packages. This could include study days, exam materials, tutorials and exam fees paid for. Also, actuaries do not have to complete every one of these exams to become qualified, as we will outline below.

Preparing for an Actuarial Career: Education and Qualifications Explained

Common Background of an Actuary

Actuaries usually come from a maths background. While this does not apply to 100% of the profession, there is a reason for the trend. Actuaries use maths to solve problems. It is therefore common for them to have a mathematics, statistics, or other quantitative degree. It is still possible for an individual with a non-mathematical background to become an actuary. However, they will need strong quantitative skills. The profession simply demands these.

Alternatively, Actuarial Science degrees are available. Applying to these will allow the student to bypass the first few actuarial examinations, upon graduation. There are numerous universities within the UK that teach these BSc courses. The list below includes some of these:

- Bayes Business School

- London School of Economics and Political Science

- Heriot-Watt University

- University of Warwick

- Queen’s University Belfast

- University of Manchester

- Queen Mary University London

- Kent University

- University of Leicester

- University of Leeds

For students who know that this is the career for them, it is an obvious choice. It gives them a head start on the IFoA exam pathway (discussed below). Usually, up to six exam exemptions can be achieved at these universities.

Exam Pathway

In the UK, actuaries sit exams under the IFoA to become qualified. There are two milestones for this pathway. Associate and Fellow. To become an associate, members must pass a total of 10 exams, from CS1 to CP3. Additionally, completion of Professional Skills Stage 1 and 2 is required, alongside 2 years on Personal and Professional Development (PPD).

To become a fellow, members must progress through 3 more exams. At this stage, however, not all exams are compulsory. The actuarial trainee will first choose two SP (Specialist Principle) exams, from a total of nine. Then, one SA (Specialist Application) exam, from a total of seven, will be selected. Exams are usually picked to supplement the trainee’s current area of work. For example, an actuary working for a life insurer will likely sit the life insurance exams.

Deciding on an Actuarial Career: Understanding What Do Actuaries Do

By getting to this stage, you may now be left wondering, is an actuarial career suited to me? If you fit the description of the following few bullet points, you can confidently chance on yes:

- Strong analytical/mathematical skills – This one should almost go without saying. If you do not like maths and statistics, steer clear.

- Comfort with data and technology – Modern actuaries need to use a range of data sources and software tools to succeed to in their roles. This trend is only increasing. These skills can be taught to some extent. However, knowing your way around common tools like Excel is a great start.

- Interest in Finance – Most actuarial work will involve finance in some way or another. If this is an area that interests you, you are in luck with this career path.

- Strong personal drive and willpower– This one is very important. Actuaries have long exam pathways to walk before they reach the acclaimed status of fellow. Without substantial personal drive, it would be easy to give up long before achieving this.

- Strong communication skills – Some people could be surprised to find this on the list. Another common prejudice is that actuaries can’t speak. But we can and, we do. The importance of communication for this industry cannot be understated. If an actuary is unable to effectively convey complex findings to others, they will be fighting an uphill battle.

Hopefully you now have a better understanding of what it means to be an actuary. The actuarial profession is a relatively small one, not known to many. However, it is an important one. Actuaries are involved with problems on a hugely varying scale. From natural disaster recovery right down to pet insurance for someone’s new poodle. Within all these problems, an actuary’s expertise of maths and finance can help to alleviate potential misfortunes. It is not the industry for everyone. There are certain characteristics an actuary needs to succeed in their role. However, many believe that the benefits of the job far outweigh the costs. So, if you fit the bill, why not consider things further?